Recurly Credit Card Processing Reviews & Complaints

Company Overview

Recurly is a recurring billing service designed to help merchant accounts manage repeating payments and subscription billing. Recurly offers its own payment gateway and integrates with a number of third-party merchant account providers including Amazon Payments, PayPal, Braintree, Authorize.Net, Worldpay, and TSYS, but it does not provide its own merchant accounts, point-of-sale equipment, or mobile card processing. In other words, Recurly can be thought of as a third-party billing management service that merchants may use in conjunction with their existing merchant accounts. They also offer data reporting and analytics for their services.

In 2022, Recurly bought revenue recognition and forecasting company LeapRev.

Payment Gateways and Methods

Recurly supports a wide array of payment gateways and methods, from credit cards and debit cards to digital wallets. This makes it easier for businesses to accept global payments and expand their market reach.

Plan Flexibility and Customization

Recurly allows for a high level of customization in creating subscription plans. Businesses can tailor billing frequencies, pricing models, and promotional codes to meet their specific needs.

Dunning Management

The dunning management feature aims to recover revenue by addressing failed transactions and payment declines. Recurly's system will automatically notify customers and attempt to process the payment again, reducing involuntary churn.

Revenue Recognition and Reporting

Recurly provides revenue recognition and financial reporting tools that comply with accounting standards. Businesses can easily track and report revenue, making it simpler to manage financials and forecast growth.

Fraud Management

Security is a high priority for Recurly, and their system includes various fraud prevention mechanisms. These tools analyze transaction data to flag and prevent suspicious activities, thus enhancing payment security.

Analytics and Insights

Recurly's analytics dashboard offers an in-depth look at key business metrics such as churn rates, lifetime value, and subscription growth. These insights aim to help businesses make data-driven decisions.

Integrations

The platform offers several API integrations, allowing it to work seamlessly with other enterprise software solutions. This extends the utility of Recurly for businesses that are already using CRM, accounting, or other software.

Location & Ownership

Founded in 2010, the company is headquartered at 201 Spear Street, Suite 1100, San Francisco, CA 94105. Dan Burkhart is the co-founder and CEO of Recurly.

| Pros: | Cons: |

|---|---|

| Intuitive and easy setup | Needs more invoice features |

| Seamless CRM and accounting integrations | Sessions time-out quickly |

| Reduces credit card deadlines | Limited user permissions system |

| Excellent customer support | Automatic logout can be inconvenient |

| Multiple payment gateways support | Limited report customization |

Recurly Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | No |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Clean Complaint Record

Our investigation reveals no significant negative Recurly reviews on key consumer protection websites, suggesting the company maintains a strong reputation. The only noteworthy incident involves a 2012 hardware outage, which led to the loss of some billing information for a limited number of clients. This event appears to have been an isolated incident and does not seem to have had a lasting impact on Recurly’s reputation. If you have any personal experiences or reviews about Recurly, please share them in the comments below.

Recurly Lawsuits

To date, there are no known outstanding class-action lawsuits or FTC complaints filed against Recurly. For those seeking to address any concerns with Recurly in a non-litigious manner, reporting to relevant supervisory organizations is an advisable course of action.

Recurly Customer Support Options

Recurly offers customer support through live chat from Monday to Friday, 9 a.m. to 5 p.m. PST, alongside email support for less urgent queries. This availability ensures timely assistance for users seeking support during business hours.

Recurly Customer Service Number

- (415) 558-6837 – Sales Inquiries

Other Support Options

- Live Chat

- Customer Service Email Addresses:

Additionally, Recurly provides dedicated email support at [email protected] and live chat support through its website, offering multiple avenues for customer interaction and assistance.

Recurly Online Ratings

Here's How They Rate Online

| BBB Reports | 3 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

No BBB Complaints

The Better Business Bureau currently assigns Recurly an “F” and is not showing accreditation for the company. The BBB has 3 complaints related to Recurly in the past 36 months. 2 of the complaints were resolved to the satisfaction of the client, while 1 was either resolved to the dissatisfaction of the client or received no final response. The company has not received any informal reviews from merchants, although these reviews are typically not subject to BBB verification.

An “A” Performance Overall

In light of the company’s clean complaint record, we have adjusted the BBB’s rating to an “A” at this time. Readers should note, however, that there are good reasons to be skeptical of the BBB’s rating system.

Recurly Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | No |

Three Pricing Plans

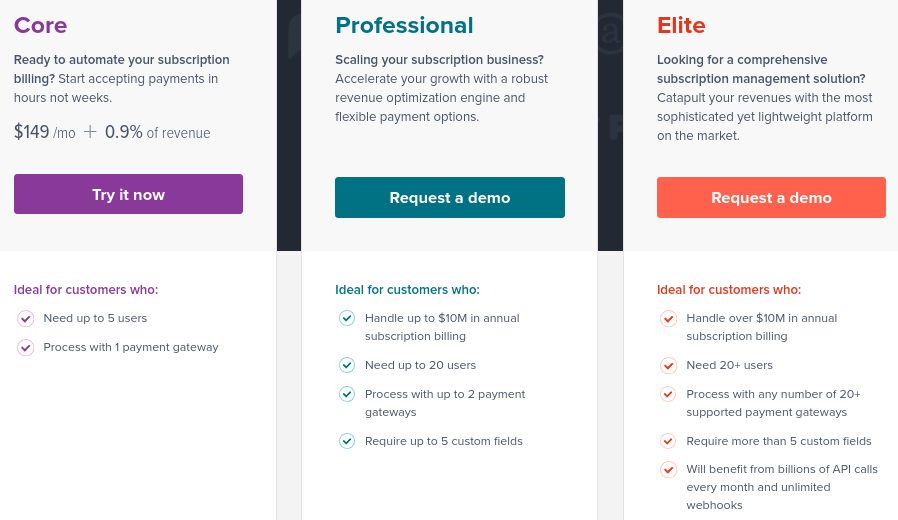

Recurly provides three distinct pricing options for its services: Starter, Professional, and Elite. The Starter plan is initially free for the first year, then transitions to $249 monthly. Pricing details for the Professional and Elite plans are not disclosed on the Recurly website.

Given that Recurly operates as a third-party service, its fees are additional to the charges associated with a business’s existing merchant account. To minimize expenses, it’s advisable for merchants to combine Recurly’s services with a cost-effective payment processor.

No Long-Term Commitments

Recurly’s services are provided on a flexible, month-to-month basis without imposing monthly minimum fees, early termination fees, PCI compliance fees, or other common charges. The “Starter” plan caters to businesses needing to process credit card subscription payments. In contrast, the “Professional” plan offers additional features such as ACH payments, invoicing, integration with QuickBooks Online and Salesforce, multi-currency support, gift card support, and fraud management tools. Recurly’s pricing information indicates that certain fees are separate from those incurred through a client’s credit card processor, including transaction and cancellation fees.

Absence of Contract Complaints

Public feedback does not include complaints about Recurly’s pricing or contract terms, and the fees for its comprehensive features are competitively low. However, for businesses that already have recurring billing capabilities through their merchant account providers, the additional cost for Recurly’s expanded tools may not be justifiable. Recurly is ideally suited for businesses specifically looking for advanced recurring billing features. Such businesses could benefit from securing competitive rates with a merchant account provider and then integrating Recurly’s payment gateway, rather than the reverse approach of starting with a Recurly-compatible payment gateway.

Recurly Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

No Independent Sales Agents

Recurly markets itself primarily through traditional advertising methods and through strategic partnerships. The company does not appear to hire outside independent sales agents or engage in telemarketing, and we have not located any Recurly reviews that accuse the company’s sales representatives of deception or nondisclosure.

No Misleading Advertising

In addition, Recurly does not list any misleading rate quotes or teaser offers on its website. In light of these factors, we have awarded it an “A” rating in this category.

Our Recurly Review Summary

Our Final Thoughts

Recurly rates as a solid recurring billing credit card processing option for merchants. It offers low-commitment pricing and provides a host of features that may not be available through traditional payment gateways. The service is a good option for mid-size and large subscription-style businesses that are unable to purchase a competitively priced, feature-rich recurring billing option through their existing providers. It may not be a good fit for smaller businesses that only require a simple recurring billing setup.

If you found this article helpful, please share it!

David Buonomo

Recurly web site now states that invoices are $1.00 per invoice.