The following text has been adapted from Fee Sweep. Download your copy of Fee Sweep here.

The $100 Dilemma

Merchant account quotes often look something like this: “Only 1.5% + $0.15/per transaction” or “2% + $0.25 per transaction for e-commerce.” Below are some advertising examples found during a quick Google search:

Rate Quote Advertising Examples

The problem with the rate quotes in the above example is that they only reveal the lowest of several possible transaction rates, which makes them the root of the “hidden fee” reputation of this industry.

Let’s start by defining a couple merchant account terms: A “Processing Fee” is the combination of two other fees: the “Discount Rate” and the “Transaction Fee.” For example, in a rate quote of 1.5% + $0.15 per transaction, the 1.5% portion is the “Discount Rate” (think of it as the percentage being discounted from the money you will get from the sale) and the $0.15 portion is the “Transaction Fee” (a flat fee per transaction). To illustrate who is getting paid by these processing fees, we’ll examine two separate $100 credit card transactions by the same customer at two different fictitious businesses: Bob’s Jewelry Shop and Jane’s Jewelry Store.

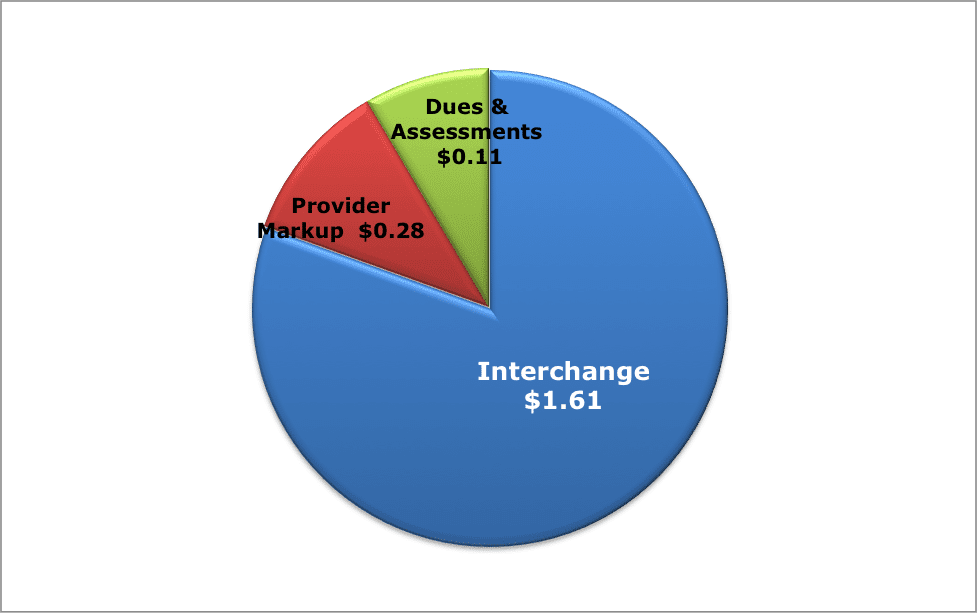

Jane got a great deal with her merchant account because she read this guide. For simplicity, we’re going to say that her $100 sale cost a total processing fee of 2% by combining her Discount Rate and Transaction Fee together (otherwise known as the “Effective Rate”) and the customer used a Citi Bank VISA credit card. For this sale, Jane will get $98 of the $100 and the remaining $2 fee will get split three ways:

- $1.61 will be divided between the bank that issued the customer’s credit card (Citibank) and a few other networks that processed and routed the transaction. Most of it will go to Citibank.

- This portion of the fee is called the “Interchange” fee. It varies in cost depending on the type and brand of credit card that is being transacted, and if it is keyed-in or swiped through a card reading device.

- $0.11 will go to VISA.

- This portion of the fee is called the “Dues & Assessment” fee and as of this writing is fixed at 0.11% for all VISA transactions.

- MasterCard’s Dues & Assessment fee is also fixed at 0.11%.

- This portion of the fee is called the “Dues & Assessment” fee and as of this writing is fixed at 0.11% for all VISA transactions.

- The remaining $0.28 will go to Jane’s merchant account provider as a “Provider Markup.” Basically, the profit margin that the provider built on top of the Interchange and Dues & Assessment fees.

Jane’s $2 Processing Fee Breakdown

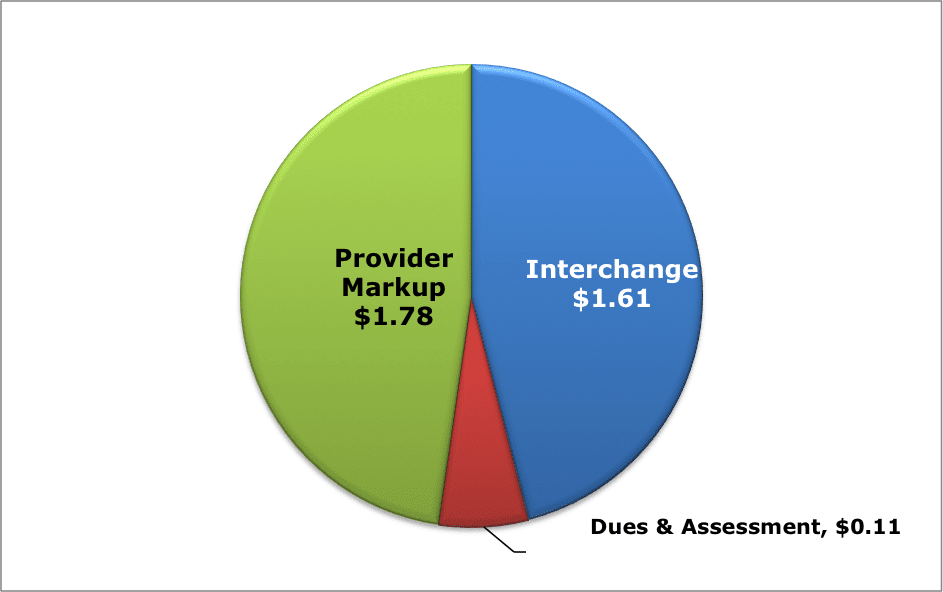

Now for the $100 sale at Bob’s Jewelry Store; Unfortunately for Bob, he did not read this guide and got what most merchants get: an expensive merchant account with no added value or features over Jane’s account. In other words, Bob pays a lot more for the exact same service that Jane gets. The $100 transaction will cost Bob an effective rate of 3.5% of the sale, a full 1.5% higher than Jane’s fee. But, why?

The answer is simple: Bob’s merchant account provider is rolling in Bob’s money. Not only that, but Bob’s merchant account provider uses sales people who are paid only on commission. For them, higher rates and fees for Bob mean bigger commissions for themselves. Poor Bob was unaware of all of this when he signed up for his merchant account. Bob’s rate breakdown looks similar to Jane’s, but with one major difference:

- $1.61 Interchange Fee

- $0.11 Dues & Assessment Fee

- $1.78 Provider Markup

Bob’s $3.50 Processing Fee Breakdown

It doesn’t take an economist to see that more than half of Bob’s $3.50 fee is going to a markup by the merchant account provider. In contrast, only 8.5% of Jane’s fee is going towards a Provider Markup. In fact, Bob’s merchant account provider is making nearly ten times as much on his account than on Jane’s account. Interestingly enough, the provider’s markup is the only portion of the rate that you can negotiate. The Interchange fees and Dues & Assessments fees are non-negotiable and outside of a provider’s control. Multiply the difference between Bob’s and Jane’s processing fees for several years, and Bob will pay thousands of dollars more in fees than Jane. Simply put, Bob is getting screwed.

So how do you avoid getting screwed? It’s not as simple as just asking a provider to lower its markup. To answer this, we need to understand which fees are being left out of most merchant account rate quotes.

The preceding text has been adapted from Fee Sweep. Download your copy of Fee Sweep here.