How The Statement Analysis Con Starts

When shopping for a new merchant account, you are likely to encounter a salesperson from a competing credit card processing company who wants to offer you a “free statement analysis.” On the surface, the offer sounds great. They are telling you that they can save you money on processing costs and show you how much you will save in comparison to your current credit card processor. What a great deal! Or is it?

Agreeing to a free statement analysis from a credit card processing company is risky for a few reasons:

- Wolf in Sheep’s Clothing: Often, it’s the worst processors that utilize the “free statement analysis” tactic to lure unsuspecting business owners into a high pressure sales gambit. In this common scenario, you unwittingly hand over your statement to scammy salesperson who then returns a cost comparison with your current processor that saves you a huge amount in fees. But there’s a catch; His manager says that you have to sign up today or the offer is off of the table. You don’t want to lose such a great deal, so you sign the application without reading the fine print. A few months go by and the fees are actually more expensive, plus the customer support is awful. You try to cancel but that’s when you find out you signed a contract that is going to cost you thousands to get out of. Now you’re stuck with them for three more years, and they keep jacking up your fees the whole time. It’s a nightmare that countless business owners have experienced, and a situation that is completely avoidable by never sharing your statement with a salesperson who is trying to get your business.

- Smoke and Mirrors: A shady processor’s goal is to show you a carefully manufactured side-by-side report demonstrating savings over your current processor’s costs. These reports are rarely an accurate representation of your actual processing costs, nor are they a true prediction of the costs you can expect by switching services. In most cases, the cost comparison you receive is a rough, ballpark estimate at best.

- Tipping Your Hand: When you send your statement to a processor, you may be unintentionally revealing sensitive information about your business that can be leveraged against you during pricing negotiations. Keep your processing data close to your chest. You don’t want them to know if you are holding aces.

- Trojan Horse: When a prospective processor sees how your current processor is assessing your fees, you give them everything they need to manipulate the data in their favor. Do you know the difference between Interchange-plus pricing and tiered pricing? Would you be able to tell if they are comparing apples to apples across your fees? They will be paying close attention to your questions and answers as you discuss the cost comparison to see if you actually understand what you are looking at. Experts can always spot an imposter, so don’t risk looking like one by handing your statement over to them.

Credit card processing companies thrive on the complexity of rates and fees. They have no incentive to help you truly understand how much you could actually be saving.

Get a True Understanding of Your Processing Costs

If you want an honest analysis of your processing costs and where you can save, the best approach is to obtain an independent “Statement Audit” from an expert who is not selling credit card processing services. A Statement Audit is different from “statement analysis” because it is not comparing your current fees with another credit card processor’s. A Statement Audit compares your current fees against the wholesale cost of accepting credit cards without any markups or junk fees. It breaks down every fee and markup to identify how much profit your processor is making from your merchant account.

How a Statement Audit Works

A Statement Audit reveals everything about the underlying card network costs as well as the fees added by your processing company.

Step 1: Identify Non-Negotiable Costs

An audit starts by identifying the fees paid to the banks that issued your customers’ credit cards, known as “Interchange.” Next, it segments the fees charged by the card brand networks (VISA, MasterCard, etc) called “Dues and Assessments”. These fees are the wholesale cost of the credit card processing ecosystem and cannot be negotiated.

Segmenting the network costs reveals markups by your processor that may by hidden via rate padding. In the audit example below, the processor was charging a wholesale rate of 0.53% on debit card transactions, which are regulated to be no higher than 0.05%. This means the processor was hiding an illegal 0.48% undisclosed markup that was costing this unsuspecting business owner nearly 10X more than it should have. Hidden rate padding is virtually impossible for the average business owner to detect because it requires cross-referencing hundreds of possible Interchange rates against vaguely defined statement charges.

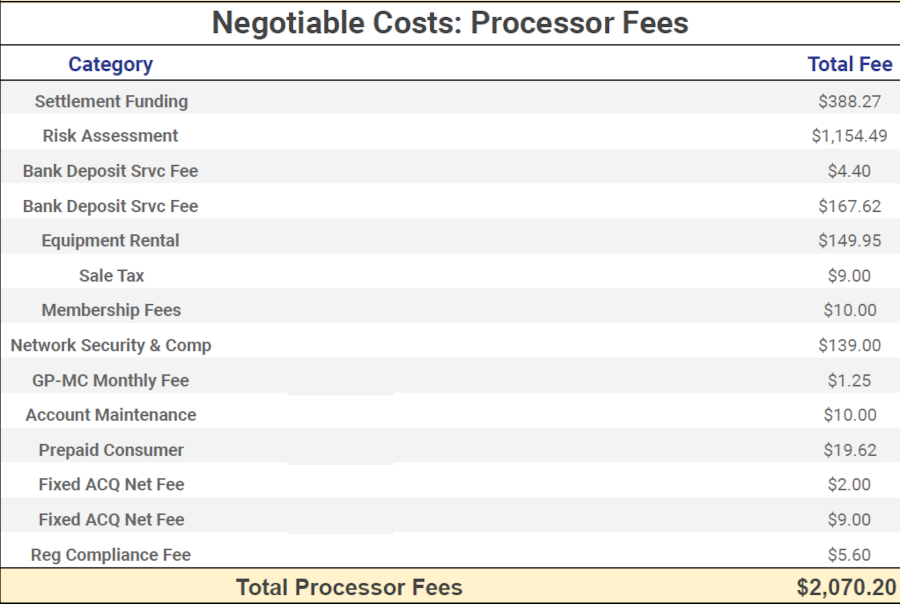

2. Extract Processor Markups and Fees

Next, an audit will identify all of the margins and markups that a processor adds on top of Interchange along with listing all junk fees that can be negotiated or removed altogether, such as unnecessary monthly and annual fees.

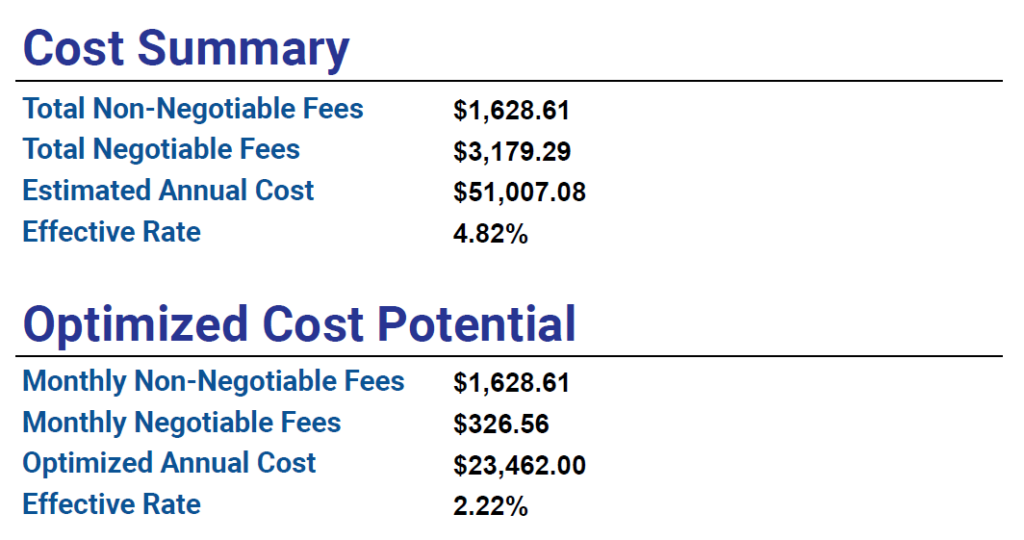

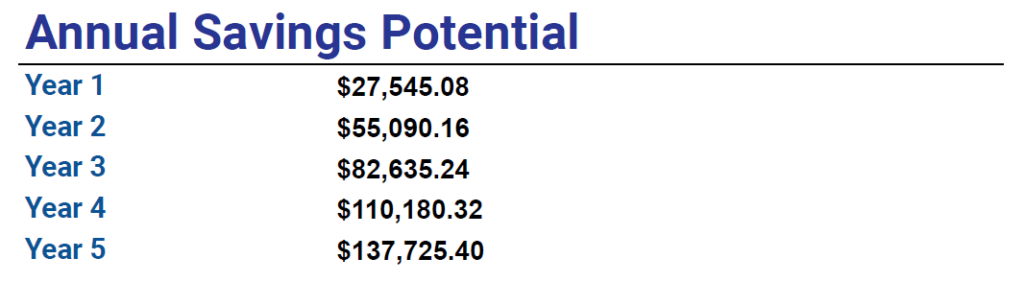

3. Compare Your Costs to Potential Savings

Lastly, an audit summarizes your current processing costs compared to what you could expect with an ethical, low-cost processor, or through renegotiation with your current processor if they are willing to come to the table.

What’s The Catch?

There always seems to be some kind of catch or trap in the credit card processing industry. If you are suspicious, you have every right to be. In most cases, you would be correct in believing that something like a Statement Audit is disguising an ulterior motive. This is why Statement Audits audits are not free. Because there is no other agenda by the auditor after completing it. You should expect to pay a few hundred dollars per statement, and it’s wise to have more than one statement audited as not all fees occur on every statement. So, is paying hundreds of dollars for a Statement Audit a smart business decision?

The average business could cut its fees in half!

Every one of the hundreds of statements we have audited contained removable rates and fees. In fact, we have found that the average business is paying 47% more in processing costs than necessary. Over the last decade, we have uncovered millions of dollars in junk fees that businesses were blindly paying, completely unaware of how much they were losing in avoidable costs. Our findings have shown that businesses processing between $400,000 and $5,000,000 in annual credit card transactions are most at risk of grossly overpaying for credit card processing services, with many incurring excessive fees totaling tens of thousands of dollars annually. Nearly every audit we have done has justified its cost many, many times over.

Beware of Free Merchant Account “Cost Consultations”

Companies that are not marketing credit card processing services to you, but offer to audit your statement at no cost, will sell you down the river. First, their primary goal is to convince you to allow them to renegotiate your fees for a cut of the savings they achieve for you. Most of them want half of the fees they removed for a period of years! If you agree to their offer, the cost of auditing your statement will likely run into the thousands as they bill you for their portion. When you factor in their fee plus the time you spend paying them, you may only be saving about 10% to 20% as compared to your original costs. That’s a savings you could achieve on your own with just basic know-how. It’s better to pay upfront and avoid long-term obligations.

“Free” is rarely free in the merchant account industry.

What if you don’t agree to let them negotiate on your behalf? At least you get a free audit, right? First, the audits these companies provide are intentionally vague. They don’t want to give you all of the details on where you are getting overcharged because you could just take such information and do the negotiation yourself. They want you to believe that you need them – that it’s all just too complex and that you can’t achieve the savings on your own. Many will use high pressure sales tactics and continually market their consultation services to you until the end of time. Some are even known to sell your information to credit card processing companies who will endlessly call you and show up to your store. Avoid headaches and obligations by paying upfront for a Statement Audit.

Don’t Wait to Audit Your Merchant Account

Why is it imperative that you audit your today? Because it’s likely that you are being overcharged without your knowledge or consent, and it could get worse. A recent Supreme Court decision may remove much of the government’s ability to regulate the payments industry. This could lead to an avalanche of new fees quietly being added to your processing costs, so it’s important to eliminate excess fees now to ensure that any attempts to add new fees later will be blatantly apparent.

A comprehensive statement audit will reveal hidden charges, inflated rates, and other discrepancies that are costing your business more than necessary. By identifying these issues early, you can negotiate better terms, switch to more cost-effective service providers, and streamline your financial operations. Additionally, regular audits help ensure compliance with industry standards and protect your business from potential mistakes in your transaction fees. Don’t wait for these costs to accumulate—take action now to secure a more profitable future for your business.

Get On The Waitlist

Due to high demand we are accepting a limited number of clients per week. If you are interested in having your statement audited, please fill in the form below. Submissions that include statements will be prioritized and will receive a preliminary review at no cost. Our response will include an estimate of the cost savings potential you could achieve through tactical negotiation as well as our pricing options for a more comprehensive audit if you wish to uncover all hidden costs. Additionally, we will provide you with a cost/benefit analysis of a more thorough audit so that you can decide if it’s right for you.