Vanco Payment Solutions Reviews & Complaints

Company Overview

Vanco Payment Solutions is headquartered in Atlanta, Georgia. The merchant account provider was originally founded in 1998 as “Vanco Services.” The company achieved its current form in May 2014, when Veracity Payment Solutions purchased Vanco Services and rebranded itself as Vanco Payment Solutions. This review originally covered Veracity Payment Solutions, but it now focuses on the merged entity that is Vanco Payment Solutions. According to a company representative, Vanco processes payments through First Data (now Fiserv).

Vanco Payment Solutions Payment Processing

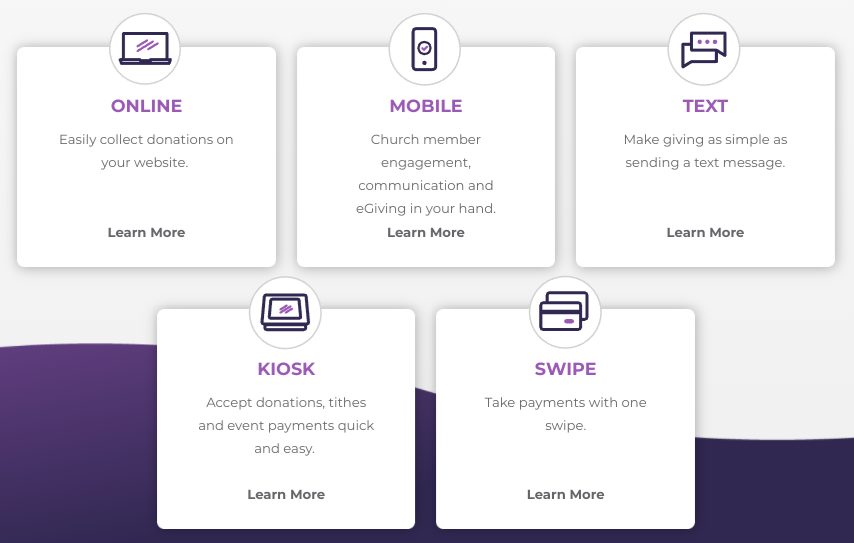

Our initial request for additional information about Veracity Payment Solutions and its business practices went unanswered by the company, both through phone calls and emails to the marketing department. However, a representative of Vanco Payment Solutions has contacted us to say that Vanco has more than 100 employees and that Vanco's primary areas of focus are faith-based organizations, non-profits, education, and professional services. Vanco Payment Solutions processes all major debit and credit cards through the following services: online payments through virtual terminals, mobile, text payments, kiosks, card swiping, and streaming.

Location & Ownership

Vanco Payment Solutions is a registered ISO of Wells Fargo Bank, Concord, CA. Vanco Payment Solutions is located at 5600 American Blvd W. Suite 400, Bloomington, MN 55437. Shawn Boom is listed as the Executive Chairman of Vanco Payment Solutions while Jim McGinnis is CEO.

Vanco Payment Solutions Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Moderate Complaint Volume

We have identified approximately five negative Vanco Payment Solutions reviews, none of which allege fraudulent activities by the company. Complaints primarily revolve around issues with customer service responsiveness, delayed payouts, and software/hardware performance. While this represents a slight increase in complaints since our last review update, it remains relatively low considering Vanco’s scale and tenure in the industry. If you have feedback to share, please contribute your own Vanco Payment Solutions review in the comments section below.

Vanco Legal Standing

No class-action lawsuits or FTC complaints have been filed against Vanco. Clients seeking alternative recourse are advised to report concerns to relevant supervisory organizations.

Vanco Customer Support

Vanco provides both phone and email support options, although these channels do not currently meet the criteria for designation as a top-rated payment processor for customer service.

Vanco Customer Service Information

- (888) 237-7850 – Toll-Free General Customer Service

- (866) 349-0613 – Sales

- (855) 704-4404 – Headquarters

- (800) 675-7430 – Operations Office

- (770) 518-5961 – Fax

Other Support Options

- Customer support form

- Live chat support

- Customer service email addresses

Vanco Payment Solutions Online Ratings

Here's How They Rate Online

| BBB Reports | 1 |

|---|

No BBB Complaints

Vanco Payments Solutions currently has two Better Business Bureau profiles, with one for its Atlanta office and the other for its Minnesota office. Both profiles are showing BBB accreditation. The profile for the Atlanta office is currently showing an “A+” rating, and the profile for the Minnesota office also has an “A+” rating. The two profiles combined have 1 complaint filed in the past 36 months. The 1 complaint was either resolved to the dissatisfaction of the client or received no final response.

What Merchants Say

Vanco Payments Solutions also has 0 informal reviews on its BBB profile, though there was a previous review which was positive in tone. The only review filed by a client cited a pleasant sales experience and quality customer service from Vanco Payments Solutions :

I’m the Treasurer for **** Presbyterian Church, ****** *****, NJ and our church has been using VANCO services since 2011 and have received outstanding professional service and support. I say thank you to those in leadership and service support staff who provide this service. Very appreciative of this tool, makes my job easier. Although there are various new apps coming along, but I stand fast with VANCO.

An “A” Performance

Given this information, we agree with the BBB’s rating. Readers should note, however, that there are reasons to be skeptical of the BBB’s information.

Vanco Payment Solutions Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | No (Sells Directly) |

Two Pricing Plans

Vanco Payment Solutions provides 3 pricing plans, each with a one-time $50 registration fee. The plans are “Grow”, “Thrive”, and “Custom”.

The “Grow” plan caters to organizations with annual donations under $250,000. It includes a 2.90% plus $0.45 transaction fee, a 1% plus $0.45 ACH fee, and a $10 monthly service fee.

For organizations with $250,000 to $500,000 in annual donations, the “Thrive” plan is available at $49 per month. This plan has transaction fees of 2.65% plus $0.39, ACH fees of 0.90% plus $0.39, and the same monthly service fee. The “Thrive” plan includes Give+ Text; this feature can be added to the “Grow” plan for an additional $10 per month. Vanco also sells processing hardware for a one-time fee.

The “Custom” plan is designed for organizations with monthly donations over $40,000. It shares the registration and hardware costs of the other plans but features personalized transaction rate pricing.

Vanco Payment Solutions Contract Terms

Vanco Payment Solutions reportedly offers month-to-month contracts without cancellation fees. An available copy of the company’s standard agreement from January 2015 aligns with the current Start plan. While these terms don’t position Vanco among the most affordable merchant accounts, they are nonetheless flexible. Additional insights on Vanco’s merchant account agreement, including details on PCI compliance fees or monthly minimum fees, can be shared in the comments. See the Vanco Merchant Agreement for more information.

Vanco Payment Solutions Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Possible |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

Varied Sales Approach

Vanco Payment Solutions markets its credit card processing services in several different ways, including partnering with faith-based organizations and software companies as well as hiring a team of sales agents. A Vanco representative has stated that this sales team consists of full-time employees. This assertion is supported by the fact that there are no Vanco Payment Solutions reviews that accuse the company of deceptive sales tactics.

No Deceptive Marketing

Additionally, Vanco does not appear to use any misleading rate quotes or unethical marketing in its official materials. We will therefore assign the company an “A” rating in this category for the time being. If you are concerned that Vanco is overcharging you, we recommend seeking a third-party statement audit to eliminate hidden fees.

Our Vanco Payment Solutions Review Summary

Our Final Thoughts

Vanco Payment Solutions appears to be a reliable credit card processing provider for non-profits and faith-based organizations alike. The company has maintained high marks since our previous update and has not amassed a significant number of complaints. Even when dealing with highly rated providers, you are encouraged to fully read and understand your merchant account agreement before signing.

If you found this article helpful, please share it!

LINDA C BLAZEK

My church recently went to using your service. At the end it asks if I want to add a specified amount to cover the cost. When I said yes, an amount was added to each area I had donated to so that I ended up paying more than the cost amount stated.

Pete

DO NOT USE VANCO – they are not a company of integrity and they prey on churches. When you try to cancel their service, you get the run-around and continue to draft your account for years. If you are considering this company – please MOVE TO ANOTHER because you will regret it.

Carol Scanlon

Bill Pay received my money from my credit union in Idaho on 8/23. They were instructed to send the money to my credit union in Texas. Now, ICCU shows money sent to Bill Pay and TruWest shows it hasn’t been received. Now, Bill Pay says they have 5 days from (8/24) when it was scheduled to be paid, BEFORE they can research this transaction and supply TruWest with a transaction number for any research to begin! Hmmmm, I wonder what Bill Pay did with my money???? I do have to wonder if it is sitting in an account somewhere or has been electronically paid out incorrectly by Bill Pay. Bill Pay is showing up on the proof of payment as Vanco. Maybe they have my money????? I’m very, very, very disappointed in the unprofessional way that this transaction has been handled. I will find out what happened to my $500+ cash. And when I do………… I will write an update! And tell every single reviewing site, BBB, etc. of their poor customer service and unapologetic procedures! We’re NOT talking $20 here!

Marianne

Very very frustrated with Vanco.

My old cc machine was no longer useful to me, we switched over to a VOIP phone line. In the interim I asked them to have sales contact me about getting Virtual Terminal set up. It’s been two weeks and no contact from them. I called twice in the past week with zero follow through.

To work around I attempted to do a Voice Authorization however it will not post to my account without a machine. I ordered a machine from the famous auction site, contacted Vanco immediately to get a V Number build up started. This was last Thursday.

I called once yesterday (Monday) about it, it was not established. ONCE AGAIN I requested to have a virtual terminal set up/have someone contact me. Neither the V Number is yet established after SEVERAL phone calls today nor have I been contacted by any one in their company about setting up an alternate system of payment. Meanwhile I have >$5k in charges pending with additional charges that need to be taken care of.

I am beyond frustrated with Vanco at this point. If I was not overwhelmed with the business end of things I would immediately switch merchants. I overpay for this level of customer service (NONEXISTENT). I would NEVER ever recommend them. I’ve been dealing with this for over two weeks now and am nowhere near having this resolved.

—

Are you with Vanco? Learn how to resolve this complaint.

Ronald Young

My personal experience with Vanco (their phone system still identifies themselves as Veracity) is totally at odds with the review provided by CPO. They may serve their business customers adequately, but their attention to users of the systems they provide their business customers has been sorely lacking in my case. If business customers want to risk poor customer relations as a result of contracting with Vanco, that is of course their decision.

Cindy Artrip

I had a problem with their equipment failing and they would not replace the terminal without charging me $95. I had been a reliable customer for many years with MTG and Verasity bought them out. Since the switch over, they will not back their equipment. Management wouldn’t speak to me or even send me a power cord to see if that was the problem. Needless to say, they lost me as a customer and soon my husbands business will drop them too. In todays economy it is important to keep your customers happy and they failed in that department. I’m sure another company will be more than happy to help us out.

Veronica Kitayama

Can a business charge a customer $0.50 for a credit card purchase that is less than a certain amount? Is that legal?

I made a charge card purchase today that was $14.05 and was told by the cashier that I was being charged $0.50 in addition to my charge total because it was under $40.

Is this allowable by Veracity?

Please advise.

Thank you

Veronica Kitayama