Paymentsense Merchant Services Reviews & Complaints

Company Overview

Paymentsense is a very large merchant account provider that claims to service over 70,000 businesses in the UK. Paymentsense is the UK branch of First Data (now Fiserv), the largest payment processor in the United States. Paymentsense provides conventional countertop and e-commerce payment solutions as well as mobile payment apps for UK merchants. In 2018, the company launched Connect — a cloud-based technology that facilitates its payment processing network.

2023 Refund Issue

Paymentsense made headlines in 2023 when an internal report revealed that UK businesses using Paymentsense lost over £48 million to refunds. It should be noted that while this story created a relatively large media buzz and was associated with the Paymentsense name, Paymentsense is not responsible for this issue but is simply reporting on it. These refunds came because of the policy of individual businesses and not because of anything done by Paymentsense.

Paymentsense Payment Processing

As part of Fiserv, Paymentsense offers payment processing on all major debit and credit cards for most types of businesses. Their advertising particularly focuses on enabling merchants to take payments in person, over the phone, and online. For in-person payments, they offer Ingenico card readers in portable, mobile, and countertop options. For online payments, they offer e-commerce shops, their own payment gateway, and the ability to pay by email. Their phone option uses their proprietary virtual terminal.

E-commerce Solutions

For businesses that operate online, Paymentsense provides e-commerce solutions that can help streamline the payment processing process. These solutions include online payment gateways, shopping cart integrations, and secure payment processing.

Merchant Cash Advance

Paymentsense offers merchant cash advance services that allow businesses to access cash quickly and easily. This service provides businesses with a lump sum payment in exchange for a percentage of their future credit card sales.

Integration with Point of Sale Systems

Paymentsense's service can be integrated with a variety of point of sale (POS) systems. The company's processing solution can smoothly interact with existing POS software, making it easy to synchronize sales data with payment information.

Mobile Payment Solutions

In recognition of the increasing shift towards mobile commerce, Paymentsense offers mobile payment solutions. These services accommodate businesses that operate beyond traditional brick-and-mortar settings, allowing for the processing of payments on the go.

Payment Gateway for E-commerce

For businesses that operate online, Paymentsense provides a secure payment gateway. This tool facilitates e-commerce transactions, enabling businesses to accept credit card payments on their websites safely.

Card Machine Options

Paymentsense offers different types of card machines to suit various business needs. From countertop models for fixed point of sale to portable and mobile card machines for more flexible operations, the company provides diverse hardware solutions for payment processing.

Location & Ownership

Founded in 2008, Paymentsense is located at The Brunel Building, 2 Canalside Walk, London W2 1DG. Jan Farrarons and George Karibian are the co-founders of Paymentsense.

Table of Contents

- Costs & Contract: Appears to offer multi-year contracts through First Data (Fiserv) with…

- Complaints & Service: Complaints number more than 600 on…

- BBB Rating: Does not have a profile with…

- Sales & Marketing: Hires independent sales representatives and has…

| Pros: | Cons: |

|---|---|

| Quick, free setup | Poor service reputation |

| Variety of card machines | Long-term contracts |

| 24/7 UK support | Early termination fees |

| EPOS integrations | Hidden fees |

| Supports 140+ currencies | No transparent pricing |

Paymentsense Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 600+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

| Recent Lawsuits | No |

More Than 600 Complaints

We are currently able to locate more than 600 negative Paymentsense reviews, including in the comment section below this Paymentsense review and elsewhere. Complainants report issues that are typical of First Data (Fiserv) and its resellers, including undisclosed fees, higher-than-expected rates, long-term equipment leases, and poor customer service. These complaints have been posted very frequently and are loaded with consistent grievances, indicating that these issues may be systemic at Paymentsense. If you have your own Paymentsense review to make, please do so below.

Some Reviews Are Not Reliable

Paymentsense currently has a 4.7 out of 5 rating based on 7,004 reviews on Trustpilot.co.uk, a customer review website. Despite that rating, 13% of those reviews, an excess of 850, give the company 1 or 2 out of 5 stars. This figure is not especially meaningful, though, given the fact that Trustpilot allows businesses to pay a fee in order to exert some control over their profiles. A survey of available Paymentsense reviews on Trustpilot reveals that at least some reviews have been flagged for review by Paymentsense and are currently unavailable. The company’s ability to report comments and subject them to review greatly reduces the credibility of this profile in our opinion, and we are not inclined to lend much credence to the company’s rating.

Mixed Reviews From Business Owners

On UK Business Forums, another consumer protection website, users have mixed reviews of Paymentsense. Some commenters praise the company’s locked-in rate guarantee, low rates, and customer service, while others bemoan its long-term equipment lease commitments and unexpected fees. Paymentsense is rarely described as a cheap merchant account provider.

Paymentsense Lawsuits and Fines

We have not found any outstanding class-action lawsuits or FTC complaints filed against Paymentsense. Dissatisfied clients who wish to pursue a non-litigious course of action against the company should consider reporting it to the relevant supervisory organizations.

Paymentsense Customer Support Options

Paymentsense provides phone and email support for its customers, which likely helps to mitigate complaints regarding poor customer service.

Paymentsense Customer Service Number

- 0800 103 2959 – Toll-Free General Customer Service

Other Support Options

- Customer service email at [email protected]

Paymentsense Online Ratings

Here's How They Rate Online

| Trustpilot Rating | 4.8 |

|---|---|

| Average Rating | 4.8 |

Trustpilot Rating Analysis

Paymentsense has an average customer review rating of 4.8 out of 5 stars on Trustpilot, based on 7,284 customer reviews. The majority of reviews are positive, with 81% of them being 5-star ratings. Common themes in the reviews include appreciation for helpful customer service and efficient problem resolution.

Negative Feedback

Woke up this morning to see these have taken £131 out my bank account haven’t dealt with these for more then a year so was surprised to see them still taking money out my account with out any authorisation.

– Review from November 15, 2023

Positive Feedback

Kevin was extremely helpful and sorted the problem with our credit card terminal. He had all the patience. Thanks once again for such good customer service.

– Review from November 20, 2023

I’ve been with PS for around 15 years. I get that there are cheaper alternatives. I don’t swap to another company because, I’ve had great customer service. I love the App, think the instant transfer option is really reasonable at 1% I’ve got next day transfers which I requested and they sorted that really quickly. I would like to have next day include weekend and bank holidays but it doesn’t so 4 stars overall very happy.

– Review from November 14, 2023

Source: Trustpilot

Paymentsense Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Discounts for Paying Annually

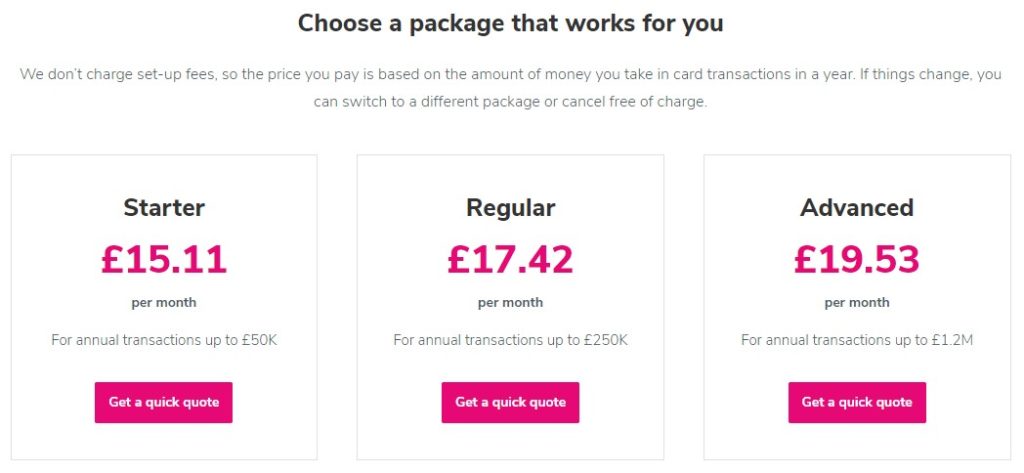

Paymentsense does not disclose all of its pricing details on its website or in its merchant agreement, but it does list its monthly fees for online payments via a payment gateway and virtual terminal-enabled phone processing. These fees can be paid annually or monthly, but businesses receive a discount for paying for a year upfront. Both types of payment plans cost £9.95 per month (£8.29 if paid annually) for businesses processing up to £50,000 per year, £14.95 per month (£12.45 if paid annually) for businesses processing between £50,000 and £250,000 per year, and £19.95 per month (£16.62 if paid annually) for businesses processing between £250,000 and £1.2 million per year. Client reviews reflect a rate of 0.20% for swiped transactions and 0.20% plus 50p for those keyed in. Each per-transaction fee is in addition to the cost of monthly payment plans.

Virtual Terminal and Payment Gateway Pricing

In addition to its storefront payment processing services, Paymentsense also dedicates a portion of its website to advertising its virtual terminal and payment gateway services. The company offers 3 different plans to facilitate online payments determined by a business’ yearly processing revenue. The Starter Plan is available to business owners processing up to £50,000 per year at a cost of £8.29 per month. The Regular Plan serves businesses processing up to £250,000 a year for a monthly fee of £12.45. Lastly, businesses processing up to £1.2m a year qualify for the Advanced Plan which has a monthly see of £16.62. According to the company’s terms and conditions, its payment gateway plans do not enforce an early termination fee and are in effect month-to-month agreements.

Multi-Year Contracts Are Possible

According to client comments available online and responses from company representatives, the standard Paymentsense contract includes an agreement of 18 to 60 months, with locked-in rates decreasing as the contract length increases. The company’s specific transaction fees vary depending on a client’s business type, size, and time in business as well as the terms presented by the sales agent. Most complaints about the company’s contract terms mention that although Paymentsense rates are locked in over the life of a contract, the company may introduce unexpected minor monthly charges over time, such as statement fees, 24-hour terminal replacement fees (£1.89 per month, according to some reports), or PCI compliance fees (£5.94 per month, according to some reports).

Termination Fees May Apply to Leased Equipment

Most reviewers also indicate that Paymentsense charges an early termination fee for the cancellation of its equipment leases, which can range from a £120 plus VAT to Liquidated Damages. Business owners are encouraged to inquire about these terms before signing up for service. We have seen an influx of complaints about five-year leasing agreements that ultimately cost far more than the retail cost of the equipment, and we continue to recommend that businesses purchase used equipment rather than buy new equipment whenever possible. Paymentsense claims to not charge an early termination fee on its actual client accounts, but the cost of canceling a terminal often exceeds most common ETFs. When it comes to providers that do not charge this kind of fee, we encourage merchants to check out our list of the providers of the best merchant accounts.

Merchant Feedback Is Not Encouraging

Given the company’s size and diverse customer base, it is difficult to determine exact figures for the standard Paymentsense contract at this time. However, the rate and volume of Paymentsense complaints we have received about the company’s pricing suggest that there is a high potential for undisclosed fees through this provider. If you suspect that undisclosed fees have crept into your monthly statement, we recommend seeking a fee reduction audit from an independent third party.

Paymentsense Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Resellers and Telemarketers

Paymentsense appears to primarily market itself through independent sales agents and telemarketing efforts. The use of independent sales agents is a practice that is commonly linked to business complaints within the credit card payments industry, and Paymentsense’s reputation appears to suffer from its use of this practice. We have found dozens of negative Paymentsense reviews that mention aggressive or misleading sales tactics by Paymentsense representatives, discrepancies between promised rates and actual rates, and incomplete disclosure of contract length. This does not compare favorably to our list of best credit card processors.

Unfulfilled Promises

Some Paymentsense complaints also state that Paymentsense sales agents promised clients that the company would pay the business’ cancellation fees with their previous providers, only to have Paymentsense deny this guarantee and refuse to follow through on it. These Paymentsense reviews have been posted with regularity and are similar to the complaints that have been filed against Paymentsense’s U.S. partner, First Data (Fiserv).

No Tricky Quotes

To its credit, Paymentsense does not engage in deceptive advertising strategies in its publicly available marketing materials. This is not enough to qualify it as a top-rated UK merchant account provider, but it does somewhat mitigate the Paymentsense complaints from business owners.

Our Paymentsense Review Summary

Our Final Thoughts

Paymentsense rates as a below-average credit card processing provider according to our criteria. The company offers long-term equipment contracts with locked-in rates that some reviewers feel are competitive, but most complainants report unexpected fees, aggressive sales practices, and poor customer service. Paymentsense rates about as well as its U.S. parent company, First Data (Fiserv), because it appears to be very similar in terms of its sales and service offering. Paymentsense users who wish to cancel their service without a fee may encounter some difficulty due to the company’s contractual language.

If you found this article helpful, please share it!

SALLY WEBSTER

HIDDEN FEES !!!!!! When the rep spoke to us we explained that we had suffered in the past with hidden fees, said we wanted all charges listed in an email that we would expect to pay throughout our contract. I have been on the phone for over an hour today trying to find out why I have extra fees on my bill. Apparently were free for the first 3 months then we were supposed to cancel them !!! One of the charges is so you can access their portal which has the monthly statements on, another new one was an account on file fee and a PCI phone in service fee. We have a very small business where every penny counts, why do they assume that they can charge what they like and their answer is “you signed the contract!!!!”

FROM A VERY ANGRY/FRUSTRATED CUSTOMER who will be changing supplier asap.

vanessa woodward

had a terrible experience. I was offered a 30 day trial on phone so let salesman Joseph from bury-st edmunds come to see me. asked for a sample signature,this was really a contract signing. Total deception bordering on criminal, did the same to my tenant next door. Also never told us there was a transaction fee of 3.85 pence (very high) or other hidden charges.

The free trial never existed. I cancelled next morning as I was conned into signing a contract that I had never read and wasnt told what I was signing. Apart from that,lovely young man !!

Found out over 700 complaints had same experience, they are obviously trained to make you sign under false pretense.

vic shield

Got a phone call from a rep saying that due to covid the government was giving special deals in contracts on numerous services and there was a rep in my area if I wanted to see what they offered.

The rep turned up and would not give me any figures to read concerning the interest rates and costs for a card machine.

The rep told me that it would be all on an email to check over once we had gone through the formalities,

I felt under a lot of pressure from the rep and it was a very quick hard sell, I kept on telling him that i needed to check the figures out to see if it was worth while, he said it would all be in the email and I had 28 days to accept it.

Cut a story short, he got me to sign his lap top for my permission to have the figures and the next thing I know is I was signed up with this company.

It was more expensive than my present provider and the figures he kept quoting were not the whole amounts

I called paymentsense and cancelled the contract which they did and were very helpful until I wanted my personal information destroyed and they said it was on record for 7 years.

Feel like ive been mugged off and tricked into something I did not want

Ryan Allison

Awful company stay away

Steve Howes

Steve Howes

Paymentsense did not fullfil there side, they provided me with the wrong card machine even though the rep had been given the model number of the one i was currently using. Wrong card machine sent but the rep and customer services did not respond or act until i told them to cancel contract as it had not even started therefor not ratifying it. They now want to sue me for cancellation of contract for over £700 plus vat. They are a total disgrace and just want your money at all costs. When taking out a contract you have to trust what what you are signing, paymentsense misled me on what they offered. They abused my trust in them!!

sonila sallaj

Worst card machine ever .

had previously my card machine , but Nicholas came to offer me his rubbish card machine , everyday charging me money . suppose my monthly bill to be total 35 but the reality i am paying 85 £ .

will never recomend this machine .

CPO

Sonila,

This article should help: Best Chip Enabled EMV Credit Card Readers & Terminals.

-Phillip

S silsby

Awful avoid payment sense at all costs. We were a customer for a two year contract unbeknownst to us when we contacted them as we believed we were out of contract, they informed us that we had renewed for a further 5 years???? Never, ever would we commit to a 5 year contract when the market for card machines is open. They are under hand, renew contracts and then say you have renewed??? When this is questioned they eventually offer to “HELP”! Shocking, their idea of help is arrange to just charge terminal rent for the duration of contract that was never renewed and certainly wouldn’t have renewed with them for a further 5 years??? However, they then go through several emails and agree to a charge which to be frank is robbery. Then when you check your statements you find actually the emails back and fourth were a pointless exercise and they “Paynent Sense” continue to charge, well basically whatever they choose. Awful company avoid, avoid, avoid.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Astrid Fitzpatrick

Stay clear of this company, there are so many hidden charges it is shocking. Now they want to charge me a termination fee after 100’s of euro’s they got out of my company in charges I never signed up for.

Don’t make the same mistake I did

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

DEBBIE FOX

COMPLETELY RIPPED RIPPED OFF… ABSOLUTELY FUMING IS AN UNDERSTATEMENT!!!!

Took out a contract, advised it was an 18 month contract, and able to cancel after this period with no additional costs…Closed down our business in March, and then enquired at the time that we had in fact, signed for 60 months with varying cancellation charges. i called again today bounced back and forth between payment sense ad First Data ( 1 hour 20 mins ) no one accepting responsibility to then go through to collections department to advise i owe then over £500 and that i havent returned the terminal and owe then an additional £705.00 i have reinstated the dd to keep the monthly line rental going after cancelling in march and advised i received no correspondance what so ever to return the terminal otherwise we would have… i am now returning the terminal and asked that i see the contract that i happily E signed… ???? i said i was advised 18 months and my contract should now be finished… so now has a marker on my credit file and being dealt with by thier collection team as i am not forking out the £500+ for cancelling >>>> completely furious is an understatement…. !!!!

This post will help: Cancelling a Merchant Account Without Paying a Fee

Jon Fratschoel

We where totally screwed over by the Irish rep who promised us that “all major credit cards will be accepted that they are in negotiations with some and it will take place in the next 2 month we signed a 2 year contract with them and found out that they never had negotiations with some credit card provider the rep vanished overnight never to answer and the company has made it clear that if we cancel the contract we are paying a penalty

I do understand that if you are in breach of a contract that it results in a penalty but what happens when they are in breach nothing the least they could do is question the rep and find common ground all they did is disrespect us and disregard our concern I hope screwing over small businesses is not a regular thing with this company

I am shocked of their conduct

Jan C

Good day , I found company service very very poor . Used card and online payment option – regularity online payments was credited in account only after 8 working days. Regularly invoices was incorrect . Have to involve solicitors To terminate a contract what in end was invalid for eu. I will advice everyone -Stay Away

Pat Libery

The worst business decision I have ever made.

Do not switch to this company.

In my experience they have been untrustworthy, untruthful regarding rates and hidden charges, evasive and difficult to contact when things went wrong.

The sales agent who called to my business lied to me to get my business and promised me so much but delivered little. I am happily back with my previous supplier. If they ring you from their call centre telling you that they have an agent in your area who wants to save you money on your card handling say “Thanks but no thanks” remember the company to avoid Paymentsense

This post will help: Best UK Merchant Accounts

-Phillip

RUTH

DO NOT TOUCH THEM WITH A BARGE POLE.

LIARS, SCAMMERS. THIEVES.

This company lied to me from the getgo and have cost me a fortune in fees. Their customer service is also woeful and once they have you under contract

YOU ARE DOOMED.

BUYER BEWARE.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Edwin

I was signed up online -apparently – and understood I was dealing with Paymentsense and that it would cost me £17’99 per month with a small percentage taken from each transaction. My transactions equated to approx 100-per month at about £10 per transaction. Gradually over the first year the charges per month racked up. Eventually I realised there were three companies all taking money every month. Fees I had never heard of. It became a nightmare. After dozens of emails and phone calls over 14 months Paymentsense refunded me a small amount and closed my account. But ‘First Data’ continued to bombard me with bills. I received anonymous voicemails asking me to return a call. When I did they asked me for my ‘reference number’. I asked, ‘but who are you?’ They said ‘you must know who we are, you just rang us’. I said I wanted to complain. They hung up the phone. Next day came an email from First Data listing a complaint I made ‘that the early termination offer was unacceptable to me.’ I warn you these people are the worst types of dodgy salesmen and underhand swindlers you could ever become involved in. To this day I continue to be bombarded by First Data and First Data Global asking for money even though I closed my shop 6 months ago. And paymentsense assured me in an email 5 months ago that everything to do with my card payment set-up was closed and I would not hear from any of them again. YOU HAVE BEEN WARNED.

Tina

BE AWARE,…..HIDDEN CHARGES, …..LYING REPRESENTATIVES,

…….

A representative called at my shop to offer payment sense services and i asked him all the relevant questions about charges, contract length,cool off period, etc , but all his answers were far from the truth.

I told him that i will not sign a thing until i have a proper look at the T&C’s.

He told me that i need to sign an empty box on his iPad in order to receive the T&c’s via email, so i could make up my mind in the comfort of my home. Stupidly, i did, don’t know how he managed to manipulate me, but i guess they train them to do that, and to my surprice i received an email with all the contracts and T&C’s with my signature on them.

The representative has tricked me into online signing the documents and it appear that the cool off period and all free cancellations he promised were in fact a lie.

I have spent a month , providing Cctv proofs and other types of proof that i was tricked into signing a contract and luckily i got out of it. It was hard work providing all the evidence. I was not ever going to work with such a fraud company and was ready to pay the £1500 cancellation fee, only to get our this contract if i had to.

This post will help: Best UK Merchant Services Providers

-Phillip

David Pavon

I was approached by a sales rep to change the card machine service provider. Everything in paper was perfect. Low charges not many payments, overall a great service. Then after a few months I saw how my bills were increasing. They changed the rates, add hidden costs and even charged me for a service that they offered me for free at the beginning. Overall an awful experience from the beginning and this has not finished yet. I found out that even having agreed with the sales rep the length of the contract they changed it in the digital contract and still have with them 20 months… A complete nightmare.

Be very careful…

This post will help: Find and Eliminate Hidden Costs In Your Monthly Statement

-Phillip

Chris

I used Payment sense for about a year.

Whatever they quote you at the beginning never equates to what comes up on your bill. Its always more, as they “forgot” to mention that there are other charges and fees that crop up monthly and annually.

The salespeople are a bunch of spivs, they will tell you anything to sign you up.

Really unprofessional company hiding behind a respectable image, which they have managed to hide behind – I strongly suspect that they are faking reviews for trustpilot. Beware people ! Chose another provider!

This post will help: Best UK Merchant Account Providers

-Phillip

Lloyd Mensah

Corrupt, Fraudulent, Unethical, Greedy……(Update)

I’ll get straight to the point – my issues with this company are:

1. Their sales people will tell you there are no hidden charges but there are plenty of them.

2. In my experience they sent me an electronic contract and the sales person said I should call him as soon as I receive it as he would need to guide me on where to sign. They do this to ensure you don’t see the 5 year contract they sign you up for and all the extra charges.

3. The contract they send you is titled ‘Regulated by the Consumer Credit Act’. This is NOT true if you sign the document on behalf of a limited company.

4. Due to point number 3 they have full confidence in sending you on to the Financial Ombudsman to settle any disputes as they know the FO only look into cases involving regulated activity with individuals rather than limited companies.

Please don’t just take my word for it. Go on to google and look at review sites for terminal service providers and you’ll be overwelmed with how many identical complaints about Payment Sense there are.

There are also a number of cases on the Financial Ombudsman website you can look at that show these people are fraudsters. Don’t be fooled by the glossy corporate image.

Due to their financial clout they have been doing this to people and individuals for years with impunity.

I will be starting a Facebook and Twitter group that will allow the public to review this company with their experiences. They do a very good job of filtering the complaints on their Facebook site to give you the impression that all of their customers think they are great. I will post the link here once I’ve done it.

After my review above here is the response from Payment Sense:

”

Good afternoon Lloyd

Thank you for taking the time to leave a review. I am truly sorry to hear you are disatisfied. I have reviewed your FDGL contract. In section 1 this does explain who the Consumer Credit Act covers, such as individuals and partnership, which is not applicable to body corporate.

Unfortunately, Limited Company and Body Corporates do not fall under The Financial Ombudsman’s jurisdiction.

We are sorry for any inconvenience this may cause.

Kind regards,

Paymentsense Ltd

”

Note that they make no mention of additional charges or any of my other concerns. This company specialise in duping you into a 5 year contract after which they can do as they please. Pathetic and disgusting that they see nothing wrong in their conduct.

My next stop will be Watch Dog, Money Box and You and Yours. Please also check out My Experience of Payment Sense on Face book.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

RTee

Is Paymentsense and Worldpay one and the same, or vice versa ? Payment credentials for one also work with the other !

Paul Phillips

I signed up this week after a friendy rep got back to me very quickly.

I’d checked them out on Trust Pilot but not here – silly me.

When i checked the agreement (for one terminal) there were a few ‘bolt ones’ included so i requested they were cancelled.

There seems to be not only monthly rental from payment sense but something else – line rental maybe – from FirstData

Anyway, after reading this forum – I was suitably spooked so have cancelled the DD’s, sent notification that I want to cancel (I signed only 4 days ago) and will post the terminal back recorded delivery.

So, I’ve learned my lesson. Just waiting to find out how costly it’ll be…

This post will help: Cancelling a Merchant Account Without Paying a Fee

– Phillip

Kerry Whittle

The sales people will lie through their teeth to get you to sign up.

This was my first experience of taking out a card terminal contract I asked the sales representative for a quote and what their charges would be, I was told there’s a monthly terminal hire, a small percentage charge for each transaction and the PCI Compliance fee.

Sneaky extra charges that this company will add to your account are…

Plus Rewards Program

A Minimum Monthly Charge

A Till Roll Subscription

A Restocking Fee

Client Line Service

Account On File Fee

PCI Phone in Service

All of these charges were added to my account without authorisation, why couldn’t they be more upfront about all the added extras in the first place.

Also be aware that you will be signing up to a 5 year contract even though i was told it was an 18 month contract.

This post will help: Eliminate Extra Fees From Your Monthly Statement Without Switching

– Phillip

Muhammad Yasir Yaseen

i will not recommend paymentsense. Do not take Paymentsense service at all! Do not believe a word they very friendly sales people tell you on the phone as none of it is true. I was promised a £7.5/month, no hidden charges on the phone for 12 month, but the reality of my contract was a huge shocked. Just got off the phone with them and cancelled at least 4 unnecessary charges they had added to my contract and it is still much higher than what they promised on the phone to me. Moreover, I just found out that my contract is for 3 years and if I want to leave I need to pay them for all five years. I just hope they won’t last long with so many unhappy clients, the company is based on scams and lies. DO NOT TRUST THEM AT ALL!!!!!

This post will help: Cancelling a Contract Without Paying a Fee

– Phillip

Mark Jones

Avoid at all costs. Originally told £19.99 a month for terminal, 1st 5 months free. Asked telephone rep, that’s definitely all I’ll be paying, right? Yes, just sign the form, no hidden charges etc. and I’ll do everything else for you. Signed the contract form for 4 years and thanked him for all his help.Within a week, nearly a £1000 taken from my account. Call up and find that I’ve been added for three services in total for a cost of £96 a month. Cancel two of them and end up paying £31 a month. Ask about the 5 months free and told, that you have to pay for 6 months upfront, before having to put in writing to them, to get your 5 months credit refunded. Then find out for the first time that FDR/FDMS a parent company then charge you an additional £39 a month on top, totalling £70 a month for a single terminal.+ additional costs.Then my business is due for a move so I check on the existing 4 year contract, surprise, surprise, I’m actually locked into 5 years. I contact customer service and tell them to ‘listen to the phone call with the rep who sold me this and will show you I’ve been mis sold.” Guess what, no phone records available, but get sent original contract, the one I signed in faith for 19.99 a month which transpires to be £31a month and 5 years locked in. Like with a lot of big business these days, you the small business have absolutely no rights at all. Wish I’d continued with izettle. Massive costly mistake.

This post will help: Eliminate Overcharges From Your Monthly Bill Without Switching

– Phillip

Chris Gregg

Do not sign up to these people it easier to get out of prison than out of a contract with payment sense.

They charge you a fortune to leave even if you are out of contact.

There is loads of no contract machines now that work out the same price and there’s not loads and loads of contracts.

Stay well clear you have been warned..

This post will help: Cancelling a Merchant Account Without Paying a Fee

– Phillip

Joseph Hawksley

the worst compnay i have dealt with. Support terrible, invoicing terrible, have paid to get out of contract and back with my previous merchant. I would never ever ever recommend this company. Awful.

From The Editor

This Post Might Help: Best Merchant Accounts for Online Invoicing

Tony McMahon

I used this company until was pointed out to me that there were many other merchant card service companies offering better rates. When I ceased trading with them it was impossible to close my account. Email communications from me usually were not acted on by them for a number of days/weeks and the standard reply eventually came back saying they had tried to contact me by phone (which they hadn’t) and I should contact them on a telephone number that had no prefix, so it was impossible for me to do that.

In the interim, they still took charges from my bank account and 6 months down the line I am still waiting for them to confirm cessation and refund unauthorised payments taken by them, which is most concerning for anybody considering dealing with any financial services company.

I would not recommend them

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

PAT O'NEILL

Very poor service. Charges were not as per contract. Back up service was none existent . Money was taken from our account that didnt match up to the invoices . Please please please do not use payment sense . We are now trying to go back to our old provider.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Maria Mirza

Sales walked into my business offering me great rates and wanting me sign up there and then. I’d never heard of Payment Sense so needed to do my research. Got a phone call the very next day. Asked the sales rep to call in again in a few weeks. He refused to let me look at the contract before signing it and basically stormed out because I queried some hidden charges that I’d read about.

I found this company highly unprofessional and the sales rep was rude and very pushy about getting my signature on a contract he refused to show me.

From The Editor

This Post Might Help: Best Merchant Accounts for Cafes

travis skelton

never go with paymentsense so many chargers and 60 mins to wait to get through world pay is so much better

From The Editor

This Post Might Help: Best UK Merchant Accounts

Joseph Hawksley

Terrible company – do not sign up. Sales rep very friendly and basically ‘sold’ it to me… many hidden charges, tied into contract, net resolution makes it nigh on impossible to reconcile accounts, hours wasted trying to balance accounts and get through to ‘cutomer service’. I believe I have been mis sold this product through upselling by rep. . Am cancelling their services and will argue my case when they try to make me pay cancellation fee… I believe the financial ombudsman should look into their methods – they are mis leading.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

S Basra

Fortunately did not sign with this company and this is due to constant phone calls and emails asking me to sign and even the sales rep turning up to my home address twice! Had the area manager call up my business and upset member of my staff threatening legal action – what for – not signing with them! I emailed him to complain, only to recieved one of the worst and rudest emails that I have ever recieved – telling me that I had made a big mistake! It was bordering on threatening. Since this I have been receiving emails daily to my business, work and personal email addresses. The only reason the calls have stopped is because they have been blocked! Do not touch these guys with a barge pole!

From The Editor

This Post Might Help: How to Report a Bad Credit Card Processor

Andrea Hodder

Awful company! I urge you to take your business elsewhere. Their high and hidden charges will cripple You! They are rude and despicable. They take money from your account without any prior warning or explanation. I am now in the process of recovering unauthorised debits!

From The Editor

This Post Might Help: Best UK Merchant Accounts

ALAN TAYLOR

Absolutely awful service. Equipment is not fit for purpose. Customer service is shocking. Added someone to our account that we have never heard of,so personal data is at risk. There are much better card operators out there, with much better equipment. Ignore all the hype about pricing, the age old rule applies. You pay for what you get. Avoid at all costs.

From The Editor

This Post Might Help: Best Merchant Accounts for Great Customer Service

Heather Smith

Great rates but you get what you pay for. I’ve been with them for 6 months and had endless connectivity problems. They will not take responsibility and are blaming my business. Unbelievable! customer service a joke. I’ve lost a lot of customers because I cannot rely on their service. I’m leaving them and they literally couldn’t care less for my custom. Disgusting service!

From The Editor

This Post Might Help: Best UK Merchant Services Providers

Tariq Malik

Hi, we recently closed our Restaurant after struggling for the last few months. we told the saleman that we only intended to stay there two years . He said fine and signed us up to a 3 year contract. He said it is standard and that we could cancel and leave at any time. Now that we are trying to cancel they are demanding over 500 pounds from us, we have been with them for about a year. Please avoid this company and there shady practises, bad service, complicated payment method and rude staff. If anyone reading this has any advice for us please help.

Ian Jackson

Paymentsense are a complete rip-off. Do not touch them but use a reputable provider instead. Charged us for months for card machines that never worked and never would work and ignored my requests to accept the machines back unless I upgraded. Taking expensive legal action.

Ruby

Please please do not use paymentsense they will not be honest on the phone and then you will have no proof they were dishonest.

Mark Jameson

I agree. Even the honest people there are confused and bureaucratic. Keep well away.

Michael

Hi

I am in Ireland, I signed up recently with PS, of it cold feet and enquired about a cooling off period which I was told via email that I had 14 days. I acted sitting 14 days and asked the the account be closed with immediate effect. I was sent a bill for closing the account for €1300 . They then said that there was no cooling off period. I am going to talk to them tomorrow so I’ll see what they have to say then.

Carolina Revilla

The salesman was very pushy and clearly (I can see now) lied to me. When I raised my complains to him one day after my contract started, he said he will look into it and later did not reply to me anymore.

I contacted him again waiting for his emails and basically he ignored me and said my cooling period had finished and I needed to pay cancellation fee.

He did everything purposly for my cooling period to finish and I definetively going to put a complaint against him.

I feel he ripped me off.

His name Raj Tanna. Avoid!

BRIAN HAWKINS

Signed up today 2pm and now read all this. How can I get out of going with them . Please advise

Ex Employee

Cancel your direct debit and call them to cancel. You have 5 day cooking off period from the day you’ve signed the contract.

Alex

Avoid at at all costs hidden charges and will sign you up to services at additional costs without making you aware!

Mark long

Sold an 18 month contract by the rep (now departed) sent in termination letter after 2 years. Contacted them today as they had failed to contact me and apparently we signed for 5 years. I argued the point only to be told by the woman from paymentsense that as I did not have it in writing ” tough ”

Shocking service !!

G

Do NOT sign up with these guys, do not even meet with a rep. I’ve never encountered such a fraudulent company during my 32 years. My experience is mixed but the only positive is a reflection on my own research and throwing legal jargon back at them. I’m 99.9% sure ive managed to get out of my “contract” without paying any fees. I received confirmation of this via email today but I’ve gone back to them to clarify that the will not attempt to take funds from my account, nor will any partner company that actually provide the machines. Once I receive that I will agree to cease any legal proceedings.

I was completely miss sold a contract by a rep, she never referred to it as a contract, she called it an application. She never told me t’s and C’s or directed me to read them, I got her to admit she didn’t do this. It’s a very long story of me going back forth but I was relentless and did my homework, the rep was on breach of the misrepresentation act, consumer rights act and so many other things. I’ve pointed this out on phone calls and emails, I’ve been lucky to deal with a very helpful customer service agent named Stacy today who has agreed to end my so called contract at no cost. Like I said I’m not counting my chickens just yet, I’ll be calling Worldpay to put a stop on my account to prevent anyone contacting them to buy me out and putting a stop on my back for payment sense and first data merchants. Once I do that AND receive the second written confirmation I’ll be happy.

If anyone has any questions regarding this matter please feel free to contact me. The injustice of this whole situation has angered me so much that I’ll spend my free time helping others that could end up in my situation.

Anonymous

Ive had the same issue with this card company does anybody know a way of cancelling with them’ they are looking for 650 cancelation fee and the card terminal doesn’t work! The past 2 months customer service is so bad!

From The Editor

This Post Might Help: Best Merchant Accounts for Great Customer Service

Bee

Hi dear, any way we could get in touch with you as we just recently signed up with them and many many issues showed already. Could you please let me know if there is a way to contact you.

prince thomas

lot of hidden charges they will rip you off and long contract period stay away from their service …they are advertising the terminals from €19 /month which makes you feel like a good deal but there will be dditional charges on everything like €6+vat on monthly reports terminal replacement charges etc.. you will end up paying €80-90 /monthly on your card payment system which is a lot for small businesses like mine . First of all when you sign up with paymentsense you automatically signed up with a company called first data and they charge you €35 /month for terminal rentals and the contract period is 5 years !!! yes 5 years today I spoke with the customer service team for ending the contract with them and they gave me a price for breaking contract it’s €1400 I have 4 years left in the contract and they want all the money that I would have paid to them for terminal rentals in the next 4 years to break the contract . that’s not it yet they were charging me for two terminals for almost 6 months when I noticed it I contacted the customer service team and they told me it was an error in the system that they thought I was using two terminals. never ever go anywhere near Paymentsense Ltd, it doesn’t make any sense

Prince Thomas

stay away from this company they are masters in robbing your money .lots of hidden charges they will charge you for services that you have never used stay away stay away ….

Myles Gallivan

I worked with Paymentsense for a while everything is very misleading and not consumer friendly no help for honest sales people move on quick!!

Chrissy

Avoid this company. We were quoted prices that were misleading. The sales rep goes through everything on a lap top and either skips small print or misleads. Terminals were so slow they affected our business. Took 3 weeks to replace a terminal that was faulty after a couple of months. We had quarterly hidden charges of £86 per terminal appear on our account with no invoice or knowlege of what the charge was for. Months later told they were 24 hour terminal replacement charges and pci compliance which we were told would not have. Follow up non existent and they pretend they have no record of the calls for support. Lots of higher processing charges than agreed. Very bad company to deal with and will cost you hundreds more each month than they say. Their complaints department are extremely ineffective.

Sharon wishart

I am very disappointed with payment sense. I used an agent who explained charges which I thought was reasonable only to find I was paying a lot more. They are a total disgrace and I am in the process of terminating my business. Why because their charges are ridiculous they take a percentage of what I bring in, Hire of equipment which is reasonable but they take £72 each month apparently I don’t comply with something or other. Did their sales guy explain this NO but he got a benefit for recruiting me. A total disgrace, I am seeking legal advice regarding this. Also I can’t close the account t until business is closed so to date they have received approx £400 for what.

H Bulford

DO NOT USE PAYMENT SENSE

Offered very good terms originally, I signed up for a 12 month contract, only to find out that they tied you into a 60 month contract with the terminal rental. Hidden charges left right and center.

Poor customer service, I was given a verbal figure to cancel the contract, and then 2 days later when I phoned to pay the early cancellation figure this had trebled in price, I was given the explanation the first figure quoted was a human error!!

I would never deal with this company again.

Tim

Where on earth are you getting your 4.8/5 reviews from 60000 happy customers that you claim on your website?!? This company is a total joke, avoid at all costs. Staff are useless, complaints procedure is pathetic, nobody deals with any and god help you if you try to leave them. I am trying to pay the £100s to leave them early and they are refusing to release me, refusing to reply to emails, refusing to return calls and every time I call them they have no record of previous calls! AVOID AVOID AVOID!!!!!

Andrew Nicholson

Stay clear of Payment Sense!

I negotiated terms with Payment Sense and they sent contracts to sign electronically. The contracts are with third party companies and what was represented to me during negotiations was not as written in the contracts. They asked me to sign them electronically which I did and we were very busy setting up a new business at the time.

It transpired that I as being charged all sorts of additional fees for terminal replacement, capped rate fees, performance reports etc. I was basically paying Payment Sense £25+Vat per month, Paytek (a third party company) £23.92+Vat and FDMS (another third party company about £40-£45 a month. These people don’t know about business ethics or commercial integrity. I spoke to them and have been told that I should have read the contracts clearly before signing. I pointed out that there is something called ‘misrepresentation’ in law which protects people who have been misled when entering into a contract. Essentially, what they say you are going to pay to get you to sign up in no way reflects what you will actually be billed for. Of course they are a large company and they believe that they can keep on punishing the little man. I just hope that they get so many bad reviews that it puts them out of business. ‘Business’ – that’s a laugh – their actions are more befitting a shady used car salesman.

Lee Padgett

Do not sign up to these, there is loads of hidden extras they put on your account and charge a fortune for, ie they want to charge you £15 per month for a box of till receipts which one box will last you a year. I was never told it was a 60 month contract, their sales person only mentioned their 12 month cash back offer, had to email a lot about it and they were only going to give me 6 months, until I showed them the thread, I’ve nearly been with them 12 months and they are supposed to give you this back after 4 months, you have to email a lot for a response, dont not give this company business, they are also First data so dont use them either

Tommy

This company is in buisness to hide its true fees and rip you off in various ways with underhand hidden charges . The sales pitch is a low monthly fee but the addons they dont tell you about can triple the charges you end up paying . when you find this out and try to leave its costs a kings ransom to get away from them . But the best move I ever made was to leave them BEWARE of Paymentsence

Samira Jafari

Be very careful working with Paymentsense! Do not beleive a word they friendly sales people tell you on the phone as none of it is true. I was promised a £10/month, no hidden charges on the phone for 12 month, but the reality of my contract was a huge shock. Just got off the phone with them and canceled at least 5 unneccessary charges they had added to my contract and it is still much higher than what they promised on the phone to me. Moreover, I just found out that my contract is for 5 years and if I want to leave I need to pay them for all five years.

I will be seeking legal action to see what I can do next. I just hope they won’t last long with so many unhappy clients, the company is based on scams and lies. DO NOT TRUST THEM!

Ant Beetlestone

2 months into a payment sense contract for a mobile card reader and just noticed the massive bills. I was told I would be paying £25 a month inc vat and a small percentage fee from sales. This percentage fee actually is another £25 per month minimum charge, a £6 card security fee, and a load of other extras that I wasn’t told about- eg a till roll supply contract, a card security help line and an extras service likened to group on. So basically I was lied to by the sales person from payment sense (called Nwe Yu) when I asked her to confirm that I would have no other monthly charges. Am currently waiting for a call back to discuss this. Will check whether I am also under the 18 month contract we agreed or if this is also fiction. Hopeless and really disappointed. So who should I have gone with? Any honest mobile card reader companies out there?

Barbara Freeman

I was told by a very charming salesman that I was signing up with paymentsense for 18 months, when I tried to leave after 2 years I was told I was tied in for 5 years and that if I want to leave I have to pay them £340+vat, I was shocked.

I said I was going to seek professional advice and was quickly contacted by their customer service department saying that they had evidence that I had had electronic contracts for 20 minutes before I signed for 60 months, so professional advice won’t help me. I told them they were scammers as I would not have signed so quickly if the salesman hadn’t convinced me that it was an 18 month contract.

Another reply then came from paymentsense saying you can leave after 18 months but you have to pay £340+vat. Well the salesman definitely didn’t tell me that it would cost me to leave them,

I have found sights on google where ex employees say they are encouraged to say its only an 18 month contract or anything else that will get the sale.

If that’s not scamming I don’t know what else is.

AVOID PAYMENT SENSE NO MATTER WHAT THEY OFFER YOU, ITS LIKEKY TO BE LIES.

Samantha Vian

I have spent two eweeks trying to sort out integration between my machine and my EPOS till. I have been pushed from pillar to post on the phone for HOURS bewtween Payment Sense, Ingenico & EPOS now. Every time you phone the customer service team you have to go through the problem from start to finish even though they keep notes on their system, you can never get through to the same person. I had to chase progress and actions as they do not call back or follow up when they say they will. Eventually they agreed that I needed a new machine so what do they do???? Switch off my current card machine before sending the new machine, without notification and in the middle of a working day!!

I could go on but I have spent so long on this issue I don’t want to waste any more of my time.

Adam Schiller

I have had nothing but problems for over six months. This stemmed from my initial enquiry about a different company to my own. Two weeks later I called about setting up an account for my own company but they managed to conflate the two, resulting in months of frequent phone calls, misallocated funds and I even had to change the name of my bank account which wasn’t straightforward. Each time a problem was resolved a new one appeared and needed dealing with. I understand that mistakes happen but if after six months these have not been resolved then it’s not good enough. The merchant rates I was given were very competitive but I would urge anybody in business to think about the quality of service as it’s evident here that you get what you pay for.

Karl Goyns

I would like to single out James Bye “Business Development Manager” for appalling service.

I will expand fully below, but in summary James purposefully opened an account knowing that the way he was going to do it would mean the account would fail with acquirer FDMS… BUT made sure he got paid first by carrying out a test transaction before the account could be declined.

This is either extremely amateur as a competent person would have got the account opened, or intentional because he is lazy and wanted a quick buck. We used to like this company as we already did business with them and had friends that work there, but my advice now is AVOID based on the deception or incompetence, neither of which is good.

I contacted Paymentsense via the telephone and James Bye answered the call. Initially very helpful and following up. I explained that an opportunity had presented itself and we needed an online payment gateway ASAP.

I got the forms in good time and response to initial queries was good. THEN when we got to the test transaction stage, contact increased until we had done what we needed to do in order for him to be able to conduct “test transactions”. For those unfamiliar, THIS IS WHAT HE HAS TO DO TO GET PAID.

Then SILENCE……

Email followup… SILENCE….

We receive a letter through the post to our business stating, “account declined”.

We were confused as you need an account to carry out test transactions right?… WRONG.

Confused I sent an email directly to James…. SILENCE…

Called his office and spoke to a colleague who would ask him to call us back… SILENCE

Contacted Customer service who couldn’t explain further on what was going on… and currently due to this amateur scenario… we are in limbo and with a declined account on our perfect record thanks to James Bye.

The cherry on top – We cant apply to the same acquirer for 6 MONTHS again… EVEN THOUGH WE ALREADY HAVE ANOTHER ACCOUNT WITH THEM!!

Thanks Paymentsense and Thanks James

David Bamford

We have been with Paymentsense for about seven years now, and I think that this qualifies me to offer a balanced assessment of them as a company.

In summary: AVOID

Whilst we have renewed twice with them, we have been conflicted between their excellent headline rates (even better when they think you are leaving them and put you through to the retentions team!), and the continual billing problems we face.

In our previous two contracts we have managed to resolve issues by continually monitoring the billing and then getting into long email chains. It is nonsense, and underhand, but these ‘mistakes’ could be resolved provided that you had the diligence and resolve to keep pestering.

Everything changed in the last year with our last renewal: we kept copies of the correspondence and asked for everything to be confirmed in emails like we always do, but this time they have hidden lots of stuff in the terms and conditions. And they do it very underhand: they speficiy deep within the T&Cs that some charges will be applied, even though in the emails, and in the charges section they are shown as zero. They sell capped rates (which we bought, and opted for a long contract for security) to find out several months later that this doesn’t apply if Visa or MasterCard change their baseline rates (how the hell do we know where the increases are coming from?) This caveat is intentionally hidden within a clause that is nothing to do with capped rates so that it will be overlook. And even though they initially understood our issue, and I could demonstrate what was offered during selling (or even the mis-selling) they are becoming much more steadfast in the defence of their T&C’s.

As the industry isn’t regulated as it should be, not only is such practice not weeded out, but it is actively encouraged to grow.

T&C’s are used to hide charges, or escape from commitments that their contract appears to offer. this isn’t the spirit of what T&Cs are for (to protect them) but instead they are used to deceive.

NEVER EVER TOUCH THIS COMPANY.

There are plenty other companies out there who may appear to be slightly more expensive, but Payment Sense is costing us much more in the long run.

Louise

I’ve signed up to payment sense Friday 26th may, after meeting with a rep who has clearly told me €17 pm plus a really low percentage for each transaction, oh and this government thing at 4.95

I asked him how long my contract would be 36months. Okay!!!

So Friday he sends me the link for the contract, it’s all very clever, digitally signing everything and jumping over all the main text so you see nothing.

So I was happy enough left it over the weekend but needed some prove of ID from bank account so called into my local branch of bank of Ireland. Lucky for me I got some advise about payment sense, at first I thought they are just trying to sell me there card merchant services. So I decided to investigate and actually read through my contract!

There is a whole lot of surprises in there

Bolt-ons, 60 month contract.

I’m within the legal cooling off period and can’t wait to call him tomorrow and tell the rep to stick his payment sense.

I’ve been to world pay, sage and bank of Ireland really wish I didn’t need to get a card machine and I’m still not convinced by any! I think you end up working to pay these Greedy companies.

Mark Jameson

conman salesman: Duran Grant

I was sold £20mth for 18 mths with a £100 cashback. The salesman was Duran Grant

they hid the £190 restocking fee by saying it was only due on default. but im not defaulting

Then say in paragraph 18 that i am liable I will try my legal advisors but feel prety sick that I have had to pay about double what I expected in hidden charges.

Lesson learned: never trust a salesman and alway read the small print.

Agata Sood

They are Thieves. They would add so many other charges on to your account which you would never get refunded. Please never ever use them as you will never get your full money in your account,You get through card payments and they will charge you for so many extra added services which you never asked for.

david

yes, you are right, I face same problem,

l just sign the contract on 28 April 2017 and received the terminal on 02 May 2017, and I found the terminal are different from the picture that sales sent to me and this terminal do not allow to void the transactions once I complete the transaction but before I completed the End-of-Day banking, I asked them to change a terminal to T4220 which list on their website, that I used before and that terminal do have VOID function, but they refused. and they also told me that the paymentsence company do not allow to VOID a transaction, that mean you have to do refund and pay the charge and fees. but other company do allow to void, this is comment function.

the sales promise me the £12 monthly fee for 12 months, and after that my fee will remain the same for as long as I need, I think just one year contract, but after I told the customer service and specialist team and they told me I cannot cancel as there are 5 years contract,

after I check the contract, it states that the company will send us another way how and when we can to give the cancellation notice , 14 days or 30 days, but we never receive it

in addition, the sales promised me the cancellation of £120 and all other fees do not apply to me, but when we notice them to cancel the contract, I have been advised many fees I have to pay, but in there website, the advent, they guaranteed the lowest cost, No other hidden costs, hassle free

I tried to contact the sales by email, phone call, text message, but he is disappeared

I have no choice to prepare to complaint to the FCA next week

Gwen Lindsay

DO NOT USE PAYMENT SENSE! The hidden charges are ridiculous, the sales people rush you through the contact so you do not have time to fully read and understand. A naive schoolboy error on my part which I have learned from but my advise steer well clear.

Linda Liasi

In 17 years of trading never have I been ripped off and blatantly lied to by a Area Manager coming into my shop selling me a merchant service. I was quite happy with World Pay Merchant services but a sales rep from Payment Sense came into my store and told me I could save over £700 if I switched to them. She said she would go away and come back with the figure I would be saving and bring in the Area Manager with her. She came back with a piece of paper showing I could save over £760.52 a year with them. I asked the Area Manager several times that there were no more additional payments and it would be just the hire of the terminal and then the card rate charges. I was assured there were no other charges and that they would even deal with the switch of my two merchant accounts from World Pay. They then said they do the contract electronically and it all appeared on my computer at the shop while they were there and I was pointed where to click for my signature and stupidly did not read the contracts. The long and short of it I was charged a £50 cancellation protection charge and 2 x switcher pack charges of £10 each. I am also charged an extra £25.70 a month in ongoing charges for the merchant accounts which I was NOT told about from the Area Manager when I asked about any other charges. Then also View My Local Charge of 2 x £24.95 a quarter for the last 2 years of the contract. This amounts to £308.40 a year extra payment. Years 2 and 3 there will be an extra £199.60 a year charges on top of the £25.70 a month. As soon as my contract ends I will be terminating it as I have never dealt with such an unethical Company in all my 17 years of trading. Customer service do not want to know. I am just warning others who may get taken in by the sales patter of their Reps.

John

Make sure you check your T&C’s. Make sure that you dont get stung by the termination agreement. Send it by signed recorded delivery via post. And back this up via email.

Myles Gallivan

You are right I worked as an agent with these people they have no ethics and its all about ad ons ..

Please inform us how to get out of your contract without costs to you!

Pouria S

When you sign up with payment sense you are basically signing up with three companies

1-Paymemtsense ( The Middle Man)

2-First Data Merchant Services ( Who is the bank )

3- First Data Global Leasing

We originally signed up with this company as they promised us to deposit the funds every 2 to 3 days, we are now expanding and as we checked the timing, we realised that we are receiving the funds every 3 to 5 days, this is badly effecting our cash flow, imagine all the payments you have taken from your clients on Monday will be deposited in your account the following Monday, we are already paying them for their services so why would they keep the cash for 5 days.

I have been contacting them since December and only today they have set a call back by one of their mangers, I’ve called them maybe 8 times and they promised that someone will call me back, and no one ever did

Today they called me up and I spoke to Iyiola who was again very unhelpful and didn’t do anything to solve my problem.

Please stay away from them!!!!!

Just go directly to First Data, that will save you time and money!!!!

John

Hi Pouria

Agree with everything that you say except for the final line.

“Just go directly to First Data, that will save you time and money!!!!”

Better to deal with a smaller company using a proper bank. You get a more personal service and its easier to get in touch with someone when something goes wrong.

I do feel your pain however

Tara Kingsley

My experience with Paymentsense has been terrible and has sadly resulted in us closing our business down. While I requested as short a contract as possible (18months I believe is the shortest contract allowed) I was locked into a 5 year contract in the small print of the contract that I foolishly signed as I stupidly trusted the very nice sales woman who set it up for me. Trying to understand the extra charges that weren’t explained to me up front was mission impossible and when I did finally make the decision to close the company down I still keep paying for equipement that never worked properly and ultimately resulted in the demise of my business.

My recommendation is to steer well clear of this company. Go for one of the credit card payment options that doesn’t tie you in through and hide the true cost of the service in small print and bolt ons

Michael Che

I don’t understand why everyone is bashing this company my experience has been excellent and these comments are not fair I guess it depends who you deal with but the person I dealt with (Ren) had gone above the call of duty I always recommend them over others even when after card machine packed up I had a new one the next day was amazed so not all bad people

CPO

Hi Michael,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

John

Exactly….they are rip off merchants all in it for the money and have staff putting fake reviews on all the time SCAM all scumbags they would take your last penny !!!!!

hyeyoung jang

I have joined Payment Sense in May. When I applied for it, I have sent every documents needed to complete the contract which was confirmed by the employee.

However after 7 months of using Payment Sense, I was charged for over £300 due to the reason of ‘Non-compliance’. I was not inform by this at all for the past seven entire month and after having a chat with the customer service, they keep arguing with me that they have informed me about it. As a nature of new business, I was really busy and I added one more account from them recently and went through the process again. But they just kept quite and hidden charges of £42 per accounts were taken from my account. I didn’t even make any transactions for three months and I was paying £90 fee per month, no one at Payment Sense informed about it. Whenever I called Payment Sense, no body informed me about it. Avoid this company, there are lots of better providers. I will opt out as soon as possible.

Satee

Payment sense is the cheating card payment machine providers.pls if anyone want card payment machine pls don’t join with them.

I join on October 26.since that they took £76,£95.67,£100 on 31October on November they took £79.97 and £100.when i phone and ask them saying its charge I agreed and signed.but I didn’t sign it for anything apart from £18.99+£5.00 p/m line.and 10% for normal card and 15% credit card charge.i only use card on October not even £70. November £580.00

This company cheat.when u ask to talk to the manager they don’t give.they say we can’t talk.i want to leave so I ask how much I need to pay to leave.u will get hard attack when u say this.they said £788.79. I ask how come they said 16 month remaining and another charge.she didn’t explain.

Her name was samira.

Corneliu Coltoan

If I was reading this before I was joining they’re team I was good now. He makes me sign over the phone and didn’t give me the chance to red any terms and condititions. The Rep he’s not taking any calls from me and they asked for over €700 to cancel the contract within 14 days. One word for them , sue me!!!

Tara Kingsley

I experienced a similar selling tactic. My advise to anybody reading this is steer well clear unless you have a great lawyer and good blood pressure

Another one ripped off !

They have attempted to stitch me up ! I was offered no charges for a year on a terminal and as soon as I received the terminal they took nearly £300 on direct debit for add-ons/bolt ons without authorisation. Absolute nonsense. Luckily I retrieved the money and cancelled the DD. Now its up to them to collect the machine. Won`t be getting another penny out of me. Liars !!!!! At first they sound efficient and convincing but are actually a total scam.

Ashley McPhee

I signed up with payment sense for what I thought was an 18 month period this was due to just starting up in business and I had signed a lease on premises for 2 years. I thought that by the 18 months I would know if I wanted to continue in business or not. I have since closed my shop and when I called business sense they told me there would be a charge of £190 pluse 4 months rental as I was tied into a 5 year term. I explained that it had been discussed I only wanted an 18 month term and was told this wasn’t a problem. The call handler told me to check my conditions and he was right the had signed me up for 60 months. Now why would anyone ask for a 5 year term if they only had the premises for 2 years. Needless to say I have been totally deceived by payment sense and just hope that anyone looking for a payment terminal does their research first because I never. Also agree with others so many hidden charges so what you think is a good deal turns out to be anything but.

Bobby

I signed up with Payment Sense in Aug 15. I closed my business since Apr 16. Since then Payment Sense keep taking £42 from my bank account every month on standard charges. Last month they collected £79, £87 and £42 for additional costs which was not on the contract!

So you are all right that Payment Sense has lots of hidden charges. Do they allow to do that?

PLEASE AVOID SIGNING CONTRACT WITH PAYMENT SENSE YOU WILL GET STUCK LIKE ME!!!

Scott

I only wish I had read these reviews before signing up with PS after a year of being with them they say I owe them £200 for “bolt ons” like most people I was never told about these charges!! Any advice on how to get out of my contract with these jokers?

James Allen

Costs on top of costs on top of costs, it never ends with this company. Have now cancelled and will never go back. Avoid!

Martin Caswell

Avoid this company, they have lots of hidden charges. The sales pitch is very good giving you good rates but they don’t tell you about lots of other charges such as compliance fees, terminal replacement insurance etc. I have only been with them a few months and they have put the rates up and been told in writing the fees are guranteed never to increase. I have tried contacting them only to be told I will be called back within 3-5 working days. I feel completely misled by them and would not recommend

Marie

Please do your business a favour and stay away from this company. I am with them since May and stopped using them a month ago (still in contract) – over €1k taken from my account between May-August. From the moment I signed the contract there was nothing but problems, from setting up accounts to getting invoices sorted.

My rep (JC) also promised they would cover the change over from Elavon which didn’t happen so also paying them for a service I can’t use. JC was very persuasive and I really believed I would save money with them – it’s been a complete shambles. Please read these reviews and take them seriously.

My invoices are in a different language so I can’t read them properly – again jC promised to sort out and hasn’t

it’s impossible to identity payments coming into the bank and matching with customers. There’s a €50 fee for telephone support which I haven’t used. If you are self employed you will be left feeling frustrated and this will have a huge impact on your business. They are not ready to support the Irish market – JC is effectively a broker and once you’re signed up his job is done. Stay well away from paymentsense Ireland.

Jerry Esmonde

Thanks Marie,

Sent off my details and am expecting a call back tomorrow sometime for a terminal for my business but I defiantly will not be signing up now. Yours is the first Irish review I’ve come across so thanks again!

Ren Pogi

avoid this company at all cost. sales rep told me that it will only cost me £23 a month — I’m getting charged more than twice that. too much hidden charges. you even pay £1.89 per month for the 24-Hour Terminal Replacement which you don’t agree or even need. they should replace your machine when it breaks down. I only have them for 2 months and my machine broke 28th of october, guess what I’m doing now. I spend countless time I call them through their 0871 number that charges you a fortune (around £15 I pay every call) — but still I have a problem with my machine and I can only use a very posh paperweight because their machine expire payment is next to useless.

Tolga OZsuer

They chase you until you sign with them .Their staff seems helpful until you agree the contract then never pick up their phone even if they they misinform you about setting up accounts.If you want to protect your business IGNORE THEM.

Joanna

Horrible company…. sales people try to do a deal as quickly as they can … telling lies …. charge double what that said

Emma koch

When speaking to the sales team the offer seemed great £18 a month with low charges on payments. Unfortunately the contract was completely misrepresented, there were many hidden charges that I was not told about and aware of as there was pressure to sign the online contract whilst on the phone to the salesman.

Since then I have been charged for a Moto account i didn’t originally want. I have told payment sense to remove it at least two months ago and many more times since then but still I’m being charged.

The time I’ve spent sorting out problem after problem is unacceptable. Payment sense have said charges are all stated in the contract, but do not take responsibility for what the sales team promise as a “good deal” and the pressure involved in signing the contract.

A contract goes two ways taking money from me when you have agreed not to is illegal!! You have therefore broken the contract, I hope you think about this before replying the charges are in line with your contract agreement.

Would never go with this company again.

Mrs Guest