Overview

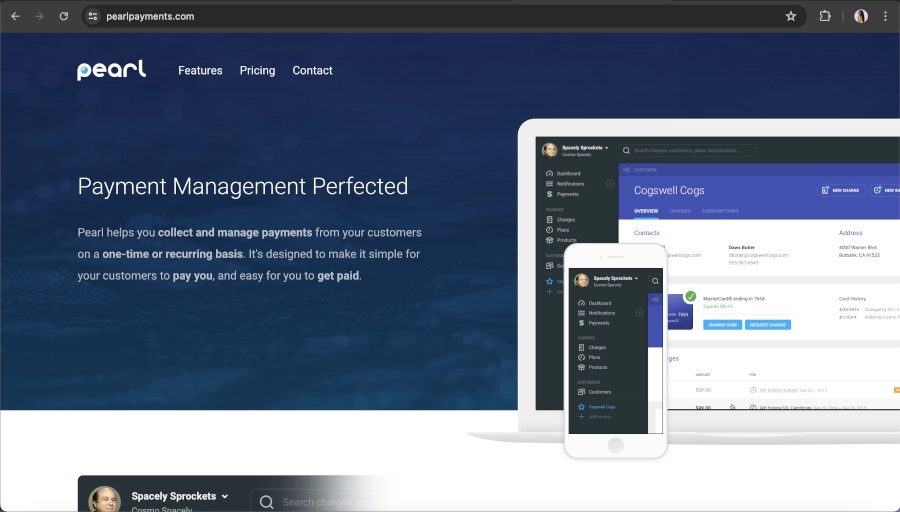

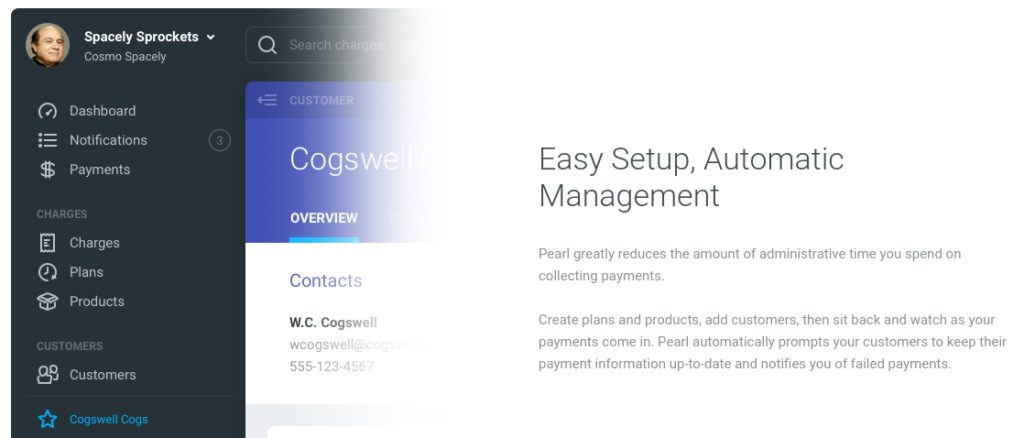

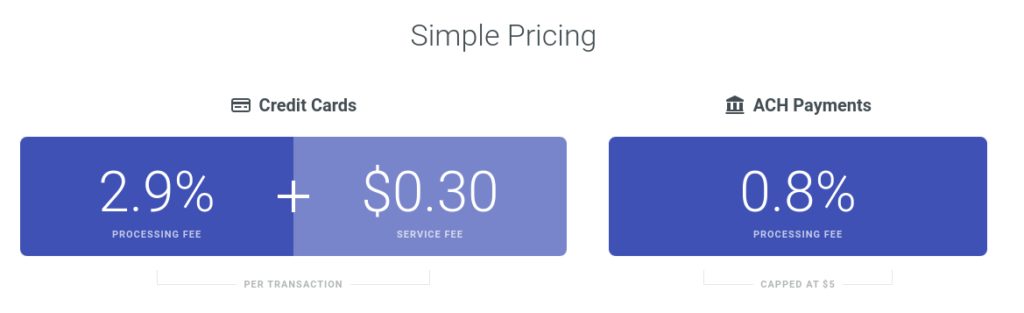

In this review of Pearl Payments, we examine this payment management software for handling both one-time and recurring payments, with a focus on automation that aims to simplify credit card and ACH transactions and reduce the time spent on collections. We also highlight potential drawbacks including common customer complaints, contract stipulations, and customer support issues. To give perspective, we compare Pearl Payments to other processors by reviewing rates, fees, and service models. For businesses considering Pearl, this review offers a balanced look at both benefits and risks. Finally, we explore Pearl’s background, including its developer Swing Set Labs, to present a fuller picture of the company behind the platform.