Overview

In this review of WebMoney Transfer, we will provide a detailed overview of the company's money transfer services. We will cover the range of services they offer, including online payment solutions, e-wallet capabilities, and mobile payment options. The review will identify the types of users and businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, security measures, and specific features provided. By the end of this review, you will understand whether WebMoney Transfer meets your money transfer needs.

About WebMoney Transfer

Founded in 1998, WebMoney Transfer is a Moscow-based money transfer service that specializes in processing multi-currency transactions and high-risk payments. The company's website claims to serve over 100,000 merchants and 39 million users worldwide.

WebMoney Products and Services

Payment Processing

WebMoney offers an alternative to traditional banking and credit networks by enabling users to purchase and transfer “WM units.” These units can be withdrawn from digital wallets in the user's local currency, operating similarly to Bitcoin transactions, although WebMoney was established nearly a decade before Bitcoin. The use of WM units allows transactions to bypass banking regulations, but it also eliminates certain buyer protections and depends on third-party “guarantors” to support the system.

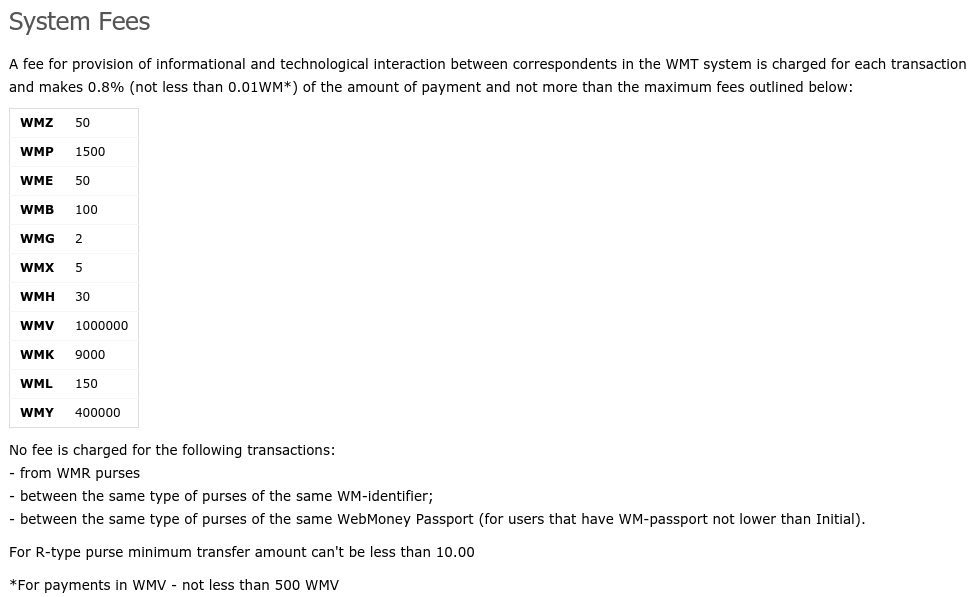

Supported Currencies

WebMoney supports a variety of payout options, including WMB (Belarusian Ruble), WMC (Bitcoin Cash), WMD (Vietnamese Dong), WME (Euro), WMF (Swiss Franc), WMG (Gold), WMH (Bitcoin Cash), WMK (Kazakh Tenge), WML (Litecoin), WMT (Tether), WMX (Bitcoin), WMY (Uzbek Sum), and WMZ (US Dollar), along with specific unit types such as certificates from megastock.com.

Regulatory Status

In November 2015, WebMoney received a license from the Financial Conduct Authority (FCA) to issue electronic currency in all countries within the European Economic Area, further legitimizing its operations and expanding its reach within Europe.

Murodullo Kurbonov

The support team of Webmoney is really s***. They never understand and explain client’s queries. I don’t wanna use of their rubbish service.

Phillip king

I was scammed by some one through this application out 1900 dollars cause they don’t ask for a ID two create a account so fare warning

Mazhero

They ask for the ID when creating an account and you will be given a passport afterwards

Gary

Webmoney is totally unfriendly for international user. The customer service is non-existed.

RJ

I tried webmoney, I have very bad experience with this service, they call themselves Universal … but they are by no means universal, the first time was loading my purse ok .. but the second time the booked money never arrived at my webmoney purse, the webmoney people are unkind they are unhelpful and they are just thieves of their own customers … watch out for webmoney Webmoney is SCAM you will lose your money you have been warned!