What is a CVV2 Code?

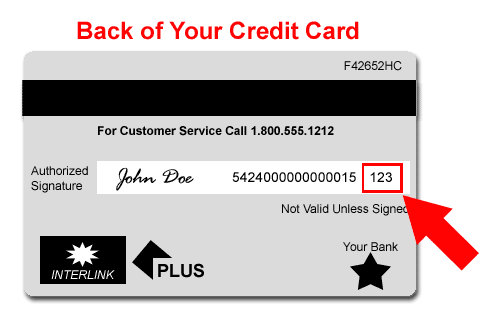

The CVV2 (Card Verification Value 2) code is a three or four-digit security feature found on credit and debit cards, designed to enhance payment security. This number is separate from the card number itself and is typically located on the back of the card, though it can be found on the front of American Express cards. Introduced to provide an additional layer of security, the CVV2 code helps verify that the card is in the possession of its rightful owner during non-face-to-face transactions, such as online or over-the-phone purchases. As fraudsters increasingly seek to acquire card details, the CVV2 serves as a crucial barrier against unauthorized use, as it is not stored by merchants, thereby limiting exposure in data breaches.

How CVV2 Codes Enhance Security

CVV2 codes play a pivotal role in minimizing the risk of financial fraud by serving as a secondary security layer for card-not-present transactions. While the primary card number facilitates the transaction process, the CVV2 code is required to authenticate the cardholder and ensure that the physical card is in their possession, making unauthorized purchases significantly more difficult. This code is not stored by merchants following a transaction, thereby offering an added security measure against potential data breaches and fraudulent reuse. Such protocols are especially critical in today’s digital age, where electronic transactions are both ubiquitous and susceptible to sophisticated cyber-attacks.

How CVV2 Codes are Generated

The generation of CVV2 codes involves a specific algorithm that banks use to ensure each code is unique and secure. This algorithm takes into account the card number, expiration date, and a secret cryptographic key known only to the issuing bank. The result is a three or four-digit code that appears random and is hard to predict without access to the bank's internal systems. This calculated randomness is crucial for maintaining the security and integrity of the CVV2 system, as it prevents potential fraudsters from simply guessing the code based on other card details. This methodological approach to security ensures that even if other card details are compromised, the CVV2 provides a robust defense against unauthorized access and transactions.

CVV2 Best Practices for Consumers

For consumers, safeguarding your CVV2 code is essential in maintaining the security of your financial transactions. It is advisable to never share this code through email or over the phone unless absolutely certain of the legitimacy of the transaction and the recipient. Additionally, you should regularly monitor your bank statements and set up alerts for unusual activities, as these practices help in early detection of any potential unauthorized transactions. Covering the CVV2 code with a sticker or otherwise obscuring it can also prevent physical theft of the information. If you suspect that your CVV2 number has been compromised, contact your issuing bank immediately.

Where to Find Your CVV2 Code