Overview

In this review of LawPay, we will provide a detailed overview of the company's credit card processing services specifically tailored for legal professionals. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of law firms and legal practices that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific services provided. By the end of this review, you will have a clear understanding of whether LawPay meets your payment processing needs.

About LawPay

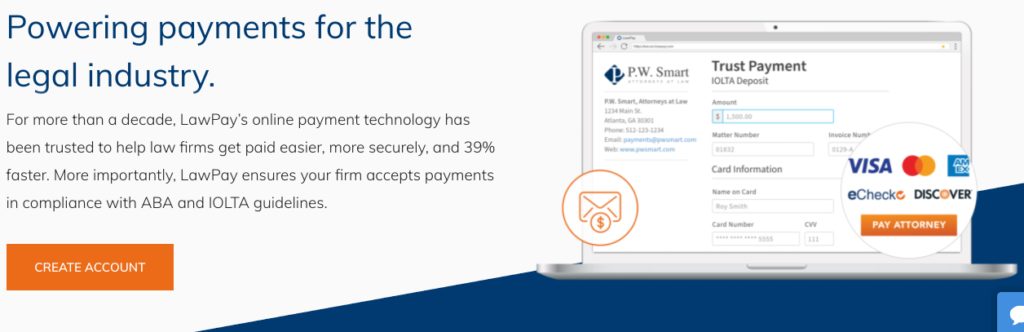

A subsidiary brand of AffiniPay, LawPay is a merchant account provider that exclusively specializes in payment processing for lawyers and law firms. Even though LawPay is technically “an AffiniPay solution,” it constitutes by far the largest percentage of AffiniPay's overall merchant portfolio. LawPay claims to serve more than 50,000 lawyers and is the exclusively recommended payment processor of the American Bar Association. In 2022, AffiniPay acquired law practice management platform MyCase. LawPay also announced integration with Nota, a fintech solution being developed to help lawyers quickly and easily track and manage client funds in compliance with state requirements.

LawPay Products and Services

Payment Processing

LawPay processes major debit and credit cards for businesses in the legal industry. Their services include card vaults, ClientCredit “buy now, pay later” options, mobile payments, QR-code payments, scheduled payments, e-check processing, data reporting and analytics, and continuing education seminars.

Charley Laman

I am a solo attorney in Phoenix, and recently had misinformation from LawPay when I was changing from one bank account for my LawPay payments to a new bank account at the same bank. As a result of this misinformation, I now have several thousands of dollors in banking limbo, and all LawPay states is as soon as the bank that they sent the funds to rejects the same because the account LawPay sent them to does not exist, LawPay will send them to the correct account.

For some reason, I do not have much confidence that this will happen soon.

SmallTownLawyer

I am an attorney using LawPay. They are better than an “old fashioned” terminal with associated monthly fees and rental and what-not, and have some lawyer-specific features excellent for some firms, but small law firms should consider whether they would make off better with a Square account. LawPay appears to be up-front, but their interface is clunky and mysterious fees appear (e.g., they’ll charge an extra $19/mo if you don’t go through a “compliance” review, they’ve added random lines with something like $1.55 for a “correction” to the fees they charged the prior month).

We’ve run LawPay side-by-side with Square. Even though LawPay’s processing % is less than Square, I’m not convinced it is the better option for lower fees. For example, on a month with $1,500 – $2,000 in Lawpay charges, total processing charges ran a bit over 5%. That included a $19 ding for apparently not filing out a compliance review. Processing $3k-$4k/mo, total processing charges ran 3.11% In comparison, our Square charges are always what-you-see-is-what-you-get.

LawPay has lower ACH charges than Square but unlike Square there is no way to select e-check / ACH as the preferred payment method when you send out the bill.

About 6 months in to the side-by-side comparison I’m not sure we’ll keep LawPay. If we used a case management platform with LawPay integration or took credit card payments for retainers LawPay would be the obvious choice.

VedaL

I am a consumer. I paid my first $1300 installment to my attorney and was charged an an administrative fee by LawPay of 29.99. I will definitely will find another method of payment.