A Rare and Highly Transparent Merchant Account Pricing Model

When it comes to credit card processing, pricing models can get complicated fast. Between tiered pricing, flat rates, and interchange-plus structures, merchants are often left in the dark about what they’re really paying. But if you’re a business that processes a moderate to high volume of transactions each month, there’s one model you should definitely understand: Volume Discounted Interchange-Plus Pricing.

Let’s break it down.

What Is Interchange-Plus Pricing?

Every time a customer pays with a credit card, the card-issuing bank charges an interchange fee, which is non-negotiable and set by the card networks (like Visa or Mastercard). This fee is passed through to the merchant’s processor which is ultimately paid by the business that made the sale.

The “plus” in Interchange-Plus refers to the processor’s markup, which is an added fee on top of the interchange, typically expressed as a small percentage and/or a per-transaction cost.

For example, if the interchange rate on a transaction is 1.65% + $0.10, and your processor charges a markup of 0.30% + $0.05, your total effective rate would be 1.95% + $0.15.

Interchange-plus pricing is generally more transparent than flat-rate or tiered models because you can see exactly how much the processor is charging you on top of the true cost.

What Does “Volume Discounted” Mean?

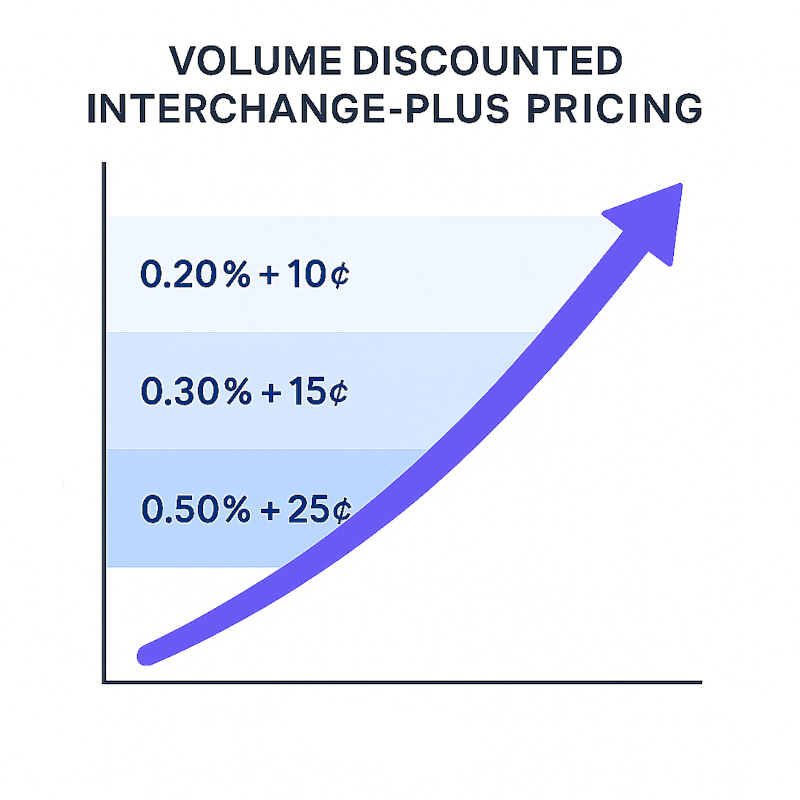

Volume Discounted Interchange-Plus Pricing adds a performance-based element to the equation: the more you process, the lower your markup over Interchange becomes.

Instead of paying the same markup regardless of your transaction volume, processors on this model automatically lower your fees as your monthly processing volume increases. It’s a tiered incentive structure, but unlike tiered pricing models (which categorize transactions), this one is based on your total monthly volume.

As an example, a processor’s markup might be 0.50% + $0.30 when you process between $0 and $25,000 in a given month. If you process within, say, $25,000 to $50,000, in a later month the markup might automatically lower to 0.45% + $0.25 for that month. Essentially, the processor is lowering your rates as you become more successful. Think of it like a bulk discount, only the “product” is your processing fee.

Why This Matters for Growing Businesses

As your business grows, your payment volume likely grows too. Under traditional pricing models, your fees might stay static, even as your processor’s cost per dollar processed decreases. With volume discounted interchange-plus pricing, you benefit from economies of scale.

This is especially helpful for seasonal businesses or startups on a growth trajectory. You’re not locked into a high fee just because you started small. When your volume increases, your fees automatically adjust down, often without renegotiating your contract.

Real-World Example: Helcim

One of the most prominent providers using this model is Helcim.

Helcim’s pricing is fully transparent and built on an interchange-plus structure, but what sets them apart is how they dynamically apply volume discounts. As your processing volume increases, Helcim automatically applies a lower markup tier the following month with no need to call in or ask for a better rate.

Here’s how it works:

- A small business processing $10,000/month might see a markup of 0.50% + 25¢ per transaction.

- As volume grows to $50,000/month, that markup could drop to 0.30% + 15¢.

- Merchants processing even higher volumes may qualify for even lower markups.

Everything is detailed transparently in Helcim’s pricing table, which is published online; something you rarely see from traditional processors.

Is It Always the Best Option?

Volume discounted interchange-plus pricing is especially useful for:

- Businesses with growing or fluctuating volume.

- Merchants tired of flat-rate pricing that hides the true cost.

- Operators who want to scale efficiently and pay less over time

That said, low-volume businesses might not immediately benefit unless their processor offers fair base-tier rates. And understanding interchange tables can be a learning curve if you’re new to payment processing.

Bottomline

Volume Discounted Interchange-Plus Pricing rewards businesses for growth and prioritizes transparency. If you’re scaling your business or want a fairer deal based growing sales, it’s worth exploring. Providers like Helcim are leading the way in offering this model openly and automatically, something that could save you thousands as your volume rises.

As always, make sure to read the fine print, ask about markup tiers, and verify there are no hidden monthly fees or contracts that undermine the benefits.

Related Articles:

- How Cash Discount Pricing in Merchant Services Works; A Cautionary Tale

- Tiered, Bucket, Bundled Pricing in Merchant Accounts Explained?

- Subscription & Membership Rate Pricing in Credit Card Processing Explained

- Flat Rate Pricing In Credit Card Processing Explained

- How Interchange-Plus Pricing Works in Credit Card Processing