Gotmerchant.com Merchant Services Reviews & Complaints

Company Overview

Founded in 1998 as a web hosting company called Simple Solutions, the company changed its name to “Gotmerchant.com” in 2001 as it shifted its focus to credit card processing.

Affiliation with Harbortouch

The Better Business Bureau lists Curtis Stevens as the CEO of Gotmerchant.com. We have also been repeatedly contacted by a sales agent named Curtis Stevens in the comment section of our Harbortouch review, and this second Curtis Stevens appears to be employed as an independent sales rep for Harbortouch.

Given the fact that the BBB lists a PO box in Fate, Texas, as the address for Gotmerchant.com, it appears very likely that the same Curtis Stevens who is the president of Gotmerchant.com is the Curtis Stevens who works as an independent sales agent for Harbortouch. In addition, a BBB complaint filed against Gotmerchant.com in November 2014 explicitly names Harbortouch as the entity with whom the client did business. It therefore appears that Gotmerchant.com and Harbortouch may not operate as entirely separate entities.

Gotmerchant.com Payment Processing

Gotmerchant.com is a merchant account provider processing most major debit and credit cards for businesses ranging from small startups to multi-million dollar corporations. The company advertises Harbortouch as part of its free POS system offer. Other services they offer include electronic cash registers, card swipers, Yahoo Store merchant accounts, access to the Authorize.net payment gateway, virtual terminals, wireless and mobile processing, MOTO, QuickBooks integration, e-commerce solutions including shopping carts, cash advances, and fraud and chargeback protections.

Location & Ownership

Gotmerchant.com is a registered ISO/MSP of Citizens Bank, N.A., Providence, RI. The company lists PO Box 751 Fate, TX 75132 as its address. Curtis Stevens is the CEO of Gotmerchant.com.

| Pros: | Cons: |

|---|---|

| Terms disclosure | Harbortouch POS long-term contract |

| Low complaint rate | Two-year contract |

| Interchange-plus pricing | $250 cancellation fee |

| No misleading marketing | $10 monthly service fee |

| Positive sales team reviews | $25 monthly minimum fee |

Gotmerchant.com Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Clean Complaint Record

Our research finds no Gotmerchant.com reviews that label the company as a scam or a ripoff. Many reviews commend the company for exceptional customer service, highlighting aspects such as same-day responses, honest dealings, and an active effort by Gotmerchant to work with its partner companies in resolving client complaints. Gotmerchant.com offers multiple support phone lines for assistance both during and after business hours. If you have experiences or insights about Gotmerchant.com, please share them in the comments below.

Mixed Responses to Complaints

It is notable that Curtis Stevens, a representative from Harbortouch (a partner company of Gotmerchant.com), actively responds to complaints on this and other platforms. While his engagement in addressing public complaints is commendable, there have been instances where Mr. Stevens has questioned the legitimacy of some complainants, suggesting they might be competitors rather than actual clients. Consequently, Harbortouch POS system clients from Gotmerchant.com are encouraged to provide evidence of their customer status when posting negative reviews to ensure their concerns are taken seriously.

Gotmerchant.com Lawsuits

There are no known outstanding class-action lawsuits or Federal Trade Commission (FTC) complaints filed against Gotmerchant.com. Clients preferring non-litigious dispute resolution should consider reporting any issues to relevant supervisory organizations as an alternative to legal action.

Gotmerchant.com Customer Support

In the absence of significant negative online complaints, Gotmerchant.com is rated an “A” in the customer support category. However, it is important to note that the company is not currently recognized as a top merchant account provider for customer service.

Gotmerchant.com Customer Service Number

- (940) 323-8888 – Local Office Contact

Other Support Options

- Online support form

Gotmerchant.com Online Ratings

Here's How They Rate Online

| BBB Reports | 0 |

|---|

No Complaints

Gotmerchant.com is an accredited business of the Better Business Bureau and is currently rated an “A+” with accreditation since 2010. Gotmerchant.com has received 0 complaints in the past 36 months.

An “A” Performance Overall

In light of the company’s low complaint total, we agree with the BBB’s rating.

Gotmerchant.com Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Two-Year Contract

The standard agreement for Gotmerchant.com typically involves a two-year term with a $250 cancellation fee, a $10 monthly service fee, a $25 monthly minimum fee, no annual fees, and a variable PCI compliance fee. Company representatives have indicated on various platforms that terms such as contract duration and termination fees can be adapted based on the specific needs of a business. Gotmerchant.com extends interchange-plus pricing to all its clients, though smaller businesses might encounter higher markups and monthly minimums. The absence of significant complaints about contract terms suggests a general customer satisfaction with these agreements.

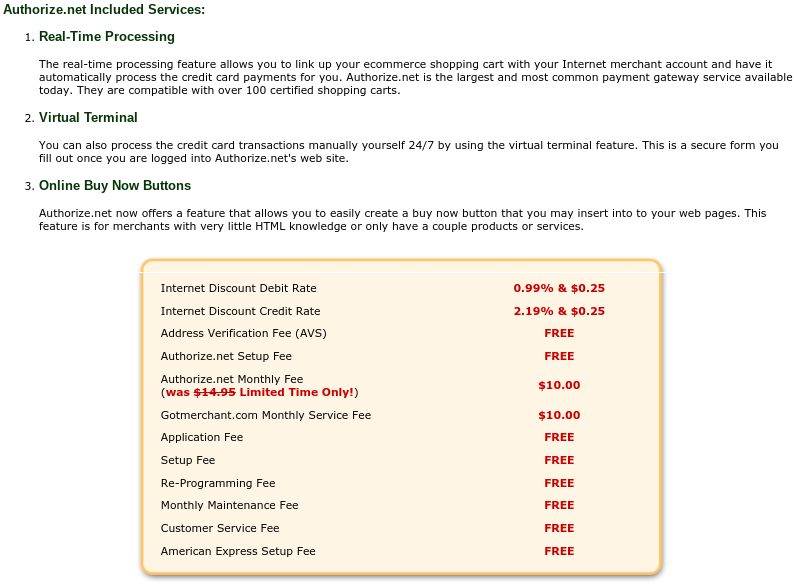

Virtual Terminal and Payment Gateway Pricing

In its e-commerce solutions, Gotmerchant.com offers virtual terminal and payment gateway services, utilizing Authorize.Net as a provider. As a reseller, Gotmerchant.com may modify standard Authorize.Net contract conditions. The company lists its transaction rates as 0.99% plus $0.25 for debit, 2.19% plus $0.25 for qualified, 2.94% plus $0.25 for mid-qualified, and 3.79% plus $0.25 for non-qualified transactions, along with a $10 monthly gateway fee, which combined with the general service fee remains lower than the typical $25 gateway fee charged by Authorize.Net directly.

Harbortouch POS Contracts

Gotmerchant.com also provides Harbortouch POS systems, which are priced on a monthly basis according to system type. These systems are offered with no initial cost but are subject to a three-year non-cancellable contract, mandating full payment for the contract’s term regardless of early termination. Returning the POS system does not exempt a client from this obligation, a stipulation that may not favor businesses due to the significant long-term costs and lack of flexibility. For context, most credit card terminals are available for purchase at less than $500, making outright buying often more economical than long-term leasing.

An Excellent Provider With Troubling Partnership

The aspects that detract from Gotmerchant.com’s evaluation include the Harbortouch POS agreement, an industry-standard cancellation fee, and the default two-year contract term. However, the company has shown flexibility with negotiation, making it possible for certain clients to secure terms comparable with the most competitive merchant accounts.

Gotmerchant.com Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

In-House Sales Team

Gotmerchant.com appears to market itself primarily through its client network and its in-house sales team. As of this update, we were unable to locate any Gotmerchant.com reviews that describe a negative experience with the sales team; in fact, there are numerous testimonials available online that relate overwhelmingly positive experiences. Many of these positive interactions mention a specific representative of the company, which indicates a high level of consistency and accountability within the Gotmerchant.com sales team.

Rates Clearly Disclosed

Although it takes a bit of searching to find, Gotmerchant.com’s rates and fees page discloses a great deal of information about how “Qualified,” “Mid-Qualified,” and “Non-Qualified” rates are assessed. It also lists each of these rates in addition to most of the company’s standard monthly fees and terms. The company’s website does not actively promote interchange-plus pricing, but a company representative has stated on other consumer protection websites that Gotmerchant.com does offer this pricing structure to all clients, with varying markups and minimums depending on size and time in business. Overall, Gotmerchant.com appears to market its services in a forthright manner, and there are only positive comments to be found about the company’s sales tactics online.

Harbortouch Equipment and Terms

It should be noted that Gotmerchant.com does not disclose that its POS system is a Harbortouch POS system. Harbortouch’s POS systems are provided to clients for no upfront cost as part of a non-cancellable three-year agreement. Our review of Harbortouch assigns the company a low score in this section for what appears to be a pattern of incomplete or insufficient disclosure by the company’s sales representatives with regard to this long-term agreement. Given the fact that Gotmerchant has a nearly spotless complaint record, we will not lower the company’s score in this review, but readers should be aware that the Harbortouch POS system requires a long-term commitment and has received numerous complaints from clients. If you are concerned that Gotmerchant.com or Harbortouch is charging you undisclosed fees, we recommend seeking a third-party statement audit to find and eliminate hidden charges.

Our Gotmerchant.com Review Summary

Our Final Thoughts

According to all available information, Gotmerchant.com rates as a reliable credit card processing provider. The company shows mostly positive reviews and nearly zero complaints online. Its standard contract isn’t especially competitive, but the company appears to show some flexibility with regard to these terms. Readers are encouraged to strongly negotiate the provisions of their contracts and to compare Gotmerchant to top-rated all-purpose merchant accounts. We also advise readers to inquire about all possible terms and fees associated with Gotmerchant.com’s Harbortouch POS system. It is worth noting that Gotmerchant.com could potentially be confused with a company called GoEmerchant in search results. These two companies are unrelated.

If you found this article helpful, please share it!

Liam Mary

I’ve been in the retail business for over a decade now, and I’ve tried my fair share of merchant service providers. However, ever since I signed up with Gotmerchant.com, my experience has been nothing short of exceptional.

From the get-go, their customer service team impressed me with their attentiveness and personalized approach. They took the time to understand my business needs and offered me a tailored solution that perfectly aligned with my requirements. Unlike some other providers, they didn’t try to upsell unnecessary services, which was truly refreshing.

One thing that really sets Gotmerchant.com apart is their user-friendly platform. It’s intuitive and straightforward, making it a breeze to navigate through the various features. I can easily track my transactions, manage inventory, and even generate insightful reports to help me make informed business decisions. All of this has significantly improved my operational efficiency, and I can now focus more on growing my business.

But the real game-changer for me has been their competitive pricing. Gotmerchant.com offers transparent and affordable rates, without any hidden fees. It’s such a relief to have a merchant service provider that values honesty and integrity, especially in an industry that’s notorious for its complicated fee structures.

Another aspect that I admire about Gotmerchant.com is their dedication to staying up-to-date with the latest technology and security standards. I feel confident knowing that my customers’ payment information is protected with top-notch security measures in place.

Overall, my experience with Gotmerchant.com has been top-tier. I can genuinely say that they have exceeded my expectations in every aspect of their service. Whether you’re a small business owner like me or a larger enterprise, I highly recommend giving Gotmerchant.com a try. Their winning combination of exceptional customer service, user-friendly platform, and competitive pricing is a game-changer in the merchant services industry.