Stax by Fattmerchant Reviews & Complaints

UPDATE:

We have recently lowered Stax's rating due to the company refusing to provide its customers with detailed account statements regarding individual transactions and the associated interchange fees. Stax claims to pass along base interchange fees with no markup; however, refusing to provide detailed statements makes it impossible to verify that the company is doing so accurately. We cannot recommend Stax until the company provides complete transparency to its customers in an easily accessible format.

Overview

In this article, we explore Stax by Fattmerchant, a unique player in the payment processing field. We focus on their subscription-based pricing model, which offers a flat monthly fee without percentage-based rates, potentially benefiting high-volume merchants. Key features such as the Omni software platform, integrated inventory management, and an advanced virtual terminal with invoice management are highlighted, showcasing the company's commitment to streamlined and efficient payment solutions.

We also compare Stax by Fattmerchant with competitors like Stripe, noting its competitive advantages like lower transaction fees and QuickBooks integration. Our article delves into customer support options, the company's legal and operational framework, and gives an overview of customer and employee reviews. Additionally, we analyze the company's transparency in pricing and its position in the overall payment processing landscape. This comprehensive review aims to provide a clear picture of what Stax by Fattmerchant offers in the rapidly evolving world of merchant services.

About Stax by Fattmerchant

Headquartered in Orlando, Florida, Stax by Fattmerchant is a subscription-style merchant account provider that was established in 2013 but began operations in early 2014. The company was previously known as “Sunshine Payment Services” and is a reseller of NPC/Vantiv (now Worldpay).

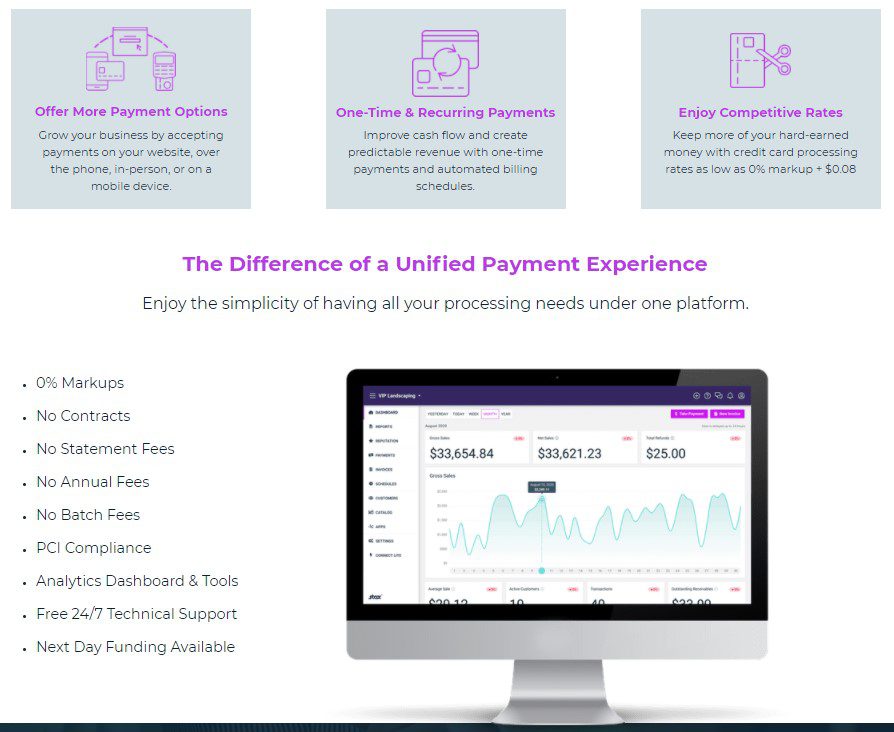

Stax by Fattmerchant Payment Processing

Like Payment Depot or Transparent Merchant Services, Stax by Fattmerchant specializes in charging merchants a flat monthly fee and a fixed per-transaction fee with no percentage-based rates. Fattmerchant offers merchant accounts via mobile phone payment processing as well as a robust virtual terminal for e-commerce merchants. The Stax mobile app is available on iOS with a just-released Android app. It can be used as a standalone solution or as part of an integrated omnichannel platform that includes both card-present and card-not-present processing. Additionally, all transactions, drafts, catalog items, and inventory updates made in the mobile app are synced in real-time across all devices, including Stax by Fattmerchant’s virtual terminal.

Subscription-Based Pricing Model

One of the standout aspects of Stax by Fattmerchant is its subscription-based pricing model, which differentiates it from many other providers in the industry. This transparent pricing structure offers businesses a cost-effective alternative to traditional percentage-based fees, resulting in potential savings for merchants processing a high volume of transactions.

Omni Software Platform

The proprietary Omni software platform developed by Stax is another distinguishing feature. This all-in-one platform consolidates payment processing across various channels, providing a unified view of a business's transactions. The platform's user-friendly interface and real-time analytics offer a seamless experience that simplifies payment management for merchants.

Integrated Inventory Management

Stax's integrated inventory management system is a valuable addition to its suite of services. This feature allows businesses to maintain accurate inventory records and streamline their operations. By integrating inventory management directly into the payment processing platform, merchants can optimize their workflow and save time on manual tasks.

Virtual Terminal with Invoice Management

Stax's virtual terminal goes beyond basic payment processing by incorporating advanced invoice management features. Merchants can create and send customized invoices, track outstanding payments, and even set up automated reminders for customers. This added functionality makes it easier for businesses to manage their invoicing and receivables.

Developer-Friendly API

Another unique aspect of Stax by Fattmerchant is its developer-friendly API, which allows for seamless integration with third-party platforms and custom applications. This flexibility makes it easier for businesses to tailor their payment processing solution to their specific needs and integrate it with other systems they may already be using.

A Powerful Competitor to Stripe

Stax by Fattmerchant's e-commerce solution offers many of the same features as the popular payment aggregator Stripe but with several notable improvements. While both services offer an API for developers, a month-to-month contract, and integrated mobile payment options, only Stax provides a lower per-transaction fee, a customer support phone line, next-day funding, and QuickBooks integration. Stax’s linked mobile solution supports invoicing, manually keyed-in transactions, saved payment methods, and camera-scanned cards. Businesses are also able to add on a Bluetooth reader or terminal if they choose to accept card-present transactions.

Location & Ownership

Fattmerchant is a registered ISO/MSP of Fifth Third Bank, Cincinnati, Ohio. Fattmerchant is located at 618 E South St Suite 510, Orlando, FL 32801. Suneera Madhani is the founder and CEO of Fattmerchant, while Sal Rehmetullah is also listed as a founder.

Video Summary

| Pros: | Cons: |

|---|---|

| Level 2 Processing Support | Additional Add-On Fees |

| Terminal Protection | Only for US Merchants |

| Custom Branding Options | Not for Low-Volume Businesses |

| Next-Day Funding Available | Reports of Billing Issues |

| Offers Digital Gift Cards | Customer Service Complaints |

| QuickBooks Integration | E-Commerce Limitations |

| Diverse Hardware Options | Equipment Return Fee |

| ACH Processing Capabilities | Monthly Fee Required |

| No Per-Transaction Markup | |

| Integrated Payments Platform |

Stax by Fattmerchant Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Limited Complaints

We have only found a few negative Fattmerchant reviews, and there is no suggestion that the company is involved in any scam or fraudulent activities. The existing complaints mostly revolve around negative sales experiences or unfavorable pricing, without a consistent pattern in the negative feedback received by the company. If you have your own Stax by Fattmerchant review to share, please feel free to do so in the comments below.

Email Invoicing Service

Stax by Fattmerchant’s virtual terminal offers the flexibility to send one-time email invoices, schedule future invoices, or set custom payment due dates to ensure timely payments.

Fattmerchant Legal History

No significant class-action lawsuits or FTC complaints have been filed against Fattmerchant. Dissatisfied clients seeking non-litigious resolutions with the company are advised to report any concerns to the relevant supervisory organizations.

Stax by FattMerchant Support Options

Stax by Fattmerchant offers phone and email contact details on its website, with additional in-house after-hours support available. This sets it apart from competitors like Square or Stripe in catering to mobile businesses and e-commerce merchants.

Stax by FattMerchant Customer Service Number

- (855) 979-1080 – Toll-Free General Customer Service

Other Support Options

- Live chat

- Customer service form

Fattmerchant is a relatively newer player in the industry, and while it may accumulate complaints over time, its strong customer support options, legal track record, and clean complaint history in its initial years of operation have contributed to its “A” rating in this category.

Stax by Fattmerchant Online Ratings

Here's How They Rate Online

| BBB Reports | 105 |

|---|

Over 60 Complaints

Stax by Fattmerchant currently has an “A+” rating with the Better Business Bureau and has been accredited with the BBB since 2020. The company has received 66 complaints in the last 36 months.

What Merchants Say

In addition to those 66 complaints, Stax by Fattmerchant has also received 41 informal reviews, although it should be noted that these informal reviews are not subject to authentication by the BBB. Of the 41 informal reviews 28 were negative in tone while 13 were positive. This is a major uptick in negative reviews from the 3 at the time of a recent review, but it appears that the company does respond professionally to most reviews. The most recent negative review mentions faulty equipment and poor customer service:

We started with Stax payments 2 weeks ago. It has been nothing but trouble from the beginning. The first Dejavoo terminal wouldn’t turn on. The second took transactions but wouldn’t batch (at all). I am still waiting for those funds. The third seemed to work, but when I self batched, no funds have hit my bank in 3 days. Only the portal got funds into my acct. Of course that takes a lot more time and keyed-in expense, I assume. They said that they were working on it (a week ago). But now waiting on those that “batched” this week too. Communication is lacking. I hope I get this resolved before we run out off money? Looks like we will have to put sales through the portal again today, as those are the only funds that get to the bank! We are a small retailer. I’ve lost too much sleep over this!

Clients in this situation should familiarize themselves with how to cancel their account without paying any fees.

A Well-Deserved “A”

Given the high resolution rate of Stax by Fattmerchant, we agree with the BBB’s rating at this time.

Stax by Fattmerchant Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Interchange + |

| Equipment Leasing | Likely |

Month-to-Month, No Termination Fee

The standard Stax by Fattmerchant merchant agreement is typically a three-year commitment through Vantiv with automatic renewal for two-year terms and a liquidated damages early termination fee. However, according to a company representative, the early termination fee is actually $0, as specified on the merchant application. The Fattmerchant website also states a month-to-month contract with no cancellation penalty. Merchants should ensure their documentation aligns with a $0 early termination fee or overrides the NPC contract’s language. Additionally, the website clarifies no charges for statement, PCI compliance, annual, batch, or monthly minimum fees.

Subscription-Style Pricing

Stax by Fattmerchant offers two plans: a $99 per-month standard plan for businesses processing under $1 million annually and a $199+ per-month enterprise plan for those over $1 million. The standard plan doesn’t include percentage-based markups above interchange but charges either $0.08 or $0.15 per transaction based on the sales environment. It includes analytics, 24/7 support, with no additional fees or long-term contracts.

Lacks Interchange Pass-Through Transparency

Despite claiming to pass base interchange fees without markup, Stax by Fattmerchant lacks transparency in transaction fees on statements, raising concerns. Detailed statements on each transaction’s interchange fee upon request were declined. This refusal raises doubts about fee transparency, potentially indicating undisclosed fee padding. Providing detailed transaction information should not be an issue if rates are based on base interchange.

Virtual Terminal and Payment Gateway Pricing

Apart from storefront payment processing, Stax by Fattmerchant offers virtual terminal and payment gateway services. Monthly fees for the Standard Plan are $99, and for the Enterprise Plan, $199. Both plans charge interchange plus $0.15 per transaction.

ACH Payments

Bank-to-bank payments are accepted through Stax by Fattmerchant at a flat rate of $0.25 (standard) or $1.50 (expedited) per transaction, included with all Fattmerchant accounts.

Enterprise-Level Options

The $199+ per month plan also skips percentage-based markups above interchange. Its per-transaction rates vary based on the sales environment and include additional features like risk monitoring, dedicated account manager, analytics reporting, and chargeback assistance. The pricing page mentions enterprise plans starting at $199 per month, with higher quotes possible for clients processing well over $1 million annually.

Stax by Fattmerchant Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

Keeping Sales In-House

Fattmerchant appears to utilize conventional advertising and an in-house sales team to market its services. There is no evidence that Fattmerchant is a typical industry “hiring mill,” and we cannot find any Fattmerchant reviews that accuse the company’s sales reps of unethical conduct. Two complaints from the past few years do mention aggressive telemarketing tactics by Stax sales representatives, but this does not seem to be a widespread issue at the company.

Full Disclosure

Stax by Fattmerchant provides a link to its contract terms on its website, and it lists its full pricing details for anyone to review. There is no indication that these fees are quoted in a misleading way. Fattmerchant’s commitment to transparency is uncommon within the industry and has earned it an “A” in this category, as well as a spot on our top-rated all-purpose processors list.

Our Stax by Fattmerchant Review Summary

Our Final Thoughts

Stax by Fattmerchant rates as a reliable credit card processing provider according to our rating criteria. The company is showing very few complaints and appears to offer competitive, transparent contract terms. Stax by Fattmerchant offers the unique value of being ideal for both newly established businesses and enterprise-level processing alike. Business owners are encouraged to request and review all documentation, even when dealing with top-rated credit card processors.

If you found this article helpful, please share it!

Jay Feldman

Run!!! After enrollment I processed a few small payments with no issues. At the time of enrollment, advised the sales person that occasionally I get a charge for a larger amount. Received remittance advice from my customer’s 3rd party payment service an presented it for payment. Was advised that it was on hold and additional documentation needed to be provided. I provided requested documentation. They also wanted me to submit additional profile info which I had just provided months earlier. They have processed the charge. They have the funds. Phone calls and emails go unanswered. Should have done my homework better. These people have numerous complaints files with Florida BBB.

Adam

FattMerchant (Sid Masso was our onboarding rep) did a good job of breezing us through onboarding and consistently represented their transparency and simplicity in their fee structure.

A short while after we started with them (with several different companies we own) we noticed our rates increasing in the form of fees we were never informed about.

When we initially onboarded with FattMerchant (stax) there was one site to login to actually process cards and see credit card activity with clients, and a separate portal to access to see our statements and fees from FattMerchant (Stax). Note: We did not have access to the site to login to see our fees and bills until several months after onboarding with Stax.

Once we did eventually get access to see our detailing billing, we noticed that we were being charged “Data Analytics/Performance Analytics Fees” as well as “Chargeback Fees” as well as PCI non-compliance fees, despite our never hearing about analytics fees before and despite our being walked through PCI compliance on a lengthy phone call with Stax.

The analytics fees are instituted in an “opt out” manner, wherein at the very bottom of your detailed billing statement, there’s a small one-line notice that they will start billing that fee and providing that “service” unless you opt out. As I mention, we didn’t even have access to see these detailed bills until months after onboarding. And even if we did, there was ZERO explanation of the imposition of additional opt-out fees like this at the outset.

As to the chargeback fees — FattMerchant said these were supposedly charged to us in error and would be refunded. Again, no mention of these at all in our contract or during onboarding. How many clients don’t catch these fees?

As to PCI compliance, we spent more than an hour on a phone call with Larissa Poidmani with Stax and walked through each question. The questions that we weren’t comfortable answering yes to, we were instructed to mark that it did not apply. At the conclusion, Larissa with Stax confirmed our satisfactory PCI compliance. Then we got billed for noncompliance anyway. We’ve gone back through and re-done the PCI compliance repeatedly and still get billed for it periodically.

Upon complaining about these fees, we engaged in a LONG email back and forth with seven different parties from FattMerchant/Stax. The initial response about the opt-out fees is that they were explained in our contract. That was not true, there was no mention of them. Then the next level of support eventually just said that Stax had employees to pay and had to have a way to generate additional revenue. Finally, we ended up with Samantha Karpovck and then Nick Wilson (the highest person we reached) and Nick eventually offered a partial refund of these fees and then just stonewalled and stopped responding to us.

Nobody ever acknowledged the suspect nature of the imposition of thes fees. Stax has a reasonable pricing model based upon what they advertise as their fee structure. BUT, they have additional fees they will institute in an opt-out manner, with essentially ZERO notice, and they won’t tell you about these. This is deceptive, especially for an entity that advertises as being simple, straightforward, and transparent.

BUYER BEWARE

Athena

Sales rep claimed Stax offered NO-contract, month-to-month services with no termination fees. He sent over the application and in small, fine print and one check box to left, there was mention of agreeing to the “Services Agreement”. Which is very much a contract. 50 pages. Fraud

Joshua Raboy

They are a Terrible Company. Once you end the Service they keep Billing you.

Adam

AMEN to lowering the rating. The lack of ability to provide detailed statements is what initially prompted us to discover thousands in additional fees we were being charged by FattMerchant/Stax. I couldn’t understand how with our previous provider we got detailed statements of every fee, interchange rate, etc. but with FattMerchant/Stax they simply say they can’t provide this.

I left a detailed review of our experience here: https://www.trustpilot.com/submitted/review?correlationid=5761d94f-d13b-4b5f-920a-4e729439f56c

Not sure if outside links are allowed, but I can provide emails, documentation, bills, etc. detailing our unfortunate experience with FattMerchant/Stax. Really disappointing.

Cheryl Truong

Beware: We signed up and never received our terminals. However, was being charged monthly fee of $209. We tried to cancel and ask for refund but the refused to refund. Eventually, we got more terminals but we called to return them and was told that I would receive return shipping labels in an email. Never received that either. I thought we could get this resolved but we were ignored and monthly drafts just piled up to upwards of $2900.00. We just had to stop payment on the drafts to our account. Probably going to seek legal advice. Never once used terminal, never once used service, never once received any cancellation notice from them even though I cancelled. I think it is illegal to charge for services/goods never received or used.

Fattmerchant aka Stax is Unreliable

Fattmerchant has been really inconsistent and ultimately we chose to leave them for Dharma after several bad customer service experiences. For us Fattmerchant could never manage the most base level customer service actions- like updating a bank account – something that should be super easy was met with inaction, mistakes, and delays so we almost left them a month into signing up but we liked the interface and figured it was a bump. However a year later and we received a threatening letter from WorldPay the merchant services because Fattmerchant failed to update a 3d cart storefront we were setting up and never could once Covid caused layoffs so we cancelled it- but low and behold we found out from a collections person that Fattmerchant had created a completely separate MID for our storefront, failed to update the bank account to it and then when we closed the storefront we never built they forgot to tell World Pay that too so monthly charges accumulated for over a year that we never were told about. World Pay said Fattmerchant had access to the billing breakdowns and could not explain how not even the account manager assigned to us knew anything about charges accumulating. But Fattmerchant blew it and when we found out and reached out- we asked for a supervisor to our account manager to contact us and they never did.

Our account manager even assured us in writing that upper management was aware and she could not explain why they were not reaching out to resolve this. We had a collections reported to our credit because of the incompetence of Fattmerchant to simply update our account information which they had confirmed in writing repeatedly they had done when they had not.

I am disgusted with them. They have a good interface but when it counted Fattmerchant was terrible. No one took responsibility. No one helped. And worse, they even tried to suggest it was our fault for “not completing a PCI compliance” but I contacted World Pay and challenged that and they said it had nothing to do with PCI and everything to do with Fattmerchant not updating our account so yeah, in our experience, Fattmerchant aka Stax, sucks.

Brad L.

This is the first processor where I understand my fees. I also have been paying about half of what I was paying with my previous processor.