Beacon Payments Card Processing Reviews & Complaints

Company Overview

Beacon Payments is a merchant account provider that serves small, medium, and large businesses based in the United States. The company is a reseller of First Data (now Fiserv) products and services. The company was purchased by Pineapple Payments in 2019. See our positive review of Pineapple Payments here.

Beacon Payments Payment Processing

Beacon Payments processes most major debit and credit cards for most business types. Their services include EMV readers and card swipers, POS systems, mobile payments, gift and loyalty programs, cash advances, and check processing.

Location & Ownership

Founded in 1998, Beacon Payments can be found at 50 Dudley St, Cambridge, MA, 02140. Beacon Payments is a registered ISO of Wells Fargo Bank, N.A., Concord, California. David Selenow is listed as the principal of Beacon Payments and Jerry Kadish is the company's current CEO.

| Pros: | Cons: |

|---|---|

| A+ BBB rating | Contractual cancellation penalties |

| Interchange-plus pricing | Monthly and annual fees |

| Transparent rates | High early termination fee |

| No deceptive sales tactics | Independent sales agents |

| Low complaint volume | Monthly minimum fees |

Beacon Payments Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Low Complaint Volume

Current findings show only a handful of negative Beacon Payments reviews outside the Better Business Bureau (BBB), which suggests the company generally maintains a positive reputation and is not associated with being a ripoff or scam. The few complaints that exist mainly highlight issues such as difficulties in canceling services, aggressive sales tactics, and dissatisfaction with monthly fees. If you have a personal experience or review of Beacon Payments, we encourage you to share it in the comments below to inform others.

Beacon Payments Lawsuits

As of this update, there are no known outstanding class-action lawsuits or Federal Trade Commission (FTC) complaints against Beacon Payments. Customers preferring to address concerns without litigation should consider reporting them to the appropriate supervisory organizations for resolution.

Beacon Payments Customer Support Options

Beacon Payments advertises 24/7 phone support on its website. However, it is not clear if this support is directly managed by Beacon Payments or by First Data (Fiserv). Despite not being recognized as a top-rated service in customer support, Beacon Payments’ relatively low rate of complaints contributes to its “A” rating in this review.

Beacon Payments Customer Service Numbers

- (877) 986-4445 – Toll-Free Customer Support

- (617) 986-4451 – Fax Line

Other Support Options

- Support form

- Email: [email protected]

Beacon Payments Online Ratings

Here's How They Rate Online

| BBB Reports | 1 |

|---|

No Complaints

Beacon has been an accredited business of the Better Business Bureau since 2011 and currently holds an “A+” rating. At this time of review, Beacon Payments is showing 1 BBB complaint in the last 36 months. The 1 complaint was resolved to the satisfaction of the client.

What Merchants Say

The company has also received 0 informal reviews in the last 36 months. A previous negative review described difficulties resolving fees charged after an account cancellation:

THE absolute worst cc processing company I have dealt with in 10 years. I should’ve known from the start when their account rep Kevin P***** came into my business to install service prior to us agreeing on terms of the account and then having to literally argue with him about it for 10 minutes in the middle of a business day. Now spending months trying to get my $250 cancellation fee refunded per my contract. Nobody has been helpful here whatsoever and it has only been a headache.

Clients who find themselves in this situation may benefit from taking the proper steps to cancel their merchant account without paying a fee.

An “A” Performance Overall

Due to Beacon Payments’ low complaint volume and diligence in responding to all complaints it receives, we agree with the BBB’s overall rating.

Beacon Payments Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Interchange + 0.05% + $0.22 |

| Equipment Leasing | One-Time Purchase |

Three-Year Contract

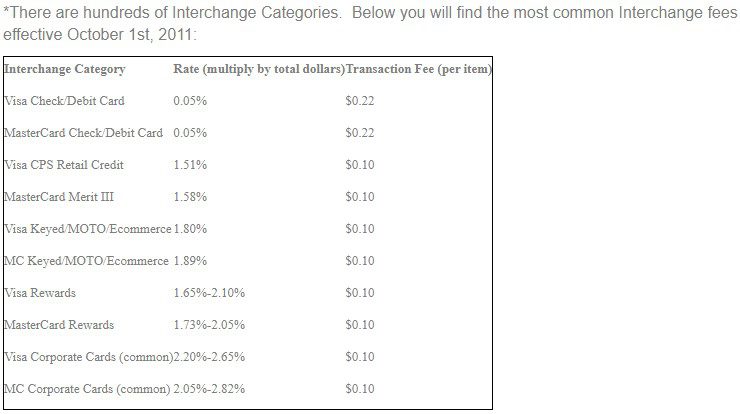

Beacon Payments is transparent about offering interchange-plus pricing, listing rates of interchange plus 0.05% and $0.22 per transaction on their website. This clear pricing model has resulted in minimal client complaints regarding the company’s standard contract. The contract, executed through First Data (Fiserv), entails a three-year term with a $495 early termination fee or Liquidated Damages, whichever is greater, along with an annual PCI compliance fee of $79. Beacon Payments does not lease equipment, instead offering customers the option to buy it outright or secure it with a $99 deposit, refundable upon the equipment’s return.

Virtual Terminal and Payment Gateway Pricing

Beacon Payments extends its services to include virtual terminal and payment gateway solutions, applying its interchange-plus pricing to e-commerce platforms as well. Additional charges, such as gateway fees, technical support fees, and batch fees, may be incurred for these e-commerce services.

Beacon Payments Fees

Some negative feedback regarding Beacon Payments focuses on its monthly minimum fees of $30 for clients not processing at least $1,500 monthly. Additionally, a $10 monthly fee may be charged to certain accounts, independent of processing volume. Compared to the market, Beacon Payments’ fees do not align with the most economical merchant accounts. If you are familiar with the specifics of Beacon Payments’ standard contract terms, sharing that information in the comments of this review would be appreciated.

Beacon Payments Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Likely |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Independent Sales Agents

Beacon Payments appears to hire independently contracted sales agents to market its services. As a general rule, this practice makes it difficult for any company to monitor and regulate its sales team’s behavior, which in turn tends to result in elevated complaint rates among merchants. There do not appear to be any Beacon Payments reviews related to its sales force.

We have located a few Beacon Payments reviews that criticize the company’s sales approach. In one complaint, a business was contacted by a sales representative, asked to sign a “merchant account application” that was actually a contract, and then was unable to reach the agent after that point. The business was surprised to see that they were being billed for a service they hadn’t received. Beacon Payments responded by issuing a full refund, and the business owner expressed satisfaction with the response and suggested that they had perhaps been too hasty filing a complaint. Some current and former sales agents with the company also state that Beacon Payments expects its agents to do a lot of door-to-door selling, which can be aggravating for both agents and clients.

Transparent Pricing

The Beacon Payments website actively promotes interchange-plus pricing, which is the most transparent rate structure available. This is a positive indicator that the company does not condone deceptive sales tactics, but the company’s overall rating does suffer from the few complaints available about its sales team. If you suspect that Beacon Payments is charging you undisclosed fees, we recommend seeking a third-party statement audit to find and eliminate hidden costs.

Our Beacon Payments Review Summary

Our Final Thoughts

Beacon Payments rates as a reliable credit card processing provider by our standards. The company appears to actively promote Interchange-plus pricing, and its low complaint rate is indicative of forthright sales tactics and competitive contract terms. Factors that lowered the company’s rating are its use of independent sales agents and complaints regarding its monthly fees. Even when dealing with credit card processors that rate highly by our standards, we encourage readers to carefully examine the terms of any contract they are given and to compare its pricing to the top overall providers.

If you found this article helpful, please share it!

Chris Capuano

Fantastic honest company. Very transparent with their prices unlike some other processors I’ve dealt with.

CPO

Hi Chris,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Sarah Wakabayashi

I signed up with this company this year because of lower fees. Receiving any help or getting replies after signing up from my rep Kevin Pheley is a struggle. It’s really not worth it in my opinion and I wouldn’t recommend them to other businesses. Getting my cancel fee from my previous company is like pulling teeth. AVOID

Steven Lojko

The way the minimum fee is described is wrong. There is a 10 dollar monthly fee which is variable and a 30 dollar minimum fee. The minimum one must process is 1,500 dollars per month, if a client does over this only the 10 dollar monthly fee is charged.