Payment Processing

Preferred Payments provides services for handling credit and debit card transactions, facilitating smooth and reliable payment processing for a wide range of industries.

EMV Terminals

Preferred Payments supplies EMV terminals that utilize chip technology to enhance transaction security and reduce fraud. These terminals can be integrated into existing point-of-sale systems and are suitable for businesses of varying sizes.

ACH and e-Check Processing

Preferred Payments offers ACH and e-check processing, enabling businesses to collect electronic payments directly from customers’ bank accounts.

POS Solutions

Preferred Payments provides Point of Sale (POS) systems that include both hardware and software for managing sales, inventory, and customer interactions. These customizable systems are designed to meet the needs of different types of businesses, from retail stores to restaurants.

Mobile Solutions

For businesses that need to accept payments on the go, Preferred Payments offers mobile solutions that work with smartphones and tablets.

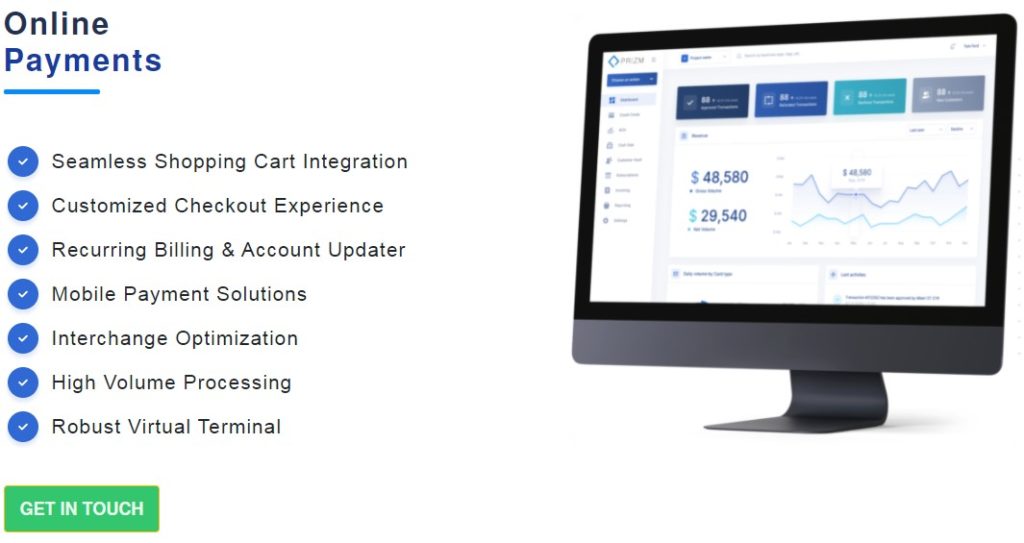

Virtual Terminals and Prizm Payment Gateway

Preferred Payments offers virtual terminals and the Prizm Payment Gateway for processing payments online. Virtual terminals allow for remote payment acceptance via internet-connected devices, while the Prizm Payment Gateway integrates with e-commerce platforms.

e-Commerce Solutions

Preferred Payments delivers a range of e-commerce solutions, including shopping carts, PCI compliance, fraud protection, recurring billing, and gift and loyalty programs.

Data Reporting and Analytics

Preferred Payments provides data reporting and analytics services to assist businesses in making informed decisions. These tools offer insights into transaction trends, customer behavior, and financial performance.