Sam’s Club Merchant Services Reviews & Complaints

Overview

Below, we offer a detailed examination of Sam's Club Merchant Services, highlighting key areas such as their rates and fees, contract terms, and customer feedback. As a reseller of Fiserv merchant services and Clover POS products, this division of Sam's Club caters to a range of businesses with specialized payment solutions. We’ll analyze their partnership with Clover, delve into customer reviews and complaints, and assess their legal challenges, including a notable lawsuit from 2020.

Additionally, our piece covers the customer support quality provided by Clover, their online ratings, and a critical look at their marketing strategies and employee feedback. We conclude with a succinct evaluation of Sam's Club Merchant Services, balancing their service offerings against customer experiences and industry standards, to provide a comprehensive view of their standing in the credit card processing market.

About Sam's Club Merchant Services

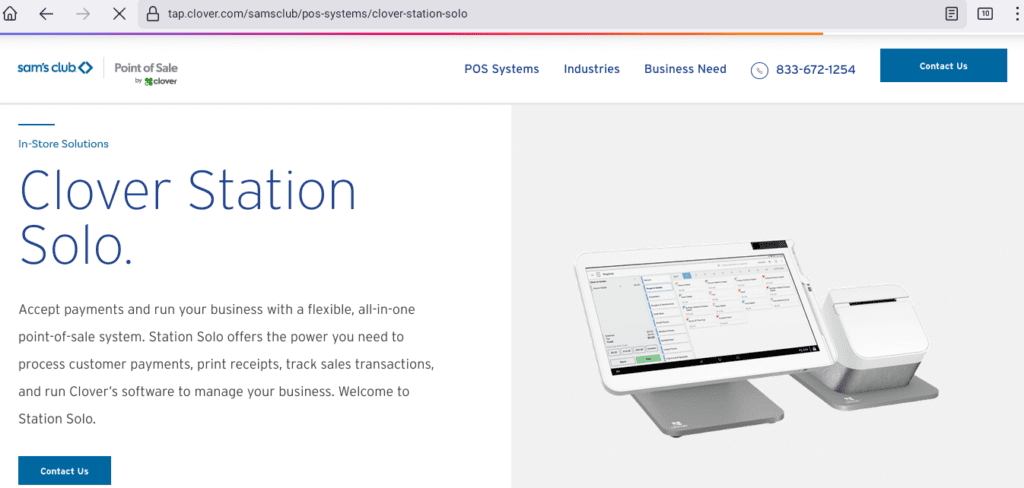

Sam's Club Merchant Services is the merchant services division of Sam's Club, a membership-only wholesale retailer owned by Walmart. As its website prominently advertises, Sam's Club Merchant Services is actually a reseller of Fiserv merchant services and Clover POS products, see our Fiserv Review for more details. This means that merchants who sign up for a merchant account through Sam's Club will receive the processing services of First Data (Fiserv). In fact, as of 2022, it appears that Clover itself operates Sam's Club Merchant services and has rebranded it as Sam's Club Point of Sale by Clover.

Sam's Club Merchant Services Payment Processing

The service offers a range of payment solutions tailored for different types of businesses including restaurants, retail, and service industries. For restaurants, it provides specialized point-of-sale systems, while retail and service businesses can benefit from payment terminals and fraud protection tools.

Partnership with Clover for Payment Solutions

Sam's Club Merchant Services has partnered with Clover to provide payment solutions for businesses. This service includes point-of-sale systems and software designed to manage payments across various scenarios such as at the counter, curbside, and online.

Additional Business Tools

Sam's Club Merchant Services also provides tools for contactless payments, online payment solutions for e-commerce, and loyalty programs to analyze sales trends and reward customers. These services are aimed at making business operations more efficient and enhancing customer satisfaction.

Location & Ownership

Founded in 1983, Sam's Club's headquarters are located at 2101 SE Simple Savings Drive, Bentonville, AR 72716-0745. Sam's Club Merchant Services is a registered ISO/MSP of Wells Fargo Bank Concord, CA, and the company's CEO is Kathryn McLay.

| Pros: | Cons: |

|---|---|

| Predictable flat-rate pricing | Poor customer service |

| Full Clover product line | Long-term contract standard |

| Contactless payments support | Early termination fees undisclosed |

| Limited online pricing info | |

| Deceptive sales practices |

Sam's Club Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 25+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

| Recent Lawsuits | Yes |

Understanding the Volume of Complaints

As Sam’s Club Merchant Services is facilitated by First Data (now Fiserv), it’s plausible that certain complaints meant for Sam’s Club may inadvertently be directed to the First Data (Fiserv) customer service teams and their online platforms. Despite this, our research unearthed more than 25 negative reviews across various consumer protection sites, with a handful labeling Sam’s Club Merchant Services as misleading or deceptive. Recurring issues highlighted in these complaints encompass non-disclosure of fees, misrepresented rates, lack of sales agent availability, challenges in contacting customer support, and encounters with uncooperative or discourteous service representatives. We encourage you to share your experiences with Sam’s Club Merchant Services by leaving a review in the comments section below.

Legal Actions and Settlements Involving Sam’s Club Merchant Services

In 2020, Sam’s Club Merchant Services found itself among several payment processors implicated in a legal dispute over alleged telemarketing violations. This lawsuit eventually evolved into a class-action settlement concluded in late 2021. Customers seeking alternatives to litigation against the company might consider reporting their grievances to appropriate regulatory bodies.

Customer Support Offered by Sam’s Club Merchant Services

Customer support for Sam’s Club Merchant Services is managed by Clover, providing a 24/7/365 telephone line along with limited chat support. These support mechanisms represent the fundamental expectations for highly regarded payment processors aiming for exceptional customer service. However, feedback from merchants indicates there is room for Sam’s Club to enhance its customer service capabilities.

Contact Information for Sam’s Club Merchant Services

- (833) 672-1254 – Toll-Free Customer Service

This article has been updated to ensure accuracy and to provide a balanced perspective on Sam’s Club Merchant Services’ offerings, based on customer reviews and complaints. It incorporates SEO strategies focusing on key phrases such as “reviews,” “complaints,” “customer service,” and “customer support,” relevant to potential search queries about the company. We’ve maintained the original links to offer readers direct access to further information and resources.

Sam's Club Merchant Services Online Ratings

Here's How They Rate Online

No Profile Available

The Better Business Bureau does not provide a profile specifically devoted to Sam’s Club Merchant Services, and the complaints on the BBB page for the larger Sam’s Club entity are not limited to any one department. In addition, it is likely that many of Sam’s Club’s dissatisfied clients have filed their reports with the First Data (Fiserv) BBB profile rather than that of Sam’s Club. It would therefore be unhelpful to consult the BBB for information about Sam’s Club Merchant Services, and we will not factor the BBB’s rating into this review.

Sam's Club Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Sam’s Club Merchant Services Pricing

In the past, Sam’s Club provided two standard pricing plans featuring tiered pricing. Additionally, they offered various Clover products for purchase, with rates starting at 1.29% plus $0.15 per transaction under the “Value Rate Pricing” plan. The “Simplified Pricing Model” offered rates of 2.29% plus $0.19 and 3.29% plus $0.19 for swiped and keyed-in transactions, respectively. Although these terms are no longer listed on their site, they may still closely resemble current offerings.

Sam’s Club Merchant Services Fees

Two reviews mention an early termination fee of $90, relatively low compared to industry standards, despite the company’s claim of no cancellation fees. Another consistent fee seems to be a PCI compliance fee of $49.95 per year, not previously disclosed on the Sam’s Club Merchant Services website. This fee is cheaper than the standard First Data PCI compliance fee of $19.95 per month. The former “Value Rate” plan also included a $5 monthly minimum fee.

Terms in Line with Industry Standards

Some reviews express disappointment with the effective rate paid, possibly due to incomplete rate-quoting by sales representatives. Certain clients also report long-term equipment leases, likely through Clover or First Data Global Leasing, which can cost thousands of dollars. Sam’s Club provides a membership for the duration of its merchant account contracts, though many customers feel this doesn’t significantly offset costs. Overall, Sam’s Club may not offer pricing competitive with the most economical merchant accounts. We recommend merchants explore our list of the top merchant accounts.

Sam's Club Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | Yes |

| Discloses All Important Terms | No |

Inside Sales Team

Sam’s Club appears to utilize its existing channels of promotion to market its merchant services, including mail, email, and in-store advertisement. As of this update, it is unclear whether businesses that sign up for a Sam’s Club merchant account will deal with a First Data (Fiserv) sales representative or a Sam’s Club Merchant Services representative, but most evidence suggests that First Data (Fiserv) services these accounts. Multiple Sam’s Club Merchant Services reviews complain of nondisclosure or misrepresentation of contract terms, and Sam’s Club Merchant Services complaints also state that agents often become unreachable after signing. This does not compare favorably to our list of best credit card processors.

Previous Rate Quotes

At the time of a previous update, the “Pricing” page on the former Sam’s Club Merchant Services website promoted two pricing plans. For clients on the “Value Rate” plan, the quoted rate for swiped transactions started at 1.29% plus $0.15. For clients on the “Simplified” plan, the quoted rates started at 2.29% plus $0.19 for swiped cards and 3.29% plus $0.19 for keyed-in transactions. These Sam’s Club Merchant Services rates are no longer visible on their site, but they may still apply.

Current Rate Quotes

One page advertising Clover products mentions rates “starting at 2.3% + 10¢ per transaction.” As with the company’s previous rate quotes, this falls short of full disclosure. The most important thing to bear in mind with regard to these rate quotes is that they are just the “Qualified” rates that businesses will see for very few swiped transactions. The “Mid-Qualified” and “Non-Qualified” transaction rates (which comprise the majority of transactions) are not listed on this page. We have found more than one client complaint expressing confusion about the rates that were advertised versus the effective rate paid. If you have had the same experience, you can double-check your monthly bill against your Sam’s Club Merchant Services contract with a third-party statement audit.

Our Sam's Club Merchant Services Review Summary

Our Final Thoughts

Sam’s Club Merchant Services rates as an average credit card processing provider by our standards. Although the company’s partnership with First Data (Fiserv) allows it to offer a wide variety of pricing plans, it also seems to have resulted in poor customer support and misleading sales strategies. Sam’s Club offers special pricing to large retailers, but small businesses will likely be better served by a top-rated credit card processor.

If you found this article helpful, please share it!

James Rundell

I used Sams Club Merchant Card Processing for a number of years. The charges were very high, but the services was good. Our bills were always paid on time. This spring I sold our business and cancelled our contract. Because we also sold the name of our business we closed our bank account to avoid problems.

That left a bill due to Sams club. Instead of billing us or calling us we were charged $150,00 for a collection fee. This is just wrong to treat a long term customer this way!!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Shane harrison

Sam’s club merchant services where to start. Was misslead about fees, they record the conversation but do not go back to hear what sales had promised. will tackle your batch , with out in going in to your bank account, you will not know untill you see bank statement. Each months fees donot stand alone, there are fees not charge form past months . That’s crazy, unless you’re just trying to confoun your customers. They are worse than most , look elsewhere for a merchant service company. Very dissatisfied.

Sheryl

Sam’s club merchant services where to start. Was misslead about fees, they record the conversation but do not go back to hear what sales had promised. will tackle your batch , with out in going in to your bank account, you will not know untill you see bank statement. Each months fees donot stand alone, there are fees not charge form past months . That’s crazy, unless you’re just trying to confoun your customers. They are worse than most , look elsewhere for a merchant service company. Very dissatisfied.

David Crowe

Avoid this merchant service. I was led to believe that my fees would be less than 2%. Over the last two months, before I dumped these guys and went with Square, my fees averaged nearly 6%.

Run. Don’t walk away.

Paul

I’m not sure where the above person gets his info but I was charged all of the fees he says are not charged and the effective rate is MUCH higher than almost everyone I have looked at

I wish I would have seen some of the reviews before I tried it.

SNEEKY pricing and billing and many hidden charges.

DON’T USE SAM’S CLUB PROCESSING!!!!!!!!!!!!!!!!!

Cliff

Sam’s has a $0 cancelation fee and no PCI Yearly Compliance. Also Sam’s has a much lower effective rate than many processors. Couldn’t be more happy with them.

Phillip CPO

Hi Cliff,

To authenticate your testimonial, please reply to this comment with your business name and location.

Shane harrison

Happy for you, your sales.person was not trying to cheat you. Wish my story was the same. 4 months in with them.