Payfirma Reviews & Complaints

Overview

In this article, we'll take a closer look at Payfirma, examining key aspects like rates and fees, contract terms, and common complaints to provide a well-rounded view of their services. We'll also touch on industry ratings, employee reviews, and the company's marketing tactics to offer insights into their operations and reputation. A significant part of our discussion will focus on Payfirma's range of payment processing solutions, including point-of-sale systems, e-commerce and mobile payment options, and their security measures. We review their analytics and reporting features, customer support effectiveness, and the recent Visa & MasterCard lawsuit settlement, giving you a concise yet comprehensive overview of what Payfirma offers to businesses.

About Payfirma

Payfirma is a merchant account provider headquartered in Vancouver, British Columbia. The company appears to resell the merchant services of Chase Paymentech and First Data (now Fiserv). Payfirma was acquired by Toronto-based payment processor Merrco Payments in February 2018 and now operates as a wholly-owned subsidiary of Merrco though it retains its independent branding.

Payfirma Payment Processing

Payfirma processes most major debit and credit cards for most business types. Their services include chip and PIN card readers, POS terminals, virtual terminals, e-commerce solutions including shopping cards and access to a payment gateway, mobile solutions, and recurring billing.

Point of Sale Solutions

Payfirma offers a variety of point-of-sale (POS) solutions tailored to suit the specific needs of different businesses. These solutions range from traditional countertop terminals to tablet-based POS systems, providing merchants with the necessary tools to facilitate smooth and secure transactions in a brick-and-mortar environment.

E-commerce Payment Solutions

For businesses operating online, Payfirma provides e-commerce payment solutions that can be easily integrated into their websites. The company's secure payment gateway allows merchants to accept online payments from customers, providing a user-friendly and secure checkout experience. Payfirma's e-commerce solutions also support multiple currencies, enabling businesses to cater to a global customer base.

Mobile Payment Processing

Recognizing the growing importance of mobile commerce, Payfirma offers mobile payment processing services for businesses on the go. By using mobile card readers and compatible applications, merchants can accept payments through smartphones or tablets, ensuring flexibility and convenience for both the business and its customers.

Security and Fraud Prevention Measures

Payfirma places a strong emphasis on security and fraud prevention, employing advanced encryption and tokenization technologies to safeguard sensitive customer data. The company also offers fraud prevention tools that help businesses detect and prevent potentially fraudulent transactions, ensuring a secure payment environment.

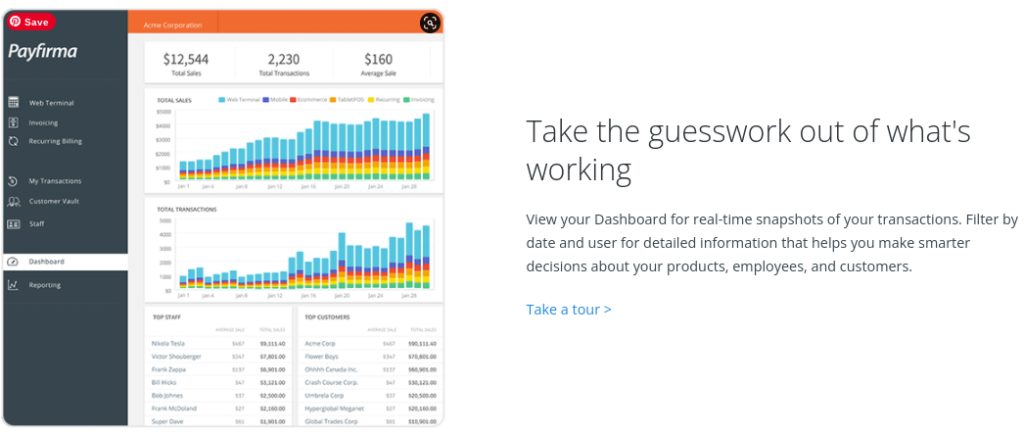

Analytics and Reporting Features

Payfirma's robust analytics and reporting features allow businesses to monitor their payment processing activities and gain valuable insights. Merchants can use these tools to track sales, identify trends, and make informed decisions to optimize their payment strategies.

Location & Ownership

Founded in 2011, Payfirma is headquartered at 1185 West Georgia Street, Suite 740, Vancouver, British Columbia V6E 4E6 and is a registered ISO of Wells Fargo Bank, N.A., Canadian Branch, Toronto, ON, Canada. Following the company's acquisition by Merrco Payments, Payfirma's co-founder and CEO Michael Gokturk stepped down. Fern Glowinsky is listed as the CEO of Merrco Payments.

| Pros: | Cons: |

|---|---|

| Positive online testimonials | Some undisclosed terms |

| Offers virtual terminal | Variable processing rates |

| Payment gateway available | Monthly minimum fees |

| Integrates with external systems | Early termination fees |

| Low complaint rate | Additional e-commerce fees |

Payfirma Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Overview of Payfirma Reviews

Our examination reveals a small number of negative Payfirma reviews, with no allegations suggesting the company engages in scam or ripoff practices. Customer complaints primarily concern undisclosed rates and fees, delays in fund transfers, challenges in canceling services, and a significant early termination fee associated with a four-year contract. Additionally, feedback from Payfirma employees highlights concerns regarding the company’s corporate culture and strategic direction, though these comments have less impact on merchant experiences. We encourage you to share your Payfirma experiences in the comments below to contribute to a broader understanding of the company’s services.

Legal and Regulatory Status of Payfirma

No active class-action lawsuits or Federal Trade Commission (FTC) complaints have been identified against Payfirma. Clients seeking non-litigious resolutions for their disputes with the company are advised to contact appropriate regulatory bodies.

Assessing Payfirma’s Customer Support

Payfirma provides a comprehensive suite of customer support options, including live chat, a dedicated phone line, an email address, a customer support form, and a self-help portal. These resources aim to efficiently address and resolve client issues in-house, reflecting Payfirma’s commitment to customer satisfaction.

Contact Information for Payfirma Support

- (800) 747-6883 – Toll-Free General Customer Service

Additional Support Resources

- Live chat

- Customer support form

- Self-help portal

- Email: [email protected]

These customer support options position Payfirma favorably compared to leading payment processors recognized for exceptional customer service, indicating a proactive approach to customer care.

This content has been updated to provide a balanced overview of Payfirma, incorporating insights from customer feedback, information on legal matters, and the quality of customer support services. By including SEO-optimized terms related to “reviews,” “complaints,” and “customer service,” the revision aims to enhance discoverability and offer valuable insights to individuals and businesses considering Payfirma’s services.

Payfirma Online Ratings

Here's How They Rate Online

| BBB Reports | 1 |

|---|

Under 5 Complaints

Payfirma is not an accredited business with the Better Business Bureau. As of this review, the company has an “A+” rating with the BBB and has had 1 complaint filed against it in the last 36 months.

What Merchants Say

The company also has had 0 informal reviews posted to its BBB profile in the last 36 months. Before that period the BBB documented 1 review, which was negative in tone. The review described hidden fees:

Signed up with PAYFIRMA 3 months ago. Their representative assured us that their pricing is as follows: “Our pricing is very simple. We charge $19/month to use our PAYHQ platform and we simply markup up the credit card rates by 0.50% on the raw costs of the card type” In the past 3 months we have not had a chance to process any credit card transactions yet, but as it turned out we we were charged $144.90 in addition to the disclosed monthly $19.00 fee. When we asked PAYFIRMA about these charges, they said they can fix the set up so that only $19.00 is charged, but they cannot refund the fees that were already charged. We realize that we should’ve examined the fine print on the contract, however payfirma’s representative should have disclosed all the fees, not just one. Obviously, all he cared about was the sale, never heard from him after signing. We never got to process card transactions with PAYFIRMA, but I am certain that if we had, there would be more hidden fees turning up every step of the way. So far we got charged $201.90 and PAYFIRMA is intending to charge a $295 cancellation fee for absolutely no services provided by them. I hope this review helps others, seeking merchant services, turn to a better company than PAYFIRMA.

Clients seeking to avoid this experience should diligently review contracts to better which fees they could incur.

An “A” Performance Overall

Given the company’s complaint total, we agree with the BBB’s rating at this time. Business owners should be aware, however, that there are reasons to be skeptical of the BBB’s rating system.

Payfirma Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Payfirma Pricing

Currently, the Payfirma website does not display its rates or fees. However, in a previous review, the site advertised rates averaging 1.99% plus $0.25 per transaction alongside a flat monthly fee, depending on the service. The Payfirma Chase MPA Setup Guide lists additional fees, including a $40 monthly minimum fee for businesses processing under $2,500 monthly, a $99 mobile card reader, a $5 fee per extra user, and an unspecified setup fee. Another document below outlines additional costs in its standard Chase Paymentech contract, such as a $300 early termination fee, an annual fee ranging from $10 to $89.95, application fees starting at $25 for Visa and MasterCard, and a monthly admin fee of at least $10. This document also details tiered pricing.

Payfirma Fees Clarifications

According to a company representative’s comment on this review, Payfirma boards most clients with First Data (Fiserv) and does not charge annual or PCI Compliance fees. Early termination fees are only applicable if businesses lease credit card equipment through Payfirma, with lease agreements through First Data (Fiserv) being non-cancellable.

Virtual Terminal and Payment Gateway Pricing

Apart from storefront payment processing, Payfirma also offers virtual terminal and payment gateway services. However, pricing for these services is not disclosed. Additional rates and fees, including gateway fees, technical support fees, batch fees, and additional transaction rates, usually apply to these e-commerce services.

Negotiate Your Terms

While these contract terms appear slightly better than average, their competitiveness may vary depending on enforcement. Many terms are negotiable based on business size, type, and tenure. Some provisions in the provided document may be outdated. It remains unclear if the previously listed pricing or the company’s Chase Paymentech model is still relevant.

Seemingly Satisfactory Contract Terms

Although the company’s advertised terms offer transparency regarding service costs, they may not be the most cost-effective in the industry, particularly compared to the cheapest merchant accounts available. At present, only one complaint about Payfirma’s contract terms is located, suggesting overall client satisfaction.

Payfirma Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Likely |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Payfirma Sales Approach

Payfirma appears to offer referral and reseller programs and employs both in-house and external sales teams to market its services. We are currently able to locate only one Payfirma review that mentions unethical sales practices by the company’s agents. This complaint describes nondisclosure of fees and misrepresentation of rates, but it was filed in 2012 and is the only Payfirma review of its kind. That said, if you suspect that Payfirma’s sales team has added undisclosed fees to your account, we recommend seeking a third-party statement audit.

Previous Rate Quotes

At the time of an earlier update, the Payfirma website advertised a rate of “1.99% + $0.25 per transaction” but disclosed in smaller font that “this rate can go up the fancier a card gets (ex. reward and corporate cards.)” Therefore, businesses should not assume that the rate quote of 1.99% plus $0.25 is a flat rate; in fact, it is more likely to be the company’s “Qualified” transaction rate, while the company charges higher rates for “Mid-Qualified” and “Non-Qualified” transactions. This rate quote seems to have been removed from the credit card processor’s website since then.

Our Payfirma Review Summary

Our Final Thoughts

Payfirma rates as a reliable credit card processing provider according to all available information. The payment processor is showing a very low complaint rate and several positive testimonials online, but some potentially costly terms in its contract have lowered its overall rating slightly. The company’s rating may be subject to change as it continues to grow and develop a reputation within the industry. Business owners considering Payfirma should first compare the company’s offerings to top-rated U.S. and Canadian merchant accounts.

If you found this article helpful, please share it!

Devi A

I have been a customer of Payfirma for close to 2 years i’m a small business owner

I had a customer who had purchase a product and then call into her credit card company and say it was not her payfirma was no help to us i lost out 429.40 please keep away from this company.

This post will help: How to Fight Chargebacks and Win

-Phillip

Peter Byrne

I am new with Payfirma. So far, it is taking longer than promised to get the funds deposited from my transactions. They say it takes 24 – 48 hours but I have not experienced anything under 48 hours.

From The Editor

This Post Might Help: Best Merchant Accounts for Painters

Metropolitan

Payfirma is a dangerous organization that will overcharge you and charge money for services not provided. stay away from them!!!

Jacques Tjonasan

I have been a customer of Payfirma for close to 2 years.

The online platform for processing payments an 8.5 out of 10. The reports available are less functional.

I do not use the Invoicing feature. Customer service is very good. Their rates are very competitive. I have done Merchant analysis for clients on a regular basis and recommend Payfirma whenever clients ask.

peter drummond

I’m a rep from Payfirma and wanted to give some clarity around our pricing. We board most of our customers with FIrst Data and have no cancellation fees for anyone on our PayHQ platform. The only time we do charge a cancellation fee is if the merchant is renting a traditional terminal. We don’t charge any annual fees or PCI fees.

Michael DiMartini

Payfirma is a dangerous organization that will provide you with overly complicated ways to cancel their services with a large amount of hidden fees. I run a small business that is based online and we reside in the US. Using their services actually has cost me almost 10% of my credit card transactions. There are far better solutions with a lot less hidden fees and lies. Also, they only provided Visa and Mastercard – American Express, etc had to have an additional service and more fees. Super tricky and their sales techniques are down right lies and their support staff will hide the truth from you at every step. Run do not walk away from this group.

Payfirma

Thanks Jason. It’s awesome to hear such positive feedback from our merchants. We’re thrilled to have made difference!

Angie Gregory

We were interested in switching our business over to payfirma, upon doing my due diligence of checking reviews your response to this complaint has definitely caught my attention and not in a good way. Payfirma you need to work on your customer service!

Jason Gibbs

We use Payfirma for our ecommerce website and on the road. They are great! Always on hand to assist us anytime we need anything.

Also of note, this is the only company we’ve found that gives us ecommerce, mobile and terminals all under a single account. Usually we have to sign up with many vendors to get what they offer single source, that’s a life saver (and price saver) for companies like ours.