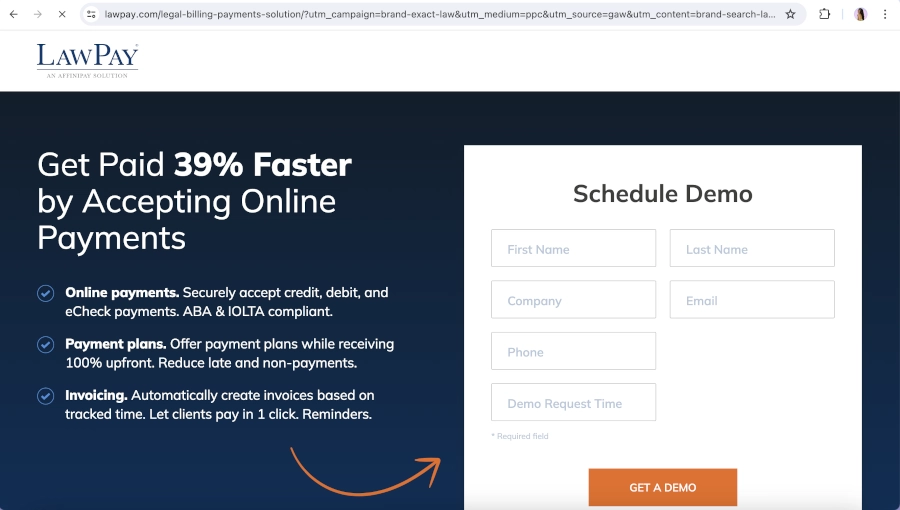

Payment Processing

LawPay processes major debit and credit cards for businesses in the legal industry.

Card Vaults

Card vaults are secure digital storage solutions that allow businesses to safely store and manage customer payment information. These vaults are designed to encrypt sensitive data, ensuring that credit and debit card details are protected from unauthorized access.

ClientCredit “Buy Now, Pay Later” Options

ClientCredit “buy now, pay later” options provide customers with flexible payment plans, allowing them to make purchases and pay for them over time. This service has become increasingly popular as it offers consumers the convenience of immediate access to goods and services without the need for upfront payment.

Mobile Payments

Mobile payments have transformed the way consumers transact, offering a quick, convenient, and secure method of payment using smartphones or tablets. Whether through mobile wallets, dedicated payment apps, or contactless payments, mobile solutions enable customers to make purchases with just a few taps on their devices.

QR-Code Payments

QR-code payments provide a contactless and efficient way for customers to complete transactions by scanning a QR code with their smartphones.

Scheduled Payments

Scheduled payments allow businesses and customers to automate recurring transactions, such as subscriptions, memberships, or installment payments. This feature ensures that payments are made on time, reducing the risk of missed or late payments.

e-Check Processing

e-Check processing offers businesses a reliable and cost-effective way to accept payments directly from customers’ bank accounts. This electronic payment method is beneficial for large transactions, recurring payments, or situations where lower processing fees are desirable.

Data Reporting and Analytics

Data reporting and analytics tools empower businesses to make informed decisions by providing detailed insights into their operations, customer behavior, and financial performance. These tools enable businesses to track key metrics, identify trends, and optimize processes based on real-time data.

Continuing Education Seminars

Continuing education seminars offer businesses and professionals the opportunity to stay updated on industry trends, regulatory changes, and best practices. These seminars provide valuable knowledge and skills that can enhance performance, compliance, and innovation within an organization.