PNC Merchant Services Reviews & Complaints

Overview

In this article, we delve into the multifaceted world of PNC Merchant Services, exploring the intricacies of their offerings, contracts, customer feedback, and more. We begin by examining their range of payment processing solutions, including point-of-sale products from Clover, which caters to various merchant needs such as mobile payments, online payment gateways, and fraud prevention. This article then shifts focus to dissect the company's rates and fees, contract terms, and the pros and cons associated with their services.

We provide an in-depth analysis of common complaints and lawsuits faced by PNC Merchant Services, offering a critical look at customer experiences and legal challenges. This includes a discussion on industry ratings and employee reviews, highlighting how the company stands in the eyes of both clients and its workforce.

Marketing tactics used by the company are also scrutinized, along with a detailed look at user reviews which shed light on the real-world implications of engaging with PNC Merchant Services. Lastly, our article covers recent developments, including lawsuits and settlements, providing a comprehensive understanding of the current state of the company and its services. This all-encompassing review aims to equip readers with the necessary information to navigate the complexities of merchant services and make informed decisions.

About PNC Merchant Services

PNC Merchant Services is the merchant services division of PNC Bank, headquartered in Pittsburgh, Pennsylvania. The company works with First Data (now Fiserv) to provide merchant accounts and Clover point-of-sale products. It is therefore not a direct processor.

PNC Merchant Services Point of Sale

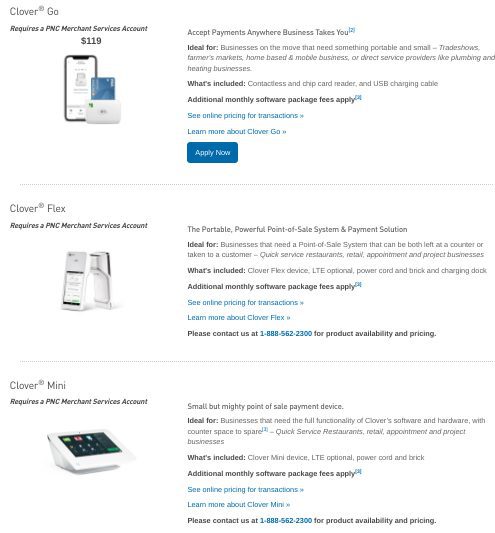

PNC Merchant Services offers debit and credit card processing through point-of-sale products from Clover. These include the Clover Go mobile solution, the Clover Flex portable solution, the Clover Mini tablet, and the Clover Station terminal. The company also offers access to a payment gateway and virtual terminals.

Payment Processing

PNC Merchant Services offers a comprehensive range of payment processing solutions, allowing businesses to accept various forms of electronic payments such as credit cards, debit cards, and mobile wallets. This flexibility helps merchants accommodate their customers' preferred payment methods.

Mobile Payments

Recognizing the growing demand for mobile payment options, PNC Merchant Services enables businesses to accept payments through smartphones and tablets. This feature allows merchants to process transactions on the go and provide their customers with a convenient payment experience.

Online Payment Gateways

PNC Merchant Services offers secure and reliable online payment gateways for e-commerce businesses. These gateways ensure smooth and secure transactions, giving customers confidence in the online shopping experience and helping merchants maintain their reputation.

Fraud Prevention

Security is a top priority for PNC Merchant Services, and they provide a variety of fraud prevention tools to protect businesses against fraudulent transactions. These tools include address verification, secure encryption, and advanced fraud detection systems to safeguard sensitive customer information.

Location & Leadership

PNC Bank is headquartered at 249 Fifth Avenue, One PNC Plaza, Pittsburgh, Pennsylvania 15222. William S. Demchak is CEO and President of PNC, Alexander Overstrom is the Head of Retail Banking, and Deanna Thomas is Account Executive at PNC Merchant Services.

| Pros: | Cons: |

|---|---|

| Gift card program. | Tiered pricing structure. |

| Multiple hardware options. | Third-party software dependency. |

| Check acceptance solutions. | Contract length: 3+ years. |

| Mobile payment processing. | Early termination fees. |

| eCommerce payment gateway. | Limited pricing transparency. |

| Accepts multiple payment types. | Initial contract term requirements. |

| Cash flow analysis tools. | Additional service fees. |

| Data security protocols. | Chargeback costs. |

| 24/7 customer care. | Potential customer service issues. |

| Custom processing solutions. | Possibly outdated technology. |

PNC Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 30+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Undisclosed Fees |

| Recent Lawsuits | Yes |

Analysis of PNC Merchant Services Feedback

Research indicates over 30 negative reviews for PNC Merchant Services across various platforms, with allegations ranging from scam accusations to deceptive practices. Recurring issues highlighted in these complaints include high early termination fees ($3,000-$5,000), undisclosed contract terms, fund holds, and challenges in accessing customer support. Despite being a low volume relative to the company’s size and tenure in the industry, the pattern of grievances about misrepresentation and excessive costs significantly impacts PNC Merchant Services’ rating, warranting a “B” at this time. We invite customers to share their PNC Merchant Services experiences in the comments below.

Legal Proceedings and Settlements Involving PNC Merchant Services

In 2018, PNC Merchant Services faced a class-action lawsuit alleging overbilling and misrepresentation of annual fees, a matter still pending resolution. Another significant lawsuit in 2017 accused the company of excessive fees and deceptive sales practices, which was settled in November 2021 for $14.5 million. Additionally, in May 2022, PNC Merchant Services was sued for failing to ensure website accessibility for the blind and visually impaired, an issue that remains unresolved.

Support Options Provided by PNC Merchant Services

PNC Merchant Services promotes 24/7 customer support through dedicated phone and email channels. However, it’s not explicitly stated whether these services are managed directly by PNC or through First Data (Fiserv), leaving some ambiguity regarding the quality of support offered.

Contact Information for PNC Merchant Services

- (888) 562-2300 – Toll-Free General Customer Service

Additional Support Resources

- Online customer support form

Although PNC Merchant Services emphasizes its customer support, comparisons with industry-leading service providers suggest there is room for improvement.

This review, enhanced with SEO strategies focusing on terms such as “reviews,” “review,” “complaints,” “customer reviews,” “customer complaints,” aims to provide a comprehensive overview while boosting online visibility.

PNC Merchant Services Online Ratings

Here's How They Rate Online

| BBB Rating | 1.1 |

|---|---|

| Trustpilot Rating | 1.3 |

| Consumer Affairs Rating | 1.8 |

| Our Rating | 3 |

| Average Rating | 1.8 |

BBB Rating Analysis

PNC Merchant Services (as PNC Financial Services Group) has an average customer review rating of 1.1 stars and a grade of “A+” on the BBB based on 3,193 customer reviews. Most reviews are about PNC’s banking, so common themes are hard to apply to its merchant services branch.

Negative Feedback

I was sent a notice in august 2023 notifying me of an escrow shortage of over $1800. They adjusted my payment by raising it $156 a month to cover the shortage. I began paying the higher payment amount for the month of September and its continued on to present day (12/2023). In august when I found out about the shortage, I began paying extra payments to escrow to catch up on the shortage so my monthly payment could go back to what it was prior to the shortage. Along with the extra $156 in each payment , I paid separate payments into escrow of $700, $500, $200 and $160. So with my extra payments I made along with the adjusted payment with the $156, once my November payment was paid I had paid $2025 back into escrow. I spoke other Pnc reps 4 times concerning this issue. The last two times I was lucky enough to get someone who took the time with me to look at everything. Their math matched mine and we agreed that I had overpaid my escrow shortage. After the third time she told me to let my payment totally process then call back and request a payment adjustment due to the shortage being paid. I called back and they claimed I was still about $468 short. I made my November payment and called again this time they agreed again that I had overpaid and submitted a complaint to the escrow dept. a week later I receive a letter saying I’m still short. The letter did not acknowledge the $156 extra that I was paying included in my payment and had no other explanation. I just made my December payment and am still in the same position. Paying a higher payment even though my shortage is OVER PAID. This company is literally stealing my money and refusing to correct their mistake. By far the worst mortgage company I’ve ever dealt with. I’ve gone through everything the best way I know how and with more patience than most. I’m fighting a losing battle and need help with this please. Thank you for your time.

– Complaint from December 10, 2023

My relationship with PNC was when my father became ill and unable to conduct his financial affairs. While being the executor of his estate and having the power of attorney PNC did not make it easy for me. Their attorneys questioned everything in the trust and other documents and I only made progress with help from my father’s local attorney. Additionally I kept getting billed for a safe deposit box that was emptied and the keys returned. After my father passed away we inherited the balance of his account which we transferred between two siblings. Ultimately I closed my account because they cancelled two on line transfers, charged a fee then would not reimburse the fee. Good riddance PNC

– Review from August 17, 2023

Positive Feedback

I have had many bank accounts over the years, because I’m 52 years old. I have been at *************** First National Bank, and about 30 others. The ******** that I will never let go of is PNC Bank. They are the most courteous and professional back I have ever dealt with. If you are looking for a bank that will treat you like a person no matter how much money you have in your account or what your skin color is try PNC Bank. You won’t be disappointed I promise.

– Review from June 9, 2023

Great service in PNC Bank Branch at *******, ** on many occasions.

– Review from June 6, 2023

Source: BBB

Trustpilot Rating Analysis

PNC Bank has an average customer review rating of 1.3 stars on Trustpilot based on 1,029 customer reviews. Again, most reviews focus on the banking side of PNC, often mentioning customer service issues.

Negative Feedback

The customer web portal is reminiscent of something from the early 2000’s era. Want to make automatic payments? Better head to your printer and then to the local post office with that stamped letter. It’s really just a ridiculously bad customer experience all around. None of the normal functionality you’d expect from a modern day banking portal. I’d never use this bank again for an auto loan and would definitely not recommend to anyone else.

– Complaint from January 9, 2024

On Saturday, 7 back-to-back fraudulent transactions were posted in my account. I contacted Customer Service, and they said the transactions looked fraudulent, and I confirmed that they were. I was told they caught things in time and they would not process them. They also suggested that I change debit cards to make sure it didn’t happen again. On Tuesday (after New Year’s Day on Monday), I went to the branch in the morning and changed cards. Later in the day, I looked and saw that the transactions had gone through; they hadn’t been stopped by PNC Customer Support as they had said they would be. They asked if I wanted to file a dispute of the charges, which means the money taken out would not be available until 10 business days, and then just provisionally. The dispute could go on for another 3 months, and the money would just be provisionally mine until it is resolved. That’s unacceptable. PNC failed to decline the transactions when they were posted, as they said they would. Maybe due to their outdated IT systems, probably old IBM mainframe computers with a screen-scraper interface to make it look like a modern GUI interface. I suspect their technology is outdated. The bottom line is, even if you report a charge as fraudulent right away like I did, PNC does not take responsibility for what happens. Your money is not safe in a PNC account! I am in the process of moving my money to Chase where I have another checking account. PNC’s Customer Service has always been lacking, and this is my final exposure to their outmoded way of doing things. Be cautious!

– Review from December 30, 2023

Positive Feedback

Been banking with PNC for over 5 years. It was the easiest bank to open an account with that can all be easily done online. When I moved from NYC to North Carolina, found so many branches here with friendly customer service. I have their banking app and is very happy with all their financial features. The Zelle app is especially useful. Love banking with them!

– Review from September 30, 2023

I’ve held an account with PNC for over 10 years. They follow the guidelines to handle banking properly. Sometimes they are a bit too rigid, but I’d rather that when dealing with my finances. Once you have over $50k in your accounts with them, they give you a personal banker. That really helps you get a lot of tasks accomplished much quicker. They have all the same fees as every other bank, but you won’t see them in the news for running scams on their customers.

– Review from December 21, 2022

Consumer Affairs Rating Analysis

Wholesale Payments has an average customer review rating of 1.8 stars on Consumer Affairs based on 1,534 customer reviews. Common themes continue to focus on the banking side of the company.

Negative Feedback

PNC customer service was terrible! I called about a transition that I made which was pending the hold business day on 12/1 and when I went to check on 12/2 the purchase was not showing and the funds was reflecting in my balance. I called the merchant and they let me know that the purchase went through and the person who I sent the CashApp to confirmed they received the funds! On 12/5 In return the call to Chantise Molina her title AVP Executive Client Relations Sr Specialist, she was not concern about what I was saying and advised me that pending charges can disappear and she sent me the terms and conditions of the terms and conditions of my account. This Sr. Specialist Chantise was abusive to me being a Senior Citizen and an African American, terrible.

– Complaint from December 6, 2023

I am (was) a long time customer of Compass Bank. When they transitioned to BBVA, it was seamless. Now, here we are, a decade later, and along comes PNC Bank. After months of mailings, instructions, timelines. I did all that was asked of me. PNC did not keep their promise. I sit here with expired BBVA debit and credit cards, and a couple books of “bad” checks. Never received new cards as stated, and also were told we could now access our accounts on the PNC App. Another lie.

Without new card numbers or “voice” pins, access is forbidden. My money has been hostage for 5 days. All of it. I have absolutely no access to my funds. Direct Deposit is scheduled tomorrow, and I guess I won’t see that either. I’m persistent when it comes to my business and have been on hold now almost 6 hours on just this call. Their online customer service is Twitter. How juvenile, strange, and unsafe is that for a financial institution to do business? (Also unresponsive to my plea for help.)

Gee whiz, folks. I am a responsible upstanding citizen, but when they take all my money away. Kids are hungry, car needs gas. I am absolutely desperate. Only what should be one keystroke away from thousands of dollars that I’ve saved in my accounts. Is impending hunger, joblessness, and homelessness if not resolved immediately. Please stop being non-responsive. That is scarier than just telling us it will take a few more days. Tell me something, PNC. Situation dire.

– Review from October 14, 2021

Positive Feedback

My late husband and I had a joint checking account, and when he passed away, I had to remove his name from the account. The customer service people were very helpful in doing so. All our electronic bill pay information was linked to his password and username on the account (I had my own username and password but no bill pay information was linked to that). When I asked how to transfer all that bill pay information to my username and password, the customer service person told me that they normally don’t do that but because we had been customers for such a long time, they made an exception for me and transferred everything. That was great because it saved me a lot of time if I would have had to redo all of it manually!!

– Review from August 9, 2020

I’ve been banking with PNC for over fifteen years. They’ve provided excellent service. This past week I had a scary issue happen with my personal banking account that was my own fault causing me to be overdrawn by more than 13,000.00. I contacted the bank and they fixed the issue within forty eight hours without penalty to me. The entire time I was panicking. They were kind and patient and handled the issue with professionalism and care. I’m beyond grateful. I wouldn’t bank anywhere else.

– Review from February 8, 2023

PNC Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Three-Year Contract

Based on a sample merchant agreement and the company’s program guide, PNC Merchant Services typically offers a three-year agreement through First Data (Firserv). This contract includes a Liquidated Damages early termination fee (ETF), which can exceed the standard First Data (Fiserv) fee of $495. Additionally, there’s an application fee of $195, a programming fee of $90, a setup cost up to $345, a statement fee of $5, and a monthly minimum fee ranging from $15 to $20. PNC Merchant Services has recently updated its pricing structure, now disclosed on its website. Swipe transactions incur a rate of 2.60% plus $0.10, while keyed-in transactions are charged a rate of 3.45% plus $0.15. It’s unclear if the company separately charges PCI Compliance fees, but setup, application, and programming fees may be reduced or waived. PNC also offers 48-month, non-cancellable equipment leases through First Data Global Leasing.

Virtual Terminal and Payment Gateway Pricing

As per the revised PNC Merchant Services pricing page, the company relies on the First Data (Fiserv)-backed Payeezy payment gateway for its virtual terminal service. Payeezy offers two plans: the Basic Plan and Pro Plan. Neither plan imposes setup, statement, or gateway fees. The Basic Plan charges a rate of 2.90% plus $0.30, while the Pro Plan offers a reduced rate of 1.89% plus $0.23 with a monthly fee of $19.95.

Industry-Average Pricing

PNC Merchant Services fees and rate structure are generally in line with industry standards, but its early termination fee can reach up to $900, significantly higher than industry averages. This fee is calculated at $25 per remaining month in the contract, potentially making it excessive. Consequently, we’ve rated the company lower compared to the cheapest merchant accounts. We recommend exploring our list of the best merchant accounts for alternative options.

PNC Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Built-In Marketing Channels

PNC appears to utilize traditional advertising and its existing network of clients to market its merchant services. There is no indication at this time that the company employs independent sales agents. We are currently able to locate more than a dozen negative PNC Merchant Services reviews that accuse the company’s sales representatives of deceptive or aggressive sales practices, including nondisclosure or misrepresentation of service length, termination fees, and rates. This does not compare favorably to our list of best credit card processors. If you believe that PNC Merchant Services rates have been misrepresented to you, we recommend seeking a third-party statement audit to find and eliminate hidden fees.

No Deceptive Rates

To its credit, the company does not appear to list any deceptive rate quotes in its official advertising materials. However, at least one merchant has recently complained that PNC did not properly honor its rebate on an equipment purchase. Business owners should therefore be sure to read the fine print of any promotional offers, such as the $500 reward for switching to PNC on the company’s homepage.

Our PNC Merchant Services Review Summary

Our Final Thoughts

PNC Merchant Services rates as an average credit card processing provider according to our rating system. The company’s contract terms through First Data (Fiserv) are costlier than industry averages, and it is showing some complaints with regard to its sales practices. The class-action lawsuits against the company also indicate that its reputation could take a major hit soon. For now, businesses are likely to obtain a better deal and more reliable service through a top-rated merchant account provider.

If you found this article helpful, please share it!

Martha

I opened an account in Richmond, TX and once I opened it the manager said it would be a good idea to listen to the merchant services they offered and compare it to what we were being offered. Once they the guy Matthew said the rates and how what they had offered me was higher I tought well let me give them a try. However, when I got home I realized their rates were actually higher so around 9 am. the next day I called to cancel. I called PNC merchant services and the lady was rude and said I had signed the contract and that was it. I would need to pay the $499 and the extra fees. It had not been 24 hrs so I send the manager an email

“Hi Oscar,

Hope you had a wonderful weekend and great start of the week. I was wondering if you heard back from your boss about the $499 that Merchant Services say I owe.” (December 12, 2023)

his response…..Good afternoon Ms. Fonseca,

I followed up with Matthew today and I am waiting for his response. He needed to contact his manager.

I will send you an update as soon as I get an answer. Thank you,

Oscar Abrego

on Feb 2024 I look in the account and I am negative almost $700

Again I reach out to Oscar because it had already been clear that I had asked to terminate 2 months earlier ..

“Hi Oscar,

It’s almost 2 days and I am wondering if the manager or the associate had reached back. Two months plus now this…I am sure there is a regional manager or higer that can help answer our concerns.

$499 charge, $43.00 and $5.99 a month

You know that we did sign the paperwork but, we asked to cancel that the next day before noon.”

his final answer (2/23) Good morning Ms. Fonseca,

“Thank you for your patience on this matter. After reviewing with Matthew and his manager the result was that there will not be a buy back/ refund in this case since the information about the product and services were disclosed to you and the contract was signed. For additional questions please contact Matthew at Phone: 412.803.1300 then hit 1 or Merchant Services Customer Care – 800.742.5030”

LIES!! They talk to you about the rates and how much per transaction. They DO NOT say that the moment you sign you are responsible for all the money! ALL A FRAUD! DON’T SIGN ANYTHING WITH THEM. They don’t respect the client. I am AWARE THAT WE HAVE A 3 day period and THEY DON’T CARE.

PAUL

Clover

Clover #[redacted]

1-800-742-5030 Merchant Service

[email protected], [email protected]

Went to PNC bank Lakewood to open my Non Profits bank account in December. Spoke to Ms. Andriana Davis. While I was there, we were casually talking and I told her that I was looking for a software/web presence to take donations. She had heard that PNC bank had a program/or were partners with Clover, a software that might work. So on we got on the phone with Sahil Patel, the representative for the software. He opened it up, showed us some of what it could do. I expressly told him that we were a non-profit and needed a strong interaction page for our donators. And it had to be easy to use. He swore that it was and that it would do everything that we needed it to do. Ms Davis of PNC bank was there the whole time and can confirm this.

I took it home late that afternoon, looked at it over the next few hours and knew right away, that it wasnt at all what we needed. So I went back to the same PNC bank branch that next day, and canceled it (or so I thought) with the gentleman that was in charge as Ms. Davis was out that day. At that point, I didnt think any more about it as I had done what needed to be done and it was all done in less than 24 hours and certainly within the 3 day period.

A few days ago, I went to my bank account. I had opened it with $200 and only had a couple of small items taken out so I knew what it should have been. To my dismay, there was a $105.95 ding from Clover. I immediately got on the phone with them asking why they had charged me. The lady there said that she had no notes that it had been canceled and generally laughed when I told her I wanted my money back. At that point I let her know that it needed to happen, she indicated the same thing again to me.

I got off the phone and called Ms. Davis at PNC. She agreed with what she remembered about our conversation with Mr Patel and we got on the phone with Clover again. Nothing had changed. They steadfastly refused to reimburse me for anything despite my quick cancelation. This was on either Jan 19 or the 22nd. She did say that she would contact Mr. Patel about this and have him contact me.

He contacted me with this email 1-23;

—

Hello Paul, this is Sahil Patel we had spoken back on December 18th about merchant services while you were at the branch. I have been told that you wanted to or have canceled the account and are requesting a refund because the software was not suiting your needs. If we could speak on what needs were not being met that would be much appreciated. I did try and call you at the phone number on file ending in 0455 but it was not answered. Please let me know a time and number I can call you to discuss or reply on here, thank you very much.

Sahil Patel

—

I checked my phone logs and there was no call from any number that I didnt know.

—

I replied to him 1-23:

Mr. Sahil, I tried calling you at 11:15am on 1-23-24. Tried to go to voicemail but it never completed the process. My phone does not show any record of any other calls coming in that I don’t know about.

Yes, I want to cancel. When we spoke while I was in the office of Ms. Davis at PNC Bank, I was very clear what I needed, a software that was geared for non-profits. I’ve used them before and Clover had very little that could be adapted to use. I went back to the bank within 24 hours to cancel, I thought it was done, the software did none of what I clearly explained I needed it to do. I canceled with the officer in the bank that day as Ms. Davis was out. Thought that was all I needed to do . However PNC dinged my account for $105.95. Please refund that amount right away. The software does not work for me or my non-profit.

Paul Heckmann

—

he replied 1-23:

Hello Mr. Heckman I understand that the portal is not designed specifically for non for profit but what was the capability you were looking for in the software? From what I recall we showed you the demo of the capability of the portal and what it does and you were satisfied with the features and agreed to doing an application. What specifically does the Clover portal not do for you that you were looking for?

Sahil Patel

—

I replied:

I have used two other software’s for Non-Profits. They offered easy to use public pages for folks to sign up on, variable dollar designations plus many other features. Yours did not. The PNC bank officer was sitting right there with me and agreed with me when talking to the folks a couple of days ago.

Please refund my money immediately. If you are not going to, please advise so that I can start the next step of this process right away. It involves the State of Texas and banking organizations.

Paul Heckmann

—

There was no response from Mr Patel. This was my email. 1-31-24

—

Paul Heckmann

2:26 PM (0 minutes ago)

to Sahil, adriana.davis

Sahil,

I still have not received my funds back in my account. I just filed a complaint with PNC bank including our conversations. I am about to file with the State Attorney Office, BBB and whatever banking organizations I can find. This would not have happened if you had simply done business correctly and returned the funds to my account. Because of your non-participation and complete neglect in this matter, I will continue to ensure that as many folks as I can find, know exactly how PNC Clover does business and the person responsible.

—

No response to any of the emails to Mr Patel, and as of 2-6-24, this has not been refunded in our account. I have to assume he is ignoring me in hopes that I forget all about him and this tragedy of a company, Clover. Now I will make it my hobby to report this elder abuse to every company that will listen.

Brennen Glass

PNC Merchant Services is a joke. When we set up our banking with PNC, we purchased a Clover POS system through them simultaneously, thus leveraging PNC Merchant Services. 2.5 years later, with millions in sales and zero chargebacks, they are terminating our account. The business bank account was terminated in February 2023 with no explanation, and now the merchant account with no explanation. The kicker is that because our Clover devices were set up with PNC, we can no longer use the Clover machines we own. We have to buy the EXACT same machines/models through our new processor. I highly recommend staying away from anyone who does business this way. No review, no phone call, one letter terminating account.

Amberlynne Ritchie

Does PNC not give back surcharges because it’s kind of funny how a lot of my friends have PNC as well and they get their surcharge feedback but I don’t

I used to then suddenly it stopped

Mouna Sylvie

PNC Merchant service is horrible. They sold the clover flex well knowing I have a new business. They rather sold things to me rather than helping me out. They gave me the wrong product and now I’m stuck with it and I have to pay $500 for an item I won’t never use. No one at PNC is actually trying to help. DO NOT OPEN YOUR ACCOUNT WITH PNC, IF YOU DID THEN CLOSE THAT ACCOUNT IMMEDIATELY .

Find other bank. Go to Chase they are professional and know how to help people.

X J

This merchant credit card machine service is costly for small business owners! I kept getting second notice of collections with an additional 100 dollars collection fee after PNC Bank decided to close out my account (yes they can do that with no reason). Interesting thing is I never received the monthly statement in letter before the collection letter, when I talked to the collection agent he told me they emailed to me instead which I also did not recieve. I was able to fight to waive the 100 dollars penalty fee the first time but for the second time it happened again the collection agent refused to waive it anymore. I was given no choice but to pay for the excessive amount due to the service that I no longer provided. and I was not the one to close the account to begin with. I find this whole thing ridiculous and I feel like it is a trap to charge you in every way possible. I highly recommand small business owners do some research on those credit card merchants and go through the contract carefully.

Susan Geller

impossible to speak to a person….ridiculous security questions when they verify your phone number…will change as soo as possible …worst service

This post will help: Best Payment Processors for Great Customer Service

-Phillip

Joe Iadonisi

For the most part, I’m satisfied with the service. My only complaint is that I was promised a $300 rebate for the equipment, but only received $100. I continually reached out to my sales rep who promised I would receive the other $200 credit, but I never did. The last email from him said the rebate was approved and I would receive it a few weeks. That was about 4 months ago and I’ve had the equipment for over a year now. I would like a resolution as soon as possible.

From The Editor

This Post Might Help: Best EMV Terminals

Darren Watzman

What was the rebate for? What type of equipment? Did you ever receive it?

Steven M

WORST customer service EVER! They closed my merchant services account with out any justification or reason. Then they held thousands of my customers dollars for 180 days. After the 180 days they are refusing to release my funds. I’ve spoken to over a dozen reps in merchant services and risk/securities and every time they tell me the funds will be released within 2 business days. I still have not received my funds. Do NOT do merchant services with PNC, its a nightmare.

Priscilla Pope

I agree, I was happy with using pnc for small business merchant service. Things happened and I had to close my business after the first year. They held me accountable to paying $25 a month until the conclusion of 3 year contract had ened. I was paying for nothing, right. PNC cares nothing about you as a customer. All they kept saying was we had a 3 year contract, most places would have torn the contract up. That tells me they only care about the money not the customer. Never again will I use or reccommend PNC bank to anyone.

Mary Havens

I have been trying to cancel my account for 3 months. I was first told I was in a 3 year contract and would have early term fees (I was only in a year contract and well over it). I was then told I had to send a letter to cancel. I was given an email address to send the letter to. I have followed their directions several times but 3 months later fees are still being deducted. I attempted two more times today to send a cancellation letter just to have the email returned as “unsendable:invalid host”. I’m beyond angry.

Elizabeth Handy

Never, never use PNC merchant services. It did not work and I swiftly cancelled it. The Clover Device was defective and the customer service people did not know how to load the app on my phone after many hours. Also, their customer service people are rude and provide anything but customer service. Clover is still refusing to reimburse me for the Clover device and I’m fighting it.

I now use AffiniPay and they are terrific.

Jodi westfall

As a small business owner I was initially pleased to try PNC merchant services believing it would pay off and be better service. Service and product have proven to be extremely expensive and ineffective. Paying for a portable card reader that was consistently not working or difficult and the ongoing monthly service fee for a service that proved ineffective was unacceptable. Contract being non-negotiable was a frustration finding the PNC service not meeting their end of the deal.

Robert

I was with PNC Merchant Services for approximately 2 years. I was charged a $200 initialization fee. I processed approximately 100-200 credit card payments in that time and was charged an average of 13% of the total gross payment, which is about 10% higher than I was told. After I submitted my letter of termination they charged my account $50 dollars in fees for absolutely nothing. Then charged me $400 for an early termination on a contract I am still waiting to get a copy of. AVOID THIS SCAM. THEY DON’T CARE ABOUT YOU AT ALL. RIP OFF.

Kinga

I had a very similar situation.

The promised percentages were growing higher and higher every month to the point that it was ridiculous.

The PNC Merchant is the most misleading and dishonest company in US Amd the PNC Bank itself is awful as well.

I would love for enough abused customers to finally start a Class Action Suit so we can get all our stolen monies back.

Istvan Kiss

This service is not safe. DO NOT USE IT!!! The credit card company going to take your money back if it was fraud no matter what. Since you have signed the contract. I had fraud credit card charge after to weeks without any warning they get to my checking account and took the money.Since i have no idea it was fraud i have spend some of the money, but they took back everything. When i have contact them the only response i got is SORRY. Read the other review for more problems.

Ron Grecco

Do not even think about signing up with PNC Merchant Services. High fees, bad service and they will lock you in to a 3 year contract that you can’t cancel. I quit using them 2 years ago and I’m still paying $40/month for nothing. Stay away from PNC, there are so many better options.

Keith Field

We have NEVER actually begun using Merchant Services. But our aggressive sales rep pushed us into getting the whole thing set up (and signing a contract) so we’d be ready when our business was at the point we were going to start accepting credit card payments. We were under the impression the contract wasn’t in force until we actually activated the merchant services =- but they have been charging us close to $50 a month with all the fees. When we tried to stop it we were treated coldly by their people on the phone and the issue was never resolved. Now, we found someone finally who wants to help but he’s advised us to keep paying $15 a month or face more hefty fees. They’ve been basically stealing our money for a service we have never even used. . Very disappointing.

J Marshall

Signed up under the guise of no monthly minimums or monthly fees. A few months into the account we started getting charged a $19.95 monthly “security” fee. Called up several times to cancel it. It took 5 months. More recently, without fair warning, they instituted a $19.50 monthly minimum. I took me 3 months to figure out what was wrong and when I asked for a refund they refused, claiming that their contract states that they can institute new fees any time they want. Never sign a PNC Merchant Services Contract!

Kelley

People on the phone with customer service can be very nice and want to help (though I’ve also received unfriendly reps), but they can’t really do anything about the surprise hidden fees. Basically, it feels like “Surprise! We’re going to take money out of your checking account for random fees that may or may not help anyone actually using the service. And we’re going to do it without telling you until after the fact.”

Mindy Morrow

All business owner beware get away from PNC & First Data company! They’re lier and fee you to death! Absolutely the worst company I have ever deal with, Fee Fee & Fee even after I canceled from May 30 to now July 6th I still got fee for $104.

B

I am completely dissatisfied with PNC Merchant Services as well. My small business purchased 5 fd400 handheld terminals 2 yearS ago for $1,000 each. Now, come to find out, the technology has changed and they are not CHIP compatible. (What really bothers me about this; however, is that they have a card reader slot, so I feel that the company was aware of the technological change and is not owning up to that now). When I called to inquire about this, the rep apologized and told me they could send me replacement machines that are compatible. So, 2 days later, I received “replacement” machines that are the EXACT same machines that I already had and they are still NOT compatible. I called them yet again and a rep told me they could make it right and resend the right machines. Then they forwarded me to a sales rep that said they cannot send me new compatible machines. So, which is it? REALLY? I told them that what is the incentive for me to buy 5 new machines AGAIN when they knew the technology was going to change and didn’t care? It will probably change again. They blamed Visa and MC. Classy move there PNC Merchant Services.

kim nguyen

I feel & have learn that the way PNC Bank but MOST of all PNC merchant dept. want you as a new account out don’t care about keeping their customers. I have NEVER been so unhappy, disappointed & disgusted with a bank unti now with PNC Bank & merchant dept.

Seth DeBra

Not a good company to work with excessive fees and poor customer service.

Raised my rates excessively, then gave 30 days notice to change.

Charged me $125 after I canceled.

I would not recommend PnC merchant services to anyone who is looking for consistency

Rob Williams

Be sure to read the fine print of the 75 page contract. If you break the PNC Merchant Services contract before the term is up, businesses have to pay almost double the monthly fee of $15 for the remainder of the contract. The sales representative also represents First Data, which charges exorbitant monthly and lease rates, and again the lease agreement is nonrefundable for the length of the term. To get a lower lease and monthly rate, they sell 4 year terms which are not a good match for start ups.

J d

PNC Merchant Services has sneaky sales tactics, unexpected costs, have an attorney review your contract but better yet go somewhere else. Very poor follow up to concerns.

—

Are you with PNC Merchant Services? Learn how to resolve this complaint.

Dawn

Absolutely the worst company I have ever dealt with….both PNC and First Data. Small businesses beware! They will fee you to death!! Do some serious research before you sign up with these guys. It would be more profitable to turn down a sale that requires a credit card for payment especially when associated with a PNC account. Both companies will tell you what you want to hear to make the sale. When you wake up to the reality of what they are charging you … good luck getting away from them because that will cost you an arm and a leg as well. .

—

Are you with PNC? Learn how to resolve this complaint.

mk

joseph ferris from new jersey area, pnc merchant service representative , you wont be able to reach them when you need them

stay away… worst customer service …you will be spending days trying to get your problem resolved with their 1800 numbers and nothing done

Fadynawwar

Hi

This merchant service are ripof

Agreed on 1 year contract canceled after 2.5 years after their fees gone hight

They charged me $250 cancelation fees and they said there is no 1 year contract in file

Be ware from those agents

Shawn Hart

The PNC merchant account using First Data is TERRIBLE! The device that plugs into my iPhone doesn’t work with an otterbox and the connection on my iPad consistently gives me an error message. They are charging me $19.99 a month without even using the service and they said that the contract is 3 years, and the cancellation fee is $25 a month for the rest of the contact (what!?). I don’t remember any discussion of this monthly fee or cancellation fee AT ALL while signing up for this service, which was supposed to be significantly less in fees than anything else. I am sticking with Square. DON’T USE THIS PNC MERCHANT SERVICE!!!!!

Duane

PNC Merchant Services is a front for First Data. First Data is absolutely the worse company that I have ever dealt with in my 10 years in business. They are liars to you on the phone. If you have any changes in you business and they advise you on how to proceed, they will then lie and say they never received your letter or they will have no record of you calling them, etc. It goes on and on…You cannot cancel an account. I have a letter from PNC Merchant Services that charges against my business have been waived and the account is settled. Then I get a collection letter and endless calls from “PNC MERCHANT SERVICES”, but the phone number and location are that of FIRST DATA. Its an endless circle that just continues between the two business names. At times you really do not know who you are talking to. PNC and FIRST DATA are the SAME COMPANY. First Data is the biggest SCAMMER company in the world. DO NOT do business with these people. They have the power to change your contract and charge you for fees you never agreed with. AND after you pay them, they still NEVER GO AWAY…

Nate R

My company is extremely dissatisfied with PNC Merchant Services. We are unable to close the account with this service due to a 3 year contract. My company is charged many additional fees to the $17.00 per month, and each time we have to call to find out the reason for the fee. At the end of 2014 we were charged just over $100 labeled as a financial adjustment fee. When I spoke with a customer service agent and asked what it was for, the individual admitted that it was a new charge not on my original contract, but that there was a message about this new charge on an online statement. Since I have never had access to any online statements where I may have seen information concerning this new charge, I insisted this charge be reimbursed. They were able to reimburse the financial adjustment fee after some convincing, but we are going to continue to receive these fees at the end of the year, along with many more. I would not recommend PNC Merchant Services to anyone, and I do not believe that this PNC service acts ethically in charging additional fees outside of a contract. Especially because it is a 3 year contract! If they choose to add additional fees and charges to their services, contract holders in contract prior to the invention of new fees should be grandfathered in, or be exempt from new fees not on the original contract, until the original contract time is up.

Erin

This company is horrible. I’ve had a personal bank account with PNC for several years, and recently opened a business account. The people at the bank are awesome and very helpful. Merchant Services, however, is a joke. Once I signed my contract my emails and phone calls were no longer returned. I simply want to know why a fee was deducted from my bank account, and I have not been contacted even though I have sent several emails to Dave McCullough, the asst. vice president. He emails me back but does not answer my question, or he will forward the email to another rep who also does not contact me. I am to the point where I am seeking legal action to end my contract due to the poor service.

Kelwin Warren

Please I need advice. I’m in the process of ending my account PNC mech. Services And I have to Pay termination fees. These fees where never explained to me when sign I up. I can’t Afford this. Do you have any advice on how to fight this. Please help. Thanks for your advice.

Sincerely,

Kelwin Warren

Mitchell Ballas

PNC misrepresented their new credit card machine’s technology in order to get rid of my ability to run pin debit cards as well as the input of security code and address info on keyed in transactions, putting me at risk for fraud and putting my transactions into a higher tier cost structure. I found all this out after about two weeks

of running credit cards with them, and switched to another company. My PNC agent asked what it would take

to make me happy and not bad mouth him, and I said to cancel the account and see to it that I wasn’t charged an early termination fee, which he said that he could do that, and we agreed to that. His boss talked him out of

that agreement(without my knowledge) and the next month they took $850 out of my account. No one at PNC

will acknowledge what their agent did, they just reiterate that I signed a contract and they will keep my money.

I now have knowledge of another merchant here in town that is having similar problems. Seems to be a pattern developing here. I’ve involved the Comptroller of the Currency and my Senator on this matter with PNC.

Kelwin Warren

Please I need advice. I’m in the process of ending my account PNC mech. Services And I have to Pay termination fees. These fees where never explained to me when sign I up. I can’t Afford this. Do you have any advice on how to fight this. Please help. Thanks for your advice.

Sincerely,

Kelwin Warren

Gail Galida

I spoke with a PNC Bank Personal and he told me briefly about the benefit of credit card processing for my clients. I asked about costs per month and what percentage is charged on transactions. The information given was vague and not everything was revealed. I now realize now that obviously they are salesmen working on commission.I did it completely wrong as I trusted PNC Bank being a customer for many years for business and personnel accounts. I was told to sign and that is what I did wrong. I never received a 10 page information guide and I did not know one existed. I still have not received one. The PNC Bank Personal told me he knew nothing about a 10 page booklet even though another person told me about it. The other person came via a phone call as I had made enquiries about canceling my credit card the day before with PNC Merchant. I was told to get out of my contract it was $25 a month which would be $825. I have only had one transaction go through.I was charged the $12 fee plus other fees of $5 plus now the next month I am charged $12 plus $2.90. I do not know what the extra $2.90 is for. My business is too small to have this credit card in operation. I was told to just keep paying the $12 fee each month and every now and then process a payment so that my account stays active. If I only pay the $12 fee a month the bank will close my account and charge an early termination fee. I am told my contract is 3 years. I would like to try and get out of this situation as my business is small and I do not have a huge balance. I operate a mobile dog grooming business. I highly recommend small business do your research and maybe not to consider offering credit cards as a means of payment for services.

Kelwin Warren

Please I need advice. I’m in the process of ending my account PNC mech. Services And I have to Pay termination fees. These fees where never explained to me when sign I up. I can’t Afford this. Do you have any advice on how to fight this. Please help. Thanks for your advice.

Sincerely,

Kelwin Warren