PayNetSecure Reviews & Complaints

Company Overview

Based in Las Vegas, Nevada, PayNetSecure is a merchant account provider that specializes in serving domestic and offshore high-risk e-commerce business types. The company shared an address at one point with another company called NationalACH, and it appears that both PayNetSecure and NationalACH may be related to a third company called Best Solutions Source. PayNetSecure does not list a backend processor or acquiring bank on its website, but the fact that the company specializes in high-risk and offshore merchants means that it is probably partnered with multiple banks.

PayNetSecure Payment Processing

PayNetSecure processes most major debit and credit cards and focuses on high-risk and high-volume businesses. According to the company's website, it specializes in serving merchants in the adult entertainment, foreign exchange, CBD, and diet/weight loss industries, as well as Bitcoin merchants. The company's services include mobile solutions, e-commerce solutions, virtual terminals, access to payment gateways, MOTO, processing for 160 currencies, fraud protection, PCI compliance, recurring payments, ACH processing, QuickBooks integration, and chargeback management. It should be noted that they do not mention in-person options such as POS systems or terminals on their site.

High-Risk Merchant Account Services

PayNetSecure offers specialized payment processing solutions for high-risk merchants. This service aims to facilitate payment processing for businesses that fall under the high-risk category due to their industry type, high chargeback rates, or other related factors.

Domestic and International Processing

The company extends its services both domestically and internationally, leveraging an extensive network of banking relationships to ensure account approval for its clients. This wide banking network is instrumental in facilitating payment processing solutions for merchants irrespective of their geographical location.

Secure Payment Gateway

PayNetSecure provides a Level 1 PCI-DSS compliant payment gateway to ensure the secure handling of transactions. This security measure is crucial for protecting sensitive payment information during transactions.

High Volume Processing

For businesses with high transaction volumes, PayNetSecure offers processing solutions that can handle a large number of transactions efficiently.

ACH and Echecks Processing

The company provides ACH (Automated Clearing House) and eChecks processing services, which can potentially increase sales by up to 20%. This service facilitates electronic money transfer between banks, providing an alternative payment method to traditional credit and debit card transactions.

Global eCommerce Solutions

PayNetSecure offers global eCommerce solutions to expand a merchant's customer base worldwide. This service is particularly beneficial for businesses looking to tap into international markets and accept payments in multiple currencies.

Ecommerce Integration

The service includes eCommerce integration, enabling merchants to sell online quickly and easily with full-stack APIs that speed up the time to market. This feature is helpful for modern businesses aiming to establish or expand their online presence.

Virtual Terminals

Virtual terminals provided by PayNetSecure allow for the secure acceptance of Mail Order/Telephone Order (MOTO) transactions.

Fraud and Chargeback Protection

PayNetSecure has robust fraud-fighting tools and chargeback management systems in place to protect merchants. These automated systems help in accepting good orders while declining potentially fraudulent ones.

Cloud Reporting

Merchants have access to cloud reporting features that provide all necessary information with the click of a button. This service allows for the management of multiple merchant accounts from a central dashboard, including the monitoring and management of transaction data.

Multi-currency Processing

The multi-currency processing feature allows merchants to accept payments in 154 different currencies. This service facilitates international transactions, offering a way to get more sales from international shoppers.

Location & Ownership

Konrad Toch is the president and CEO of PayNetSecure. The company is headquartered at 3773 Howard Hughes Parkway, Las Vegas, Nevada 89169.

PayNetSecure Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Clean Complaint Record

At present, we cannot find any negative PayNetSecure reviews, suggesting that the company maintains a favorable reputation and is not associated with any scam or ripoff activities. This is particularly noteworthy considering that high-risk credit card processors often receive more complaints due to the volatile nature of their merchant pool. PayNetSecure’s clean record in this regard is commendable within its industry. While some complaints may inadvertently target PayNetSecure’s partner banks, there is no substantiated evidence to support such occurrences. If you have your own PayNetSecure review to contribute, we encourage you to share it in the comments below.

PayNetSecure Lawsuits

As of now, we have not encountered any class-action lawsuits or FTC complaints against PayNetSecure. Customers dissatisfied with the company’s services and seeking alternative recourse are advised to consider reporting their concerns to relevant supervisory organizations.

PayNetSecure Customer Support Options

PayNetSecure provides 24/7 phone support for its merchants and offers a contact form on its website. However, these support channels alone do not elevate the company to the status of a top-rated provider for customer service.

PayNetSecure Customer Service Number

- (888) 572-9638 – Toll-Free Support

Other Support Options

- Customer service via email at [email protected]

PayNetSecure Online Ratings

Here's How They Rate Online

No Dedicated Profile

The Better Business Bureau does not maintain a profile for PayNetSecure at this time. NationalACH, which previously shared an address with PayNetSecure, has an “A+” through the BBB with 0 total complaints. This profile does not appear to cover PayNetSecure, so we will not factor a BBB rating into this review for the time being.

PayNetSecure Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Unclear |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Unclear |

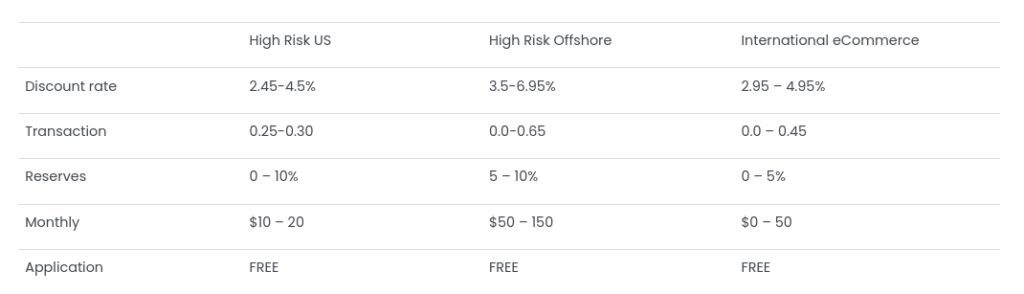

The information provided about PayNetSecure’s pricing and fees is largely accurate, but some specifics and additional details can be added for a more comprehensive understanding. PayNetSecure is known for specializing in high-risk merchant accounts and offers a range of services, including credit card processing, ACH processing, and high-risk payment processing. Their services cater to a variety of industries, including adult entertainment, CBD, and telemedicine, among others.

For high-risk U.S. business types, PayNetSecure’s per-transaction fee ranges between 2.45% plus $0.25 and 4.5% plus $0.30, with a monthly fee between $10 and $20. High-risk offshore clients are quoted per-transaction fees between 3.5% and 6.95% plus $0.65, and a monthly fee ranging from $50 to $150. For international e-commerce clients, they quote a per-transaction fee between 2.95% and 4.95% plus $0.45, with a monthly fee up to $50.

The company doesn’t publicly disclose all fees, such as the early termination fee or PCI compliance fee, implying that these may vary depending on the specific agreement with each client. Furthermore, PayNetSecure requires high-risk accounts to maintain a rolling reserve, typically ranging from 5% to 10%, as a safeguard against potential chargebacks.

In terms of customer satisfaction and legitimacy, there aren’t many customer reviews available online, and PayNetSecure is not listed on the Better Business Bureau. However, the lack of negative reviews or scam-related accusations online suggests a generally positive reception.

Overall, PayNetSecure appears to be a legitimate option for high-risk merchant accounts, offering competitive rates and a variety of services suitable for businesses in need of specialized payment processing solutions.

PayNetSecure Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Possible |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Independent Resellers

PayNetSecure appears to utilize a combination of independent sales offices and referral partnerships to market its services. The use of independent resellers is usually linked to high complaint totals because these types of sales offices tend to receive less training and oversight than in-house sales teams. In this case, however, we have not found any PayNetSecure reviews that mention deceptive tactics by the company’s sales team.

A Rate Chart Guideline

The PayNetSecure website includes a “Rates” page that provides general price ranges to help clients assess their potential costs through the company. The page lists ranges of rates and fees rather than the lowest possible “teaser” quotes. It therefore appears that PayNetSecure’s rate quotes are genuinely intended to help business owners anticipate their potential costs rather than to mislead them. However, readers should not assume that the costs shown in this table are all-inclusive. If you suspect that PayNetSecure is charging you undisclosed fees, we recommend seeking a third-party statement audit to find and eliminate hidden charges.

Our PayNetSecure Review Summary

Our Final Thoughts

PayNetSecure rates as a reliable credit card processing provider according to our rating criteria. The company is not showing any public complaints at this time, and the contract terms that it discloses are competitive for high-risk merchant types. Our rating may be subject to change once the company receives more public feedback or establishes a profile with the BBB.

If you found this article helpful, please share it!

Testimonials & Complaints

How Did PayNetSecure Treat You?