Circle Plus Payments Reviews & Complaints

Note: As of 2023, the Circle Plus Payments website is down. We are unsure of the status of the company at this time. If you have any information, please let us know in the comments below.

Company Overview

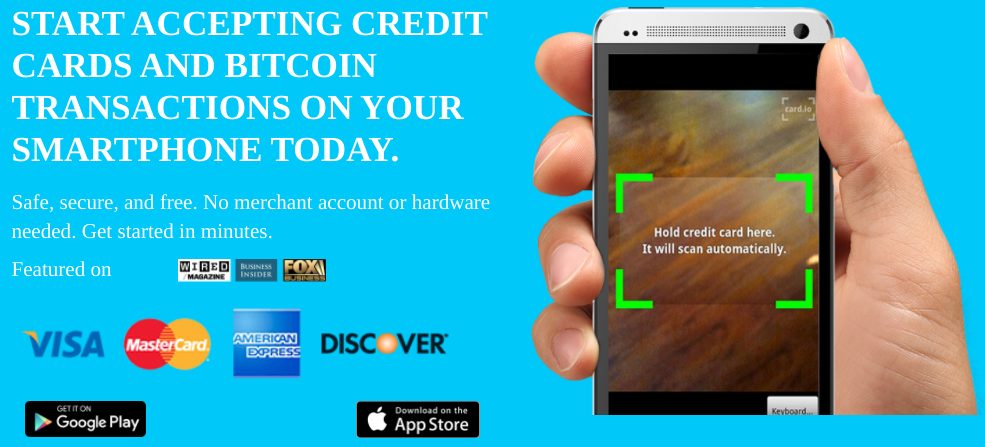

Founded in 2013, Circle Plus Payments is a software development company that creates money transfer and mobile wallet apps. Specifically, the company designed the mobile app Payable for iOS and Android devices that businesses and consumers can use to send and receive payments, but Stripe handles the actual payment processing. Payable is primarily intended as a business transaction service rather than a peer-to-peer money transfer app. Payable also allows merchants to scan credit cards without a traditional terminal as well as accept Bitcoin for payments without having a Bitcoin wallet of their own through Stripe's payment network.

Credit Card Processing Services by Circle Plus Payments

The primary service provided by Circle Plus Payments is their credit card processing. This service enables businesses to process a wide range of card payments securely and smoothly. The system is designed to ensure efficient transactions, fostering a seamless payment experience for both the business and its clientele.

Mobile Payment Solutions from Circle Plus Payments

In response to the rapid expansion of mobile transactions, Circle Plus Payments provides mobile payment solutions. These services permit businesses to manage transactions from mobile devices, facilitating secure and swift operations while catering to a mobile-first consumer base.

POS Systems Offered by Circle Plus Payments

Circle Plus Payments provides POS systems that seamlessly integrate with the existing infrastructure of businesses. These systems facilitate easy transaction processing and can be adjusted according to specific industry needs, offering a comprehensive payment solution that aligns with business operations.

Virtual Terminal Services by Circle Plus Payments

For businesses that require a flexible solution to handle transactions remotely, Circle Plus Payments offers virtual terminal services. This feature allows businesses to manually enter card details into a secure online system, making it easier to manage transactions over the phone or through mail orders.

Circle Plus Payments' E-commerce Solutions

Recognizing the growth and importance of online business, Circle Plus Payments offers robust e-commerce solutions. These services enable businesses to handle online transactions securely and efficiently, thereby allowing a smooth online shopping experience for customers.

Security Measures by Circle Plus Payments

Understanding the crucial role of security in maintaining client trust, Circle Plus Payments provides advanced security features. These include encryption, secure socket layer (SSL) protections, and comprehensive fraud monitoring tools to shield businesses and their customers from potential security threats.

Location & Ownership

Circle Plus does not provide merchant accounts and therefore does not utilize an acquiring bank. Nitish Kannan is the co-founder and CEO of Circle Plus Payments, which is headquartered at 1427 pacific plaza, Suite 1600, Santa Monica, CA.

| Pros: | Cons: |

|---|---|

| No independent resellers: Direct marketing approach. | Customer service issues: Some complaints about service quality. |

| International transfers: Useful for sending payments globally. | High monthly fees: $1,000/month for Payments package. |

| Blockchain tech: Niche use of blockchain technologies. | Additional transaction fees: Costs extra on top of monthly fees. |

| Online management: Enhanced online account services. | Account cancellation reports: Growing number of such incidents. |

| No misleading marketing: Clear marketing strategies. | Limited app usage: Not for all business transactions. |

Circle Plus Payments Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | Under 10 |

|---|---|

| Live Customer Support | No |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Few Complaints

We have found very few negative Circle Plus Payments reviews online. It’s likely that Payable and Wallet Payable users will need to contact Stripe for customer support. Stripe does not provide live phone support except in special cases, so most Payable users will need to conduct all of their customer support via email. This prevents the company from cracking our list of the top merchant accounts for customer service, and users are advised to keep this in mind before signing up and processing payments through the service. If you have your own Circle Plus Payments review to make, please do so in the comments below.

Circle Plus Payments Lawsuits

We have not found any outstanding class-action lawsuits or FTC complaints filed against Circle Plus Payments. Dissatisfied business owners who wish to pursue a non-litigious course of action against the company should consider reporting it to the relevant supervisory organizations.

Circle Plus Payments Customer Support Options

Circle Plus Payments does not list a customer service option on its website beyond a simple contact form. Businesses seeking customer service should defer to Stripe’s customer service. Stripe appears to offer 24×7 phone support in English for all Stripe users but does not publicly list a dedicated support phone number. This is a primary factor keeping it from being considered one of our top-rated providers. However, the company does provide a help section on its website, a community forum, and email support. We are currently able to locate over 300 negative Stripe reviews on this and other consumer protection websites, many of which express concern that Stripe is a scam or a ripoff. This represents a steady increase in complaints since our last review.

Circle Plus Payments Online Ratings

Here's How They Rate Online

No Profile

The Better Business Bureau does not maintain a profile for Circle Plus Payments or for Tarsin Mobile at this time. We therefore will not factor a BBB rating into this review.

Circle Plus Payments Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | No |

| Processing Rates | Variable |

| Equipment Leasing | Unclear |

Pricing From Stripe

The standard Circle Plus Payments contract is simply a merchant account through Stripe with a slight markup above Stripe’s standard pricing. The company charges 2.9% plus $0.30 on all credit and debit card transactions and 0.8% per Bitcoin transaction (with the fee capped at $5). There is also a $0.05 per-transaction fee on all transactions up to $100 and a 0.1% fee on all transactions over $100. There are no monthly fees, setup fees, PCI compliance fees, statement fees, or early termination fees through Circle Plus Payments, and users are free to cancel at any time. The company’s “Payable” app and its companion “Wallet Payable” app are both free downloads through the Apple App Store and the Google Play Store.

Standard Cost, Low Commitment

Overall, the company’s pricing is simple and transparent. Its per-transaction fees for card-not-present payments and Bitcoin transactions are standard for the industry, but mid and high-volume businesses are likely to get better pricing through a budget merchant account with interchange-plus pricing. There are no complaints about Circle Plus Payments’ contract terms at this time, which is a solid indication that most users are satisfied with the rates and fees they pay.

Circle Plus Payments Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

No Sales Complaints

Circle Plus Payments appears to market its products primarily through online advertising and strategic partnerships. There is no evidence at this time that the company employs independently contracted sales agents, and we cannot find any Circle Plus Payments reviews that accuse the company’s sales team of nondisclosure or misrepresentation. As an additional point in the company’s favor, there are no misleading rate quotes or unrealistic guarantees on the Circle Plus Payments website.

Full Disclosure

Circle Plus lists its pricing plainly (it’s the same as Stripe’s pricing) and appears to be completely transparent with regard to its contract terms and fees. If you suspect that Circle Plus is charging you hidden fees, we recommend seeking a free third-party statement audit.

Website Disclaimer

Circle Plus Payments makes it clear on their website that they do not offer payment processing services with the following disclaimer:

Circle plus payments,Inc.™ is a software development company. We enhance payment experience with Stripe Connect for merchants. We do not sell/have merchant accounts or perform transactions for you. We enable a better experience through an integrated secure front end with various transaction options. We are a Stripe Connect platform App with all the features. You as a merchant through our app can sign with Stripe and assume all financial and legal liabilities for the transactions.

Please Do not use www.circlepluspay.com as your website when you sign in and please sign in with your business website as a Connect user. Please do not signup if you are one of the prohibited businesses per Stripe. Stripe Prohibited Business.

Our Circle Plus Payments Review Summary

Our Final Thoughts

Circle Plus Payments rates as a reliable money transfer and credit card processing service at this time. We have not found any information that paints the company in a negative light, but it’s also hard to see how it differentiates itself from Stripe outside of its user-friendly app. Circle Plus Payments is not showing any complaints and appears to offer industry-standard pricing and contract terms. Users should be aware of Stripe’s lack of live customer support and ought to consider working with a top mobile card processor.

If you found this article helpful, please share it!

nitish kannan

The website and new app is being relaunched!

Nitish Kannan

Circle Plus Payments is an independent company that’s doing a joint IPO with Tarsin Inc, not owned by. Also the address is 829 Broadway unit 310, Santa Monica, CA 90401.

Nitish Kannan

CEO CirclePlusPay