Overview

In this article, we will provide a detailed review of AffiniPay, a credit card processing company. We will discuss the range of services offered, including merchant accounts, payment gateways, and point-of-sale systems. The review will examine the company's pricing structures, contract terms, and overall reliability. Additionally, we will analyze customer feedback and support quality to give you a comprehensive understanding of the user experience. Comparisons with other payment processors in the industry will also be included to help you determine if AffiniPay suits your business needs. This article aims to provide you with all the necessary information to make an informed decision.

About AffiniPay

AffiniPay, founded in 2005, is a full-service merchant account provider specializing in retail and internet merchant accounts as well as processing for professional associations such as accounts, psychologists, and especially law professionals through its specialized platform LawPay. As of 2022, AffiniPay also owns legal software firm MyCase.

AffiniPay Products and Services

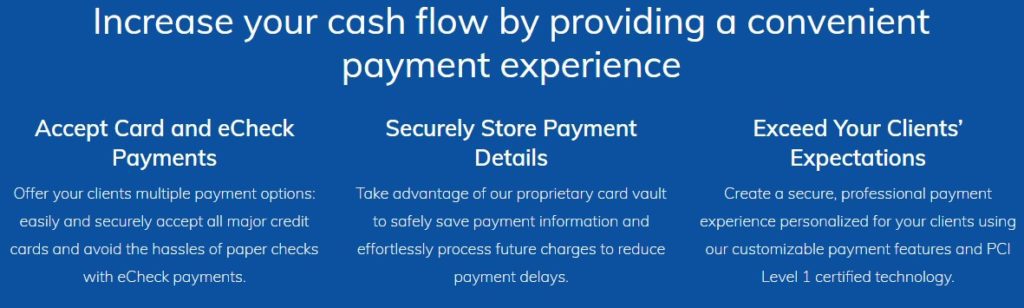

Payment Processing

AffiniPay handles payment processing for all major debit and credit cards, specializing in services for specific industries such as legal, accounting, nonprofit, architecture, engineering, design, medical, and construction. Their offerings include Level 1 PCI compliance, QR code payments, mobile payments, a payment gateway called ClientPay, recurring payments, fraud and chargeback protection, and ABA and IOLTA compliance.

Accounting Payment Processing

CPACharge, an AffiniPay product, is designed for accounting professionals, providing various payment methods, reporting, and reconciliation features, along with robust data security.

Architectural and Engineering Payment Processing

ClientPay allows professionals in architecture, engineering, design, and construction to securely accept credit card and eCheck payments.

Association and Non-profit Payment Processing

AffiniPay offers solutions for associations and nonprofits, enabling them to accept member payments, run reports, and ensure information security.

Amy Porter

Phillip,

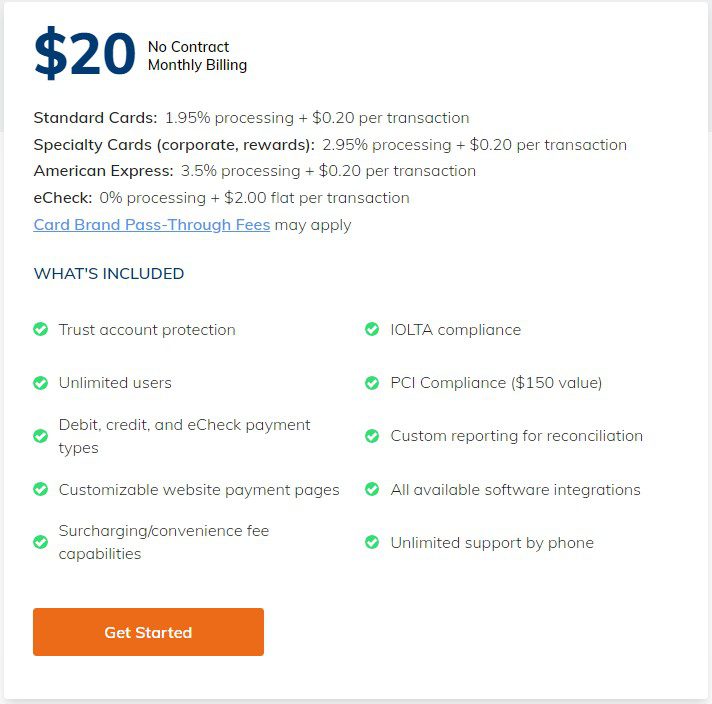

Thank you once again for your review and ranking of AffiniPay/LawPay. We appreciate the recognition of our efforts in the industry. I also hope you will reconsider your change from A+ to A regarding our fees. Our pricing has not changed since last year. I also believe our account options are clearly disclosed on our website, which unfortunately is something not always done in this industry, but we strive to do. The 3.50% you mentioned is simply an option available through our LawPay program for smaller firms looking to have one FLAT RATE with NO TRANSACTION fees. No one with a Standard LawPay plan would ever pay 3.5%. The options for this plan, and the standard LawPay plans are clearly available under the “Open Account” link on the LawPay website.

Best regards,

Amy Porter

CEO, AffiniPay

Marge Falendysz

Affinipay (DBA LawPay, MedPay, CPAcharge) Of course you will not find poor reviews for Affinipay because the review are all under their third party processors. I requested a copy of AfiniPay pricing and I received a copy of their ‘Program Guide’. It is important to read everything about the program guide so a merchant will understand additional charges that are not listed within the program guide. They use Priority Payment Systems, LLC as their payment processor. (only bad reviews), The customer is also required to pay for ‘additional services’ for third party processors, such as Transarmour by First Data Services. These fees are not delinated in your agreement. But you will pay a ‘batch fee’ of .20 per item. FirstData services only does Batch Processing. This is what I would call hidden fees and there are a lot of them.