Overview

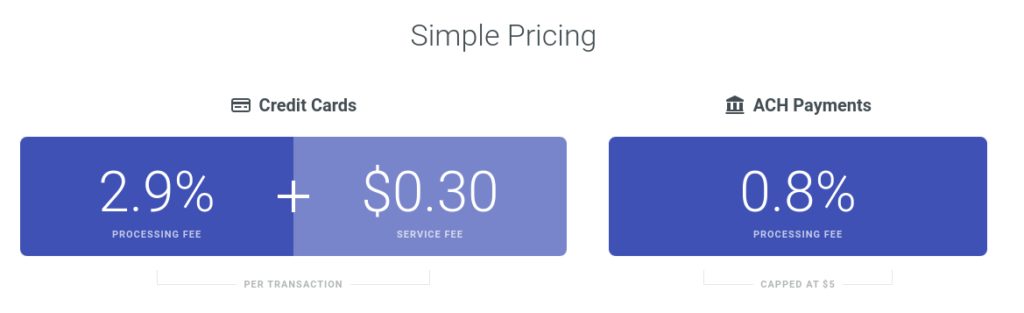

In this review of Pearl Payments, we will take a detailed look at this payment management software designed to streamline handling both one-time and recurring payments for businesses. With a focus on automation, Pearl Payments simplifies credit card and ACH deposit transactions, aiming to reduce the time spent on collections. However, it's not just about efficiency; we also explore potential pitfalls, examining common customer complaints, contract terms, and challenges with customer service.

We will analyze Pearl Payments in the context of the wider payment processing industry, considering its rates and fees and how they compare to competitors. For businesses thinking about adopting Pearl Payments, this review offers a balanced view, highlighting both the advantages and areas where caution is needed. Lastly, we will delve into the company's background, including the enigmatic status of its developer, Swing Set Labs, to provide a well-rounded perspective on this potentially transformative tool.

About Pearl Payments

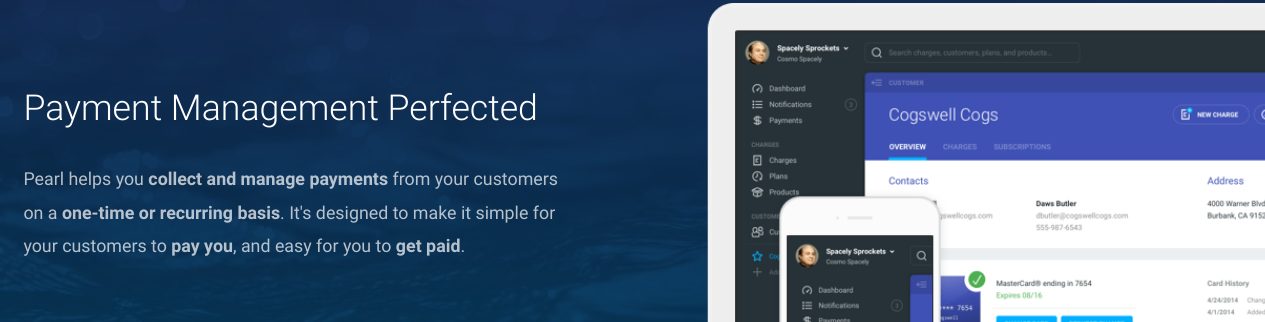

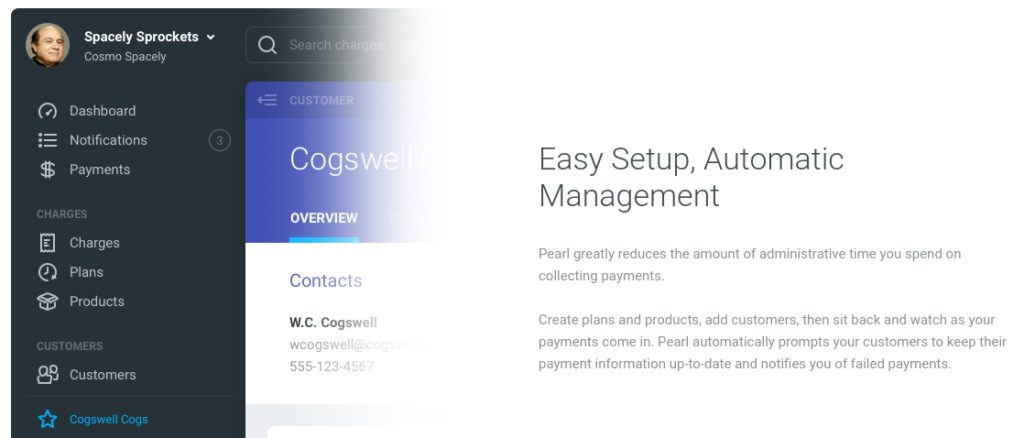

Pearl Payments is a payment management software that has been developed to enable a merchant account to automate its recurring payments made by credit card or ACH deposits. Additionally, the company also allows clients to charge one-time payments. The interface allows users to minimize the amount of time they spend on collections. In addition to automation, Pearl Payments also helps merchants keep their customer's information up to date and notifies them of missed payments and past-due balances. Pearl Payments was developed by Swing Set Labs, which may be out of business.

Pearl Payments Products and Services

Payment Processing

Pearl Payments provides a payment management platform that facilitates the collection and management of payments for businesses. This service supports both one-time and recurring payment options.

Automation Features

The platform includes features that allow businesses to automate recurring payments through credit card or ACH deposits.

MIKE SALEH

DO NOT SIGN-UP, BEWARE!!!!

THEY ARE FRAUD COMPANY THAT WILL SIGN YOUR LEASE FOR MERCHANT PROCESSING MACHINE WHICH YOU CANNOT CANCEL EARLY. THEY HAD ME LOCKED ON 4 YEAR LEASE FOR A MACHINE THAT I AM NOT USING AND WHEN I CALLED TO CANCEL. THEY SAID I HAVE TO CALL THIRD PARTY TO CANCEL.

RATES ARE HIGH, MACHINES ARE REALLY SLOW AND NEVER WORKED, AND LOCK YOU INTO PAYING FOR EQUIPMENT BY PUTTING YOU LEASING IT TO YOU.

Candace Farris

BUYER BEWARE! DO NOT USE THIS COMPANY! From not paying our early termination fees as they promised they would, to charging us WAY MORE monthly than we had been paying in processing fees, to not being able to get in touch with anyone, to having to pay early termination fees again to get out of the lease with Ascentium when we finally left Pearl(after paying early termination fees when we left our previous processor that we never received reimbursement for), to being bounced from one employee to another…this company is a nightmare! We ended up being out right around $7,000 in fees and overcharges that they miraculously never could do anything about, although they were “looking into it” the entire time. When we first signed up with them they couldn’t get us a machine that would work. This was right at the beginning of the pandemic. We were charged for 6 months(including non-use fees as we weren’t processing any payments through them). Those 6 months of fees were never reimbursed although it was their fault we couldn’t process during this time! What this company does should be criminal! I should have read reviews on them before we switched. They sent a salesman to our company, we did not seek them out. They were a nightmare from the beginning.

Donna Irish

I have been trying to contact them for my account for weeks. every number including customer service goes to voice mail which is ok but not if they all have full mail boxes. going to stop automatic payment see how fast they get incontact with me then.

Debbie Ferguson

When I started working with Pearl Payments I did not know very much about POS companies or products. After several months I received a Clover mini. This did not work as it was too small. After several more months I finally received an EHopper. Keep in mind, each of these companies use a different credit card processing company. The EHopper was way too big so again, after several months I finally received the E500 Pax. Perfect size, works great.

The problem is that now one cancelled the credit card processing contracts that went with the Clover and EHopper. Although I had no choice, these companies will not cancel. They are 48months term. I have called Pearl, written Pearl, left voicemails. I have been promised that it will be taken care of, but to date, I am still paying over $300 to credit card processing companies I not longer are using.

I will be filing a complaint and cancel all business dealing with Pearl.

DO NOT DO BUSINESS WITH THIS COMPANY! THEY WILL SELL YOU SOMETHING AND THEN IGNORE YOU!

Catherine McWhinnie

Could you help me get in contact with John Sarkisian? Thanks

Colin Qian

This is not an honest company. There are fees that are not disclosed at the agreement signing. They don’t honor what they promise to do like a free trial. Also I just noticed that they could alter the contents of the agreement you signed off. And the worst is their merchant support. For legitimate issues and concerns, they ignore your calls and emails, not willing to help you resolve them.

Colin Qian

This is a follow-up to my review on October 19, 2019.

I want to commend Mr. John Sarkissian, Director of Operations, for reaching out to me and trying to address my concerns. I got sold a plan that didn’t meet the goal of saving card processing fees using a second payment system at my store. There were also fees that were not communicated to me when I signed up. John was willing to address my concerns. Now I’m on a different plan that he thinks would work for me. For his efforts, I would recommend Pearl Payments. Also I really like the smart terminal they have, Poynt. It is flexible in that it has apps to allow different plans to meet different customers needs.