Overview

In this review of Bindo, we will provide a detailed overview of the company's point-of-sale (POS) system. We will cover the range of services they offer, including inventory management, customer relationship management (CRM) features, and e-commerce integration. The review will identify the types of businesses that might benefit from these services, with a focus on retail and hospitality sectors. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific features provided. By the end of this review, you will understand whether Bindo meets your POS system needs.

About Bindo

Bindo is a cloud-based point-of-sale software and online marketplace for retail and e-commerce merchant accounts. In 2022, the company rebranded as Bindo Labs.

Bindo Products and Services

Payment Processing

Bindo aims to empower smaller, local merchants by offering an online platform and marketplace to help them compete with large online retailers like Wal-Mart and Amazon. Bindo allows merchants to list their inventory in real-time and accept payments from both local and online shoppers, with options for same-day pickup or delivery based on the merchant's capabilities. As a provider-agnostic service, Bindo can integrate with a merchant's existing account provider or set up processing through a Bindo partner. Additionally, Bindo provides display systems, virtual terminals, payment gateways, mobile ordering, kiosks, data analysis software, staff management tools, and gift cards. Merchants can try the service with a 14-day free trial available on the company's website.

POS System for Retailers

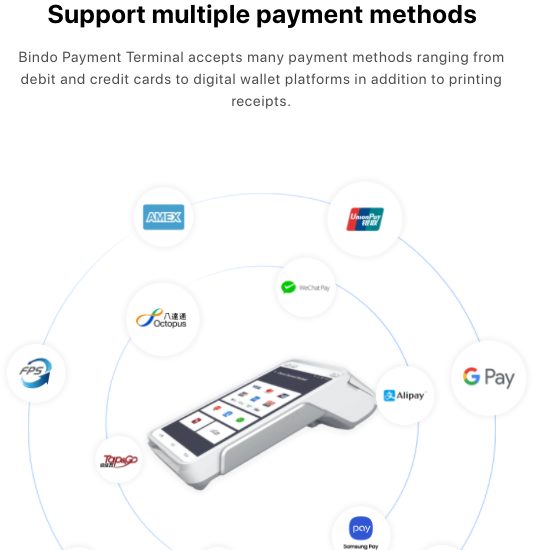

Bindo offers a comprehensive Point of Sale (POS) system designed for retailers, combining sales, inventory management, and customer relationship management. The user-friendly interface of the POS system accepts various payment methods, including credit and debit cards, cash, checks, and mobile payments.

Marketplace: Connecting Local Shoppers and Stores

Bindo Marketplace creates an online shopping community by connecting local shoppers with local stores. This service helps businesses increase their visibility and reach a broader customer base. Shoppers can make purchases directly from the marketplace and pay using their credit card, streamlining the transaction process.

CRM and Loyalty Programs

Beyond payment processing, Bindo offers integrated Customer Relationship Management (CRM) tools that allow businesses to track customer purchases and preferences. This data is valuable for targeted marketing efforts. The platform also includes features for setting up loyalty programs, which encourage repeat business by rewarding customers for their loyalty.

Mira

I currently have Bindo and am looking for a new pos provider. The system is awful. They have so many bugs after updates. Had to close the store due to the system being down. Awful customer service also. Only had system for 6 months and am regretting it. Credit card service goes down all the time! Overall awful system

—

Are you with Bindo? Learn how to resolve this complaint.