Connect Pay Reviews & Complaints

High-Risk Specialists

Founded in January 2019, Connect Pay is a merchant account provider that serves both standard and high-risk business types. The company distinguishes itself from its competitors by openly advertising that it can process payments for CBD vendors and other extremely high-risk industries.

Connect Pay Merchant Services Payment Processing

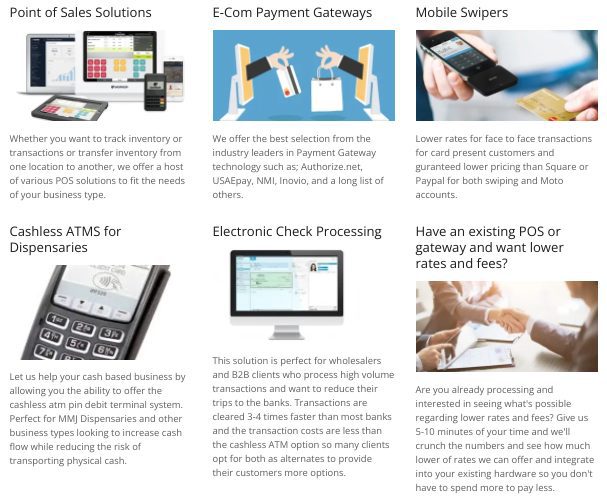

Connect Pay Merchant Services processes all major debit and credit cards for most business types including high-risk. Their services include EMV readers and card swipers, POS solutions, cashless ATMs, access to payment gateways, e-commerce solutions, e-check processing, business loans, and QuickBooks integration.

Connect Pay Merchant Services Location & Ownership

Connect Pay Merchant Services is headquartered at 24052 Cottage Cir Dr, Santa Clarita, California 91354, and does not publicly list its partner banks. Melvin Butters is the founder of Connect Pay Merchant Services.

Connect Pay Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | No |

| Most Common Complaint | N/A |

Notable Complaint Record

Our research reveals no significant negative Connect Pay reviews, suggesting the company is not involved in scam or ripoff activities. This notable absence of complaints, especially considering the relatively short operational history of Connect Pay, is particularly impressive in the high-risk payment processing sector, where issues like fund holds and account cancellations are more common. We welcome and encourage you to share your personal experiences with Connect Pay in the comments below.

Connect Pay Legal Concerns

In our comprehensive search, no substantial class-action lawsuits or FTC complaints have been identified against Connect Pay. For those with unresolved issues, non-litigious options, such as reporting to the appropriate supervisory bodies, are advisable.

Connect Pay Customer Support Accessibility

Connect Pay currently offers a basic level of customer support with a general contact form and phone number available on its website. Here are the contact details:

(661) 309-2801 – General Customer Service

While these support options meet essential needs, they do not yet match the comprehensive services typically found with leading payment processors renowned for exceptional customer service. Enhancing their customer support could further improve Connect Pay’s reputation and customer satisfaction.

Connect Pay Merchant Services Online Ratings

Here's How They Rate Online

No Profile Available

The Better Business Bureau does not maintain a profile for Connect Pay at this time. We therefore will not factor a BBB rating into this review.

Connect Pay Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Swiped Rate | 1.00% - 4.99%+ |

|---|---|

| Keyed-In Rate | 1.00% - 4.99%+ |

| Early Termination Fee | Variable |

| PCI Compliance Fee | Variable |

| Equipment Lease Terms | Variable |

Connect Pay Contract Terms

There is no publicly available information about the standard Connect Pay contract, but it’s likely that the company’s pricing will vary from merchant to merchant. It is entirely possible that standard-risk merchants could pay monthly minimum fees, PCI compliance fees, and early termination fees through the company.

Higher Risk, Higher Fees

The CBD industry is currently as high-risk as they come, which means that payment processors who serve CBD merchants often charge high rates, require six-month rolling reserves, and enforce very strict chargeback limits. Hemp merchants who opt to work with Connect Pay should therefore expect more restrictive pricing and contract terms than standard-risk merchants usually receive. We would encourage merchants to check out our list of the providers of the best merchant accounts.

No Red Flags

We cannot find any complaints about Connect Pay’s contract terms, which suggests that most of its users are satisfied. CBD and hemp merchants, however, should not expect Connect Pay rates to compete with the cheapest merchant accounts. If you have any information about the standard Connect Pay agreement, please share it in the comment section below.

Connect Pay Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Employs Independent Resellers | No |

|---|---|

| Advertises Deceptive Rates | No |

| Discloses All Important Terms | No |

In-House Sales Team

Connect Pay appears to market itself primarily through web advertising and referrals. There is no evidence that the company hires independent sales agents, and we have seen no Connect Pay reviews that mention deceptive sales conduct or misleading rate quotes.

This compares favorably to our list of best credit card processors.

No Rate Quotes

The Connect Pay website does not list any misleading rate quotes or unrealistic guarantees. For now, we don’t see any reason to warn merchants against Connect Pay. However, if you believe that the company has misrepresented itself to you, you can double-check your monthly bill with a third-party statement audit.

Our Connect Pay Merchant Services Review Summary

Our Final Thoughts

A Viable Option for CBD and Hemp Vendors

Connect Pay rates as a solid credit card processing option for CBD merchants at this time. The company is uncommonly forward about its ability to serve hemp and CBD vendors, which suggests that it has reliable banking partnerships for handling these types of transactions. Our rating will be subject to change as we receive more feedback about this company.

If you found this article helpful, please share it!

Christopher Julie

As a small business owner, finding a reliable payment processing partner was crucial, and Connect Pay has exceeded all my expectations. Their seamless integration with my online store and in-store POS system has made accepting payments a breeze. No more worries about delayed transactions or technical glitches!

The customer support is top-notch too. Whenever I’ve had a question or needed assistance, their team has been there with quick and friendly responses, helping me resolve any issues promptly. It’s refreshing to work with a company that truly values its customers and goes the extra mile to ensure smooth payment processing.

Since switching to Connect Pay, my sales have increased, and I have peace of mind knowing that my transactions are secure and efficient. I highly recommend Connect Pay to any business looking for a trustworthy and efficient merchant services provider!