Lavu Reviews & Complaints

Lavu Point of Sale

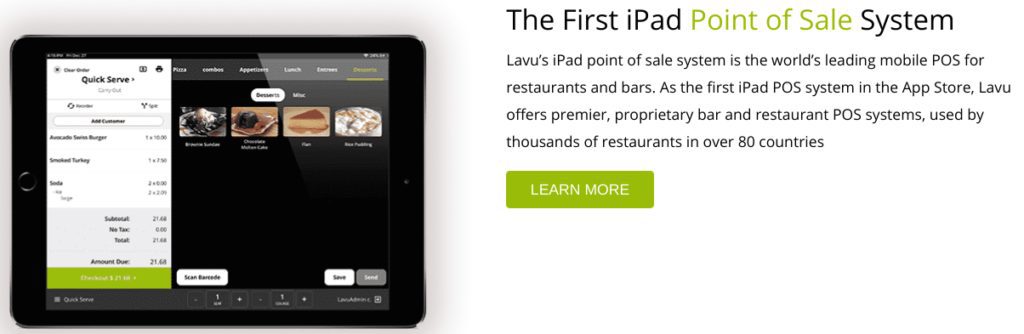

Founded in 2010, Lavu is a cloud-based, mobile point-of-sale product intended for restaurants and bars. Lavu is currently only available for the iPad. The company offers its own merchant account solution called LavuPay as well as integrations with Heartland, Moneris, Square, PayPal, Vantiv, and EVO Snap. Lavu also offers management features, kiosks, and a loyalty app. 2019 saw Lavu acquire MenuDrive and Sourcery. In 2022, Lavu partnered with Verifone.

Lavu Location & Ownership

Lavu is headquartered at 2632 Pennsylvania St NE, Suite D, Albuquerque, New Mexico 87110. Saleem S. Khatri is the CEO of Lavu.

Lavu offers an iPad-based POS solution

Lavu Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 30+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Product Malfunctions |

Low-to-Moderate Complaint Volume

We have identified over 30 negative Lavu reviews, with some characterizing the company unfavorably. However, Lavu holds a 3.6 out of 5 rating on the Apple App Store from 27 ratings. Recurring issues raised by customers include sporadic software performance, less responsive customer support, limited features, and a perceived mismatch between monthly cost and product value. On the positive side, several reviewers commend Lavu for its effectiveness in restaurant settings, suggesting its performance may vary with the usage environment. If you have an experience to share, feel free to add your Lavu review in the comments.

Lavu Lawsuits

No major class-action lawsuits or FTC complaints have been found against Lavu. The company was involved in a legal matter regarding office rent, but this does not pertain to its core merchant services and thus isn’t included in this review. Merchants preferring non-litigious resolutions are advised to consider reporting issues to relevant supervisory organizations.

Lavu Customer Service Options

Lavu provides 24/7 support via phone, chat, and email. However, some users report slow responses in resolving issues through these channels.

Available Lavu customer service contact:

(855) 767-5288 – Toll-Free General Customer Service

While a dedicated email support address is not provided, Lavu offers live chat and a support form on its website.

The support system meets the basic requirements of top-rated payment processors for customer service, yet there is room for improvement in resolving merchant issues effectively. For SEO, terms like ‘Lavu complaints’ and ‘Lavu customer reviews’ are crucial for helping potential clients find relevant service quality information.

Lavu Online Ratings

Here's How They Rate Online

| Total Complaints | 7 |

|---|---|

| Resolved Complaints | 1 |

Under 10 Complaints

Lavu has been accredited with the Better Business Bureau since 2015 and its profile is showing an “A+” rating. The company has received 7 complaints in the past 36 months. 1 of these 7 complaints was resolved by the company to the satisfaction of the merchant. The remaining 6 were resolved to the dissatisfaction of the merchant or received no final response.

What Merchants Say

Lavu has also received 6 negative informal reviews through the BBB. The most recent review describes unexpected charges and poor customer service:

Jan 2021, prepaid for a year of software at two locations. Starting February, got charged ~$80 monthly software at both locations. Called, emailed, refunded, made clear to remove my payment info, etc. Happened again in March. (Added a 3% processing fee with no prior disclosure too!) Then every month thru July. Called and emailed them every time, eventually refunded with slower and slower responses.In Aug, I just started disputing transactions as threatened. Random multiple terminal fees now popping up, still charging monthly. (We only have one terminal.) Also a random $50/mth per location charge for using PayPal for processing was added in July; that was never disclosed to or approved by me. I implemented a credit card stop-pay from the merchant. They have multiple merchant accounts; kept charging. Literally put Lavu on an unnecessary card and closed it just to get them to stop charging me random amounts. Now, Dec 2021, switching back to our former POS and processor now that our year is over despite the extra cost per month because Lavu cannot be trusted with credit card information and does not disclose their charges. Do not ever provide Lavu your credit card information.

Merchants may be able to avoid these situations by seeking top-rated payment processors with excellent customer service.

An “A” Performance Overall

In light of the company’s time in business and complaint rate, we agree with the BBB’s rating at this time, but merchants should be aware that there are good reasons to be skeptical of the BBB’s reviews.

Lavu Fees, Rates & Costs

A Closer Look at The Contract

| Terminal Fee | $69 Per Month |

|---|---|

| Swipe Rate | 1.00% - 4.99% |

| Early Termination Fee | Variable |

| PCI Compliance Fee | Variable |

| Equipment Lease Terms | 12 Month |

Lavu POS Pricing

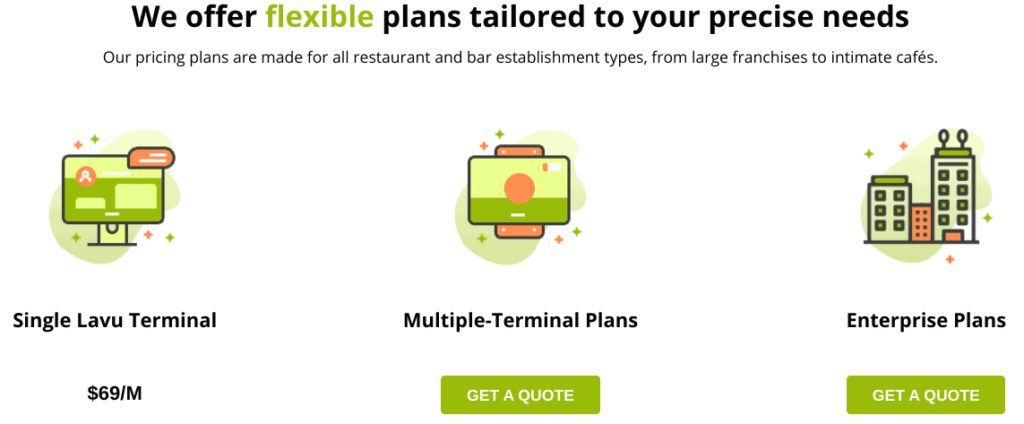

Lavu offers three pricing plans for its POS systems: single terminal, multiple terminal, and enterprise. The single terminal plan costs $69 per month per terminal billed annually. The other two plans charge less per terminal depending on the number of locations and devices required. We would encourage merchants to check out our list of the providers of the best merchant services.

LavuPay Pricing

Lavu’s in-house payment processing, LavuPay, appears to come with custom rates based on each merchant’s business type and processing history. Lavu also offers integrated payment processing through Heartland, Moneris, PayPal, Square, Vantiv, and EVO Snap. Merchants can expect the pricing offered by each of these partners to be similar or identical to that company’s standard merchant account pricing. If you have any knowledge of Lavu’s rates, please share it in the comment section below this review.

No Red Flags

We are unable to locate any Lavu complaints that describe excessive fees or unreasonable pricing. To minimize costs, merchants should first secure a merchant account from a restaurant-friendly merchant account provider and then inquire as to whether Lavu can offer a custom integration for that provider.

Lavu Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Employs Independent Resellers | Yes |

|---|---|

| Advertises Deceptive Rates | No |

| Discloses All Important Terms | No |

Lavu Features

Lavu offers multiple features optimized for all restaurant operations:

- Front of house – Layout and menu customization, menu item hotkeys, hold and fire, offline orders, order status updates, custom discounts, and preauthorized drink tabs

- Back of house – iPad kitchen displays, integrated ticket printing, paid and unpaid identifiers, and order timers

- Management – Shift scheduling, QuickBooks integration, labor and sales reporting, customer database, multi-language support, access levels, and a pizza-building module

- Inventory – Consolidated vendor relationship management, real-time menu integration, location transfer, and warehouse management

- Tracking – Real-time reporting of earnings, labor, inventory, and long-term trends

No Deceptive Advertising

Like most other POS providers, Lavu markets itself primarily through an in-house sales staff, a referral program, and resellers. The company does not publicly list any promotions or rate quotes that we consider to be deceptive. We have found no Lavu reviews that mention deceptive sales techniques. This compares favorably to our list of best credit card processors. If you suspect that Lavu has misrepresented your rates and fees, we recommend seeking a third-party statement audit to find and eliminate billing errors.

Our Lavu Review Summary

Our Final Thoughts

A Solid Point-of-Sale System

Lavu rates as a reliable point-of-sale system for restaurants at this time. The company does not appear to engage in predatory sales tactics or offer unfair contract terms, but it has received a moderate number of public complaints related to the product itself. Merchants will need to scrutinize the terms of their agreement through Lavu and compare with top iPad POS options in order to obtain the best deal.

If you found this article helpful, please share it!

Debrah

I’ve notice .05 percent added to my menu items cost before taxes then the extra fee for use of credit card in lieu of cash. My menu you prices are inconsistent because of this causing loss of customers

Thiago Debbie

I am thrilled to share my amazing experience with Lavu! This innovative restaurant management system has truly revolutionized the way we run our business. The seamless integration of ordering, payments, and inventory management has boosted our efficiency and eliminated any operational hiccups.

With Lavu’s user-friendly interface and robust features, our staff quickly adapted to the system, resulting in improved order accuracy and faster table turnover. The real-time analytics and reporting tools have given us valuable insights into customer preferences and sales trends, allowing us to make data-driven decisions that have positively impacted our bottom line.

Beyond the excellent software, Lavu’s customer support team has been outstanding. Their prompt and knowledgeable assistance ensured a smooth transition during the setup process and continued to provide timely support whenever needed.

Lavu is undoubtedly a game-changer for any restaurant looking to streamline operations and enhance customer experience. Kudos to the team for creating such a fantastic product!