So, What Exactly is a Chargeback?

The Buyer's “Undo” Button

Besides being a major pain in the neck, a chargeback is a customer-initiated reversal of an electronic payment. The main difference between a chargeback and a refund is that customers initiate chargebacks by placing a dispute with their card issuer. A refund, on the other hand, is the result of a merchant and customer mutually agreeing to credit the customer back through a direct interaction. A refund is usually less contentious and also involves a return of merchandise, whereas a chargeback may not.

What Happens Next?

A chargeback results in the forcible reversal of a transaction, thereby causing the transaction amount to be taken from your merchant account and credited back to your customer's credit card. If you do nothing in response to a chargeback, the sale will effectively be cancelled and the customer will receive their money back as well as the product or service they have already received. If you want to avoid this outcome, you must file a counter claim and provide proof that the customer approved the transaction.

What Does a Chargeback Cost?

In addition to costing a merchant the amount of the sale and the actual inventory sold, chargebacks can result in other fees and penalties charged by their processor as well as the internal time spent fighting the disputed charge. Merchants with excessive chargeback rates (typically greater than 1% or 1.5% of all transactions) may find themselves unable to qualify for a merchant account or placed on the MATCH list.

Chargebacks Can Happen to Anyone

Although online and high-risk merchants tend to deal with chargebacks on a more frequent basis than traditional retail merchants, all businesses that accept credit card payments are vulnerable to chargebacks. Luckily, it is possible for merchants to successfully dispute chargebacks, recover their funds, and keep their chargeback rates low. Below, we've listed some of the best strategies for fighting a chargeback and winning a chargeback dispute.

4 Ways You Can Fight Chargebacks

1. Resolve Complaints Through Customer Service

Proactive and effective customer service can go a long way toward resolving chargebacks or preventing them altogether. Chargebacks are most commonly initiated when customers feel as if they are unable to obtain a refund through your customer service department. By clearly displaying your customer support contact information on your website and making your refund policies available to customers, you can prevent buyers from feeling powerless and perhaps encourage them to think twice before pursuing a chargeback.

When a customer initiates a chargeback, you'll typically have a small window of time (7-10 days through MasterCard, 30 days through Visa) to dispute it through Visa and MasterCard's established channels. In this period of time, it can often be helpful to contact the customer directly and inquire as to the reason for the chargeback. Customers can undo chargebacks by contacting their card issuer, so reaching out to the dissatisfied party in a genuine and timely manner may persuade them to stop pursuing the claim.

If the customer's complaint is valid, you should issue a refund as soon as possible rather than concede the chargeback. If you feel that a refund is not in order, this exchange may at least provide some idea of why the customer felt compelled to initiate a chargeback rather than request a refund in the first place. This information will be useful both during the dispute process and when assessing your chargeback prevention policies.

A good general rule:

If you believe the customer is in the right to request a reversal of the sale, refunding the customer is the recommended course of action. However, if you believe the customer's complaint is without merit or perhaps an attempt to avoid paying for a legitimate transaction, evaluate your chances of winning a chargeback dispute.

If you do not feel 100% confident that you will win the chargeback dispute due to a lack of documentation, an inability to respond on time, or any other factors that put the strength on the customer's side, you may be better served by issuing the refund instead of risking a defeat to your counter-claim. It may seem like a senseless loss to concede the funds, but, by doing so, you can avoid a hit to your chargeback success rate and save yourself the headaches involved with the chargeback process. Issuing a refund is always preferable to losing a chargeback dispute.

That being said, if you have solid documentation and the time and energy to contest the chargeback, you should by all means submit a counter claim and try to recover your money.

Visa Merchant Purchase Inquiry

In February 2018, Visa shortened and streamlined its chargeback process for merchants and customers. One change that the company made was the introduction of a simple plug-in to Visa's chargeback resolution program called Merchant Purchase Inquiry. Whenever a customer files a chargeback against a merchant who uses Merchant Purchase Inquiry, Visa will immediately check the available details surrounding the transaction and offer the merchant three options:

- Respond with additional data (provide transaction-specific data such as a description of goods purchased or device used)

- Respond with customer credit (credit the cardholder prior to receiving a dispute)

- Respond with additional data and a credit

Through this system, Visa enables you to offer one of these resolutions to the customer's issuing bank before the chargeback process begins in order to avoid the entire process. Visa will also scan its transaction records for any transactions that appear to have resolved the dispute (for instance, a payment from you to the customer in the same amount as the transaction) and supply this to the customer's issuing bank. Merchant Purchase Inquiry is an entirely optional step, but you may be able to save a lot of time with this approach.

2. Gather Transaction Records

If a customer won't accept a refund, or if you want to fight the chargeback, you will be faced with the burden of providing evidence to contest the customer's claim. This evidence will usually be some sort of transaction or delivery documentation, including (but by no means limited to):

- signed receipts

- delivery or pickup notification

- any communication between you and customer regarding the transaction

- the customer's IP address and the download time and date (if a digital service)

- evidence proving that a customer lives or works at the delivery address

- evidence that the customer has previously used the same transaction information to process undisputed purchases

- evidence that someone related to the customer could have made the purchase with the customer's card

Today, much of this information can be captured and stored digitally through point-of-sale systems. Keeping organized transaction records will help to ensure that you can assemble all of the necessary evidence within the short timeframe allowed.

3. Respond Quickly

Once you receive notification that a chargeback will proceed, you should quickly and efficiently prepare a response. A chargeback dispute must travel through several levels of review and authorization and will be subject to scrutiny by multiple parties, so it is essential that you present your evidence clearly and with urgency.

Your first step should be to take note of all applicable deadlines, which may vary depending on the processing network involved. You'll want to ensure that these deadlines will be monitored and met. You may want to prepare a spreadsheet ahead of time to store this information, or you could schedule notifications in some sort of digital calendar. You should also ensure that all documentation is formatted properly (saved in the file types required by Visa/MasterCard and arranged in the correct sequence) and sent via the appropriate channels as specified by the card network.

One helpful strategy is to prepare a chargeback response template ahead of time, with all of the general information and paperwork pre-assembled, and then fill in or attach case-specific evidence when a chargeback occurs. General information that could be included in this template may be your business's return policy, terms of use, delivery schedule, and/or other contracts or agreements which could be applicable to all potential chargeback cases. This will save you the trouble of having to re-learn the process each time a new chargeback arises.

Chargeback Reason Codes

Your initial chargeback notification will include a particular “reason code” used to classify the chargeback. Just as it sounds, this is a number that corresponds with a particular reason that a customer might request a chargeback. These reasons can include a long list of issues, from fraud to non-delivery of services to processing errors, and the specific codes assigned to each problem vary between card networks.

Understanding a chargeback's reason code is essential when preparing an effective chargeback dispute case. For instance, if the chargeback reason code alleges that merchandise was not delivered, you should provide tracking and delivery notifications, evidence that the customer lives or works at the product's destination, or other proof that the customer received the product. Please note that some reason codes only allow a specific range of evidence, as the card networks do not want to sift through more information than they consider necessary. For this reason, you should be sure not to include irrelevant or excessive information and to follow any provided guidelines as to what evidence is admissible.

Compelling Evidence

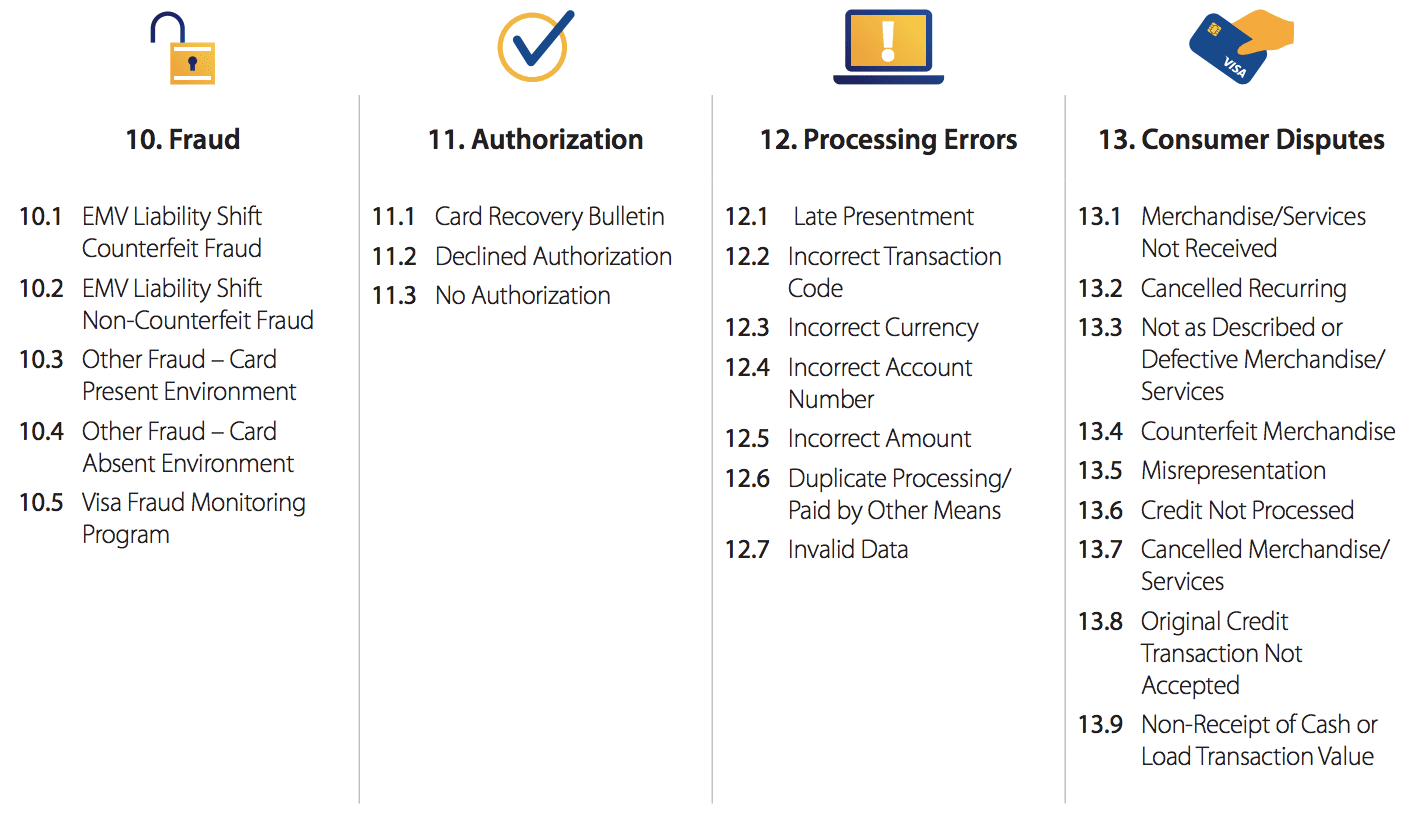

As part of its 2018 overhaul, Visa consolidated its 22 reason codes into four distinct categories: fraud, authorization, processing errors, and customer disputes. The exact grouping of these codes can be seen below:

Visa also provides an extensive breakdown of specific evidence that you can submit to contest a claim under any of its codes. You can see that breakdown in its Visa Chargeback Management Guidelines.

As this document shows, allowable evidence includes a broad range of data, from photographs to signed invoices to IP addresses. You may have some or all of this information stored somewhere, but you should include only what is allowable and relevant. Be sure to arrange it in a sensible way; remember that Visa and MasterCard are not familiar with the case and will be seeing this information for the first time. By including clear, detailed, verifiable evidence and submitting this evidence ahead of the established deadlines, you can dramatically improve your chances of successfully contesting chargebacks.

4. Track Successful Dispute Methods

After you submit your rebuttal to the card network, the chargeback dispute is out of your hands. Your processor's acquiring bank will review the information and, if necessary, forward it to the customer's issuing bank. The card network will then make an ultimate decision about whether it will process the chargeback, and it will inform the customer of its decision.

Although a large portion of the chargeback dispute process is beyond your control, you can still learn from each chargeback. You should take note of which chargeback dispute attempts prove successful and then seek to replicate them. You should also keep track of common chargeback reasons. Is there a trend? For instance, if customers are frequently reporting fraudulent card swipes, you might look into your fraud prevention policies at the point of sale.

You Can Win!

The truth of the matter is that you have some level of control over your chargeback rate whether through prevention or through solid dispute procedures, which means that you always have a chance to recover your money. Chargeback disputes can be an expensive and time-consuming process, but you can save yourself headaches (and money) by establishing a sensible, efficient chargeback dispute process.

We want to hear from you! Share your chargeback stories in the comment section below. Tell us how you have successfully fought a chargeback claim, or what you learned from losing a chargeback dispute.

Rick

In the past, on other marketplaces, I’ve been able to be notified and resolve or win fraudulent claims and chargebacks, but I am currently selling on Facebook marketplace and frankly they flat out lie about notifying you and also about any means to dispute.

They never send you a email about any claim, you must stumble across that there is now one at your insights and they say there’s an appeal button that doesn’t actually exist.

On chargebacks, they say they will email and put in commerce manager when a chargeback occurs, but they do not email you and there s no listing in commerce manager for the items or a orders and dispute.

You just get to find out by seeing that a sale you delivered 104 days ago, suddenly is having the money deducted from your recent orders payouts and you are also being charged a $20 chargeback fee, will no way to appeal squat. Claims and Chargebacks just get processed without you having any ability to submit proof or dispute them at all.

All the while support gives you meaningless template responses and always refer you to non-existant ability to be notified and appeal. I ABSOLUTELY HATE LIARS TO THE N’TH DEGREE.

Carole Arsenault

After reading this most helpful article I was able to find a connection between the owners main address and the shipping address. Am submitting my evidence and feel more confident to win the chargeback dispute. Thanks so much for this valuable insight. Will keep you posted

Shelby Wood

I had the same experience 2 different transactions worth $300 each to Mexico. After 30 days they dispute charges. 1st transaction never received item and 2nd didn’t recognize transaction. After sending all documents and even transactions and tracking number Credit card company still siding the thieves. They had the product for free, totally insane.. that’s why I decided to hold off my online store.

I am thinking they have to be forced signing a disclosure when purchasing a product or cash on delivery. What do you guys think?

JB

As an online retail store, we are no longer accepting PayPal. They have granted the customer a refund although it was in violation of our store policy and the customer has had the item for 4 months. They did ask the customer to return the product first, which I guess was nice? Although we provided copies of every part of the transaction, down to pictures of the product we shipped prior to shipment (these are custom so we take pics) they sided with the customer who simply gave one sentence…The product I received was not the same. (It was but once they received it they didn’t like the color THEY chose). The customer even agreed to our store terms and conditions when purchasing and still, we are at a huge loss. There is no real seller protection. You just have to hope that your customers are honest and good because the few who are not can get away with anything. Just can’t take that chance on a daily basis so they are no longer a payment option for our company. This is unfortunate because as a consumer, I used PayPal often but will not in the future. It works great…until it doesn’t!

This post will help: Best PayPal Alternatives

-Phillip

pliendante47atgmaildotcom

With the help of a recovery expert i was able to recover my money from a scam broker , Happy to share my experience.

claudia whetstone

I need help to recover my paycheck stolen by client’s credit card dispute. Who can help please?

Judy

What I have learned about chargebacks is that the credit card companies control everything. Years ago, if you had all of your evidence then the company would win. Most chargebacks are scams or people changing their minds, or the customer makes a mistake with his/her size or color on a custom item and doesn’t want to be responsible and pay the fees to return it. Additionally, the credit card companies do not insist that the customer return our merchandise and just give them back their money – and I have to pay the fee. So not only do I lose the sale but also the vendor costs and the shipping and fees. Sometimes the customer will allow us to pick it up but again, it costs us additional shipping. It has to stop. The rules need to change. Maybe I should advertise discounts if people paid by bank check.

Julie

Credit Card companies are scamming businesses and siding with customers no matter what. Apparently the customer is always right. Just like Judy said, the customer has buyers remorse, or item doesn’t fit or they don’t like it, so they file a dispute and no matter what evidence you give, the business is always in the wrong. They don’t have to return their item/s, so now you’re out product, product fees, the dispute fee and you can’t even sell the item back because it was never returned! For example: I sell an item to a customer for $100 and I paid $50 for the item. The customer files a dispute and wins. Now I’m out $150 plus the credit card dispute fees. And I’ll never get that money back because the customer didn’t have to return the item! How is this fair???? Please let me know Stripe, VISA, American Express, etc… Someone has to stop this. Customers are scamming the system because the credit card companies are allowing them to. Very frustrated.

From The Editor

This Post Might Help: How to Fight Chargebacks and Win

PayPal Terminator

There are several reasons of why many of times the buyer wins a credit card disputes. (1) the sellers dont sue Visa and Mastercard for their business practices. Its the same thing that PayPal gets sued for and still continues to do it. Everyone has to start getting together and tell the credit card companies that merchants arent going to put up with their crap any longer. Buyers are morons period. Credit card companies have brainwashed these weak minded people into using their credit card for everything. Then running a campign that says basically “you got a problem file a chargeback your 100% covered.” So the credit card companies themselves promote fraud. And that so called chip that was supposed to get rid of fraud, more of credit card companies moronic thining that merchants should sue them. They didnt stop fraud with the chip, these aholes pushed the fraud to the internet and thats why fraud is climbing and they are doing nothing about it and they know it. (2) Credit card companies, have the final decision in on who wins, and its the buyer’s credit card company. Who do you think they are going to side with, you the merchant or someone they are making 25% interest off? Another law suit merchants should intiate against visa mastercard etc. (3) credit card companies allow the dispute process to be easily done. There are so many ahole buyers out there that will sit there and play stupid and purposely commit fraud. Especially when they know the product ships. You’ll put every single piece of evidence that you know the buyer is lying and then all of the sudden you lose the case. Your processing company wont appeal the decision or step in because they already got your processing fees and chargeack fees for it. They wont make any more money. And another thing you can sue visa master card about is the arb fee for 2nd chargebacks that are used to scare of the merchant and give the product and money to the buyer. The buyer does not pay one cent for it but the seller is forced to sign a document saying its going to cost $hundreds to fight. (3) the fact that no one is on your side as a company. If you run a company and operate as one everyone and we, we mean everyone is out to screw yo over. Try to sue the buyer, the buyer just ignores it, take them to court and they can right into your state attorney generals office. And they dont do anything. They see the complant from the buyer and your guillty immediately. Regardless of the evidence you have t prove fraud, your still the theif. A long time go buyers had a harder time to file disputes and had to go through a process that was enforced, but since banks are greedy, they lax these rules and a buyer can file a dispute the second the transaction clears and there’s nothing the banks are going to do about it. Until merchants fight back and sue visa and mastercard there’s nothing thats going to be done. Merchants should be in fear that their source of income is going to be turned off. You have to make every single buyer pay for the fraud that happens. Its the buyer that causes the problem so every buyer has to pay for everyone elses actions.

This post will help: Visa’s New Chargeback Rules: What You Need To Know

-Phillip

miguel

I am having a charge back on Paypal

I sold about $800 value on herbalife supplements to a costumer on my website. In order to process payment I use PayPal.

After three months this costumer filled a charge back.

I sent all sales proof to paypal and the credit card issuer of the buyer decided the case on their favor.

I tried to contact the buyer by phone and by email. I haven’t been able to reach them. The first time when I called the buyer they answered it and they told me they are going to called me back because they were busy, but never called back.

I kept calling them and leaving Voicemails and I am still being frustrated.

Anyone knows how can I proceed or how can I still fight this transaction.

Maria

I too was scammed through Paypal for $1000.00. I sold $4200.00 worth of a fragrance 150 bottles at $28.00 each the thief reach out to me after he saw a posting on eBay and wanted to do business on a larger scale . he asked if we could bypass eBay and use only Paypal and he could get a better deal as I would be saving on fees, I told him that I would have to investigate as to how I could be sure that my investment would be safe. I called Paypal and asked for advice I did everything they suggested I took three people with me to a UPS store I had each count and verify the contents of each of five boxes and I got signed affidavits including one from the clerk that helped me for a total of 4 affidavits each box contained a packing slip and a disclaimer on each packing slip that each box came with $100.00 of insurance from UPS and that additional insurance was not provided and buyer had declined the option to buy, one of the boxes had a receipt for his records and our return policy “All Sales Are Final” these boxes were sealed in front of us and left there to be shipped. Three days later I get a phone call from the thief he states that he got all five boxes but that one contained only one bottle and some papers (I shipped 5 boxes each containing 30 bottles) he goes on to say he is missing 34 bottles which adds up to a total of 35 in that box 34 missing plus one he claims was inside would I be sending the missing bottles I told him that I was parking and that I would call him right back, instead of calling I emailed so that I could have everything in writing. I told him I had proof and he asked for it I then told him that I would provide it as my defense should he file a claim , He must have believed me because he quickly changed course and said that they must have been stolen by UPS workers while in shipment. I filed a complaint with UPS as he requested and gave them all my file on the transaction including the emails pertaining to 35 bottles after UPS went to his house and investigated took picture of the boxes and concluded that they had not been tampered with. He never filed a complaint with Paypal but filed for a charge-back 10 months later I have records of everything Paypal did on my behalf and they messed up a lot at one point it showed that they asked for additional information and that I did not provide I lost my case and the reason? “unable to dispute on seller’s behalf” their own records on the time line clearly shows that all the evidence was provided two days before their deadline . I got them to reopen the case and then I get an email saying the buyer changed his dispute from product not received to not received as described send additional evidence now as of today it says that the buyers card issuer maintains that the charge-back still stands did I mention that 34 (missing) bottles at $28 is $952.00 I don’t think that their is going to be any amount of evidence I can supply that will change their minds they seem to be letting him make things up at will and siding with him PLEASE HELP

April Fonseca

Unfortunately the biggest mistake you made was not following ebay policy. The state it many times DO NOT TAKE THE TRANSACTION OFF OF EBAY PERIOD. 1 its called fee avoidance and 2 you willnot be protected. If the transaction would have occurred on ebay which by the way is were the buyer contacted you then ebay would have covereed you. The second thing was paypal know this rule all to well for them to advise you to take the transaction off of ebay was just plain wrong. They know better than that but i find some reps on paypal are not well trained. Im sorry for your loss all you can do at this point is file an internet crime report on 1c3.gov. And also with the local police department in which the buyer lives. There is also for california complaint resolution process with the government you can get that address from ebay terms of service policy. If you live outside of california there is information on how to file a complaint against paypal in the same area on ebay. Take this as a very expensivelesson. Most fraudsters want to take transactions off of ebay and they buy big and in a hurry as to not get caught. Remember the rule of thumb anything over $200 get a signiture and possibly have them present thier id when signing.

Steve

Credit Card Companies Do have control. Two months ag i sold a camera on eBay. Within 30 minutes of notification I received an e-mail asking to change address. Called eBay and was told, NO possible scam, and told if i send it to take pictures and document shipment. I was also told that it appeared on eBay end he was OK. ??? Anyway went ahead and shipped, Signature required, and insured along with taking photos and having witness’s watch being packed and item shipped. Days later got email for what appeared to be person sent to, saying thanks. Hour or so later got email from eBay saying refund item, then within another hour received email from PayPal saying refund request. several calls and digging into situation found customer was saying he did not receive camera, but claimed he had rocks, then wood, then papers. Claimed he opened it at post office. Called post office in Colorado Springs and found out they issued the package and after an hour or two he returned asking to file claim. Which he did. E-mailed customer and confronted him as to what post office said. The customer replied with yes “he opened package in front of Post Office, found no camera but left to go for breakfast and cup of coffee, then returned to post office.” his words in reply. Over next week or two both eBay, and PayPal dismissed the claims because of me providing, Email where he admitted leaving Post Office then returning. (Not as he had told either company in original filing) About month or two goes buy and got email from him saying Thanks for refunding him, (I had not) then email showing where he had filed claim at Post Office requesting insurance pay for missing items? In this email he said he was sorry but put in wrong amount for claim that it was his Alzheimer and dementia but would send me the money when claim was paid. Now latter on got a phone call saying it was him, got phone number from eBay or PayPal, My office phone is not listed on either, so we think he did internet check, But anyway he threatened me saying he was going to win! i better give him back his stolen camera, and if not i would be sorry, he would send someone to visit me… Oddity here was in the call he said wait hold on? (i thought someone at door) in 2,3, or 4 minutes he came back to phone and started off with “Who the He** is this? what do you want? why are you calling me?…. I hung up Next day got notice from PayPal that bank was requesting charge back,, Called PayPal and talked they were fighting it…. Now PayPal had all the notes, and most of the information, But never asked me for statement of events. Over several weeks and not hearing I called several times and PayPal we are fighting, not to worry I am covered and agreed there was something wrong on his end. Yesterday PayPal notified me case lost took money from my account and said it was SNAD (Not as described) from Bank. So Out the camera and lost 925.00 out of account. PayPal says they cant tell me which bank, was it a Visa or other card? In fact i am in the Dark with no information… Today i write this, and then decide what to do next , File with Attorney General? FBI? Police? Post Office for fraud? what next, Still Thinking…. So why the post? to agree Banks control it all, and why? they fight to keep their customer and not for right or wrong… PS in all of this I called my Banker and asked questions about the process. He said two things of importance, 1. the instant I said eBay, he said we always file as NOT AS DESCRIBED and don’t require customer to return goods unless over 1,500.00 2. PayPal doesn’t bother us by their size, in Fact they have to go by Cards decision, otherwise they wouldn’t be able to accept cards, as Visa, MasterCard and so would stop them from taking Bottom line, Banks and card companies have to much control

From The Editor

This Post Might Help: How to Make Your Payment Processor Release Your Money

Doreen

My problem is with Pivotal Payments. At end of July 2013, 2 men pretending to be father/son booked accommodation for 10 days. One of the men pretended to be a wounded war vet. As a result of the wounded war vet story, I gave them accommodation for $50 a night instead of $115 per night. At 3 p.m. on the second day they left without notice. (They had a physical altercation) I charged them the full amount that they had signed for. They put in a charge back that they did not recognize the charge. They had signed so they lost that charge back.

They charged back again, only this time they only want to pay for the two nights they stayed here at $50 a night. They said that the property was not as described (This is a legal B&B) They left at 3:p.m. which is the very least, a third day. Their 10 day booking took in two weekends for which I had turned other people away . I charged the con-men for the full booking of $513.000,.

I not only deserved the third night but also notice that they were leaving.

Pivotal payments used these con-men as an excuse to keep all of my August Visa receipts of $5700. How can they? Pivotal Payments kept all my receipts from August of $5700 and also tried to remove another $600 from my bank. How can they?

All my transactions with customers are paper, signed contracts with all pertinent information on them.

This is October, I received a notice that the money Pivotal Payments are holding will be held for at least another 180 days ( a further six months) that means that they can hold my money in access of 8 months. That would put most small business out of business

Pivotal Payments needs to be put out of business. What can a small business do to stop this theft? Where do do I go? How does a small business protect them from this kind of exploitation?

I have already contacted the Canadian Government, but the credit card rules seem to be a voluntary code of conduct. That is not happening! Something needs to be done to protect the unwary small business owner.