Eureka Payments Reviews & Complaints

Company Overview

Eureka Payments is a Eureka, California-based merchant account provider that was founded in 2010 by a group of former executives from Humboldt Merchant Services. The company appears to be a reseller of Moneris Solutions and Clover POS.

Eureka Payments Payment Processing

Eureka Payments processes most major debit and credit cards for most business types. Their services include the Clover POS system, access to a payment gateway, gift cards, and online and mobile solutions.

Custom Gift Cards

Eureka provides custom gift card services, allowing businesses to offer branded gift cards to their customers.

Mobile Payments

The company also offers mobile payment solutions, making it convenient for businesses to process transactions on-the-go.

Terminal & POS Deployment

Eureka Payments supports terminal and point-of-sale (POS) system deployment, integrating payment processing in various sale systems for businesses.

Local Benefits

For businesses in South Oregon and North California, Eureka Payments offers free use of a “Chip Card” terminal, free receipt tape, integration with many POS systems, local service and support, and a PCI Portal for PCI compliance assistance.

Location & Ownership

Eureka Payments is a registered ISO/MSP for Westamerica Bank, Santa Rosa, CA, and is headquartered at 2930 E Street, Eureka, CA 95501. Steven Kimberling is the president of Eureka Payments.

Eureka Payments Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Clean Complaint Record

We are currently unable to locate any negative Eureka Payments reviews, and there is no evidence to suggest that the company is a scam or a ripoff. As noted above, the company’s Facebook page showcases a large number of testimonials praising Eureka’s sales team, pricing, and customer service. This reflects positively on the company, especially when compared to the total absence of Eureka complaints. If you have your own Eureka Payments review to make, please do so in the comments below.

Eureka Payments Lawsuits

We have not found any outstanding class-action lawsuits or FTC complaints filed against Eureka Payments. Dissatisfied clients who wish to pursue a non-litigious course of action against the company should consider reporting it to the relevant supervisory organizations.

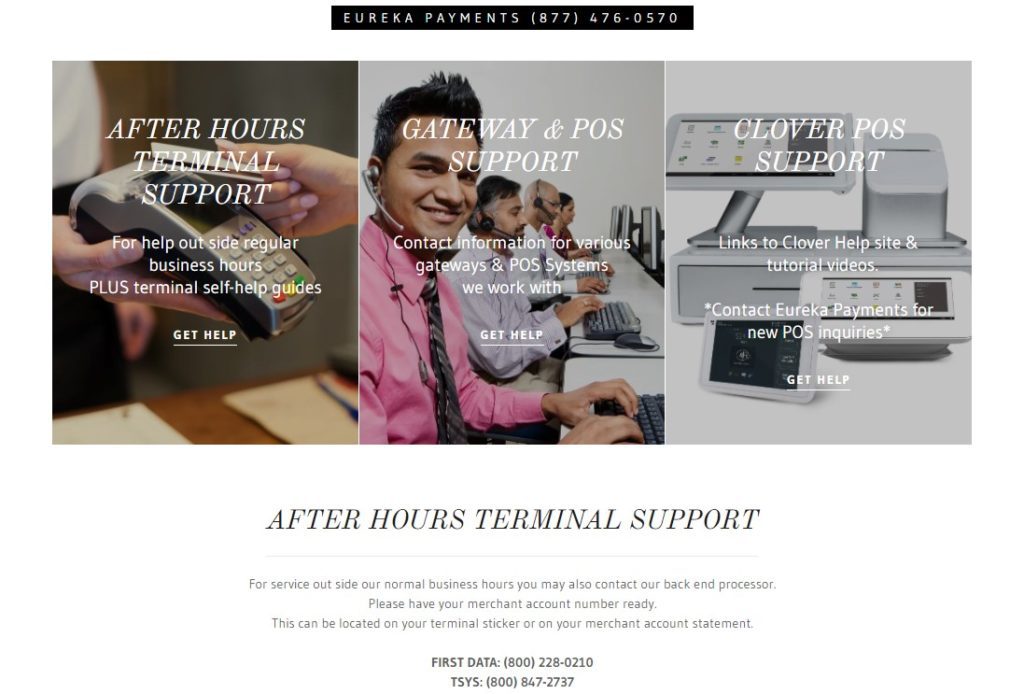

Eureka Payments Customer Support Options

Eureka offers phone and email customer support contact information on its website. The lack of complaints against the company suggests that these lines perform as well as the top merchant accounts for customer service.

Eureka Payments Customer Service Number

- (877) 476-0570 – Toll-Free Support

Eureka Payments Online Ratings

Here's How They Rate Online

| BBB Reports | 0 |

|---|

No BBB Complaints

The Better Business Bureau currently assigns an “A+” to Eureka Payments and has not granted the company BBB accreditation. Eureka has received 0 complaints in the last 3 years, and it has also not received any informal reviews through the BBB.

An “A” Performance

We agree with the BBB’s former rating at this time, but readers are advised to view any BBB rating with skepticism.

Eureka Payments Fees, Rates & Costs

A Closer Look at The Contract

| Processing Rates | 1.00% - 4.99% |

|---|---|

| Cancellation Penalties | No |

| Monthly & Annual Fees | Unclear |

| Equipment Leasing | No |

Eureka Payments Contract Flexibility

Specific details regarding the standard Eureka Payments contract are currently scarce. The company’s website does not provide pricing information, and reviews from clients also lack mention of rates or fees. Notably, Eureka Payments highlights its commitment to transparency by advertising no application fees, monthly minimum fees, early termination fees, activation fees, or annual fees. A testimonial on Facebook also confirms the absence of a long-term contract requirement. Eureka Payments likely tailors its pricing and fees to individual merchants based on factors such as business size, type, and processing history. Additionally, Eureka affirms that it does not engage in equipment leasing.

E-commerce Solutions Pricing

Apart from its in-store payment processing services, Eureka Payments promotes its virtual terminal and payment gateway services. However, pricing details for these services are not disclosed. Additional charges such as gateway fees, technical support fees, batch fees, and supplementary transaction rates are typically applicable to these e-commerce services.

Regional Considerations

Eureka’s contract terms are notably influenced by geographic focus, particularly targeting businesses in southern Oregon or northern California. It remains uncertain whether the company extends its services beyond this region or offers different contract terms to remote clients. This distinction is critical, especially considering that Eureka’s local pricing appears competitive even among the cheapest merchant accounts. Despite the absence of complaints regarding Eureka’s pricing, potential clients are advised to thoroughly review all relevant documentation before proceeding.

Eureka Payments Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

In-House Sales Team

Eureka Payments appears to primarily market its services via strategic partnerships and targeted advertising. There is no evidence that the company employs a large team of independent sales agents, and we cannot find any Eureka Payments reviews that accuse the company’s sales team of deceptive tactics. In fact, there are a large number of positive testimonials about the company’s sales staff on the Eureka Payments Facebook page. We generally don’t factor Facebook testimonials into our reviews because Facebook pages are controlled by the companies being reviewed, but positive reviews are certainly better than negative reviews.

Improved Rate Quotes

At the time of an earlier review, the Eureka Payments website stated that the company’s rates “can be as low as .39%” based on the applicant’s business type and volume. This claim likely referred to Eureka’s Qualified debit rate, while it made no mention of the higher Mid-Qualified and Non-Qualified rates that clients will pay on most of their transactions. Readers who see this quote should heed the company’s language and be aware that their effective rates will almost certainly exceed 0.39%. If you are a current Eureka client, we recommend seeking a third-party statement audit to confirm that you are being charged appropriately.

Our Eureka Payments Review Summary

Our Final Thoughts

Eureka Payments rates as a reliable credit card processing provider according to all available information. The company has received exclusively positive feedback from clients since it was founded in 2010. Its performance in client reviews places it in competition with some of the top-rated all-purpose credit card processors.

If you found this article helpful, please share it!

Waylon Judy

Eureka Payments has been a total game-changer for my business! I can’t believe I didn’t discover them sooner. From the moment I signed up with Eureka, I knew I was in good hands.

First of all, their payment processing solutions are top-notch. Setting up my account was quick and easy, and their platform is so user-friendly. I love how seamlessly it integrates with my website and point-of-sale systems, making the payment process smooth and hassle-free for both me and my customers.

Security is a top priority for my business, and Eureka Payments takes it seriously too. Their advanced security measures give me peace of mind knowing that my customers’ data and transactions are safe and secure. It’s great to know that I can trust them with such sensitive information.

One thing that really stood out to me is their customer support. It’s seriously the best I’ve ever experienced! Whenever I have a question or need help, their support team is just a call or message away, and they always respond promptly and professionally. They genuinely care about their customers’ success and go above and beyond to ensure we have a positive experience.

Another big plus with Eureka Payments is their competitive pricing. I’ve compared rates with other providers, and Eureka consistently offers some of the best deals in the market. They are transparent about their fees, and I appreciate that there are no hidden surprises.

Since I started using Eureka Payments, I’ve noticed a significant improvement in my cash flow. Their quick funding times have been a game-changer for my business’s financial health.

In conclusion, I can’t recommend Eureka Payments enough. They have simplified my payment processes, provided top-notch security, and offered outstanding customer support, all while saving me money. If you’re in need of a reliable and efficient payment processing partner, look no further than Eureka Payments. They’ve definitely earned my loyalty as a customer!