Intuit Merchant Services Reviews & Complaints

Overview

In this article, we take a focused look at Intuit Merchant Services, also known as QuickBooks Payments, highlighting its recent shift in operations and the discontinuation of QuickBooks Desktop POS, a change that necessitates users to seek alternative solutions. We provide a concise analysis of the key aspects of their service, including rates and fees, contract terms, and the impact of these factors on businesses.

Our examination includes insights into customer and employee experiences through an evaluation of common complaints, industry ratings, and user reviews. This gives readers a balanced view of Intuit's performance in the merchant services sector.

We also cover the essential services offered by Intuit Merchant Services, such as payment processing, online and mobile payment solutions, fraud protection, and invoicing features, with a special focus on the seamless integration with QuickBooks software. This integration is crucial for those relying on Intuit's ecosystem for their accounting and transaction needs.

The article also touches upon Intuit's customer support avenues and provides a brief overview of the company's online ratings across various review platforms. This concise yet comprehensive overview is designed to equip readers with all the necessary information to understand and evaluate Intuit Merchant Services for their business needs.

About Intuit Merchant Services

Intuit Merchant Services, also known as QuickBooks Payments, is a merchant account provider based in Mountain View, California. Intuit first entered the merchant services industry in order to package credit card processing services with its QuickBooks accounting software. To make this easier, the company established a partnership with Innovative Merchant Solutions. In 2003, Intuit acquired Innovative Merchant Solutions, and in recent years the company has restructured its merchant services division under the QuickBooks Payments brand. In fact, it's possible that Intuit Merchant Services is no longer a distinct unit within the QuickBooks family of products, but we will continue updating this review until the company officially scraps it.

In spring 2023, Intuit announced that it would be shutting down its QuickBooks Desktop POS by October 3, 2023. The market share of the QuickBooks POS is not massive, but companies that do use it need to find an alternative before that date.

Intuit Merchant Services Payment Processing

Intuit Merchant Services processes all major credit and debit cards for most business types. Their services include ACH and check processing, pay-enabled invoices, mobile payments, scheduled and recurring payments, next-day deposits, bookkeeping, invoice tracking, QuickBooks cash bank accounts, and payment links. They appear to focus exclusively on payments out of a store, though their mobile options may work for in-store payments for small businesses. Intuit announced at the end of February 2023 that they no longer sell their POS product.

Online Payments with Intuit Merchant Services

For businesses that operate online, Intuit Merchant Services offers online payment tools. This includes a payment gateway for processing transactions over the internet, and the ability to set up payment links in invoices sent through QuickBooks.

Mobile Payment Solutions from Intuit Merchant Services

For businesses that need to process transactions on the go, Intuit Merchant Services offers a mobile payment app. This feature allows businesses to accept card payments directly from a smartphone or tablet, providing flexibility for businesses that aren't tied to a physical location.

Intuit Merchant Services' Fraud Protection

Understanding the importance of secure transactions, Intuit Merchant Services incorporates measures to prevent fraud. These tools aim to protect businesses from unauthorized transactions and reduce the risk of financial loss.

Invoicing

Intuit Merchant Services offers an invoicing feature that allows businesses to send invoices to their customers and receive payments online. The platform provides customizable invoice templates and allows businesses to set up recurring invoices for their regular customers.

Seamless QuickBooks Integration

The vast majority of merchants learn about Intuit Merchant Services through QuickBooks, a small-business accounting software program developed by the company. Intuit has done a great job of packaging its credit card processing service into QuickBooks. The integration makes it very easy for businesses to seamlessly charge cards and track the sales in essentially one step. In fact, we have found that many clients will accept higher processing rates with Intuit (rather than switch processors) to keep the easy, integrated accounting functionality. Intuit's primary merchant account product at this time is QuickBooks Payments. The company uses First Data (now Fiserv) as its processor but handles its customer service and operations in-house.

Location & Ownership

The president and CEO of Intuit is Sasan K. Goodarzi. Intuit is located at 2700 Coast Ave, Mountain View, CA 94043.

| Pros: | Cons: |

|---|---|

| User-friendly interface. | Slow deposit times. |

| Comprehensive solution in one platform. | Sluggish server performance. |

| Transparent pricing structure. | High charges for lower sales. |

| Seamless QuickBooks integration. | Frequent updates and downtime. |

| Predictable flat-rate pricing | Limited invoice customization. |

Intuit Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 250+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Fund-Holds |

| Recent Lawsuits | Yes |

Insights into Intuit Merchant Services Reviews

Our comprehensive review has identified over 250 negative Intuit Merchant Services reviews, with several labeling the service as a scam or a ripoff. While Intuit’s substantial size as a company inevitably leads to a higher volume of complaints compared to smaller entities, it’s crucial for potential clients to consider this context. Encouragingly, the overall rate of complaints has either decreased or stabilized in recent years. If you’ve had an experience with Intuit Merchant Services, sharing your review in the comments below can greatly benefit others.

Detailed Client Complaints

A significant portion of the complaints highlight unexpected fees, disappointing customer service, and abrupt account holds or freezes. A notable account shared here describes a merchant’s frustration with an indefinite freeze on a valid $30,000 transaction. This example is reflective of numerous similar grievances found in feedback sections, underscoring the need for Intuit to improve transparency regarding fees and hold policies.

Legal Encounters and Regulatory Actions

Intuit Inc. faced a $11 million fine in 2014 for participating in wage suppression tactics. Additionally, in 2019, Intuit was accused in a class-action lawsuit of misleading low-income taxpayers into paying for services advertised as free. The most recent developments include a rejected $40-million settlement in March 2021 as insufficient for the affected consumers, followed by an unsuccessful attempt by Intuit to move class-action suits to small claims court in July 2021, which was denied.

Customer Support Provided by Intuit Merchant Services

Intuit offers both telephone and email support to its users. However, frequent reports of long wait times and unhelpful responses have hindered the company’s ability to be recognized as a leader in merchant account customer service.

Contact Information for Intuit Merchant Services Support

- (877) 683-3280 – Toll-Free Customer Support

- (844) 529-4511 – Sales Inquiries

Considering the breadth of customer feedback and Intuit’s response to service-related concerns, the company has been allocated a “B” rating in this review. Enhanced with SEO-optimized phrases such as “reviews,” “review,” “complaints,” “customer reviews,” “customer complaints,” this analysis aims to offer a balanced perspective on Intuit Merchant Services’ offerings while improving its online discoverability.

Intuit Merchant Services Online Ratings

Here's How They Rate Online

| BBB Rating | 1.09 |

|---|---|

| Trustpilot Rating | 1.1 |

| SiteJabber Rating | 2.9 |

| Average Rating | 1.7 |

Profiles Cover More Than Merchant Services

Profiles for Intuit cover the entire company, including its merchant services department. Since Intuit’s payment services are typically integrated with its other products, it seems reasonable to consult the company’s BBB profile as a reflection of its customers’ satisfaction.

BBB Rating Analysis

Intuit has a customer review rating of 1.09/5 stars on the Better Business Bureau (BBB) website, based on 513 customer reviews. The company has faced 3,519 complaints closed in the last 3 years, with 1,192 complaints closed in the last 12 months. Common themes in the reviews include issues with product/service and customer support.

Negative Feedback

The Quickbook ********************* does not work on desktop and hasn’t for many months. However, it is the only way to repair the link between the expense service and one’s bank account. Without it, ********************** Self Employed does not work. I’ve used the chat function, emailed them about this, and tried to call, but none of the employees can help and I’ve been paying for a service that effectively does nothing. Please email me rather than calling because ******* will not know anything and is just there to assuage customers rather than fix their problem.

– Complaint from November 7, 2023

My payment and QuickBooks account have been cancelled without my permission or any communication in the past two months.

– Review from November 9, 2023

Positive Feedback

There are no positive reviews published about Intuit on the BBB website.

Source: BBB

Trustpilot Rating Analysis

Intuit QuickBooks has an average customer review rating of 1.1 out of 5 stars on Trustpilot based on 577 customer reviews. The majority of reviews are negative, with common themes including complaints about poor customer service, software issues, and difficulties with account management.

Negative Feedback

This is the most convoluted, unintelligent, purposely confusing software you could use to run your books. This is designed to destroy your calculations. Shame on everyone involved in this scam. Rot in hell.

– Review from November 20, 2023

I have been a TurboTax customer for years and I’ve seen a steady decline in both their customer service for the past three years. 1. Try calling them. Not about tax related items but other items related to your account. 5am-5pm pacific time Monday-Friday except for a bazillion holidays. 2. Try to remove your credit card information from their site. You can’t. Customer service cannot either. 3. Try requesting your credit card information to be removed via their data privacy program. Again, you can’t. The only way to get the credit card deleted is to delete your entire account.

– Review from November 16, 2023

Positive Feedback

There are no positive reviews published about Intuit QuickBooks on the Trustpilot website.

Source: Trustpilot

SiteJabber Rating Analysis

Intuit has a diverse range of customer reviews on SiteJabber. The reviews cover various aspects of Intuit’s services, including software performance, customer service, and specific issues with financial transactions. While some reviews express satisfaction with the software and its features, others highlight significant concerns and negative experiences.

Negative Feedback

Open forum unprotected and manned by people who, in my case, were of limited competence and had no access to the submitted TurboTax material nor to tax income return being investigated. The software was embarrassingly poor, of the kind that freezes, sends you away, or goes back to the beginning. It was difficult to find the individual postings of my case. One of the moderators sometimes intervened with sarcastic and uncalled-for comments. I had expected that they would be able to review my return, but the moderators were outside people. They needed my password to go my papers, and they did not know much more than myself. I suspect that a lawyer would be needed to get the company’s attention. After the incident, I searched the web for other criticism. Do you know what? TurboTax is used by hundreds of thousands of people, but I found it difficult to find critiques.

– User Review

Intuit made a serious mistake putting thousands of dollars of someone else’s money in my account. When we tried to return it, they would not accept part of it and charged us money for refunding the funds they had wrongly put in my account. Months later, they began to call, email, and threaten us to pay them, but they did not provide an invoice or any explanation, and it was not even clear to us that the demand was not a scam. I called the investigator who had tried to sort this out and was told they would sort this out. When I received more threats, I called the phone number on the email twice and was told I would get a call back, which never happened. Now they have sent the issue to collections, which they told me they would not do, and they are charging me an additional $500+ dollars. They are not only incompetent but not even attempting to rectify their serious mistakes.

– User Review

Positive Feedback

Love the product and partners they have for both QBO and QBD. Tax1099.com is one such partner that saved my life during busy 1099 filing season. Keep bringing such value-added partners to the ecosystem.

– User Review

Been using them for a while now for payroll and books. It’s a great software, just did not like the fact that they closed W2 e-filing 2 days before the deadline.

– User Review

Source: SiteJabber

Intuit Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | No |

Complicated Pricing

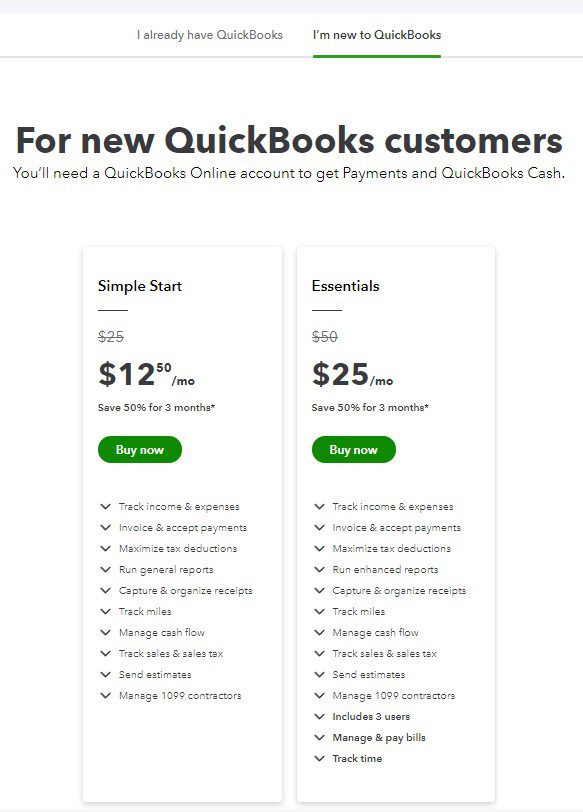

Intuit’s costs and fees have been somewhat complex. Currently, the company offers four distinct pricing schedules based on when a business was approved for a merchant account through QuickBooks Payments or Intuit. An overarching merchant agreement applies to all pricing schedules. Advertised rates and fees on the QuickBooks Payments website align with the most recent pricing schedule.

Point of Sale Pricing

QuickBooks Point of Sale Payments presents two plans: “Basic” and “Pro.” These plans from Intuit Merchant Services streamline information integration into QuickBooks, eliminating the need for manual entry. The “Basic” plan features a swiped rate of 2.7% and a keyed-in rate of 3.4% with no monthly charges. The “Pro” plan costs $19.95 monthly with a swiped rate of 2.3% plus $0.25 and a keyed-in rate of 3.2% plus $0.25. While Intuit Merchant Services doesn’t impose early termination fees, it reserves the right to charge up to $2,500 for account cancellations due to merchant misconduct.

Intuit’s array of pricing plans has caused frustration among business owners due to its complexity. Many complaints stem from confusion surrounding the rates and fees. The transition away from conventional merchant accounts and the staggered rollout of QuickBooks Payments have resulted in a patchwork of contracts, further contributing to the complexity.

Reported Intuit Contract Terms

Previous information suggested that Intuit offers month-to-month contracts without early termination fees. While the current website doesn’t specify the contract length, past reports indicate a two to four-year service agreement with a $295 early termination fee and a PCI Compliance fee of up to $100. Some complaints highlight a structure where Intuit doesn’t enforce a specific termination fee but withdraws a substantial sum from the client’s bank account upon cancellation, returning the funds after settling outstanding debts.

Month-to-Month Contracts

It appears that Intuit currently offers month-to-month contracts without early termination fees across its merchant accounts. This pricing is competitive with the cheapest merchant accounts available. However, clients should ascertain which set of contract terms applies to them and inquire about specific details. We also recommend business owners explore our list of the providers of the best merchant services.

Intuit Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Multiple Marketing Channels

Intuit uses various methods for marketing its credit card processing services, including email, direct mail, and telemarketing. Based upon many of Intuit reviews, there is evidence to suggest that the company uses deceptive advertising when it comes to rate and fee quotes. Numerous complainants describe undisclosed fees and confusing pricing structures through Intuit. Many of these complaints are probably the result of the company’s frequent pricing changes over the last few years (more on this in the next section). This does not compare favorably to our list of best credit card processors.

Previous Rate Quotes

In the past, the Intuit website listed misleading rate quotes by only showing the “Qualified” fee tier for swiped and keyed transactions and making no mention of the more expensive “Mid-Qualified” and “Non-Qualified” tiers. Now that the company is primarily selling merchant services under QuickBooks Payments, it does not utilize these types of tiered rate quotes. As a further point in its favor, Intuit does not appear to hire independent outside sales agents. If you suspect that the company is charging you undisclosed fees, you should consider seeking a third-party statement audit.

Our Intuit Merchant Services Review Summary

Our Final Thoughts

Intuit Merchant Services rates as an average credit card processing provider according to our rating system. The company can improve its rating by reducing its complaint count significantly. This can be accomplished by improving its pricing and contract term transparency, reducing or eliminating its early termination fee, and improving its customer service. On the bright side, Intuit does a good job of resolving complaints through the BBB, and most of its customers appear to be satisfied when you take into account the size of the company. If you are looking for an alternative to the QuickBooks accounting environment, you might want to consider using a FreshBooks-integrated merchant account.

If you found this article helpful, please share it!

Jennings

DO NOT sign up for Merchant Services through Quickbooks.

It’s a nightmare and there is NO help from them when you have an issue.

I’m currently dealing with them charging our business account for a service we never signed up for. I have been on the phone for over 2 hours trying to get the issue resolved and it’s impossible.

Meanwhile, I have payments from customers sitting in delayed status for no reason, double charges for ACH fees, and NO ONE at Intuit who is capable of correcting the issue.

Add to all of that – Merchant Services absolutely bogs down the quickbooks program. It crashes several times a day, freezes up, and is so slow it’s almost unusable.

Gail

I do not recall it being a major headache to set up the merchant service account but today’s lack of support was astonishing. After three phone calls and two chats; I finally found someone who knew exactly what I required and how to find it. On the negative side; I still never received a direct phone number to merchant services or email contact details and hope we never had a major issue as they clearly have no desire to deal with their clients.

donna randolph

I recently got a merchant error – enter a valid zip code after a successful swipe of a credit card in merchant services. Cannot enter a zip code because it is a swiped transaction.

Lindsey Archangel

Same issue here. I reported it to Intuit and was told they are aware of the problem and working on correcting the issue. I told them the only way to make the transaction go through is to manually enter it instead of swiping, which costs us a higher % paid to Intuit. I asked if they would be refunding those higher %’s due to it being their fault and we are waiting on them to fix the issue. Their response was no, we have no intention to refund anyone higher %’s. As with all other issues we have with Intuit/Quickbooks, these issues take years to resolve and this will cost us alot of money by the end of it.

Eva

MERCHANT HERE

This is crazy! A customer disputed a payment out of an honest mistake. She tried to fix it, and her bank said it was in process. On my end, I submitted all required documents: Customer’s signatures, receipts, etc. I get a communication from Quickbooks saying the case is closed (against me). I called for an explanation and nothing, and when I ask for an explanation, this is what I get by email: “Although the merchant provided name, phone, email, and address, compelling evidence was not met: name and address do not match cardholder details. Email could not be verified. IP address was not provided. Documentation does not prove the cardholder is in possession of and/or using the merchandise. Per Visa re-presentment rights for compelling evidence, minimum requirements not met.”

The text above not only is full of crap, it even has typos! Looks like someone just typed it, but it has no essence. How am I supposed to submit an IP address, when they did not ask for one? “Documentation does not prove the cardholder is in possession of the merchandise”. I GAVE THEM A SIGNED INVOICE FROM THE CUSTOMER THAT SAYS ORDER IS COMPLETED AND CORRECT.”

There is no appeal process, no detailed explanation of how this happen. So now I have to invoice the customer again (just because she is cooperating), pay all the merchant fees again, etc. I will probably have to go to the State Attorney General and denounce them for fraud? I think I am going crazy here.

Harvest A Seed

Merchant Payment Chargebacks – Intuit (QB) allowed a consumer payment of over 6K to be reversed without cause. I had a contract, notarized agreement and copy of License to how approval of charges. Not only did they reverse my payment they didn’t even bother to help with the process.

Sophie

A vendor reporting here: Intuit Merchant Services is an absolute nightmare. Nothing functions correctly. Endless errors and nonresponsive website pages, errors when I try to set up an account (it thinks I already have one) or reset password (never get the email to do so, and no, it’s not in my Spam folder). Don’t tell me to clear my browser cache or change browsers–every other financial and business program I use works fine on this browser. I can’t access tax forms or set up a quick-pay link to my bank, must wait a week for you to deposit the payment into my bank account. One of my clients changed to your service and I’m ready to drop the client because of it.

Rob Mee Blind

If you use the phone with these folks you are an idiot, bottom line is they are fraudsters, you don’t matter only them…. You ready for the red tape, the inept company will gladly do everything they can to put the screws to you and your company… trust me beware…. They are worse than any company you have ever dealt with… you have been warned!

Shaun

These guys are crooks, they will sink your business in a hurry. Don’t use them use somebody else,Oracle comes to mind, you will receive no empathy from these guys they are horrible, like ticks… there customer service is , it’s all about them not you they should abandon the attempt to be any sort of service and join the ranks of fraud and scammers. If you ever have a problem with them it’s all gridlock no action…. Be happy with my 30,000 of funds you hold and fight to keep for almost a month.

A Pencilpusher

We have had a horrible experience with QB Payments, certainly unethical and aside from signing away our rights in their contract likely illegal. We processed a bank wire transfer through them over 6 figures, the funds were secure in their clearing bank withing 24 hours, they have now withheld the money for NO reason for over 30 days. Trying to deal with them is IMPOSSIBLE. They have become a horrible unethical company, our advice would not to walk but RUN. Could not be worse.

PayPal Terminator

What all you people need to know is RISK and that is first you should never handle large amounts of money through a third party! Places like Intuit are the ones that handle the large types of transactions and associate a fee with processing the transaction. What people like Intuit are scared of is the word Chargeback. That means the person whos the card was charged, files a complaint against any charges that were made. So they panic immediately for the only reason they are under suspision that they are going to be the one’s holding the debt on the disputed amount. The buyer’s credit card company will literrally pull the money out of Intuits bank account (Chase) and then Intuit will attempt to go after you. They are scared that once the money is in your bank account either you will put a merchant hold on their merchant id or close your account.

Secondly people on this planet are dumb point blank. They are lazy as well. They do not (a very small percentage) actually do background checks on anyone. They will get a $10k order from Nigeria and think nothing of it. And then boom! Everyone knows that Nigeria is like the top scam country in the world! Thats the problem in this world they hand out credit to any stupid moron on this planet.

Intuit loves to play games left and right. They will hold your funds for over 6 months and litterally steal it from you making up some bs reason saying you lost the chargeback dispute. The second you demand documentation from the cardholder’s bank stating such (and the buyers bank is legally required to submit documentation and state the reason why you lost the case) Intuit will refuse to hand over that documentation. You will spend hours on the phone talking to one moron, the next day over the same topic with another idiot, and still nothing gets done.

When you deal in business, (1) you have to know who your customer is (2) what your selling (3) what if that buyer files a chargeback (exactly what is going to happen and what your financial losses are (4) how do I lessen my exposure and expense to filing disputes.

The fact is that the banks and credit card companys are the real scam artists in this whole credit card processing scheme. Intuit is well aware of it and is part of that scam. If you do large transactions, then consider safer methods of transfering money, especially look into the ones that do not involve a third party. The more people who get involved in the transaction, the more complicated things get. Dont ship or release anything until the money is physically in your possession and never before!

Intuit does not care or any other company care about you, they only look at their risk and also say if or not they are making money from you. The whole credit card scheme as a merchant is a whole scam. Buyers can file chargebacks at any time for any reason. Even though its the buyer’s bank that has to review and should be going through procedures to see if the claims the buyer’s file are valid, they dont! There are documents called bank documents or issuer documents in which clearly state what the buyer had told their credit card company into filing the dispute. 99% of those documents are complete lies made by the buyer. Their banks dont care and even if you even call them out on that fraud, the buyer’s bank just pretends it doesnt exist.

Unless you take legal action against anyone and everyone who defrauds you, they are going to look at you, laugh real hard and then continue as if nothing has happened. Buyers deliberately file fraudluent disputes on purpose to steal and the banks know this and purposely turn a blinds eye to it. Until merchants start filing complaints with the FTC and the attorney generals office against these banks, things will only get worse.

Look at Banks like Bank of America and Wells Fargo ripping off their own customers on a daily basis. Every day you hear it in the news, its because they think they can get away with it!

Cameron

Holding large amounts of payments for a small business. Causing overdraft in bank account. Outrageous! Similar to the United Healthcare scandal.

Donna Suggs

Our company receives a substantial amount of our invoices via credit card per year . In February of 2020 we were quoted a better rate ( via email) In February of 2022 we discovered we were being charged a higher rate than we were quoted . After calling numerous times , and our case being sent to escalation department they finally admitted they have reviewed the account and see their error. Another month has gone by and I have contacted them several more times trying to get our account credited back the over charge fee . Which is over $3,000.00.

I have repeatedly been told some one will call me back within 10 minutes or within the next hour . Sixty seven days later , total of 7 phone calls, over 8 hours of logged in phone time (mostly on hold ) we still do not have our money refunded . To make matters worse , I have never received ONE returned phone call from merchant services . I have always initiated the calls where I have to recap the entire issue for the first 20 minutes . . I will call

them ONE more time today. If i do not have my issue resolved we have no other choice but turn this over to our legal team .

Robert Anthony

I have contacted Merchant Services numerous times for an issue where I want to change a phone number and I ask them to call me with a verification code because I cannot receive texts on a landline phone. The call never comes. Merchant Services support was a waste of time. I will have to remove my account due to a lack of adequate support for this service.

Curt Hagstrom

As stated in some of the comments below, QBMS had approved my merchant account and had my debit card to deposit funds into. My first charge of 10K that was made to my account didn’t go well and have been dealing with it since late June. I have tried to resolve it the way I was instructed and it was embarrassing not only to me as well as my relationship with my client. I will now have to wait til March 2022 for it to be reviewed again. This doesn’t guarantee me the funds. My next step it filing small claims suit against QBMS. I have now set up an MS account with my bank and is seamless.

Linda

QuickBooks Merchant Services want to know my personal business before they will release my QB payments into my business account. Negatively affecting my small business. ILLEGAL. Will turn complaint over to the SBA. Discrimination. I am a woman owned company!

**Also hidden fees…

Kathleen Ertmer

QuickBooks merchant services is the absolute worst I have ever dealt with. They could not get anything right after being on the phone for 4 days with them. Money was never routed to the correct bank yet the fees they charged always seemed to make it to the right account. I would not recommend anyone using this service.

Stan Meverick

Don’t bother wasting your time with Quickbook Merchant services, they aren’t the worst but they are close. Have had enough of them (1) they keep screwing over merchants by mysteriously losing chargeback documents, (2) you go 120 days plus until you get your money back where as most companies give you the money back, so you have to keep track of everything you have disputed, and 90% of the time Intuit mysterously forgets to refund your money. (3) every time you call for documents, be prepared to call 5 or 6 times wasting hours plus, because Intuit loves to play games. They will pretend not to have the documents you need to defends the case and most of the times the chargerback codes or reasons are wrong, and then after you lose the case, they had the docs the whole time (3) they are highest of all services because they are backed by the con artists Chase and (4) they have no automatic credit card processing. Everything has to be done by hand, intuit is too cheap to have automatic credit card processing, so you have to chase deadbeats down that cards have declined. I’ve had it with Intuit

Don

Froze my account at “their discretion” while over 7k in invoices were paid and waiting to be released. I was told that I would need to wait 270 days for it to be sent to the state as unclaimed property to receive it. They wouldn’t tell me why that it was just a business decision. So I either go to my customers and look like an idiot or I wait almost a year???

James Brandon

Dont bother with this company. They love playing games when you need documents to prove a case. They love sending you the wrong documents or copies of the same ones you have over and over again. You’d think they’d know the difference between documents, but incompetient morons is what they are.

Debbie Bregante

totally outrageous fees. At first, I was only paying .50 a check transaction now they want 10% or a monthly fee and 3.00 per check deposited. How do you go from .50 to 10% or 3.00? I’ll never purchase an intuit product again. I hate this company I wish there would be another bookkeeping product that can complete with their books

Dene Sweeney

AWFUL! I would NEVER suggest anyone use them. I used them for many years as a business thinking since they were the processor of our credit cards they had our back. This is not the case we had a customer purchase nearly $20,000 on stolen cards. I called to double check with Intuit to make sure there is no way this was fraud or could come back. The said absolutely not it was good to place the order. So I did,I placed the order and shipped it to the costumer. Long story ends up it is a stolen card. The CC company charged back and intuit is trying charge me for it. I have not paid it back. BUT I am an LLC and my business is what is using intuit and QuickBooks. According to them it doesn’t matter they are sending me personally to collections. Mind you they didn’t call me or let me know this was a stolen card as soon as it happened it took over 30 days to let me know.

Diana Firey

When upgrading QuickBooks POS, we took Intuit up on the “no strings attached”, buy one license, get one free IF we try their card processing. We did try their card processing and what a mistake! You have to wait around a week before credit cards are deposited into your account. This is purposeful highway robbery to hold onto money that long! We switched back to our regular card processor who deposits next day. But now Intuit charges our bank account $19.95 every month whether we use their slow processing service or not (I’m sure it was there in the fine print that they could do this). I am complaining on this forum but also am considering filing a complaint with The Federal Trade Commission on this unfair practice.

Erick

Useless support nobody there is vested in the customer, they’re main skill set is collecting fees. Would never again use this bloated company for processing credit cards

Marc Porter

Horrible experience, not unlike other reviews posted here. First payment took 3 weeks to post to my account. 5 phone calls over 5 days answering questions and sending documentation, each time being told the funds were being released, there was nothing left to do, only to find out the next day they were still withheld. I was assured after the first batch, all future batches would be cleared. Not the case. After waiting 9 days for the second batch to move from pending, it moved to “in review” just like the first batch. Another email was received requesting all the same documents already provided. This comes after spending an hour on support before the email arrives, and the support agent assuring me everything was fine and the funds would release the same day. I am not looking forward to another 5 days of phone calls to get my money. Stay clear of these guys. Use a different processor unless you can wait 2 weeks for your funds and lots of time on the phone.

Susan

Funny story, I have been waiting over 30 days for QuickBooks to release my funds. I just finished speaking with yet another representative via chat for about an hour now. I had to ask if they were a bot or a human because they just kept repeating the same answer over and over. The one and only possible way that we can get funded is to wait till the end of the month to receive our bank statement. Proving that the bank did not received the money. Of course I asked for documentation in return to provide proof that they sent the money. Nope they can’t do that. I must provide my bank statement to them in order to prove I have not gotten paid but they are claiming to not have the ability to provide documentation to me. The end of the month will be another two weeks from today. At that time I am to send my bank statement to QuickBooks and then hope that they will re release the funds and then of course there will be at best, another couple days for that to get processed into my bank account. PS QuickBooks has already been paid, they collected their “processing” fee out of my bank account the day the transaction occurred. There’s got to be a law somewhere about this. Wish me luck on hunting it down.

Delaina Hanssen

David vs. Goliath: I am a small (smallest) business owner using Intuit’s Merchant Services 10+ years. I canceled my account, for which I received a case number. Two months later Intuit continued to charge my bank account (still active/dedicated solely for Intuit) which caused an overdraft of $56. After an hour of my time on the phone with 4 different Intuit reps, they admit they made a mistake and would credit the monthly charges but over 4 weeks. However, Intuit is unwilling to pay the bank overdrafts – clearly due to their mistake. I am left owing $56 overdraft, plus my hour of time getting the lukewarm resolution offered. Moral of the story: while small business strives to succeed, big business gets away with cheating and sweeping their mistakes under the rug. I would like to update this review that they stepped up to plate to resolve this issue. Let’s see.

Tracy Obrey

Do not do it! It’s been 17 days since payments have been processed. They told me a fraud alert came up because somebody’s card declined. After 2 1/2 weeks, 8 phone calls, every bit of information about my business, 6 scanned contracts, DL, EIN filings, phone numbers and addresses of clients, two interviews with employees. Treated like a criminal.

This post will help: Best Merchant Accounts for Fitness Instructors

-Phillip

Jo M

DO NOT USE INTUIT!! Especially if you have a home business. I use a UPS box as my business address. I repeatedly told into it this when I was trying to tell them I was unable to give them utility bills cell phone bills Etc with my business address on it because it was a UPS address. They refuse to listen they told me that if I couldn’t do it then I would not get my one transaction money from my customer. I asked them to close the account and they told me they would hold onto my money for almost a year (270 days) before they could decide to release it or not. Anytime I call to check status, they can’t even find my company in their database without extensive searching. They’ve purged me from the records it seems and held on to almost $1,000.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Jeff Zewin

I was charged full processing fees for payment collection and when I refunded the charge about 12 hours later I was then charged again the full processing fees on the refund amount. I collected $0 and they think its ok to not only keep the original transaction fees but then on top of it charge me again to refund it. Not good business

This post will help: Cheapest Merchant Accounts

-Phillip

William Lee

My business was a user of the Intuit POS and we had a merchant account with Intuit.

We used the Intuit POS system and merchant account for several years. In 2016 we were notified that we would need to upgrade our system to be able to accept the now mandatory chip cards. After finding out the cost of the upgrade was more than we paid for the original software, we cancelled the merchant service, continued using the POS system, but used Square for credit card transactions. The merchant account was closed in August of 2016, after our last transaction on the system, or so we thought.

Fast forward to June 2019. The business ceased operations December 31, 2018. I received an email from Inuit stating that their monthly fees were declined from the bank.. The bz checking account has remained open to clear any outstanding debts or money owed to the bz. Intuit attempted to make the charge the bank account a 2nd time.

Now I come to find out that they have been charging the account monthly $45 for service that was cancelled.

I called and was giving a bunch of “merchant agreement bs”, but they offered to refund me only $29.95 for 12 months (about $360), and basically told me to kick rocks over the $150 in insufficient fund bank charges they caused to run up.

So after charging me $1395 for a service that was cancelled, $360 less the $150 bank charges I would have to pay.

I spoke with “Kayla” (if that is her real name) at a Intuit call center in Florida (she refused to tell me what city or her last name, though they had all of my information) and she was the call center supervisor that offered the lame settlement.

They put the blame on me that I should have called back to make sure the account was cancelled, and that their end everything is computer generated.

They really tried hard to get me to upgrade the software and to chip reader at a heavy cost. Merchant account was cancelled at that time.

Many better and quicker and cheaper merchant accounts to use such as Square or Stripe.

I offered to accept $990 over the $1395 actually owed but the went from offering 6 month refund to one year, less the $15 monthly minimum charge.

Im NOT done, I will get my $1395 plus the $150 bank charges. They dropped the ball on this several times, as INTUIT failed to followup.

This post will help: How to Get Out of a Merchant Account Contract

Kelly

Quickbooks……where did I begin! Been in business 23 years, used QB for 17 of them. Thanks to websites like yours, it saved us more stress than what we have already ben enduring. We went to the online version and almost jumped to the Merchant Services Program, but have had 6 months if pure hell with customer service with just the desktop conversion! We have lost 7 years of data, important tax data. Our only intact file is locked and being held hostage by their techs over seas. We cant get any help in the US! We have been unable to process anything for OVER 5 weeks! The online program should be renamed, it IS NOT the Quickbooks we all have learned. Its crap. And the monthly fee we are all paying is going to their R&D department while they continue to progress on a program that was out into the market place long before the bugs were worked out! Move on people Intuit has run its course.

This post will help: Best Merchant Accounts for QuickBooks Integration

-Phillip

Penny Fowler

It’s been a while, when I complained they cancelled me and took a $500 charge for early termination. The credit card machine they provided with no fee in writing, was charged $500 to my account when account cancelled. There are no government services to help businesses so buyer beware.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Brady

I ordered a new card reader and when i got it I found out they had charged me twice and sent me 2 card readers. I called back and all I wanted to do was return the reader get my refund and have them pay for shipping because it was obviously there fault. Well the first person i talked to couldnt help me and then I got put on with his supervisor. His name was Nick, He was the rudest most ignorant big headed dingbat I have ever had the displeasure of speaking with! He refused to give me any information that could identify him and he would not pass me on to his supervisor. All he would say is he would not pay for my shipping on the product that I didn’t buy. I finally got mad enough to hang up and re call. Jaileen was fantastic, her and her supervisor were able to refund me the money and get things squared away. Owning my own business if I ever had a supervisor treat a customer the way I was treated I would have fired him on the spot. Over all I am still pissed with merchant services customer service its the worst I have ever had to deal with, but I am glad there was someone who was reasonable to deal with.

This post will help: Best Merchant Accounts for Great Customer Service

Ali

Don’t sing up for QB merchant service. They don’t have enough phone support. You will be wasting countless hours for being on hold.

They are wanna-be merchant service company but they can’t support that.

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

Purchasing

The worst credit card processing company alive! Be prepared to spend an hour on hold every time you attempt to contact Intuit Merchant Services. Every single time they are changing their phone system and every single time they do it to annoy the hell out of you. Be prepared to pay the highest of all credit card fees around. Not only that if you get scammed by a buyer, good luck trying to get Intuit to defend you. They give you the run around bs statement saying they are just the processor for you and we’re this and that and never deliver. They sit around doing nothing, need bank documents for a dispute good luck trying to get them. They will lie and do nothing they don’t care about you as a merchant period! And in addition, their software for processing credit cards automatically is non existant. They have nothing that will automatically process credit cards for you. So stay away.

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

Chris

Seems like a recurring problem. I am a freelancer who was scammed for employment. The customer used a fraudulent credit card with information they had stolen. The money received is long gone on sources needed to complete the work. I’ve received calls from credit card companies claiming that these charges were unauthorized and now I fear having to owe thousands in chargebacks. This is money I don’t have and I fear Intuit holding me responsible and losing everything that I have. Has anyone had success in fighting these chargebacks? Can anyone help me or refer me somewhere? I’m desperate for help.

This post will help: How to Fight Chargebacks and Win

-Phillip

Ryan Wilson

Terrible customer service. Withheld my money from me for over a month (an invoice of over $3k that I needed to pay my bills.) When I called I probably spent 2 hours on hold each time and was told something that didn’t happen. No one knows what is going on there. Terrible experience – I won’t be using their merchant services ever again.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Retail Operations

Would never again use Intuit Merchant Services. The biggest problem is their chargeback department. This department is a complete joke, first they keep changing their telephone number and will purposely play stupid pretending there is nothing wrong. Intuit constantly changes their number and contacting them is next to impossible. If you do manage to find our way to this department, be prepared to wait 45 minutes to an hour for a simple question to be answered. Intuit has the highest fees around that we’ve ever had. If you get a chargeback most credit card company’s will credit you back once you submit the paperwork, not intuit, they will purposely hold your money for 2 months even longer. You will get no help from Intuit except hearing that its the customers credit card company that makes the decision and they will do nothing. On top of that, their software to process credit cards is so outdated so if you have an online store forget Intuit. Everything you do has to processed by hand. So be prepared to get your time wasted from declined cards and the customer running off. Intuit does not eve know what programs they support and what they dont. So any software you for an online store is not going to work. We have had it with the disputes department, like today they give us a falsified dispute and gave us less than 24 hours to respond. Legally we have 30 days to respond, but not intuit, try to call them and they hit you with this bullshxt call center that you cannot get anyone. Avoid Intuit at all costs!

This post will help: How to Fight Chargebacks and Win

-Phillip

Dave

Not happy with this service, but from a developer’s perspective. Integrating your own custom code for your own website is an exercise in madness. Their developer forum has thousands of completely unanswered integration questions and the examples all assume that you are only using Quickbooks Online and that you’re making an app to sell to others. The sandbox (for testing) ONLY works with QBO, and won’t show charges, nor will the Test Merchant Account. There’s little to no explanation if all you wish to do is accept credit cards on your own website (and don’t have a shopping cart where you can just buy a plugin). The other developers are nasty, competitive and tight-lipped about anything and everything (they “answer” your questions by sending links to the documentation – which, incidentally, is pathetic, confusing, or too sparse to be of any use). I’ve worked with over 100 APIs for everything from payments to accounting over the years and never had this much trouble just to do something this simple! To make matters worse, their site constantly (and, yes, daily) has problems, they don’t appear to support half the browsers out there, and they continually act like nothing is wrong. It’s hair-pulling madness. Good luck to anyone needing real help.

This post will help: Best Merchant Accounts for Developers

-Phillip

Angela Montenegro

Theifs. I canceled my card reader services and they continued to charge me for a yr. I filed two claims. When I call to speak with someone they ignore and stay quiet on the phone line and don’t respond. When I call back I get automatically hung up on. I will try small claims court

This post will help: How to Report Bad Credit Card Processors

-Phillip

Ava

DO NOT USE THIS COMPANY!!!!!! I have a construction company so once a client paid their invoice we have a project timeline…All of this was explained when talking to the salesperson. The first transaction they withheld for 10 business days (basically 2 weeks). After I had already waited 2 weeks I get a call/email stating that it had to be reviewed and once everything was done they would deposit the funds within 2 business days. In all I waited 3 weeks for them to deposit the funds- setting me back 3 weeks on my project… I should have gotten rid of them at that time; however, the agent assured me that it was a one-time event because we were new customers. SHE LIED…My next 2 projects came in and the customers submitted their payments and they are holding the funds…and every agent gives me the SAME BS and run around. I hope they shut this company down! I am cancelling as soon as they deposit my funds. I really think that they are doing something illegal with all of their customer’s money holding it that long…It’s ridiculous!!!

This post will help: Best Construction Merchant Accounts

– Phillip

Falguni

Very awful, rates are high, and withhold money for very long time, I strongly Don’t recommend it.

This post will help: Find and Eliminate Hidden Fees In Your Monthly Statement

– Phillip

Mark J. Gabel

I switched to Intuit Merchant accounts and it has been nothing but a nightmare from start to finish. Can you believe they actually stopped payment from one of my clients because they thought it was fraud and didn’t even bother to alert me? It wasn’t fraud.

Next they lost nearly $700 of my money. Took me two weeks and hours of being passed from person to incompetent person. Finally they found it but so far gave NO reason for this.

Don’t do business with this pathetic company. They have no idea what’s going on.

From The Editor

This Post Might Help: Best Merchant Accounts for Marketers

John

Avoid Intuit Merchant services at ALL costs… Just one reason they frustrate me: If you need to process a return on a credit card transaction (even the same day!), they will charge a transaction fee for both the initial charge and the return. For a $500 sale that is returned, that amounts to $65 charge that Intuit keeps and you lose. If you wait 14 days and spend an hour on hold and threaten them, they will offer to return 25% of this fee as a one time courtesy. As a comparison, Square charges no fees in this situation and is handled entirely online.

From The Editor

This Post Might Help: Top All-Purpose Merchant Account Providers

Rick Carlock

DONT DO IT.

they held up my funds (an entire batch of $7300 for weeks to do a random review of my activity. they say they do it to all accts, so know this that at any point in time they will hold your money and make you jump through hoops to get it.

this is an absolute breach of their fiduciary responsibility.

From The Editor

This Post Might Help: How to Make Your Processor Release Your Money

Scott Cooper

Intuit’s Merchant Services department is rife with problems. I could go on and on detailing all the various problems with their management and poor handing of credit card processes and shoddy customer support. I will be looking for a new credit card processing company immediately. I have used many different companies to process credit card transactions with multiple companies over the last 20 years and Merchant Services is by far the worst

From The Editor

This Post Might Help: Best Merchant Accounts for QuickBooks Integration

Mary Shackleford

Have been trying for several years to cancel our subscription as we no longer use it but are still being charge $37 a month

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Jane Banning

Horrible customer service. Rejected a payment on 4 invoices paid from a client with similar name because they suspected him to be an employee. Customer Service agreed that there was not an issue but stated it would always be rejected in the system. 3 invoices paid by credit card were refunded, but refund never updated to our system and invoice paid by ACH transfer was held by risk dept and they would not release it. Told us that we needed clients bank to dispute it, which we did, then they tell us they will release funds, but need clients bank to send a letter stating they will not dispute it.

From The Editor

This Post Might Help: Best Merchant Accounts for Electronic Invoicing

Gina Russon

I just found out that for the past 10 years, Intuit has been direct withdrawing $34.90 per month for using their merchant services…. thing is, I’ve never once used their services! I may have signed up for a “Free One-Month Trial” but if I did, again, 10 years ago, I would have cancelled. They can easily see that I have never once posted a credit card transaction with them – YET, they continued to take $34.90 per month out of my checking account! Don’t you think that for the $418.80 they have stolen from me per year for the past decade that they could have one time sent me a letter or called me to say that “we notice that you are not using our services, but that you are being charged for services that are not being used”? They have never tried to contact me – not by phone, not by letter and not by email. If you currently do business with them, or are even considering doing business with them…. I would highly recommend you look elsewhere – ANY other company other than Intuit for your credit card processing – or should I put it as Credit FRAUD processing! What a joke this company is! I have filed a complaint with my bank, with the Better Business Bureau, and will continue to post anywhere I can about what a total SHAM business Intuit Merchant Services is!

lee willard

Used intuit quickbooks for customer credit card charges. This has been hands down the worst customer experience ever. Place them on speaker phone and continued my office duties…..On hold for 1 hour & 15 mins. Then finally an ans. apologizes for the excessive hold time. Then the phone magically disconnects. I call back on hold another 45 mins. Apologizes transfers me to another sector …on hold another 25 mins. A useless rep answers. My advice ….find your own credit card processing company. A merchant nightmare

Annie

Major issues with Intuit Merchant Services. I manage three of these for three companies and it has become a nightmare. Payments are repopulating over and over on the deposit download link and there is no way to delete these. If they are downloaded again in an effort to move them off the Merchant download page and also causing duplicate payments plus errors in the bank account ledger, the payments then re-populate as if never downloaded. Cannot get any help or resolution from Intuit Merchant Services – even if you get an Intuit rep on the phone after holding nearly one hour. The first answering rep is overseas who cannot assist at all, then you get transferred around and still no help. A REAL NIGHTMARE

Claudia Nascimento

Worst customer service ever – 45 minutes to 1 hour for someone to pick up the call. Several issues processing transactions and having to contact over and over even after issue explained. When thinking issue has been resolved then another email to contact again. Very disappointed with Intuit!

Alison

We’ve used Quickbooks credit card processing for about two years now and haven’t really had any problems – with the exception of two or three invoices going to the wrong people. We find the hardware to be easy to use, customer friendly since we can email or text receipts; and we haven’t had any problems with getting funds on a timely basis.

I do have to admit that customer service is a little on the complicated side if you’re doing anything but asking a question. If you need technical support, be prepared to spend at least a couple of hours on the phone.

Overall, though, we’re very happy with it. One problem has just surfaced though – the two people who process cards have acquired IPhone X which has no earphone port. Haven’t approached QB about alternatives yet as it just happened today. Hopefully they are ahead of that curve.

Dave McIntosh

Moneris currently has a set up fee refund on the processing of the first $2500.

19 years running a business and I have never had such a terrible experience with a supplier of any kind. Same as so many others. Decided to switch from the merchant services company I had been with for the prior 6 years without a single charge back to Quickbooks for what appeared to be an easier process. Put the first charges through for 16000 and got an email from the risk dept. Spoke to a very nice person, explained my business that deals with multi national companies whose reps are allowed to use their expense acct cards to pay the invoices 30 days after I ship and invoice. After a 10 minute conversation I am told everything is fine and she will put through a request to raise my limit to 60000/month. I then proceed to process a further 14000 a week later on the same card and I get another email. This time they insist on seeing the invoice and bank records and the rest of the list. Now after telling me my online copy of bank statements are not sufficient I went to the branch and have them print a copy and stamp it. Still not good enough. Now after 4-5 hours on hold and talking to 4 levels of supposed bosses; Even with 6-7 times the amount of the charge in the bank and a 6 figure LC and not a single charge back in my history, they decline to process the payment after holding the funds for 3 weeks. Now I have to go through whatever arduous charge back process they have.

Moneris contract was signed before they ever declined it as I was never going deal with them again.

Do not be fooled by the no fee easy process. Spend the time and get a serious Credit card Merchant Service.

Do your homework first and read reviews. This is for very small companies with small low risk charges. A large number of similar complaints can be found in the review section of many merchant services review sites.

Danielle

I run a small software business and have used Intuit for many years. We’ve had nothing but problems with them. Any time they update their software, something gets broken. Customer service NEVER cares that their errors disrupt our business and the services we offer our own customers. They won’t speak to us without our tax id and our bank account number. They are incompetent and many times rude. My average wait time is 30 minutes and average overall phone call is one hour. I can call three times and receive three different insufficient resolutions. Beware, and stay away from this company at all costs!

NoMoreINtuit

Today I’ve decided to no longer accept or process via Intuit. There are several factors in which I do not like about their services. First is there high fees. They are the largest fees around. Second they have no automated way of processing cards. Everything has to be done manually and good luck trying to chase buyers down because of a declined credit card! The biggest reason is their charge back policies. If you sell online you might want to listen to this. First and foremost, dealing with Intuit you are at the biggest risk of getting screwed left and right. With Intuit, if you receive a chargeback, Intuit will not notify you until 10 to 14 later after it happens, leaving you out both the money and the product. With every other company you hear about it within 48 hours, not with Intuit. They have the chargeback in there hands the second it happens, and they hold onto it for 2 weeks! When a chargeback happens, they give you no documentation so you can support your claims and catch the buyer lying and trying to rip you off. You’ll lucky if you call and you get a 1/2 page of what the buyer said to their credit card company. Its your legal right to obtain the documents, you have to call every single time to get whatever documents they have. If its in their possession, why dont they send it? they dont. And above and beyond, no other processing company does this, but Intuit will hold your money for over 2 months after you respond to the dispute. So you have to keep track of every single dispute and write it down. After getting 2 BS disputes today, from buyer’s I’ve had enough with Intuit, they waited 2 weeks to inform me and they didnt even inform me, I had to notice 2 amounts about $200 being taken out of my bank account, not to mention, other disputes I’ve won and they are still holding onto my money. I’m switching over to another processor startign today.

Josh Goodman

I have been using Quickbooks Online for years and finally had a reason to try out the merchant services. Unfortunately the experience has been difficult and a waste of time. Any “suspicious” activity results in the funds being held. In this case, it was our first transaction and apparently that was suspicious. Then after an hour on hold (in a single call) I was able to provide the explanation of the transaction, and low and behold, they decided to refund the funds to our client. I have yet to get a satisfactory explanation, and our client now has to go back through the payment approval process within their organization to make another payment. I was also told that these holds could happen more in the future, especially if we receive more funds than we would typically receive in a given month. Long story short, don’t waste your time with this service.

Robert Price

Have used the Go Payment app on my tablet for my service business. After viewing my checking account statement recently I noticed they started charging my account 9.95 a month for PCI. I had no idea what the charge was for and immediately tried to call, after spending hours on the phone I never once got to speak to anyone. Fed up with the service I signed up with another company. It has taken quite a while to be able to speak to a live person. Was told the charge was for my protection. Closed my account immediately. Good riddance.

Suzette

TERRIBLE customer service!!!! They processed my customer’s card 2X. I was literally on the phone for over an hour. While I could reverse the charge onliine, I can’t take away the angry customer or the two extra processing fees that I had to incur. (They refused to refund them). Looking for another merchant service.

Eric Tessmer

Customer service is pathetic. Easily an hour wait to talk to someone. They constantly are requiring software upgrades that are expensive. We have randomly lost ability to process cards, at least a couple times a year. Horrible company

retail

Been using Intuit for years. Its not good for online ecommerce business that’s for sure. Everything you do with Intuit has to be done by hand. that means if a customer goes to your site and the card gets declined or no address match, you might as well throw away the sale. Their chargeback department is another joke. You get chargeback notifications 2 weeks after the customer files it, which means your product is long gone into the customers hand and you have both the money and a $25. They dont bother to update you on anything. You have to call in to get bank documents which should of been already included in the notification since they were sitting on it for 2 weeks. They promise to refund you fees which they never do, their chargeback department doesnt bother to send you an email or document stating the outcome of the dispute. We’re moving away from Intuit due to their poor service to established customers.

Claudia Fuentes

Intuit decided to hold funds from going into my account without letting me know ahead of time. My business does kitchen and bathroom remodeling. My client took the day off to have his kitchen floor installed. Because the funds were held back I was unable to pay for the flooring for this project. I had to move the date back. The people at intuit merchant serviced did not seem to care when I called to ask what the problem was. They could not explain why they were doing this except that I had a $10,000 min to deposit which I did not come close to that amount for them to do this. Now I have to wait 2 days to get the money. I pay this company $20 a month to do transactions and a high% which is normal on top of that. Stay away from this company it seems easier to use with QuickBooks but you will pay a pretty penny for the commodity. The customer service had me on hold for 45 min and at the end just said oh it’s our job to review you. I asked how to I pay for these materials. She said “I can’t tell you how to run your business”.

Leigha Shepard

After processing transactions through Intuit merchant for two years, I received a call today that they are shutting me down because we are a financial services company and thus an unacceptable business type. Two years later? Don’t you think they would have noticed “financial” in our business name when the account was set up? No warning and now we have to find an alternative service. Was on the phone with them for over an hour to even discover what was going on. No one seemed to know and they gave me some bogus reason the first time around promising that someone would call me back…of course, they did not. Would highly recommend you think twice before signing up with this company. I will be moving my books to a different system as well. Terrible company and terrible customer service.

George Steele

I came to this service after years with another at the suggestion of a friend. Not a good experience. I was unfortunate in that my first transaction was a check that came back NSF. Long story short, they closed my account because someone else wrote a bad check. What’s worse, I had to talk to 3 layers of employees and spend 2 hours on hold just to find out that the check bounced, which they could have told me up front but declined to do for reasons I do not understand. I can’t recommend this service, and I wish I had checked their reviews before wasting my time with them.

BARBIE BURCH

The WORST. After signing up for the service, I had two clients pay several invoices via bank transfer. Each transaction sent me a confirmation that payment had been made and about 5-7 days later, I received a notice on every single one that they had been “unable to locate account”. Both clients repaid each invoice (6 in total) a second time, and again I received confirmation. Again, a few days later I received notices that they were unable to locate account. Clients paid a THIRD time (thank goodness for their patience!). After over an hour on the phone with Intuit support, they basically said there was nothing they could do nor could they cancel the third transactions while they were “pending” so that clients could pay by check or Venmo. At this point we are three weeks waiting on funds!Then I receive a call from Intuit with a case number and I log in and realize they’ve disconnected my account without even telling me. They’ve withdrawn all the funds from the clients at least 5 days ago and now the only way they’ll release them to me is if I send them a copy of my driver’s license, business license AND utility bill (which is not in my name). To prove that I’m a business? You haven’t minded being my accounting software for the last three years and monitoring tens of thousands of transactions across checking and credit card accounts and now you’re wanting to verify I’m a business? How about that EIN that’s entered in my profile? The credit card you bill monthly? The checking account you record all my other invoice deposits go into? This is ridiculous. Never again!

S. Thomas

Intuit is coming after me for a $5300+ chargeback that was their fault. I don’t have the money nor do I have the funds to hire an attorney. I am afraid of loosing my company. I bring in less then $1000 a month. I would love to be involved in a class action lawsuit if one is created. I don’t want to loose my company and I will never be able to pay this in addition to the $3500+ in merchandise that was shipped, received and signed for that was purchased with this cc. Intuit approved the transaction and deposited it into my account within 3 days. It wasn’t until 2-3 months later that I got the chargeback and since the name and cc number on my records do not match the true identity of the cc owner, Intuit is not going to pursue a rebuttal for me. They just paid it without my consent and even before I got the chargeback notice.

Julie Moore

I had a similar experience. My customer, a small college, charged back a purchase they made and had delivered, because they didn’t” recognize the charge. We were sent a chargeback notice and we quickly remitted everything we had INCLUDING the phone conversation of the person placing the order, naming the cardholder and giving us her information. It seems that because we didn’t identify the cardholder in the billing address section, they refused to honor the charge and would not send this on to Visa, etc. We were, however, able to contact the customer, get a different card and run this through our online merchant system. Never again.

From The Editor

This Post Might Help: How to Make Your Payment Processor Release Your Money

mike

I guess I will echo many of the previous comments. My first transaction with Intuit Quickbooks was a total disaster. A client of 10 years was my first Intuit Quickbooks credit card services user. Intuit took their payment, withheld their funds from me, waited 3 days to contact me and then requested 6 months of bank statements before releasing the funds. They said minimum of 2 days to review my bank statements before deciding whether or not to release the funds.

STAY AWAY FROM THESE GUYS IF YOU CAN. FIND ANOTHER COMPANY TO HANDLE YOUR CREDIT CARD SERVICES.

Mark Johnson

Phillip man. You have to help us here. I just found this site and I feel very very bad for everyone here. I was snake bit as well. They want $40k from me. My police force won’t call it criminal but they know it is. Lawyers and court costs are the only way we can stand up to this criminal injustice. I’m in if you want to go class action!

Kare

OMG!! WTH? So QB changed their software which they neglecting to inform us. We run a multi-million $ construction company. We received a check for $89k.

I called the number that was on the screen to find out why our check was being declined. The guy told me they changed the service and they’re only accepting checks upl to $50k limit. WTH? The customer service rep told me to call the customer and tell them were going to break open the deposit. Sounded strange. Were in our home in Georgia and our company is in Hawaii, where our bank is too. So we decided to send the check to Hawaii and have one of our guys deposit it. He deposited in on personal acct (btw he’s a construction worker) on a Friday. So I figured I would use intuit to write a check to deposit to our business acct.

On Monday I noticed the funds had been removed from our personal acct but the funds I wrote through intuit was being withheld along with 3 other checks. Almost $100,000.I had a surgery on Tuesday and I figured everything would work through by the time I healed. So on Friday nothing had changed. So I called Intuit and asked what was going on. I was asked about the funds I took from our personal acct to our business account. I was told that was unacceptable. Yes its not the best practice but had they informed us of the changes this would have ended up differently. Then the other funds they are holding haven’t been released either. So I had to send 6 months of our banking statements, and the invoices and contacts for each deposit that is being with held. So I did and they said we had to wait 48 business hours. Finally on Wednesday they refunded our personal check. I was being very patient and I figured it had been well over 48 bus hours. I called and they said they are waiting on the invoices. The auto-response email they say ‘We’ll let you know if there is anything else they need they’ll let me know’.

Why didn’t the tell me. So now our funds have been on hold over a week. Another 48 hrs. So irritating. So Friday I called and asked if they have everything and the guy claimed they did and if they need anything they’ll either call or send an email. Hopefully tomorrow they’ll let know something because it’ll be over 2 weeks that they’ve been holding our money.

We’ve also been using this service since 2011 and were very happy with the service but this has left me with a horrible memory and I don’t know if we’ll be able trust this service again.

Intuit should be totally ashamed that they’ve done this. We’ve paid good money thousands for their services. We get credit card payments over $100k.

Chris

This is probably the worst service in the market. My first transaction was flagged a “periodic review”. Had the service only 2 weeks, horrible customer service. They want their money but want to hold yours. It has now been 8 days for a small charge and I feel like a circus animal jumping through hoops to receive my money, and still haven’t received it. I would never recommend this company to a small business, they will let you go bankrupt waiting on payment. They do not care for their customers at all. Please look at other options before using them.

Michael

I sold a very expensive piece of radiology equipment to a doctor, delivered it with a one-year warranty. The doctor called Intuit and asked for the last payment back and Intuit gave it to them. Now Intuit is asking me to personally pay the chargeback despite the fact the doctor received and accepted the equipment and the fact that the contract was non-cancellable and no refunds in clearly stated on my website and in the contract they signed. Intuit says they have ever right to do it however when I asked for proof that they actually sent the money to the customer, they grew quiet and unresponsive and turned it over to a collection company.

Joan

Reliability is terrible, servers go down often. Have you over a barrel if you use their POS, have to use their cc processing. Upgrade to newest POS and they change your merchant account number without them transitioning anything from the old to the new. Even Risk Mgmt thinks I’m a new customer. Migrates to new servers during business hours thus causing down time in US businesses. Automatic service charge to me of $25 if customer disputes transaction . . . customer not aware of where his children shop. Charge the customer Intuit, not me, the system approved the transaction. Takes 7 days to get approval of my third store . . stores one and two have been using IMS for 10, yes 10, why must I go through full approval again? Ridiculous! POS and IMS should speak to one another when developing new software versions, they work in silos and IMS customer services admits “I don’t know anything about POS” I could go on and on . .

Susan Southcotte

They are horrible. My first deposit they withheld the funds from my customers payment and refused to reverse it. I have called and e-mailed many times. I think my customer is going to have to dispute with her credit card company to resolve this. A week later – still unresolved.

Tony

Any updates?

Alex Sivar