AffiniPay Reviews & Complaints

Company Overview

AffiniPay, founded in 2005, is a full-service merchant account provider specializing in retail and internet merchant accounts as well as processing for professional associations such as accounts, psychologists, and especially law professionals through its specialized platform LawPay. As of 2022, AffiniPay also owns legal software firm MyCase.

AffiniPay Payment Processing

AffiniPay processes all major debit and credit cards. They specialize in processing for specific business types including lawyers, CPA firms, nonprofits, architects, engineers, designers, medical professionals, and construction professionals. Their services include Level 1 PCI compliance, QR code payments, mobile payments, a payment gateway called ClientPay, recurring payments, fraud and chargeback protection, and ABA and IOLTA compliance.

Accounting Payment Processing

CPACharge, a product of AffiniPay, provides functionalities vital for accounting professionals including varied payment methods, and reporting and reconciliation features alongside data security.

Architectural and Engineering Payment Processing

ClientPay enables professionals in architecture, engineering, design, and construction to securely accept credit card and eCheck payments.

Association and Non-profit Payment Processing

AffiniPay facilitates associations and nonprofits with a method to accept member payments, run reports, and ensure information security.

Location & Ownership

AffiniPay’s headquarters is located at 3700 N. Capital of Texas Hwy., Suite 420, Austin, Texas 78746, and the company is a registered ISO/MSP of Wells Fargo Bank N.A., Concord, CA; Synovus Bank, Columbus, GA.; and Fifth Third Bank, N.A., Cincinnati, OH. Amy Porter is the founder and executive chairman of AffiniPay while Dru Armstrong is the CEO.

AffiniPay Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Clean Complaint Record

After a thorough search of other consumer protection websites, we were only able to locate 2 negative AffiniPay reviews. Neither of those reviews accuse the company of being a scam or ripoff. In fact, we found few non-BBB complaints filed against AffiniPay by clients at all, though there are a couple of negative reviews from former employees on GlassDoor. AffiniPay’s website states that the company employs an in-house customer support team, which is likely a major factor in the company’s excellent complaint rate. If you have your own AffiniPay review to make, please do so in the comments below.

AffiniPay Lawsuits

We have not found any outstanding class-action lawsuits or FTC complaints filed against AffiniPay. Dissatisfied clients who wish to pursue a non-litigious course of action against the company should consider reporting it to the relevant supervisory organizations.

We did find evidence of a patent infringement lawsuit brought by OHVA, Inc. in the Western District Court of Texas. The case was opened in early 2020 and closed less than a month later with few details on the outcome of the case.

AffiniPay Customer Support Options

The lack of AffiniPay complaints and strong support options in the form of a dedicated customer service line, FAQs on its website, and a clear contact form puts the company on track to qualify as a top-rated processor for customer service. For a company of AffiniPay’s size and time in business to be showing zero complaints is nearly unheard of, and we therefore award AffiniPay an “A” in this category.

AffiniPay Customer Service Numbers

- 855-656-4684 – General Support

- 800-459-5798 – LawPay Support

- 844-362-2605 – CPACharge

- 855-492-5995 – ClientPay

- 855-656-4685 – AffiniPay for associations

Other Support Options

- Chat

- Support form

- Customer service via email at [email protected]

AffiniPay Online Ratings

Here's How They Rate Online

| BBB Reports | 6 |

|---|

LawPay-Specific Complaints

AffiniPay has been an accredited business of the Better Business Bureau since 2010 and currently maintains an “A+” grade. The company shows 5 complaints in the last 36 months. 4 of these complaints have been resolved to the satisfaction of the client. The other complaint was either resolved to the dissatisfaction of the client or received no final response. It should be noted that some if not all of these complaints may be for LawPay or one of AffiniPay’s subcompanies.

What Merchants Say

In addition to those 5 complaints, AffiniPay has received 1 negative review to its profile. The review describes being denied service due to business type:

If I could review it 0 stars – I would. Started attempting to make an account with this company for a payment processor that I wanted to implement pertaining to my membership based subscription service business. At first, they stated that I could not make an account with them because the *** business registration code was not supported by their bank. After providing more information about my business the representative stated that his manager approved the decision and to submit financial documents, bank information, and also a personal ID card. I just formed my LLC so some information I did not have access to – such as recent bank statements. How would I have statements if I am trying to set up a payment processor?? But that is besides the point. So now, after having access to my bank information (account and routing numbers) and also my photo ID, they decided to deny my request for an application. Even after their manager approved it, all of a sudden they tell me they cannot move forward with my application due to the original reasoning that my business is not supported. This company is a scam, and just straight up fraudulent liars. Now I am trying to make sure they utmost properly dispose of my personal, sensitive information. The only reason I was using this company was because the other company I set up my website with (where I will be accepting the payments from) had Affinipay as their default partner and also with the lowest fees (other companies you have to pay additional, such as registration costs, monthly subscriptions, and payout fees). So I wasted weeks where I could have already set up the payment processor. The original representative I was chatting with back and forth via email just straight up stopped replying, and another rep took over. Please do yourself a favor and pick another merchant to process your payments. Very unprofessional and very fraudulent to deny my application after I submit sensitive info. AVOID AT ALL COSTS NOT WORTH IT.

An “A” Performance Overall

Given the company’s resolution rate, we agree with the BBB‘s rating at this time.

AffiniPay Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Interchange + |

| Equipment Leasing | One-Time Fee |

AffiniPay Contract Overview

AffiniPay offers terms that appear very appealing for professionals and organizations, highlighting the absence of long-term contracts, application, startup fees, and monthly minimums on its website. This approach is designed to be highly competitive within the industry.

For associations that use YourMembership.com alongside AffiniPay, there’s a special rate available: interchange plus 1.39% and $0.25 per transaction, with a $15 monthly minimum fee waived for those processing over $1,000 monthly. This offer, while limited to specific clients, presents an attractive option, aligning AffiniPay’s offerings closely with the market’s most affordable solutions.

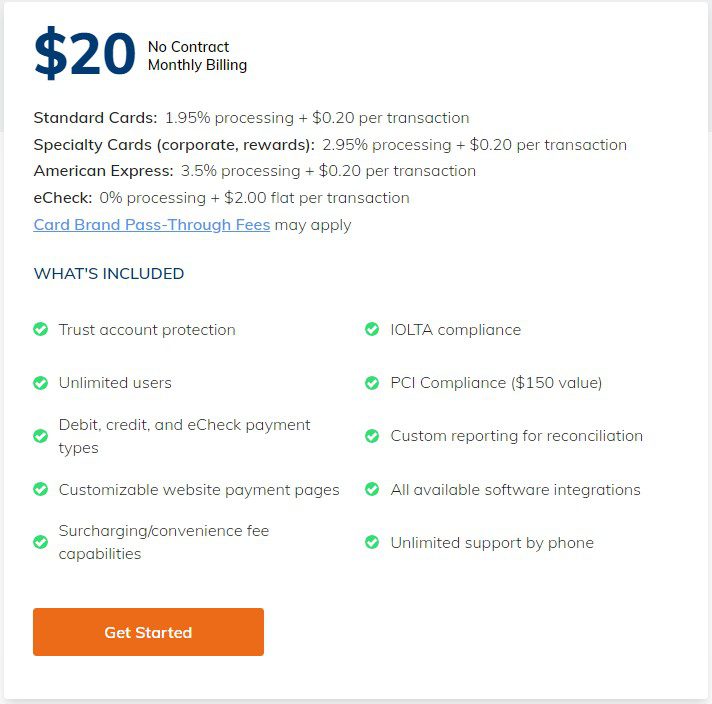

LawPay’s Specific Pricing

AffiniPay also operates the LawPay brand, tailored specifically for law firms, suggesting most AffiniPay merchants will likely encounter LawPay’s pricing structure. This includes a transaction rate of 1.95% plus $0.20, alongside a membership fee available monthly at $20 or annually at $180. This targeted approach helps law firms with predictable and straightforward billing.

Client Satisfaction and Terms Transparency

The lack of public complaints regarding AffiniPay’s pricing or contract terms suggests a high level of satisfaction among its users, reinforcing its position as a reliable processor, especially for professional associations. AffiniPay’s focus on specific professional sectors, such as legal services, further underscores its specialization in meeting the unique needs of its clients.

For those with additional insights or experiences regarding AffiniPay’s service terms, including any PCI compliance fees or termination fees, sharing your experiences could provide valuable context for others considering their services.

Businesses looking for competitive payment processing solutions are encouraged to explore our curated selection of the best merchant accounts to compare services that best fit their needs.

AffiniPay Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | Yes |

| Discloses All Important Terms | Yes |

In-House Sales Team

AffiniPay appears to rely on an in-house sales team and its numerous partnerships with professional associations to market its services. There is no indication that the company hires independent sales agents, and, overall, we are unable to locate any negative AffiniPay reviews about their sales tactics.

Potential Deception

The LawPay website currently lists a rate quote of “2.95% & 20¢ per transaction.” This rate quote is not inclusive of the company’s per-transaction rates, as AffiniPay merchants may pay up to 3.5% per transaction under certain circumstances. We consider this type of rate quote to be deceptive in nature because it could give merchants an unrealistic expectation of the rates they will pay.

No Complaints

In spite of this, AffiniPay has not received any merchant complaints that cite misrepresentation of fees. We will not lower the company’s score at this time, however, If you suspect that AffiniPay is charging you undisclosed fees, we recommend seeking a free, third-party statement audit.

Our AffiniPay Review Summary

Our Final Thoughts

AffiniPay rates as an exemplary credit card processing provider according to our criteria. There is not a great deal of information available about the company’s contract terms, but as of this update, AffiniPay enjoys a clean complaint record on all of the usual consumer protection websites. Owing to the performance of its DBA LawPay, the company rates as a top-rated legal account merchant provider. Even when dealing with seemingly reliable merchant services providers, readers are advised to carefully examine the terms of any contract they sign.

If you found this article helpful, please share it!

Amy Porter

Phillip,

Thank you once again for your review and ranking of AffiniPay/LawPay. We appreciate the recognition of our efforts in the industry. I also hope you will reconsider your change from A+ to A regarding our fees. Our pricing has not changed since last year. I also believe our account options are clearly disclosed on our website, which unfortunately is something not always done in this industry, but we strive to do. The 3.50% you mentioned is simply an option available through our LawPay program for smaller firms looking to have one FLAT RATE with NO TRANSACTION fees. No one with a Standard LawPay plan would ever pay 3.5%. The options for this plan, and the standard LawPay plans are clearly available under the “Open Account” link on the LawPay website.

Best regards,

Amy Porter

CEO, AffiniPay

Marge Falendysz

Affinipay (DBA LawPay, MedPay, CPAcharge) Of course you will not find poor reviews for Affinipay because the review are all under their third party processors. I requested a copy of AfiniPay pricing and I received a copy of their ‘Program Guide’. It is important to read everything about the program guide so a merchant will understand additional charges that are not listed within the program guide. They use Priority Payment Systems, LLC as their payment processor. (only bad reviews), The customer is also required to pay for ‘additional services’ for third party processors, such as Transarmour by First Data Services. These fees are not delinated in your agreement. But you will pay a ‘batch fee’ of .20 per item. FirstData services only does Batch Processing. This is what I would call hidden fees and there are a lot of them.