Overview

In this review of Nextpay, we will provide a detailed overview of the company's credit card processing services. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific services provided. By the end of this review, you will understand whether Nextpay meets your payment processing needs.

About NextPay

Founded in 2009, NextPay is a Panama-based merchant account provider that specializes in providing international credit card processing to e-commerce merchants. The company claims to serve over 200 businesses, many of which are located in Latin America. The company should not be confused with a Carrollton, TX-based payment processor called NextPay Merchant Services or the NextPay out of the Philippines. The companies are unrelated.

NextPay Products and Services

Payment Processing

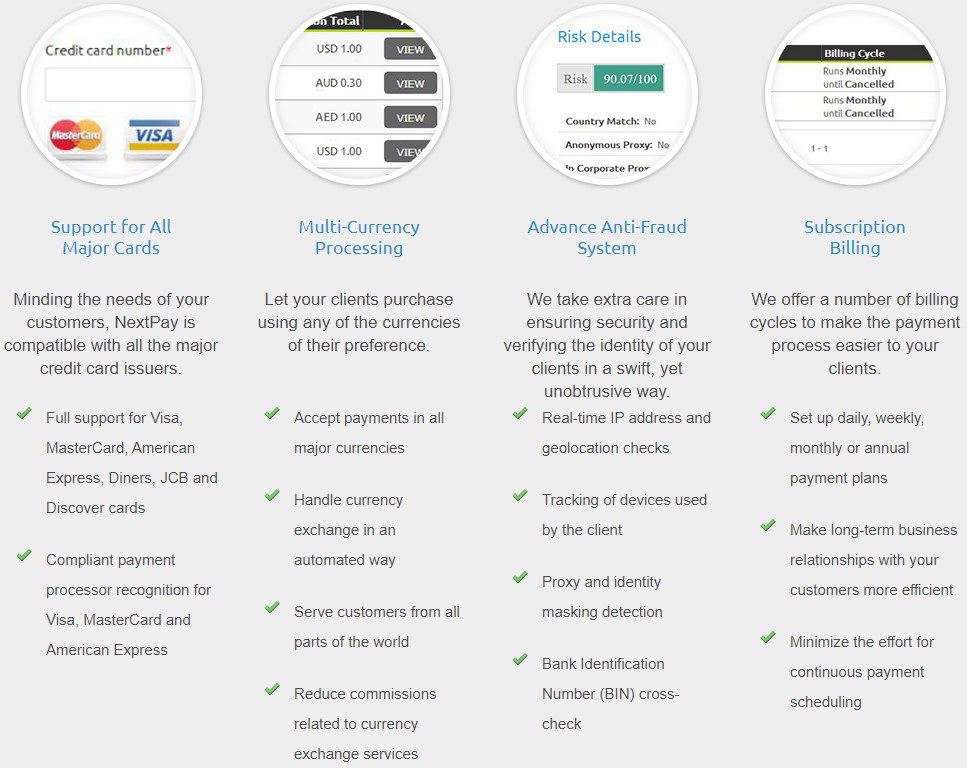

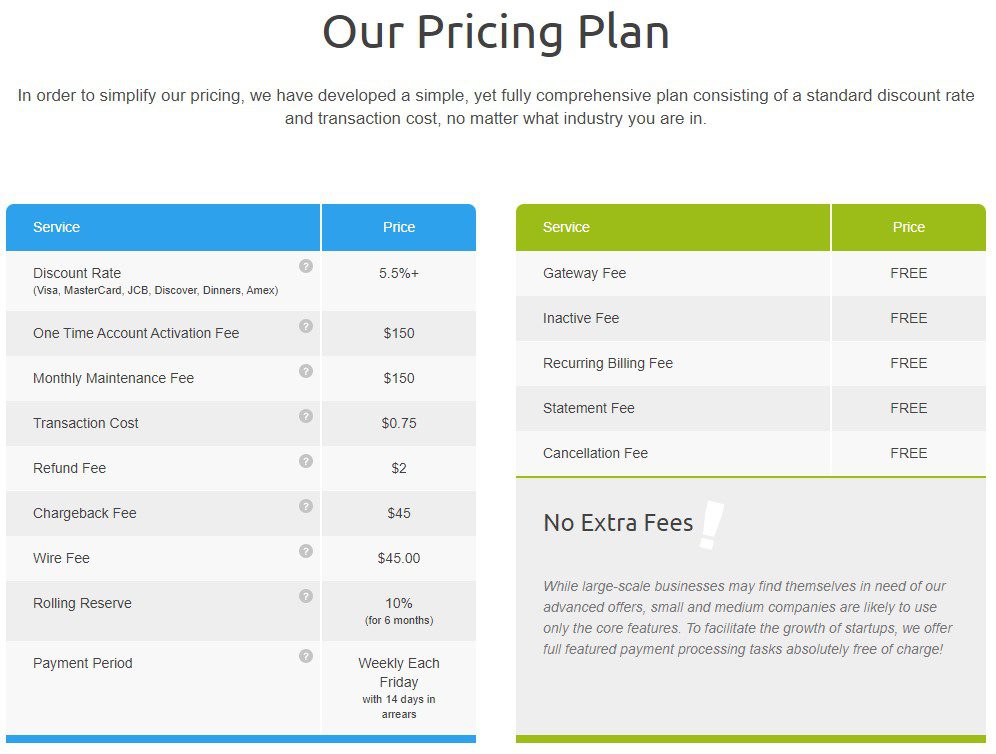

NextPay processes most major debit and credit cards for a variety of business types. Their services include multi-currency processing, anti-fraud tools, and recurring billing. Beyond e-commerce products, NextPay also offers a mobile POS solution for in-person payments.

Software for Acquirers

NextPay provides software solutions designed to help acquirers manage their payment processing tasks effectively. Their adaptable software can scale to meet the specific demands of different businesses.

Payment Gateway Module

NextPay's payment gateway module enables dealers to conduct online transactions securely. It supports various secure payment methods, facilitating a smooth online transaction experience.

Processing Module

The processing module offered by NextPay enhances payment processing by integrating seamlessly with existing payment infrastructures. It aims to automate and streamline business workflows.

3DS Server Module

NextPay's 3DS Server module ensures the authentication of online transactions according to the latest standards. This added security layer helps protect transactions from fraudulent activities.

Luis

El servicio al cliente es muy malo, ahora mismo estoy en espera de su respuestas,

ISABELLA, la chica de atención al cliente, deja en espera y cuando le dices que la atención es mala, te corta el chat y coloca que por ahora no atienden.

The customer service is very bad, right now I am waiting for your answers,

ISABELLA, the customer service girl, puts you on hold and when you tell her that the attention is bad, she cuts off the chat and says that for now they do not attend.