Merchants Bancard Network Reviews & Complaints

Overview

In this article, we provide a concise yet comprehensive analysis of Merchants Bancard Network, a merchant account provider for various businesses. We will explore key aspects such as their rates and fees, contract terms, and the equipment and support they offer. Additionally, our article addresses customer and industry feedback, including common complaints and employee reviews, and examines the company's marketing tactics and user reviews. We also touch on MBN's additional services, including partnerships and special programs, and provide insights into their legal history and customer support options. This review aims to offer a well-rounded perspective to help businesses make informed decisions regarding their payment processing needs.

About Merchants Bancard Network

Merchants Bancard Network is a merchant account provider for retail and e-commerce businesses to standard and high-risk merchants and offers various payment services and equipment to clients.

Merchants Bancard Network Payment Processing

Merchants Bancard Network processes most major credit and debit card payments for most business types, including high-risk. They offer solutions including Clover POS and mobile systems, an online payment gateway, cash discounts, mobile wallets, and recurring billing.

Equipment and Support

The company provides point-of-sale (POS) equipment at discounted prices from leading brands. They also offer in-house support and free PCI compliance, with no hidden fees.

Additional Services

MBN has a partnership with Lendio to offer access to small business capital. They also have a cash discount dual pricing program aimed at eliminating interchange costs for the merchant.

Location & Ownership

Merchants Bancard Network was previously located at 27433 Tourney Rd Suite 210, Valencia, CA 91355, but it appears to have moved to 365 E Windmill Ln STE 100, Las Vegas, NV 89123. It is a registered ISO/MSP of Wells Fargo Bank, N.A. Walnut Creek; Westamerica Bank, Santa Rosa, CA; and Esquire Bank NA, Jericho, NY; and it is a reseller of First Data (now Fiserv). Jerry Cain is the CEO of Merchants Bancard Network and Travis Cain is vice president.

| Pros: | Cons: |

|---|---|

| Multiple payment channels supported. | Complaints about deceptive rate quotes. |

| Transparent pricing, no hidden fees. | Three-year contract with renewal. |

| Competitive rates for all businesses. | Early termination fees may apply. |

| Free PCI compliance included. | Possible unexpected rate increases. |

| 24/7 customer and technical support. | Expensive, non-cancellable equipment leases. |

| Cash Discount Program available. | Uses telemarketing and independent agents. |

Merchants Bancard Network Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 40+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Poor Service |

| Recent Lawsuits | Yes |

Analysis of Merchants Bancard Network Reviews

We have identified over 40 negative reviews of Merchants Bancard Network across consumer protection sites and the comment section of this review. Complaints frequently mention misrepresentation or lack of clarity regarding contract terms, challenges in contacting customer service, unauthorized charges, and obstacles faced when attempting to cancel accounts. It’s worth noting that many grievances were directed at the company under its possible former name, iMAX Bancard Network, hinting at a rebranding effort. More than half of these complaints have elicited responses from the company, though the effectiveness of these replies varies. We encourage you to share your experiences with Merchants Bancard Network in the comments below.

Legal Challenges Facing Merchants Bancard Network

In May 2020, a class-action lawsuit was filed against Merchants Bancard Network for alleged violations of the Telephone Consumer Protection Act, which was settled in 2021. Those looking for resolutions without litigation are advised to report their issues to relevant supervisory bodies.

Customer Support Services at Merchants Bancard Network

Merchants Bancard Network provides a range of support options on its website, including phone lines and email contacts for customer assistance.

Contact Information for Merchants Bancard Network Support

- (877) 871-4629 – General Customer Service

Additional Customer Support Channels

- Online customer support form

- Email support for various inquiries:

- [email protected] – General Inquiries

- [email protected] – Partner Support

- [email protected] – Technical Support

Despite providing customer support channels similar to those of highly regarded merchant accounts, Merchants Bancard Network’s efforts to address complaints internally seem to fall short at present.

This updated content strives to offer a balanced perspective on Merchants Bancard Network, detailing customer complaints, legal history, and available support services. By incorporating SEO-optimized keywords related to “reviews,” “complaints,” and “customer service,” the revision aims to enhance visibility and provide valuable insights for potential clients.

Merchants Bancard Network Online Ratings

Here's How They Rate Online

| BBB Reports | 41 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

Rebooted BBB Profile

Merchants Bancard Network has an “A+” rating with the BBB and has been an accredited business since 2011. The company’s profile is currently showing 20 complaints in the last 36 months.

What Merchants Say

Merchants Bancard Network has also received 21 informal reviews to its BBB profile, 8 of which were negative in tone and 13 of which were positive in tone. Almost all of the positive reviews come from within the same few-month period, which is somewhat suspicious, but it may be simply a campaign from the company to get its customers to leave a review. The most recent negative complaint deals with issues closing an account:

Worst company iv done business with. I am struggling to cancel them though iv sent requests and called many times for several months. Each time they run me through some speech that it’s being sent to management. I will be filing a complaint and reporting them to my bank as they continue to charge me. Do not ever use this company! Untrustworthy and were problematic the entire time I used them but I was stuck in a contract. I would not trust this company with your businesses card processing.

Clients in situations like this can benefit from understanding how to cancel a merchant account without paying a fee.

A “B” Performance Overall

Given the fact that the company’s old BBB page was essentially wiped clean, we are adjusting its grade to a “B” for the time being.

Merchants Bancard Network Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 1.00% - 4.99% |

| Equipment Leasing | Yes |

In-Person Point of Sale

For in-person transactions, MBN charges $0.10 per transaction with a monthly fee of $10. They provide in-house support, transparent pricing, free PCI compliance, and assure no hidden fees.

Card Not Present Transactions

For transactions where the card isn’t present, the cost is $0.20 per transaction, with a monthly fee of $20. This plan also includes in-house support, transparent pricing, free PCI compliance, and no hidden fees.

Cash Discount Program

MBN offers a cash discount program with no transaction cost and a monthly fee of $25. Like other plans, it includes in-house support, transparent pricing, free PCI compliance, and no hidden fees.

Three-Year Agreement

Merchants Bancard Network’s contract may involve a three-year agreement via First Data (Fiserv), with automatic renewal on a month-to-month basis. Typical First Data (Fiserv) rates include 2.69% + $0.19 for swiped transactions and 3.69% + $0.19 for keyed-in transactions. However, as a reseller, MBN retains the right to modify terms, evident from a $250 early termination fee and an annual fee of $89, separate from the monthly PCI compliance fee. The early termination fee may rise to nearly $1,000 in certain cases. These terms are less competitive compared to other merchant accounts.

Unexpected Rate Adjustments

Some clients report notices of MBN “rate increases” after the first month, possibly due to deceptive rate quoting. It’s likely that the initial rate presented at contract signing differs from the effective rate after a month of billing. We advise business owners to review our list of the top merchant services.

Long-Term Leasing

Several complaints mention costly, non-cancellable equipment leases through First Data Global Leasing, obligating clients to pay the full contract regardless of equipment return. Overall, these terms receive a “D” rating compared to industry averages.

Merchants Bancard Network offers point-of-sale solutions via Fiserv’s Clover family of products

Merchants Bancard Network offers point-of-sale solutions via Fiserv’s Clover family of products

Merchants Bancard Network Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Outside Sales Team

Merchants Bancard Network appears to use telemarketing and independent sales agents to market its services. The use of independent sales agents is often linked to elevated complaint rates among clients, as ISAs are generally untrained and receive little oversight. We are able to locate multiple Merchants Bancard Network reviews that mention nondisclosure by agents, lack of follow-through on altered contract terms, and misrepresentation of the agent’s identity over the phone. This does not compare favorably to our list of best credit card processors.

Deceptive Rate Quotes

At the time of an earlier review, the Merchants Bancard Network rates on their website featured a quote of “low rates from 1.19%” on its homepage. We consider this type of rate quoting to be deceptive, as it might lead business owners to have an unrealistically low expectation of the rates they’ll pay. The company appears to have removed these quotes from its website, but clients should be aware that they may still appear in the company’s advertising materials.

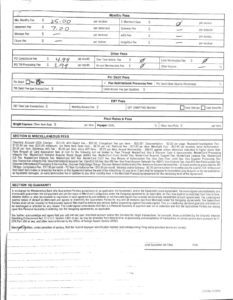

Misleading Contractual Language

We have found a 2018 Merchants Bancard Network complaint from a business alleging that they were charged an early termination fee despite their contract listing an early termination fee of $0. The document, which can be seen below and here, does indeed list “$0” in the “Early Termination Fee” box. However, it also contains the following language in Section 9 lower on the page:

In the event that Client terminates or breaches the terms of this Agreement before the end of the initial three (3) year term, Client shall be obligated to immediately pay Acquirer or its representative, as liquidated damages, an early termination fee in addition to any other monthly fees in the Merchant Processing Agreement for the remaining term of the Agreement.

The business claims to have been charged over $960 for cancellation, which indicates that even a clear “$0” in the “Early Termination Fee” section of the Merchants Bancard Network contract isn’t enough to protect clients from a very large cancellation penalty. In our opinion, this is a highly deceptive practice that warrants a “D” rating in this section. If you suspect that Merchants Bancard Network is charging you undisclosed fees, we recommend seeking a third-party statement audit to find and eliminate hidden fees.

Our Merchants Bancard Network Review Summary

Our Final Thoughts

Merchants Bancard Network rates as a substandard credit card processing provider according to our rating system. The company’s former name of iMAX Bancard Network shows a higher-than-average volume of complaints online, and the complaints filed against the newer Merchants Bancard Network name do not indicate a dramatic shift in policy since the apparent rebranding. The company’s overall rating is likely to change as its new BBB profile gathers client feedback. It’s also worth noting that there could be some confusion between Merchants Bancard Network and Merchant Bankcard, which is an unrelated entity.

If you found this article helpful, please share it!

Jaron Rice

FULL DISCLOSURE: We’re a sub-MSP, a competitor. They called my office several times in a row. We saw the name on the caller ID and chose not to answer because I’ve got better things to do. They called and called and called and called (back to back to back several times). Eventually I answered the phone. They’ve got telemarketers soliciting sales agents. I told them I’m happy with my processor and not interested. She goes on to tell me how they offer huge upfront bonuses and lifetime residuals. I politely told her again I’m not interested. Wash, rinse, and repeat. Eventually I just hung up because she wasn’t getting the point.

As a sales organization, even if we were on the market for a new partnership, their approach is extremely unbecoming.

No thanks.

Susan

My merchant ‘agent’ switched me to them in October. Since then, there are many mistakes – statements going to wrong address, inability to follow through on their ‘promises.’

We are seasonal so some times of the year are dead.

One of my requirements is NEXT DAY CREDIT to my bank account. The latest? I did a close out around 2 PM their time on 3/7. It was not in the account on 3/8. Nor on 3/9. Nor on 3/10. Nor on 3/11. Today my agent phoned and they had some crap story about how the transaction was cancelled in some sort of ‘test run’ with ‘their bank’ whomever that is. Either they have no internal checks and balances. No internal controls. No means of reconciliation. OR they are themselves, frauds. It has taken an entire day of my billable hours to set this straight and I still won’t know until tomorrow if the money will be there. It has caused us to run behind on our customer orders.

They had a lot of excuses but refused to take personal responsibility and they even ‘went there’ – that they aren’t making enough from my account. Seriously???? So they will steal from an account if they don’t feel they’re making enough money?

Do not do business with these people. They are clearly childish, sloppy or perhaps they’re just frauds.

This post will help: Best Merchant Accounts for Seasonal Businesses

-Phillip

trung nguyen

yes they are a bunch of liar ,i try to cancel my service and fax to them 7 days till have no respond

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

trung dien nguyen

Bad customer service ,over charge when you want to cancel they make is so hard and take to long so they can charge you one or more monthly fee.i hope some one can find the way bring them to justice

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Barry Cohen

I Recomend That You Do Not Do Business With MBN! I did do business with MBN (Merchant Bankcard Network) in CA. For many years. Last year my credit card machine that I purchased from them totally broke down. I called MBN to ask them to repair it or replace it and they told me that they would not support anything with my credit card machine. I then asked them to cancel my account and they said that they would and I stopped doing any business on that account. Months later I discovered that they were still charging me through my bank account and taking over $37.00 per month from my bank account after they said that they would close my account. I called them up and told them to reimburse me for the many months of fees that were taken from me. They told me to write a letter to them this time to make sure the account was closed and to request the refund. I did this and they refused to refund me anything at all from the money they took from a zero active account! I called them by phone and they said to bad for you we can do what we want to do and you are not going to get any refund (zero balance) or not! I feel that MBN (Merchant Bankcard Network) are a bunch of strong arm dishonest scammers and I recommend that any reader of this review Not To Do Business With Them Ever!

James

RIPOFF! I’m a seasonal business. I was able to open and close my account without a termination fee. However even though I closed my account on December 26th as we are closed Jan through Mar. They took $85.89 in fees for January even after they admitted it was an oversight. Said it would take a couple of weeks to return the funds to my account. it’s been 4 months and still waiting. During my peak season they were making $2,000 to $3,000 in bank fees per month from me, only to stiff me for $85!?

Needless to say I reopened with a different credit card service.

Laura

I have been trying to cancel my account with them for months!!! I cannot get anyone to give me a correct email to send the cancellation letter. I call the “customer service” number and they say they can’t talk to me that it has to be in writing, but refuse to give me good email addresses. I have sent three (3) letters to anyone and everyone I have ever spoke with at Merchants Bancard Network, only to be told when I do finally get someone on the line, that they no longer work for the company.

SOOOOO FRUSTRATING!!

Yesenia

Stay away!!! Horrible service. Hidden fees and High cancellation fee that they don’t tell you about. Read the fine print. They are rude and unprofessional . It is a scam.

steve kuebler

Do not do business with this company.

I talked to a sales person and we went over everything all the products we sell etc.

He said sure no problem and assured me we would be good to go.

Account was then setup and we were processing for two months.

Then I login on Tuesday to check our business bank account and the funds wern’t in there.

They asked for some info from us which I gladly sent in.

Next I’m told that they now consider us a high risk account and are closing our account and holding $6000 for 181 days and not a thing we can do about it.

This is now going to cause a loss to our business while we have to setup another merchant account.

That money is from gross sales as a small business owner we needed to buy more inventory, pay employee’s and book other shows(we do home shows).

do not do business with this company or you two will be screwed over.

Cynthia

Your service suck I never received the machine and you was taking money out of my account so when I call to get my refund that I never received the machine the guy told me 14 days now it is 18 days I called back today with the number 877 637 8800 customer service was very poor the manager had an attitude they tell me I’m not getting my money back that they took out of my account because they never collect so they want to see my bank statement but I don’t do that because if I give my bank statement they can get into my business I would never ever use this service and I’m going to get into I’m going to get in touch with the Better Business Bureau this company has to be stopped

Dennis

I’m not satisfied with any of Merchant Bancard Services. I never got the equipment first of all, then they just started debiting my account for so called miscellaneous fees every month. Now the guy I talked to never told me anything about miscellaneous fees. He told me the equipment would be free, which I never got. Now to get the account closed is like jumping through hoops. Merchant services has submitted my refund 2x now and so far no refund. The one thing though is as I was informed that they only issue refunds on Friday or so called upper management approves all refund requests. I’m so sick of dealing with these people.

Ken Mershon

Merchant Bankcard’s business practices are questionable. I made it crystal clear to the rep who first contacted me that I do very few transactions because my business is just something I do on the side and paying monthly fees would not make any sense, He assured me there were no monthly fees..HE LIED! Not only do they charge a $17 a month fee but there is also a random $45.80 fee they periodically throw in there.

After the first $17 charge is when the problems started. I contacted Merchant Bankcard and demanded a refund and my account to be cancelled immediately. Gavi Smith then said he would cancel the account and I needed to send the device back to them (on my own dime). 2-3 weeks after this conversation I had a random charge on my account for $45.80! I was absolutely livid at this point. I sent a few emails and got NO RESPONSE. A few more weeks went buy and I received a statement in the mail telling me another charge for $17 is coming out on 6-16-16!!! Gavi never cancelled my account. I then called and left multiple messages cause I couldn’t get anybody on the phone (these people are difficult to contact). I also sent more emails and wrote my previous Google review (that I am now editing). Gavi Smith finally emails me and asks for a good time to speak (ASAP duh!). I guess their philosophy is “don’t call us, we’ll call you” >.<. I call Gavi and he finally answers. I explained all over again how upset I was with the lies and constant charges even though I NEVER used the device or their service. Gavi was helpful though and understanding. He had my money refunded within 2 days. Why did it have to get to this point though?! I really hope Merchant Bankcard looks closely at this entire situation from the shady rep to my account not getting cancelled and also the difficulty to access a person via phone.

In closing, I of course DO NOT recommend them. They do however have relatively low fees when compared with other services albeit it's not clear when or why you will be charged. In my case It was a VERY bad sales rep that lied to me right off the bat. And while Gavi was able to refund my money, during our first call he said that he had to check to see if I was eligible even though it was established that I had only had service for a month and they have a "90 day risk free guarantee". I think they are confused about what that actually means.

Derick

A friend recommended this company to me in June of 2004, to my beauty supply company. We were with MBN for about a year. We cancelled their service because they were horrible, unprofessional, and disrespectful. They also take advantage of people with accents. An MBN manager named David Sanchez asked my company to write a letter if we wanted to discontinue our service with them , which we did and we also returned their credit card processing equipment to them. This company was still however charging my company every month even though we did not use their service. I called the manager David Sanchez and told him about it. He said they gave us a pin pad and that’s why they were charging us. However we never had a pin pad and they never gave us one when they were fixing the equipment. He continued to argue with me for 30 minutes and still did not believe me. I called Alex the guy who came to fix the credit card machine and he said he installed a pin pad. Both me and my wife work together and never had used a pin pad. This company is a theft and David Sanchez is a crook,thief, disrespectful, and nasty. On February 1st 2016 this Company used another name called Cash Merchant to withdraw $1,760 from my bank account. I checked my bank statement and found out, after I stopped using their service for about 8 months. After BB&T bank contacted them, they apologized and said it was a mistake. I advice all businesses to not work with this company but rather deal directly with banks for their credit card services. Especially this guy named David Sanchez at Merchant Bancard Network (MBN)

Kristine Riis

I worked with JEFF THORNTON. He told me all kinds of lies and untruths to get my business. I trusted him and was too busy to pay attention to what was going out and it cost me THOUSANDS AND THOUSANDS of dollars. Shame on me but do not trust this man or this company. Shady, shady, shady!!!!!

—

Are you with Merchants Bancard Network? Learn how to resolve this complaint.

Rick Litberg

“Enter, stranger, but take heed

Of what awaits the sin of greed,

For those who take, but do not earn,

Must pay most dearly in their turn.

So if you seek beneath our floors

A treasure that was never yours,

Thief, you have been warned, beware

Of finding more than treasure there.”

― J.K. Rowling, Harry Potter and the Sorcerer’s Stone

I have been in the bankcard processing business for over 30 years. I’ve worked as a full time employee for National Data Corp., Global Payments, Inc. (GPN) NaBanco, (Now First Data), and Wells Fargo Merchant Services, as a direct Sales Representative in their Business Banking Group. I am a bankcard professional. Prior to going out on my own, I worked for an Elavon ISO who placed First Data platform required merchants with iMax/Merchants Bancard Network on a one off basis. I can tell you hands down these people are complete crooks. I state that without equivocation. They under paid us on our payouts for our merchants we booked through them. When we caught them in the act, over several months and thousands of dollars in their favor, all they could use to explain their brazen thievery was that “First Data – had a flag on their system set incorrectly” ; which is complete gibberish. After reading your rating, the BBB info, reviews and others, not only do they apparently rip-off and mislead their merchants, they also outright steal from the agents and sub-agents they partner with to earn merchant’s business. A word to the wise, both merchants and Agents – watch out for these bandits !!!!

Chelsea Dorich

This company is hands down a scam. The sales person told me that it was a low rate and no commitment, and the first month I didn’t receive any of my money, so I called them to figure out what was wrong. They said that they never connected to my bank account properly (which is untrue, I spoke to my bank representative about this) and the company charged me two thousand dollars worth of fees because of this alleged problem. In this time no one tried to contact me at all about the problem. I spoke with the manager of the company, and he told me nothing could be done, they would just be keeping my money and that was that. I asked him to close my account, he said he did, they mailed me a check, and that was supposed to be the end of it. Now, four years later, I received a collections bill for another three thousand dollars, which no one ever contacted me about before. I don’t know how this is legal, but I wish I had found these reviews before I used this company. These people are thieves and I will be hiring an attorney.

Mireya Mendez

The account has been closed since 8/2011. There are no fees owned to MBN, as all fees were waived upon closure.

Larry Moonilal

I signed up with this company with a promise of lower fees and better service, but I did not receive any of that. Month after month my statements reflected 80-120 dollars in fees! This is ridiculous. My salesman stopped answering my calls and emails and I have not been able to contact anyone else. This is extremely poor customer service. My salesperson also stated that he would get me a credit for signing up which never happened. He also stated that he would get me a refund for those fees but again never did. I am sick and upset with this company and this salesperson

Customer Service

Hello Mr. Moonilal. I am sorry you are experiencing a hard time reaching the sales office. I am unable to locate your account by name. Please contact our customer support at 877-871-4629 to get any issues resolved.

Angela Crutchfield

I haven’t had an account for credit card service since I completed by contract and returned the equipment in 2008. In July 2013 Merchant Bancard debited my bank account $2350.00. They would have taken more, but there was no money left. They managed to get $650.00+ more than I had in the account. I’ve left numerous messages and I can’t get this resolve this issue. I can’t locate a number that will reach anyone other than the answering service. Please let me know If anyone has a better contact number or any help they can offer so I can get this resolved.

Customer Service

Hello,

We could not locate your name anywhere in our systems. Please contact us directly at 877-871-4629 for issues regarding billing or fees. MBN would like to resolve this issue as quickly as possible.

Thank You

kari

liars thiefs that’s all u are this is a scam they steel money

Evelyn Garrett

I was getting charged varying amounts of charges randomly, never receiving a statement to know what these charges were for. I stopped using the services a month ago and just got the highest charge to date. I finally figured out it was this company and asked them to stop charging me as I no longer used the business. They told me there was an early termination fee of $250. Since the charges several times a month added up to this anyway, I told them I would rather pay one lump sum and know that was the end. Of course, no one was available in that department, so the person I talked to said she would leave them a message to call me w/i 24 hours. We’ll see if they call back.

Aaron Ables

Ms. Garrett, I am unable to locate your account. Please contact Merchant Service at 877-871-4629, thank you.

J Weimer

I’ve been trying for more than 2 years to get IMax/Merchants Bankcard Network to cancel my account. I only used credit cards 4 times and it was more than 3 years ago. Two separate times I called in over a two year period to see if my initial contract was us and both times I was given a date it would be up and then told the contract would automatically cancel after that. Last month I called in again as my monthly charges tripled on a service I wasn’t using. I spoke to someone who told me my contract had ended last September and that they put me on a month to month contract. She wouldn’t let me cancel over the phone but gave me the email to her manager, David Sanchez ([email protected]), who would be able to cancel it and refund the month to month charges through last September. I sent David an email on February 7, 2013 with no response. Then another charge came out. I forwarded him the email again, about 11 times, on March 7 with no response. Finally, I called in and somehow was lucky enough to get him on the phone. David was the rudest person I’ve talked to in a long time who kept interrupting, refused to acknowledge what I had been told by 3 separate individuals, told me none of this was his problem, refuses to refund my money, and claimed he was too busy to respond to my email (because we all know that he wasn’t sitting at his desk on the phone, right?? Or did I somehow call his mobile?) so that I would have something in writing that the account was canceled. I asked to speak to his boss, which he refused to do, wouldn’t give me a name, and said I’d have to fax something to the President’s office if I had any complaints about his behavior. This company quite obviously could care less about the businesses they have as customers and care only about their fees collected.

Lana

I am having the same problem.Jan fee came out to 9.5% Called and canceled the account.Faxed a cancel notice they said they never recieved.Just recieved another statement for 55.00 formonthly fees?Am already using a differant company.Just got off the phone with David S. I totally agree,he is rude and tells you its all your fault.There is a class action settlement going on.Contact http://www.PaymentCardSettlement.com 1-800-625-6440

Aaron Ables

Mr. Weimer the account was closed 03/07/2013 and a refund of $244.45 was credited back for November 2012-February 2013 Fees as a courtesy. If you have any other questions or concerns please contact Merchant Service at 877-871-4629, thank you.

Kevin

Salesman says ” Just try me for a month and you will see the savings” (costed more) so I switched back to old provider and faxed a cancellation letter to Merchants. Merchants kept trying to get money out of my account for monthly fee’s and then called me stating I had signed a three year contract and would be charged a cancellation fee. I told him I would not pay. he stated that it would get turn in and would go against my personal credit rating. We will see!!!