Transparent Merchant Services Reviews & Complaints

Budget-Friendly Pricing

Transparent Merchant Services is a merchant account provider based in Scottsdale, Arizona. The company offers standard credit card processing solutions for all business types, but what sets it apart from most of its competitors is its unique pricing model. Similar to Payment Depot or BaseRates Merchant Services, Transparent Merchant Services charges merchants a flat monthly rate with a per-transaction fee of interchange plus a fixed dollar amount. This means that Transparent does not keep a percentage of each sale for itself, which could make it appealing for merchants with high average tickets who want the cheapest credit card processing possible.

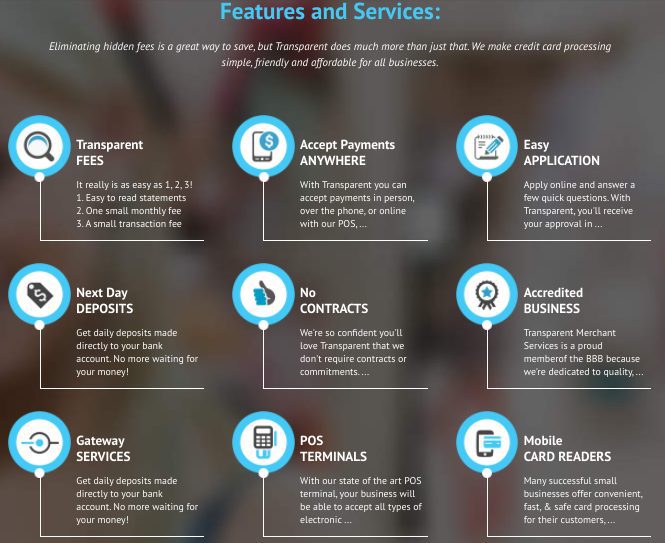

Transparent Merchant Services Payment Processing

Transparent Merchant Services appears to process most major debit and credit cards. They offer POS solutions through Ingenico, Walker mobile payment equipment, the Poynt 5 terminal, PCI compliance through Conformance, and a payment gateway, though it is unclear which gateway they use.

Transparent Merchant Services Location & Ownership

The Transparent Merchant Services website states that its merchant accounts are provided by Base Commerce, LLC, a registered ISO/MSP of Synovus Bank. The company is located at 1776 N. Scottsdale Rd #845 Scottsdale AZ 85257. Dustin Sparman is listed as a managing partner at Transparent Merchant Services.

Transparent Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

Clean Complaint Record

Transparent Merchant Services reviews, garnered from various consumer protection websites, show very few negative experiences. Notably, there are no suggestions online that the company is involved in fraudulent activities. The minimal number of Transparent Merchant Services complaints suggests the company’s commitment to providing excellent customer support and resolving issues efficiently. If you have a Transparent Merchant Services complaint, we encourage sharing your experience in the comments below.

Transparent Merchant Services Lawsuits and Fines

As of our latest research, there are no outstanding class-action lawsuits or FTC complaints filed against Transparent Merchant Services. Merchants seeking non-litigious resolution of disputes with the company can find guidance on how to report concerns to supervisory organizations.

Transparent Merchant Services Customer Service

Transparent Merchant Services prides itself on offering multiple channels of customer support. These include phone support during business hours, along with chat support and email assistance, ensuring a comprehensive approach to customer service. Additionally, their website hosts a blog that provides valuable insights for merchants.

For assistance, the following Transparent Merchant Services customer service numbers are available:

(623) 920-0231 – Toll-Free General Customer Service

(866) 316-9993 – Fax

For further support, merchants can reach out to the dedicated email address at [email protected], or utilize the live chat support and support form available on the company’s website.

Transparent Merchant Services Online Ratings

Here's How They Rate Online

| Total Complaints | 0 |

|---|---|

| Resolved Complaints | 0 |

No Complaints

Transparent Merchant Services currently has an “A+” rating with the Better Business Bureau and was formerly accredited since June 2014 but no longer is accredited. The company’s BBB profile has only existed since June 2014 as well, but it has not accumulated any formal complaints in that time. There are also no unverified reviews posted about the company in the BBB’s “Reviews” section.

An “A” Performance Overall

Given the company’s clean complaint record, we agree with the BBB’s rating. This strong performance with the BBB is a major reason why we recommend Transparent for dentist merchant accounts, pharmacy merchant accounts, mechanic merchant accounts, and other professional services.

Transparent Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Swiped Rate | Interchange Plus $0.09 or $0.15 |

|---|---|

| Keyed-in Rate | Interchange Plus $0.09 or $0.15 |

| Early Termination Fee | None |

| PCI Compliance Fee | $99 Per Year |

| Equipment Lease Terms | $9.95 Per Month or Free |

Two Plans to Choose From

Transparent Merchant Services offers two primary pricing plans: Pro and Elite. The Pro plan entails a flat monthly fee of $64.97 alongside a per-transaction fee of interchange plus $0.15, tailored for merchants handling up to 500 transactions monthly. On the other hand, the Elite plan, priced at $99.97 per month, includes a per-transaction fee of interchange plus $0.09, catering to merchants processing over 500 transactions monthly. Additionally, for businesses exceeding $100,000 in monthly transactions or $1.2 million annually, the company provides customized Enterprise merchant account pricing.

Month-to-Month, No Termination Fees

Both lower-tier pricing plans come with a month-to-month agreement devoid of early termination fees or setup charges. However, there is a $99 annual PCI Compliance fee levied on the third billing cycle. The company also provides point-of-sale equipment, which can be rented for $9.95 monthly, purchased outright for $249, or offered for free to businesses processing over 300 transactions monthly. Overall, while these Transparent Merchant Services rates are reasonably competitive within the credit card processing industry and boast high transparency, merchants are advised to calculate costs based on their transaction volumes and applicable pricing tiers prior to enrollment. We encourage merchants to explore our list of the top merchant accounts and thoroughly review their Transparent Merchant Services contract.

Transparent Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Employs Independent Resellers | No |

|---|---|

| Advertises Deceptive Rates | No |

| Discloses All Important Terms | Yes |

Clean Complaint Record

Transparent Merchant Services appears to utilize traditional advertising methods and in-house, W2-employed sales agents to market its services. This tactic is generally preferable to hiring mill strategies because it ensures a greater degree of control over agents’ conduct. We are currently unable to locate any Transparent Merchant Services reviews that accuse the company’s sales staff of deception or nondisclosure, indicating that the company places an emphasis on forthright sales pitches.

This compares favorably to our list of best credit card processors.

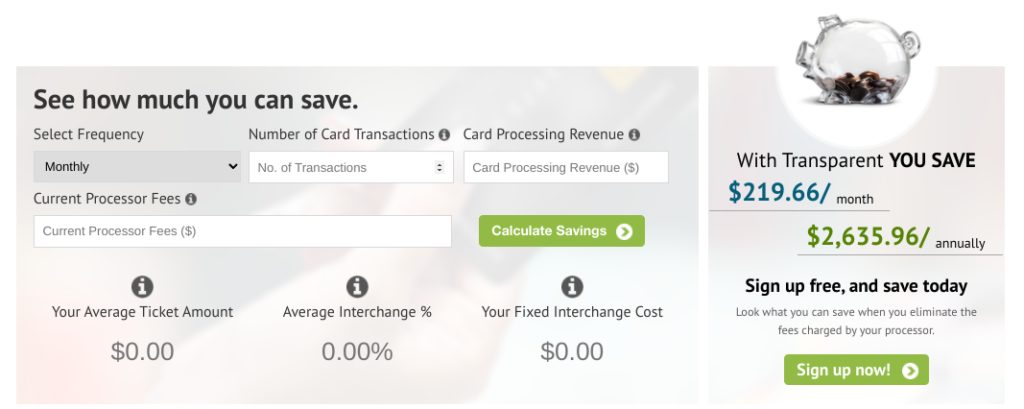

Understanding the Rate Calculator

As of this review, the Transparent Merchant Services website features a tool for calculating your potential savings through the company. This tool is useful for merchants who are currently on interchange-plus pricing because it draws a direct comparison between Transparent’s markup above interchange and a merchant’s existing markup above interchange. Merchants who are on tiered pricing should note that the tool assumes an average interchange rate of 1.6%, which may be more or less than the average interchange rate each merchant typically receives.

True to Its Name

To its credit, the company’s website does not promote any outright deceptive “teaser” quotes. Transparent’s pricing is fully disclosed for anyone to view, which is a major reason why we consider it a top-rated merchant account provider.

Our Transparent Merchant Services Review Summary

Our Final Thoughts

Huge Potential for Savings

Transparent Merchant Services rates as a quality merchant services provider according to our rating criteria. The company offers month-to-month agreements with transparent pricing and is not showing almost any complaints online. The one potential drawback for merchants to consider is that the company’s pricing, though transparent, may not be the most cost-effective option for certain business types. As a general rule, merchants who process fewer transactions at larger volumes are best served by the company’s pricing model.

If you found this article helpful, please share it!

Rita Carnevale

I’ve left many different forms of messages for their sales dept. to contact me as a potential customer, but my efforts were fruitless. Can you imagine a company not responding to a potential customer’s numerous messages???? I shudder to think how they treat their existing customers!!!! **POOR SALES SERVICE**