Stripe Recurring Payments: Safe, Easy, Reliable

As many business owners know, collecting recurring credit card payments can make a huge difference to your company’s economic health. Regular and dependable cash flow is the lifeblood of a business, and that’s exactly what taking recurring payments can give you. Automatic recurring billing means you have predictable revenue and cashflow and reduces losses from late payments. If you’re running a non-profit, or a subcription service (some examples being a lawn care service, tech support, a stream or podcast, or childcare services), it gives customers an easy and safe way to stay current on their bills.

So, how do you offer your customers the option for recurring payments in a way that they trust and understand? Stripe is one of the world’s most well-known, trusted, and widely-used payment platforms that offers several of great recurring payments options. Recurring Stripe payments are a great option for most industries, so let’s take a look at exactly what recurring payment services Stripe offers to businesses.

(Note: Everything below requires an existing Stripe account for a business. If you don’t have one, head over to the Stripe website, where you can set one up within minutes).

Stripe Recurring Payments Options

As one of the premier payment processors, Stripe’s recurring billing features are extensive. In a moment, we’ll break down the ways you can take recurring payments with Stripe, but first, let’s look at the many features that you get when you add a Stripe recurring pay option to your website or business:

- Take payments at any recurring time, for any amount of time. Whether you need to get paid once a month until the customer unsubscribes, twice a week for a limited number of weeks, or on any other schedule, Stripe recurring charges can be set up in any number, on any day, for whatever period you choose.

- Add Stripe pricing tiers and optional upgrades easily. Not all payments are created equal, and Stripe knows that. If you offer your customers options, such as tiered product qualities/amounts or optional upgrades, Stripe makes that easy to incorporate into your Stripe checkout. You can even add advanced features such as discounts and trials!

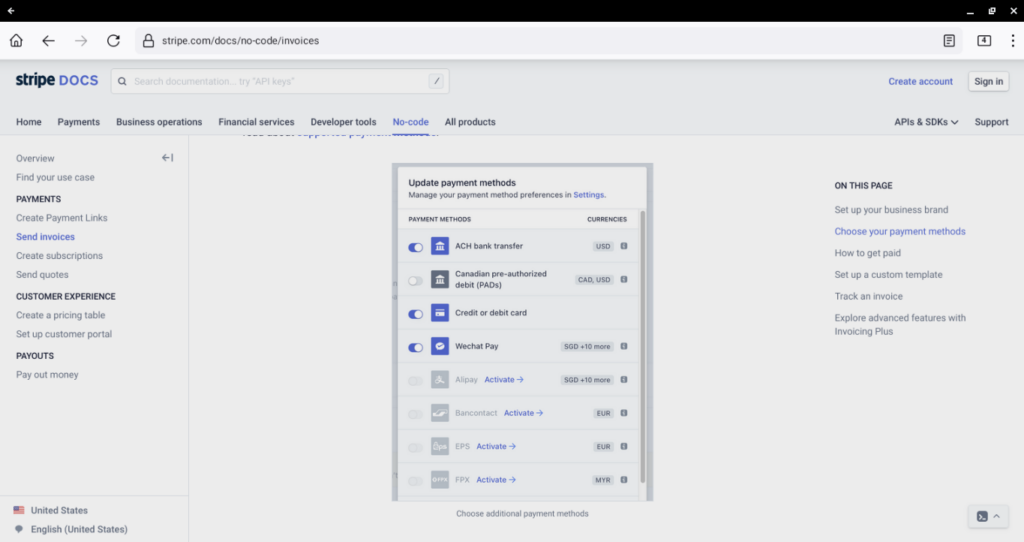

- Set what types of payments you accept. Stripe’s options for taking recurring payments in different currencies and in options like Wechat Pay or Alipay are extensive, and you can quickly and easily set up and change which options you offer. This is especially simple when setting up a Stripe recurring invoice or a Stripe recurring payment link, but it’s also possible when coding using Stripe’s recurring payment API.

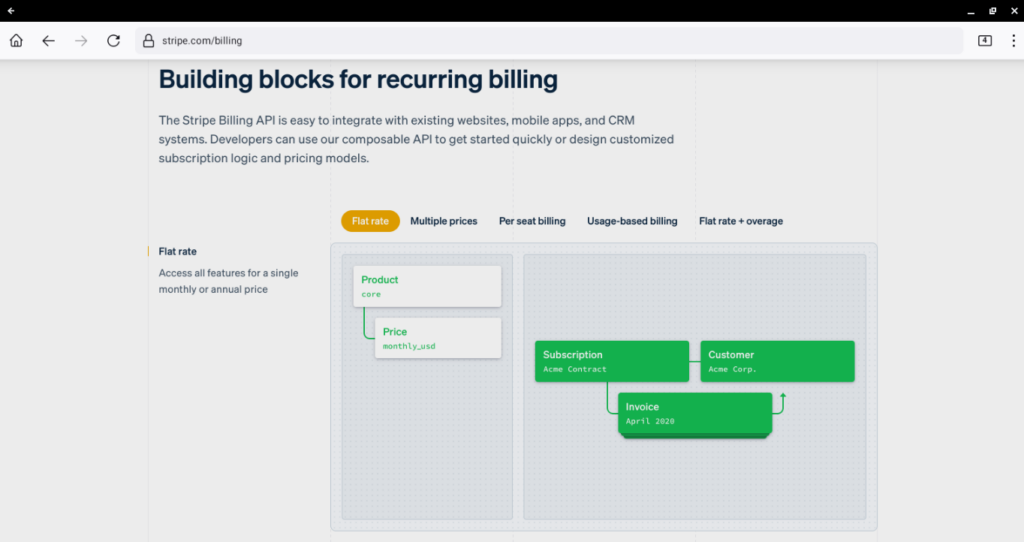

- Integrate Stripe billing with your existing financial management structure. Speaking of Stripe payment APIs, those looking to add advanced Stripe recurring integration into their existing website or payment software code have the option to tell Stripe’s recurring payment code to report directly to their financial management software. This means you can easily achieve deep Stripe recurring payment integration with your financial tools, allowing for extensive reporting and data analysis on your recurring Stripe payments.

Setting Up Stripe Recurring Payments

With Stripe recurring payment integration, you can choose simple, easy-to-setup options like the Stripe recurring invoice, Stripe subscriptions, or Stripe recurring payment links to quickly offer your customers recurring payments through Stripe. Alternatively, those with more complex needs can use Stripe’s payment tool sets to create more robust options. These include using Stripe Checkout and APIs to take recurring payments as well as utilizing Stripe’s recurring payments API to write customized code to add recurring payments processed by Stripe to external payment software.

Here’s a quick breakdown of the basic Stripe recurring options:

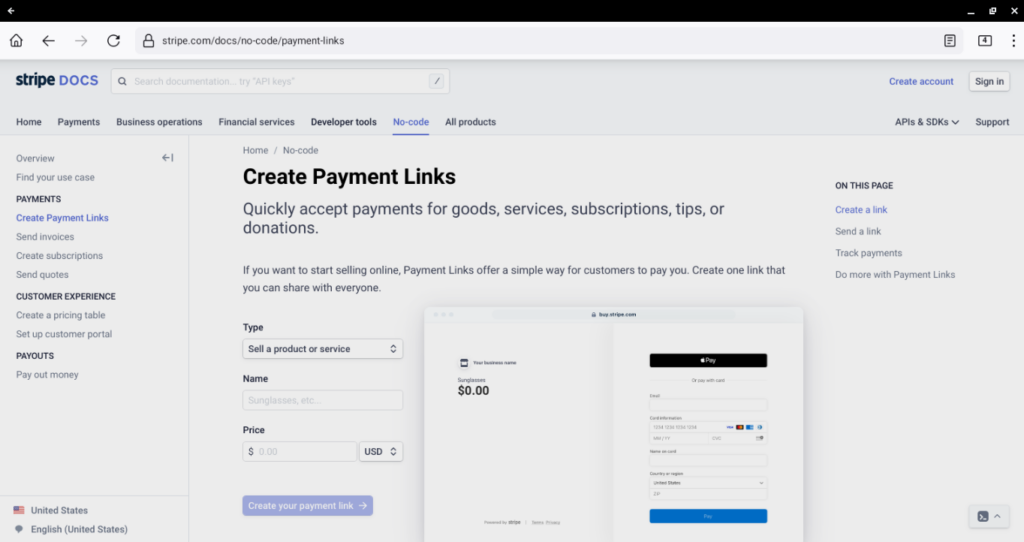

- Stripe recurring payment links – The simplest and easiest-to-setup way to use Stripe billing for recurring payments is to use a Stripe recurring payment link. These are the same as a regular Stripe payment link, created through their website, but you simply select the recurring option and set the period for the recurring Stripe payment to occur. This is the most straightforward option for those that want to avoid coding and is the most common way to set up Stripe subscriptions.

- Send a Stripe recurring invoice – Using an email or a link (similar to the above), Stripe invoices are a popular way to contact customers with a Stripe recurring payments form. Also easy to set up, you can issue these from the Stripe Dashboard. Like the Stripe payment links, you can choose what payment methods you allow, but you can also provide itemized lists of goods and services rendered. Invoices from Stripe also offer invoice tracking, email reminders for customers, and even customer management through the Stripe portal. Additionally, Stripe Billing offers advanced features such as invoice recovery to Stripe Plus users.

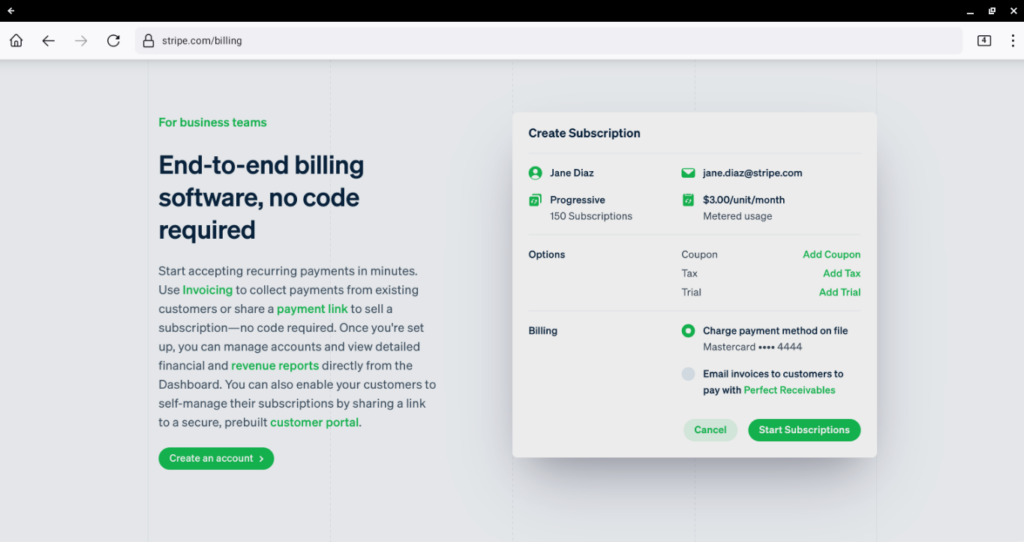

- Manually add subscriptions – For those businesses that have made recurring billing agreements in person or from previous sales situations, you can manually add a Stripe recurring subscription to your customer’s account. This requires you to have the customer’s information already in your Stripe account and can be done through the dashboard with the same features available as sending a recurring Stripe invoice or creating a recurring Stripe payment link. This is an excellent option when moving your payments to Stripe or if you have a unique sales environment, but of course, you will need to make sure your customers have officially agreed to these payments before you set them up.

- Add recurring payments with Stripe to Stripe Checkout – If you sell your products through a Stripe Checkout page, common for online stores, you can use the Stripe API to offer recurring payments. This requires a coding background or hiring someone to set it up for you, but otherwise, Stripe makes this fairly simple by following instructions on the Stripe Docs section of the Stripe website. This is the most powerful and customizable way to offer Stripe recurring billing, and it offers advanced features such as being able to offer only specific products on a recurring schedule or all products, as well as unique payment tiers and options.

Whichever of these options fits your business, head to the Stripe website and follow the extensive instructions there to get Stripe recurring payments set up for your company.

Stripe Recurring Payments Pricing

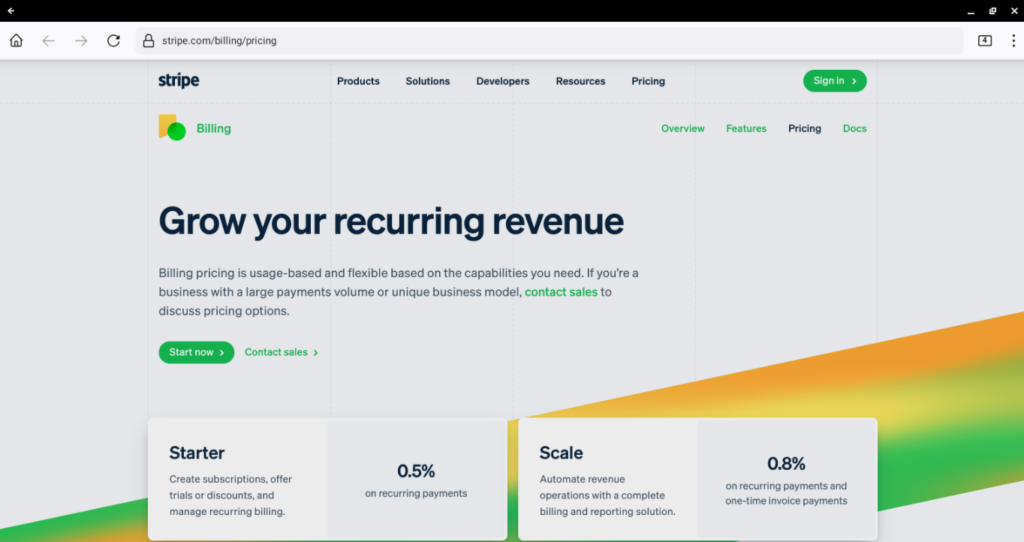

Of course, as much as using a well-trusted company such as Stripe for recurring payments has its benefits, in the end, it’s the pricing that will make or break the service for most companies. Stripe offers recurring payments in three tiers:

Starter – Stripe’s Starter tier costs 0.5% per transaction.

Scale – Stripe’s Scale tier costs 0.8% per transaction but offers additional billing and reporting options.

Stripe recurring payments for large businesses- Stripe notes on their website that they offer boutique prices for those companies processing very large volumes. They request that companies in this tier give their sales team a call to work out options.

It should be noted that these prices are for recurring billing options alone and don’t include Stripe’s standard pricing.

Our Verdict On Stripe’s Recurring Payment Tools

Considering the ease of setup, the flexibility to create solutions for nearly any business, and the security and support that come with a brand as big as Stripe, we rate Stripe’s recurring payments as among the best in the industry. We would recommend Stripe recurring billing for small and medium businesses of most kinds.

If Stripe recurring payment processing sounds like something you’re interested in, we’d highly suggest taking a look at our Stripe reviews so you can determine if this credit card processor is right for your business.

Reader Comments

Tell Us What You Think