Merchant Industry Reviews & Complaints

Overview

In this concise overview, we'll delve into Merchant Industry, a versatile merchant account provider. We'll explore their array of services, including mobile solutions, e-commerce tools, and unique offerings like Swipe4Free and Apple Pay integration.

Our review will critically analyze the company's rates and fees, contract terms, common complaints, industry ratings, and marketing tactics. Additionally, we'll assess their payment processing capabilities, PCI compliance, and the impact of their wireless terminals. We'll also discuss the tailored payment solutions they offer and their stance on equipment leasing.

The article aims to provide a succinct yet comprehensive understanding of Merchant Industry, equipping business owners with essential insights for informed decision-making in payment processing solutions.

About Merchant Industry

Merchant Industry is a merchant account provider founded in 2007 that specializes in providing credit card processing and debit card processing services to small businesses within the United States. The company also appears to do business under the name “National E-Payment, Inc.” and possibly resells the merchant services of First Data (Fiserv) and TSYS according to the company's inclusion of those merchant account providers on its website. In May 2017, Merchant Industry launched a DBA called “Swipe4Free” that exclusively promotes a cash discount pricing program. The company also provides Apple Pay integration services to businesses.

Merchant Industry Payment Processing

Merchant Industry processes most major debit and credit cards for most business types. Their services include a wide variety of credit card terminals, mobile solutions, POS systems, QuickBooks processing, AMEX processing, gift and loyalty programs, Apple Pay, TransArmor security, data insights from Insightics, next-day funding, e-commerce solutions, cash advances, telecheck, and PCI compliance.

Merchant Cash Advance

The company offers merchant cash advances as a form of financing for businesses. This is presented as a risk-free alternative method of funding for business improvements.

E-commerce Solutions

Merchant Industry provides e-commerce solutions that include a set of tools designed for businesses of all sizes. These tools are intended to facilitate online transactions.

Mobile Payment Solutions

The company offers mobile payment solutions that allow businesses to process payments anywhere using a mobile device. The service is designed to be simple and efficient.

PCI Compliance

Merchant Industry guides merchants through the Payment Card Industry Data Security Standard (PCI DSS) compliance process. They offer a step-by-step assessment questionnaire and document review to help businesses become PCI compliant.

Wireless Terminal

The company provides wireless terminal solutions that use wireless network and store-forward technology. This allows businesses to process payments wherever they are located.

Customized Payment Solutions

Merchant Industry offers a range of customized payment solutions, including B2B processing, virtual terminals, software integration, and more. These solutions are designed to be compatible with various point-of-sale systems.

Equipment Leasing

The company also offers equipment leasing options for businesses that require hardware for payment processing.

Location & Ownership

Merchant Industry LLC is a registered ISO/MSP of Wells Fargo Bank, N.A., Concord, CA. and Esquire Bank, N.A., Jericho, NY and Commercial Bank of California, Irving, CA, with corporate offices at 36-36 33rd St., Suite 306, Queens, New York, 11106. Leo Vartanov is the founder and CEO of Merchant Industry.

| Pros: | Cons: |

|---|---|

| Great for Small Transactions: (specific to flat-rate credit card processing) Suited for low volumes. | Lack of Transparency: (specific to flat-rate credit card processing) Fee breakdown unclear. |

| Convenience for Customers: Quick, seamless transactions. | Transaction Fees: Interchange, processing, assessment fees. |

| Enhanced Cash Flow: Faster fund access. | Chargebacks: Customer disputes, revenue loss. |

| Global Expansion: Broader market access. | Security Concerns: Cybersecurity investment needed. |

| Simple Pricing Structure: (specific to flat-rate credit card processing) Easy to understand. | Technology Costs: Initial, maintenance expenses. |

| Reduced Fraud Risk: Advanced security features. | Third-Party Dependence: Reliance on processors. |

| Improved Record Keeping: Efficient financial management. | Higher Fees: (specific to flat-rate credit card processing) Compared to interchange rates. |

Merchant Industry Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 40+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Sales Tactics |

| Recent Lawsuits | Yes |

Overview of Merchant Industry Complaints

Our research has identified over 40 negative Merchant Industry reviews, with allegations of scam or ripoff practices. Complaints commonly highlight issues such as misleading sales tactics, excessive billing, unfulfilled verbal agreements, challenges in service cancellation, inadequate customer service, and substantial undisclosed fees. Merchant Industry has engaged with some of these complaints, offering resolutions ranging from partial to full refunds, while in other instances, reinforcing contract obligations. The recurrent theme of misrepresentation by sales representatives raises concerns about the fairness of enforcing certain contract terms. We encourage you to share your Merchant Industry experiences in the comments section below.

Legal Actions Involving Merchant Industry

In 2019, Merchant Industry faced a lawsuit for an alleged violation of the Telephone Consumer Protection Act (TCPA), but the case was ultimately dismissed. Clients seeking alternatives to legal disputes may find it beneficial to report their concerns to appropriate regulatory agencies.

Assessing Merchant Industry’s Customer Support

While Merchant Industry has shown responsiveness to complaints regarding billing issues, this may offer limited consolation to businesses compelled to escalate their grievances publicly. Despite some positive feedback, the authenticity of such testimonials remains unverified. Merchant Industry provides live phone support across several lines, yet the quality of this service does not meet the standards set by leading merchant accounts known for exemplary customer support.

Contact Information for Merchant Industry Support

- (866) 811-1005 – Toll-Free General Customer Service

- (877) 841-4818 – Technical Support

Additional Customer Support Channels

- Online support form

- Live chat feature

- Email: [email protected]

This revision aims to present a balanced view of Merchant Industry, focusing on customer feedback, legal history, and support services. By integrating SEO-optimized terms related to “reviews,” “complaints,” and “customer service,” the content seeks to improve visibility and aid readers in making informed decisions about Merchant Industry’s services.

Merchant Industry Online Ratings

Here's How They Rate Online

| BBB Reports | 35 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

2 Relevant BBB Profiles

As of this review, Merchant Industry holds an “A+” rating with the Better Business Bureau and has had 31 complaints filed within the last 36 months, only 9 of which were resolved to the satisfaction of the complainant. The company has been accredited since May 2015. Merchant Industry’s alternate business name of National e-Payment also has a BBB page, which currently has no rating and no reviews or complaints, though at the time of a previous review, it held an “A+”.

What Merchants Say

Merchant Industry has also received 4 informal reviews to its BBB profile, 1 of which was positive and 3 of which were negative. The most recent negative review mentions being charged unexpected fees even when not using the service:

So when I signed a lease with ******(bad mistake) in 2015 they signed me up with this company. I used the machine one a week at the farmers market. We had months were we didn’t use the machine because of it being winter. They never once said anything about inactivity fees. They would never do anything about it. Our contract ended in March with ******(kept giving us the run around about the equipment) Finally in august I was able to close clover down. I assumed that since I signed with both companies at one time they would cancel both at one time. MY BAD! I haven’t used this machine for several months but yet get billed $125.00 (inactivity fees )each month. I found out that I had to cancel with this company too. I called and was told someone would call me back. I have yet to here from them. This has cost me around $900.00 so far. I guess the next thing to do is cancel my bank account. I will never work with this company,,,,

Businesses may benefit from taking the steps to understand how to negotiate rates and fees to avoid situations like this.

A “C” Performance

In light of the company’s complaint total and resolution ratio, we have adjusted the BBB’s rating to a “C.”

Merchant Industry Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 1.00% - 4.99% |

| Equipment Leasing | Yes |

Three-Year Agreement

The standard Merchant Industry merchant agreement spans three years through First Data (Fiserv). While the agreement lacks a specific fee structure, typical First Data (Fiserv) terms entail a swiped rate of 2.69% plus $0.19 and a keyed-in rate of 3.69% plus $0.19. Included in the Merchant Industry terms are an early termination fee of $395 or liquidated damages (whichever is greater), a PCI Compliance fee of $79.99 per year, monthly PCI non-compliance fees of $19.95, an annual fee of $99.95, a $9.95 statement fee, and a monthly minimum fee of $25.

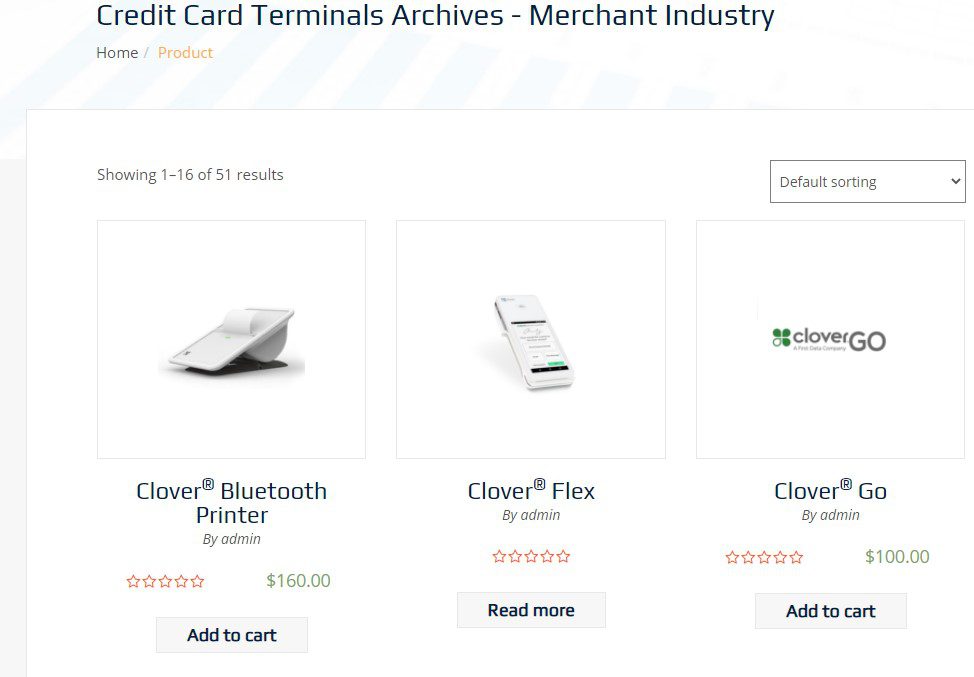

Additionally, the company offers equipment leases, potentially with their own terms and fees. Its website features a section dedicated to equipment leasing, even providing an interactive table of various credit card terminals and their associated costs. While specific lease terms are not outlined, monthly lease charges can reach up to $160, resulting in over $1200 in annual expenses compared to purchasing an alternative terminal for under $500.

Virtual Terminal and Payment Gateway Pricing

Merchant Industry advertises its virtual terminal and payment gateway services on its website. However, pricing details for these services are not disclosed. Additional rates and fees, such as gateway fees, technical support fees, batch fees, and additional transaction rates, usually apply to these e-commerce services.

Contract and Pricing Complaints

Numerous client complaints filed against Merchant Industry and its subsidiaries express frustration with undisclosed costs, particularly early termination fees and PCI Compliance fees. These charges seem to be enforced even when misrepresented by sales agents. While these expenses surpass those of budget-friendly merchant accounts, the company’s rating might improve if these costs were consistently disclosed upon signup. We also recommend business owners review our list of the top merchant accounts.

Part of the Merchant Industry credit card terminals section of the website

Part of the Merchant Industry credit card terminals section of the website

Merchant Industry Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Likely |

| Misleading Marketing | Yes |

| Discloses All Important Terms | No |

Outside Sales Team

Merchant Industry appears to rely on numerous sub-ISOs and independent sales agents to market its services. There is evidence that the company operates under multiple business names and allows its resellers to use the Merchant Industry name at their various locations, which causes some client confusion. We are currently able to locate numerous Merchant Industry reviews that describe nondisclosure and misrepresentation by the company’s sales agents, higher Merchant Industry fees than were agreed to upon signup, and failure by the company’s sales team to deliver on promises made at the point of signing. This does not compare favorably to our list of best credit card processors.

ETF Payment Promises

One major issue appears to be multiple agents claiming to pay a business’ early termination fees and cancel their account with their existing processor if they switch over to Merchant Industry. In many cases, these agents do not follow through on either guarantee, leaving their clients subject to continuing monthly payments and the full early termination fee upon cancellation.

Incomplete Rate Quotes

The company’s website includes multiple tables and charts advertising various Merchant Industry rates and fees. In all cases, the company’s “Qualified” rate is prominently shown, while its “Non-Qualified” surcharge is accompanied by the claim that “most clients do not experience these fees.” This is not true, and we consider this type of rate quoting to be deceptive because it may lead clients to have unrealistic expectations of the rates they will pay. In addition, Merchant Industry rates list many types of fees common to the industry and claim that, while it’s average for merchant services providers to charge all of these fees, Merchant Industry does not charge them (or charges them at a reduced price). The company does not mention several other large, common fees that it does charge, such as PCI compliance fees and early termination fees.

A “D” Rating

Overall, it is our opinion that the company’s rate and fee quotes are deceptively presented, and there are multiple client complaints supporting this interpretation. If you believe that Merchant Industry is overcharging you, we recommend seeking a third-party statement audit to eliminate hidden fees.

Our Merchant Industry Review Summary

Our Final Thoughts

Merchant Industry rates as a substandard credit card processing provider according to all available information. Businesses are reporting a consistent pattern of deceptive practices from the company’s sales agents, and the company’s contract terms are more expensive than industry averages. These issues have resulted in the company receiving a moderate-to-high complaint rate for its size and time in business, and the company’s public responses to these complaints have not demonstrated any serious commitment to customer service. For now, clients can expect to be better served by a top-rated merchant account provider.

If you found this article helpful, please share it!

Olivia Brown

Merchant Industry has truly transformed the way we handle payments at our company. We’ve been working with them for over five years now, and their dedication to providing top-notch credit card processing services is unmatched. From their seamless B2B processing to their user-friendly virtual terminals, they’ve covered all the bases for us. What stands out the most is their commitment to tailored solutions. They took the time to understand our unique needs and designed a payment processing strategy that perfectly aligns with our business goals. Thanks to Merchant Industry, we’ve seen a significant increase in efficiency and cost savings. It’s not just a payment processing company; it’s a partner in our success.

Phillip CPO

Our comment system has flagged this submission as a fake testimonial. To preserve the integrity of our detection methods, specific details about the detection process cannot be disclosed. It is currently unclear whether the action was sanctioned by the company subject to this review.

Robert Valdez

Merchant Industry’s virtual terminal has been a game-changer for my business. Being constantly on the move, I needed a reliable solution to accept payments from anywhere. The virtual terminal allows me to do just that, whether I’m at a client’s location or attending events. The recurring payment feature has also simplified billing for my regular clients. I appreciate the ease of use and the comprehensive features it offers, making payment processing a smooth experience. Merchant Industry has exceeded my expectations, and I’m grateful to have them as my payment processing partner. If you’re looking for a versatile and efficient virtual terminal, look no further!

Phillip CPO

Our comment system has flagged this submission as a fake testimonial. To preserve the integrity of our detection methods, specific details about the detection process cannot be disclosed. It is currently unclear whether the action was sanctioned by the company subject to this review.

James

The Merchant Industry has been an integral part of my e-commerce journey. Their e-commerce solutions have made setting up and managing my online store a breeze. The platform seamlessly integrates with various e-commerce platforms, and their virtual terminal allows me to accept payments over the phone or through email. I’m impressed by their attention to security and PCI compliance, ensuring my customers’ data isw protected. Whenever I’ve had questions or needed assistance, their support team has been prompt and helpful. I trust the Merchant Industry to handle my online transactions, and they have never let me down. Highly recommended for any e-commerce business!

Phillip CPO

Our comment system has flagged this submission as a fake testimonial. To preserve the integrity of our detection methods, specific details about the detection process cannot be disclosed. It is currently unclear whether the action was sanctioned by the company subject to this review.

Kinsley

“I cannot speak highly enough about the services provided by Merchant Industry. Their credit card processing solutions have significantly improved my cash flow and allowed me to expand my

customer base. The team at Merchant Industry is professional, responsive, and always willing to

go the extra mile to ensure my business needs are met. With their advanced technology and

robust features, I feel confident in the reliability and security of their services. I highly

recommend Merchant Industry to any business owner in need of a reliable credit card processing

partner.”

Phillip CPO

This appears to be a fake testimonial. The comment also left one that is very similar on our Swipe4Free Review.

Levi Strauss

Merchant Industry has been a game-changer for my business. Their credit card processing services have not only simplified the payment process but also increased the overall efficiency of

my operations. The setup was seamless, and their platform is user-friendly, making it easy to

manage transactions and access detailed reports. Additionally, their commitment to security and

fraud prevention gives me peace of mind knowing that my customers’ information is protected. I

am thrilled to be working with Merchant Industry.”

Phillip CPO

This comment appears to be fake review. To authenticate your testimonial, please reply with your business information.

Jack Johnson

I am extremely satisfied with the payment processing services provided by Merchant Industry. Their solutions have greatly streamlined my business operations and made it easier for me to

accept credit card payments from customers. The rates offered are competitive, and their

customer support team is always available to address any concerns or questions I have. I highly

recommend Merchant Industry to other businesses looking for reliable and efficient credit card

processing services.

Phillip CPO

Hi Jack, please reply with your business contact information to authenticate your testimonial.

Janet

I purchased a clover after several encouraging calls from the sales rep. I quickly found several small fees popping up on my account. After I had resolved the issue it still continues. Found their billing process extremely confusing with hidden fees and I requested to close the account. Not realizing I had signed a contract after rejecting payment. I received a call from the sales rep telling me I could pay $325 to get out of my contract and everything would be final so I did so. Then the call started back up saying I owe them over $1000 due to late fees etc. etc. the clover was a big mistake.

Brian

Horrible company. Stay away from them. Their customer service is horrible. If you are a current customer look at your statements carefully. They’ll sneak fees on it and when you call them to complain they will tell you it’s not from them, though luck. But when you call to cancel your account magically they can fix it. Really.

Adiel Huck

Nothing but positive thing to say about Merchant Industry. They have saved us money while streamlining our point of sale process. We no longer have to wait several days for our cash to be available. Best move we could have made.

Dominic Caglione

Slime of the earth. Company that charges cancellation fees that are about 10X the national average. Talk about bad business practices. Their staff is rude as hell too.

yaqu bearnest

I switched to Merchant Industry because I was losing business by my inability to process small sales. Now I can take a debit or credit card for a small amount without losing money. In the produce business when your average sales is around $10. 00, this really helped. I have been very pleased by the fast availability of funds.

CPO

Hi Yaqu,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Jack David

Excellent merchant processing company. My business falls into the category of high risk. After providing additional information about my business the opened my account. My sales rep was very helpful walking me through the entire process. The rates are good and the virtual terminal is awesome.

CPO

Hi Jack,

Please reply to this comment with your business name and testimonial in order to authenticate your testimonial. Thanks!

Bora E

This company is very frauduant. I have tried to get them to stop charging my business, but they continue to make unauthorized charges. I have tried to contact them more than 100 times!! they always answer they are reviewing. if you work with this company, you will see your business money will be out of your pocket every day.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Amy Bove

THE BOTTOM LINE

There are multiple reasons to opt for Merchant Industry. From their approval rate and fast turnaround, to their customized processing solutions and state-of-the-art equipment, they offer tons of benefits and cater to multiple types of businesses. Whether your business is online or in-store, it’s likely they’ll be able to provide the right solution for your payment and processing needs.

Roman Winfeld

I read some of these review and I was concerned. But their price was so good that I took a chance anyway. I couldn’t be happier that I did. I have a store and also an online option to sell my goods and they took care of setting up both. When I had an issue with my machine they were responsive and took care of it right away. Even when I called on a weekend. They are solid in my mind 100%.

CPO

Hi Roman,

Please reply to this comment with your business name and location in order to authenticate your review. Thanks!

Amy

I could not be happier with the experience I had with Merchant industry. From the first conversation, I was very impressed with the level of professionalism and the the time the team took to answer all questions and inquiries so that I could grow my business. Equally impressive was the customer care experience after making the decision to proceed on with Merchant Industry. The service provided was above and beyond my expectations. I encourage any and all small to medium sized companies to reach out and work with this amazing team!!!

CPO

Hi Amy,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Rise Up Boards

They are an awful company and you should stay far away from them. First I signed with Global payment Solutions who it turns out is at the same office as Merchant Industry. they promise low fees at first but if its to good to be true it is. global locks you into Merchant Industry who then locks you into a 3 year contract. I couldn’t process credit cards and wanted out of the company. they will charge me with almost $3,000 of early termination fees. In the meantime they will be charging for about $50 a month for no services. Their customer service, machinery is just horrible. Run away from this awful company. If you did get scammed call local law enforcement.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Charles Palumbo

Terrible terrible company stay away

doug barrett

Run from this business! I’ve attempted to resolve issue’s for months for our e-commerce business without any success. Good luck trying to communicate with them as well. You can email them on every issue and beg for a response and you still get ZERO response. I was sent to them by a third party and and now I’m looking at switching because these guys simply don’t care! Sean Puri sent me a new contract back in March 2018 stating new rates and just sign. We signed and we are still being charged the old rates even as of this writing. When asked about our rates Paul informed me that Sean didn’t have us sign the correct documents so he did send them.They put our parent companies name on the credit card report so now I’ve been flooded with customers calling stating they didn’t purchase anything from that company. This has also led to three charge-backs at $35. per charge which is totally their fault however they seem unable to make this change which I’ve asked since March/April 2018 time frame.

I’ve dealt with Nafisa Sanchez, Paul Kanevsky and Sean Puri and all three don’t seem to care about fixing it.

SO IF YOUR LOOKING FOR A CREDIT CARD PROCESSOR RUN FROM THIS COMPANY! I’d say that one could accuse them of being a scam or ripoff as your under contract for one rate however they charge you another.

I’ve given them sufficient time frame to fix their mistakes and even just yesterday I asked them for feedback on the over charges on our invoice which I sent to the three names above and as of this writing NONE of the three even cared to state they received my email.

I’m even moving towards talking with my attorney on this issue about them as we’re now talking about a decent amount of cash in fee’s they really owe me for overbilling.

If I could give zero star rating I would have. Just look at all the other people who have given them exceptionally bad reviews. You think they have a problem!

Marjorie Hollingshead

I am so glad I found this page. I made a mistake and called this company thinking I was calling my bank BB&T. I was trying to return a machine that was sent to me by my bank. The sales Rep deceived me into thinking I was talking with BB&T. He asked for my merchant number and when he realized that it was not their service he switched my Merchant number to their companie’s service, Instead of telling me that I had called them by mistake. He then asked me to return the bb&t Merchant Service machine to them, now they are saying they do not have the machine. I have contacted the CEO of their company and a lawyer in NYC. I have put together a case along with recordings of the deception. They did not tell me that they have a 30-90 day cancellation policy. They also tried to get me to cancel with BB&T and promised to pay the cancellation fees. I am very disappointed and cannot believe that this is happening. I am going to fight to see how far I can go to stop this from happening to anyone else. Is there a class action suit out there on these people? I am being threatened by them to pay $750.00 cancellation Fees.The sales Representative is Spencer and the Manager is Paul.

Lee

Its June 2018 , called to get credit card machine download to use their company in January 2018.

All they have managed to do is lie about the services ai would get and the cost.

They downlaided the machine finally in May , but did not include the EBT account which is why I really needed this anyway . Then said my machine wouldnt work ( its brand new) but they never tried to redownload . They then said I needed to by a machine and the cost added up to almost 2000.00 for a (200.00 machine).

I was like I Am not buying a machine .

I asked to just cancel and forget it , Then I was told it would cost 700.00 early termination fee , FOR WHAT YOU DID NOT PROVIDE ME WITH THE SERVICE . However they did deduct 34.98 x 6 months for inactivity fee , which the Account Manager said specifically that the only charges i would have was when i swiped a card, so he lied from day one. Inactivity fee , that is ridiculous when I could not use the machine . I lost that money , the money Inpaid fir the machine , as well as the business just from EBT alone , approximately 1200.00 more dollars .

I have called called and called , no reply .

The time someone answered warned me this conversation is being recorded, ok good then pull all the conversations I had with Craig , help desk and finially Morgan the retention specialist. She was going to help me get it all straight , That was going on 2 weeks ago , and she hasn’t returned any of my calls.

I am done with these people .

Horrible , the way they took advantage of me and my company.

Jason Weindruch

DO NOT do business with this company. They are literally white collar criminals: Sean Puri and Bill Grey are unethical and have zero customer service skills.

Maria

stay away from this company it is the worst I’ve known. if you have a small business they do not help you grow. i canceled my account but they still charging even without activity, when I called they told me that since the day i canceled it takes a month to make the cancellation effective but in the meantime they still charge you.

paul moore

Maria is correct! This company is a total scam! The salesperson misrepresented the program and when I talked to the supervisor she just said “that is in the past”.

They are criminals.

JessicaDon

I was promised a one year contract with this new service, Terence Gumbs was my account manager and did a very poor job at that. I would leave several messages for him and never would get a response. Would finally have to call someone else to get my issues taken care of. Because of his lack of duty with this company they lost our credit card processing services and then have decided that they will charge me the 300 early termination, even after he assured me multiple times that we only had a 1 year contract with them. Once i was digging around tryin to find out when my one year contract was up, the date they gave me was a month later than when I actually signed the paperwork. I was just fed up with them and ready to do business with someone I know i can trust and will take care of me. so very disguisted with this company really from day 1. They hit me with an early termination fee yet they still dont show that i have cancelled my acct. REALLY???

Jessie M. Cass

Merchant Industry really came through for me when I needed them the most. I am a start up business owner and I needed to get all of my accounting in order as well as be able to process credit cards. I called and they provided a free credit card terminal and have the best service including cash advance if we need it. I was blown away; it just doesn’t get any better than this. It has been a great help.

Phillip CPO

Jessie (or Justin Clark according to you email address),

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Al

Merchant Industry as well as ” Statewide Merchant” “Bank card” is the one takes your money from your bank account. they get you confused there. They gave me a contract of $39.00 dollars a month plus .3 visa and other card charges. I did around $780.00 on a credit card transaction and got a $195.00 fee!!!!

then They never paid the first company which charged me early termination fee and e maid me they can only pay $25.00 per a month . I canceled them and so far they took $250 and another $200.00 dollars out of my bank.

I kept all the e-mails and looking to find the way give them back the stress and get my hard working money back.

they are just a big scam even 100 dollars from one person think 20,000,000 people fall in to their trap. that is a lot of money which they earn with dishonesty. Some one will sue them big in future.

ThomasFisher

I needed to accept credit cards for my business and I wasn’t sure which equipment would be best for me. I called Merchant Industry in New York and they couldn’t have been more helpful. We discussed my business and what would save me the most amount of money. After comparing rates and fees with other providers, it was a no brainer. These guys are hands down the best that I found and I still use them today. HIGHLY RECOMMENDED!

Phillip CPO

Hi Thomas,

In order to verify this testimonial, please add a reply to this comment with you business name and location.

JamieR

Absolute worst merchant card processing company I have had the unfortunate misfortune to deal with. Promised a lot of really great deals. Guaranteed a savings of $150 a month over my then current company. In actuality it cost me $150-$200 more per month. Promised free debit machine tape. Yes, after calling three different people I finally got the paper 4 weeks later and a whole 5 rolls of paper. I would have to call every 2 days in order to keep us in free paper. It was impossible to reach my rep. I left several messages regarding what I thought were overcharges. I never got a call back from my rep. I finally spoke with a different rep who did indeed acknowledge I had been overcharged. Promised to look at my account in more detail and call be back the next day. She never called me back and I have yet to see the credit. I was guaranteed next day batch deposits. However all deposits hit my account 2 to 3 days after I closed the batch. They then started charging extra fees. I had enough and began the process of severing the contract. I gave them their 10 day notice in writing. I closed my account in October and received an automatic deduction out of my account for $780 in early November as a one time cancellation fee. I again received another automatic deduction for $58.49 in December. I have since refused that ACH charge and am taking steps ensure they can not continue to take money from the account. I have read from others in my same position the only way to stop this from happening is to close my checking account. These guys are the worst and I HIGHLY RECOMMEND anyone looking to do business with these guys to think twice and say NO.

mars wong

how you find the solution at the end? will they refund you the termination fee since they did not honor what the promised you from the contract? I have the same issues with this company, they promised a lot of things and signed the contract, they keep overcharged me every month, they said I have saved more than $150 every month if I switched to them but ended up I paying even more than what I was paying. They are just scam