In the ever-evolving world of card acceptance, the cost-effectiveness of payment processing systems are a primary factor most businesses consider when selecting a credit card processor. Recognizing the importance of this aspect and how it is often difficult to compare, we embarked on a comprehensive journey to evaluate the costs of top credit card processors in the market. Specifically, we zeroed in on credit card processors that offer the flexibility of charging no monthly fees or locking business owners into contracts or long-term equipment leases.

Methodology

This investigation was tailored to uncover a realistic view into what business can expect to pay at varying levels of processing. Our methodology was meticulous and thorough, ensuring that each processor was tested under uniform conditions to extract data that is both reliable and comparable. The calculations are based upon each processors advertised rates and transaction fees with each tier assuming a $50 average transaction. In a few cases, such as will Helcim, wherein the processor passes through the wholesale Interchange cost with a fixed markup, we averaged the Interchange rate at 1.7% + $0.05, plus the processor's advertised markup.

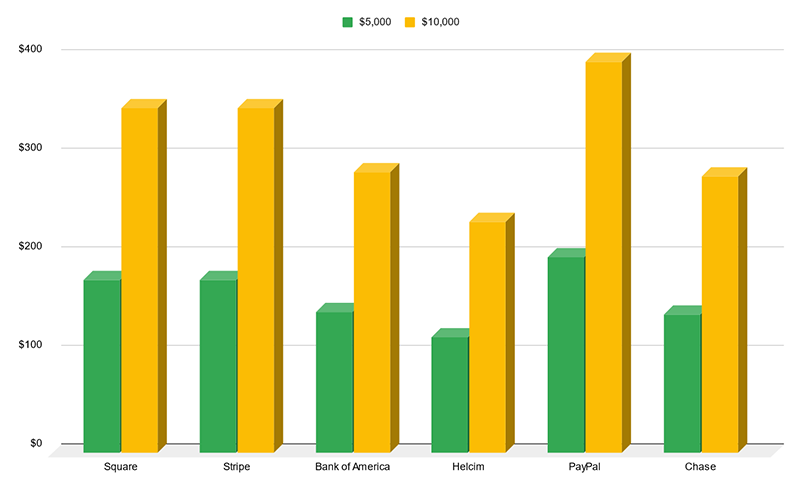

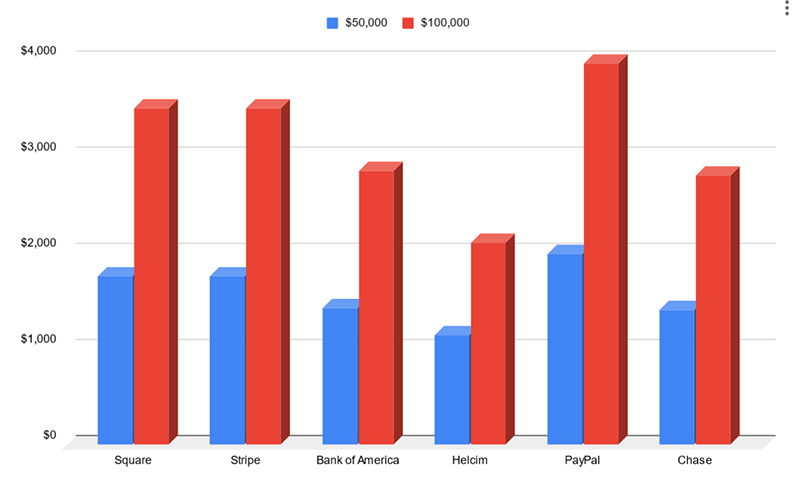

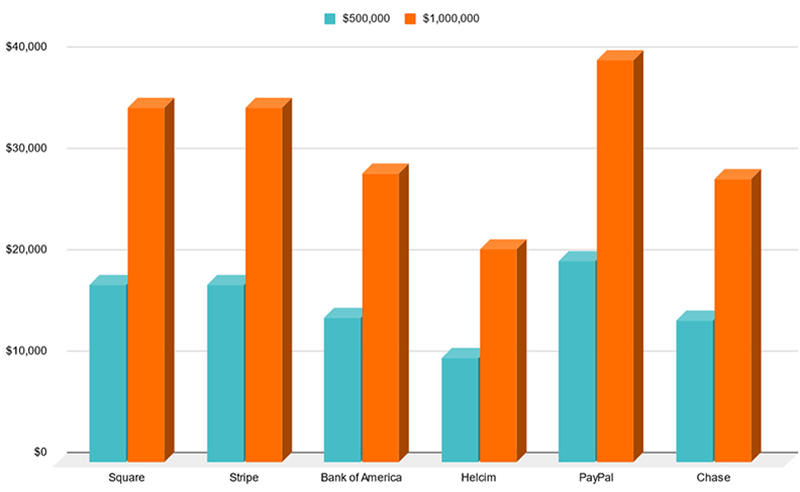

Card Present Results

In our first set of tests, we used the quoted rates and fees of each processor for standard retail, in-person transactions wherein the card it transacted at the the business' location using a card reader. In the left column are the processors that we tested. The top row is the amount of processing tested and the intersecting cells are how much the processing costs including the rate and transaction fees.

| Processor | $5,000 | $10,000 |

|---|---|---|

| Square | $175 | $350 |

| Stripe | $175 | $350 |

| Bank of America | $142.50 | $285 |

| Helcim | $117 | $234 |

| PayPal | $198.50 | $397 |

| Chase | $140 | $280 |

| Processor | $50,000 | $100,000 |

|---|---|---|

| Square | $1,750 | $3,500 |

| Stripe | $1,750 | $3,500 |

| Bank of America | $1,425 | $2,850 |

| Helcim | $1,135 | $2,100 |

| PayPal | $1,985 | $3,970 |

| Chase | $1,400 | $2,800 |

| Processor | $500,000 | $1,000,000 |

|---|---|---|

| Square | $17,500 | $35,000 |

| Stripe | $17,500 | $35,000 |

| Bank of America | $14,250 | $28,500 |

| Helcim | $10,350 | $21,000 |

| PayPal | $19,850 | $39,700 |

| Chase | $14,000 | $28,000 |

Card Present Cost Summary

Our findings indicate the lowest costs across all processing level were with Helcim followed by Chase Merchant Services. The most expensive was PayPal with Square and Stripe sitting in the middle of the pack. It is important to note that real world results may vary from our finding above as rates and fees can be affected by numerous factors including, but not limited to, the type of cards your customers use. Additionally, PayPal offers lower fees when both users have a PayPal account with funds transferring between accounts.

Cost For E-Commerce and Card-Not-Present

Is your business online, or do you key card information instead of swipe the card? The costs for these transactions are different. Let us know in the comment section below if you would like to see a breakdown of card-not-present transaction costs. Subscribe to be notified of follow-up comments and we'll let you know when we publish it!

Disclaimer

The above article is for illustration and educational purposes only. Please always do you own due diligence before signing up with any credit card processor.

Blaine Dunn

We are a 20 year old small retail business. Most of our transactions are keyed in. Our average ticket is $1,000.00 with a annual total of $100,000.00 approximately.

We are looking for a processor that charges a flat rate, no contract and low monthly fees. A company that is transparent with no surprise PCI or annual fees. Can you suggest a good company for us?

Phillip CPO

Hi Blaine,

This may depend on a couple factors related to how you process sales. Are you taking deposits before you fulfill the orders, or do you send the furniture as soon as the order is placed?