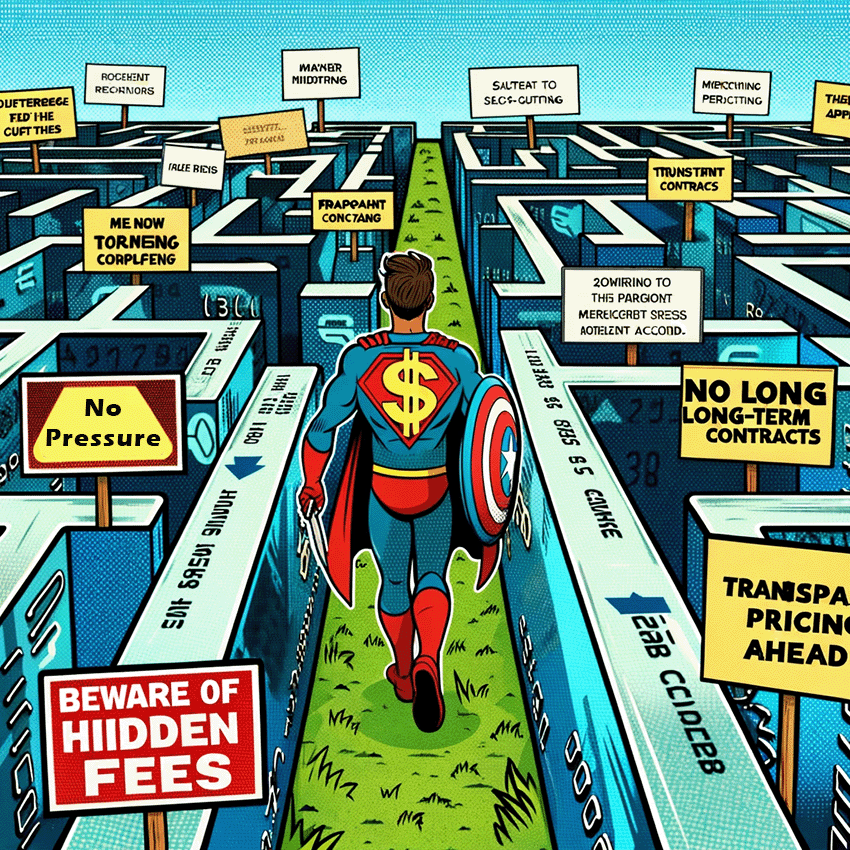

Successfully Navigate The Merchant Services Labyrinth

As a small business owner, managing your payment processing costs effectively is crucial to your success. One critical aspect of this is choosing the right merchant account provider for your credit card processing. This decision goes beyond just comparing fees and features; it involves finding a trustworthy provider in a landscape where scams and misleading practices are all too common. The importance of being well-informed and vigilant cannot be overstated when navigating the myriad of merchant account options available in the market today.

In this constantly evolving industry, small business owners face the challenge of deciphering complex fee structures, understanding contractual terms, and identifying genuine value. The threat of falling into a merchant account scam looms large, with consequences ranging from overpaying for services to getting locked into restrictive contracts that hinder your ability to switch providers. Therefore, being equipped with the right knowledge and approach is imperative to protect your business from such pitfalls.

This article aims to guide you through the top five ways to avoid merchant account scams. By understanding these key strategies, you can make informed decisions that safeguard your business's financial health and ensure your merchant account is a boon, not a burden. These tips are designed to give you the confidence to select a credit card processing service that aligns with your business needs, offering transparency, fairness, and flexibility

1. Do Not Pick a Processor That Doesn't Publish Its Pricing

Transparency is the cornerstone of any trustworthy financial service, and this holds especially true in the world of merchant account providers. A reputable provider should always be open and upfront about their pricing structure, making it easy for you to understand what you're paying for. The importance of this transparency cannot be overstressed, as it is a key indicator of the provider's integrity and customer-focused approach.

When evaluating a provider, be wary of those that do not publish their rates and fees on their website, or seem hesitant to disclose their complete fee structure without first seeing what you are paying with your current processing company. A common sales tactic among shady merchant account providers is to offer a “statement analysis.” Often, such an analysis is intended to show you enough savings to get you to switch your services but is rarely an accurate representation of what you will end up paying. They often omit important fees or “downgrade” charges that can end up costing you just as much, or even more, than your current provider. Hidden fees are a common among providers that market themselves though providing statement analysis. These can include various undisclosed charges such as statement fees, terminal fees, PCI compliance fees, and even contract termination fees. Over time, these hidden costs can accumulate significantly, leading to a substantial financial burden for your business.

To avoid such pitfalls, it is crucial to look for providers who provide clear, detailed information on all potential charges. This should include not only the obvious transaction fees and monthly charges but also any additional expenses that might arise. For instance, some providers might charge extra for customer service, online reporting tools, or even for the processing of certain types of transactions. A clear breakdown of these costs allows you to budget effectively and compare different providers on a level playing field.

Moreover, transparency in pricing isn't just about preventing hidden costs; it's also about understanding the value you're getting for your money. A provider that is straightforward about their charges is more likely to offer fair and competitive pricing and to provide services and features that genuinely meet your business needs. This level of openness fosters a trusting relationship between you and the provider, ensuring that your business's financial operations are handled with honesty and integrity.

2. Never Sign Service Length Agreements

Long-term contracts in the realm of merchant account services can indeed be a double-edged sword. While they might initially appear attractive, particularly when accompanied by the promise of lower fees, the reality is often less favorable for small business owners. The allure of saving money can quickly be overshadowed by the inflexibility and potential risks associated with such commitments.

One of the primary concerns with long-term contracts is that they may not align with the dynamic nature of small businesses. Your business needs today might be vastly different in a year or two, whether due to growth, market shifts, or changes in customer payment preferences. If you're locked into a multi-year agreement, adjusting to these changes can become complicated and expensive. For instance, if you find that the services provided are no longer adequate or if newer, more cost-effective options become available, you're still bound to your original agreement. Exiting these contracts typically involves paying substantial termination fees, which can be financially damaging.

Additionally, long-term contracts can create a sense of complacency for the service provider. With the security of a fixed contract, there may be less incentive for them to maintain high service standards or stay competitive in terms of pricing and technology updates. This situation can leave your business at a disadvantage, both in terms of costs and the quality of service received.

In contrast, opting for a provider that offers month-to-month services introduces a level of flexibility that can be invaluable for a small business. This approach allows you to evaluate the service continuously and make changes without the fear of punitive costs. If you're dissatisfied with the service, or if you find a better deal elsewhere, you can switch providers with relative ease. This flexibility not only keeps your business agile but also encourages your merchant account provider to continuously work to meet your needs and expectations.

Furthermore, the ability to switch providers without severe financial repercussions empowers you as a business owner. It allows you to negotiate better terms and take advantage of advancements in technology and services that could benefit your business. It also creates a healthier, more competitive market where service providers are motivated to offer the best possible terms and services to retain their clients.

3. Never Feel Pressured to Act Quickly

High-pressure sales tactics are indeed a significant red flag in the world of merchant services and, frankly, in any business transaction. When a provider is aggressively pushing you to make a quick decision, it's often a strategy designed to prevent you from fully understanding what you're agreeing to. This approach can lead to hasty decisions, which might not be in the best interest of your business.

The reason behind such urgency is usually twofold. Firstly, these providers might be trying to prevent you from scrutinizing the fine print of their contracts. These details often contain hidden fees, unfavorable terms, or clauses that are disadvantageous to your business. By rushing you, they hope to gloss over these aspects, leading you to commit without fully understanding the implications.

Secondly, high-pressure tactics are used to deter you from shopping around and comparing their offer with other providers. In a competitive market, taking the time to compare different services, fees, and contract terms is crucial. This process ensures that you find the best possible fit for your business needs and budget. Providers who discourage such comparisons are often aware that their offer might not hold up under scrutiny.

A legitimate and reputable service provider, on the other hand, will recognize the importance of this decision for your business. They will provide you with all the necessary information and give you ample time to consider their offer. Such providers are confident in the value of their services and are willing to allow you the space to make an informed decision.

It's always advisable to take your time when making decisions that impact your business financially. Do thorough research, read all the documentation provided, and don't hesitate to ask questions if anything is unclear. This might include researching specific fees, contract terms, or service commitments. Remember, a good provider will be transparent and patient in addressing your queries.

Consulting with a financial advisor or a fellow business owner who has experience in merchant services can also provide valuable insights. They can help you understand the industry standards, identify potential red flags, and make a decision that aligns with your business goals and financial health.

4. Only Agree to Interchange-Plus Pricing

Interchange-plus pricing is indeed widely regarded as the gold standard for transparency in credit card processing fees. This pricing model is appreciated for its straightforwardness and fairness, qualities that are essential for small business owners who need to manage their finances carefully.

In the interchange-plus model, the costs are broken down into two main components: the interchange fees and the processor's markup. The interchange fees are non-negotiable charges set by the credit card networks (like Visa, MasterCard, etc.) and are the same for all merchants. These fees go directly to the card-issuing banks and vary depending on several factors such as the type of card used (debit or credit), the card's brand, and the nature of the transaction (in-person, online, etc.).

The second component, the processor's markup, is where the credit card processor makes its money. This markup is added on top of the interchange fees and is where you'll find variability between different processors. What makes interchange-plus pricing so transparent is that this markup is clearly delineated from the interchange fees. You can see exactly how much you're paying the processor over and above the baseline cost of the transaction.

This transparency is in stark contrast to tiered pricing models, which can be confusing and less transparent. In a tiered model, transactions are categorized into different tiers (qualified, mid-qualified, non-qualified), and each tier has its own rate. These tiers are determined by the processor, often based on criteria that are not clearly disclosed to the merchant. This lack of clarity can lead to a situation where you end up paying significantly more than you expected, as transactions that you assume would fall into a lower-cost tier might be classified differently.

Furthermore, tiered pricing models can be used to hide excessive markups. Since the criteria for categorizing transactions into tiers can be obscure, processors can manipulate these tiers to maximize their profits. For example, a large number of transactions might be routed into higher-cost tiers, leading to higher overall charges for the merchant.

By contrast, interchange-plus pricing offers a clear, itemized statement showing exactly how much you're paying in interchange fees and how much is going to the processor. This transparency enables you to understand your costs better and can aid in negotiations with the processor. You're more likely to get a fair deal when the costs are laid out plainly, and there's less room for hidden charges.

A Note About Flat-Rate Pricing

Although Interchange-plus is the most transparent pricing option, most processors offering it require a credit check of the owner and a full evaluation of your business. If you are just starting out or testing a new business idea, it could make more sense to select a provider like Square that offers a flat rate for all transactions. With such providers, you will not be subject to a credit check or an in-depth analysis of your business. You will pay a rate of approximately 2.9% + $0.30 per transaction, which is more expensive than Interchange-plus. However, your access to card acceptance will be quicker, and your costs will be more predictable.

5. Only Pay Extra Fees for Actual Features

When it comes to selecting features and services from a merchant account provider, it's crucial to focus on what's relevant and valuable to your business, and avoid incurring obscure monthly or annual fees that don't directly contribute to enhancing your operations. Many providers may try to include various non-essential fees as part of their service packages, such as statement fees, PCI compliance fees, or other miscellaneous charges. It's important to discern these from fees that correspond to value-added services.

For any small business, every expense should ideally be tied to a tangible benefit. Features that directly contribute to the efficiency, security, or customer experience of your payment processing are worth considering. For example, security features that protect customer data, efficient payment processing systems, or analytics tools that offer insights into your sales trends are all services that add clear value.

On the other hand, charges like statement fees or PCI compliance fees can often be less transparent in terms of the value they bring to your business. A statement fee, for instance, is typically charged for the delivery of a paper statement, but in today’s digital age, most businesses can easily access this information online at no additional cost. Similarly, while PCI compliance is crucial for the security of your transactions, some providers might overcharge for this service or include it as a separate, obscure fee. It’s important to understand whether these costs are justifiable and if they align with the actual services provided.

When evaluating the cost structure of a merchant account provider, ask for a detailed breakdown of each fee and how it contributes to your service. If a fee doesn’t seem to directly support a service you require, it’s worth questioning its necessity. In many cases, providers are willing to negotiate or waive certain fees, especially if they are not tied to any specific value-added service.

Additionally, always consider the overall cost-effectiveness of the services provided. Sometimes a slightly higher upfront cost for a service can be more economical in the long run if it includes all necessary features without additional obscure fees. Conversely, a seemingly lower-cost option might end up being more expensive due to these hidden charges.

Bottom Line

As a small business owner, you have enough on your plate without worrying about falling victim to a merchant account scam. By following these five guidelines, you can protect your business and ensure that your credit card processing is a boon, not a burden. Remember, a trustworthy provider will prioritize transparency, flexibility, and fairness, aligning their services with the needs of your business. Stay informed, stay vigilant, and choose a partner that supports your business's growth and success.

Scam-Free Processors

Helcim

Helcim is the only provider we have found that fully aligns with the principles outlined above. With this processor, you will only pay when you process a sale, as there are no monthly or annual fees. Additionally, Helcim exclusively offers Interchange-plus rates with a transparent and fair markup. Furthermore, it is the only processor in the industry that automatically applies volume-based discounts. This means that as your business grows, Helcim reduces its markup without you needing to request it. This feature is truly exceptional in the credit card processing industry.

All of Helcim's services are included without any additional charges for value-added features such as invoicing, online store creation, subscription payments, etc. The only extra costs are for affordable credit card processing hardware, such as countertop or mobile card readers. We truly hope that more processing companies will take notice and adopt Helcim's model of pricing and features.

Visit Helcim's website for all of the details.

Questions or feedback? Please let us know in the comment section below!

Reader Comments

Tell Us What You Think