UPDATE 10/05/2022: The National Bureau of Merchant Services appears may now be operating as National Internal Processing Center. It appears that National Bureau of Merchant Services may also still be in operations but without an active website. If you have any information about and merchant services companies operated by Michael Salman or Suzanne Salman, please share it in the comment section below this review.

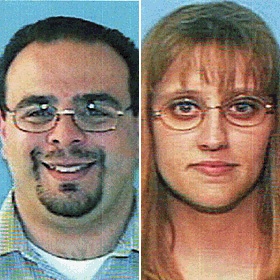

National Bureau of Merchant Services, Inc. (internalresourcenetwork.com, internalprocessingcenter.com & merchantservicebureau.org), also known as the Merchant Services Bureau, is an Arizona-based company that is commonly linked to another entity named Internal Resource Network in merchant complaints. In fact, it seems as though the website for National Bureau of Merchant Services (merchantservicebureau.org) is designed to resemble a consumer protection or watchdog site, but according to complainants, it is actually a site for a merchant account provider that also operates under the name of Internal Resource Network. Merchants are advised to keep in mind that there is no privately owned or government-run watchdog group known as the Merchant Services Bureau. Additionally, it has been reported that a new ISO has been formed under the DBA, “National Internal Processing Center.” National Bureau of Merchant Services was founded in 2004 and is headquartered at 3003 W Northern Avenue #1, Phoenix, Arizona 85051. The company's website does not list an Acquiring Bank. NBMS is owned by Michael and Suzanne Salman.

On April 9, 2014, we were contacted by Jennifer Portillo, a representative of Internal Resource Network. She stated that Internal Resource Network and the National Bureau of Merchant Services are two separate companies, that Internal Resource Network is not owned by Michael or Suzanne Salman, and that Internal Resource Network is based in New York. However, numerous online complaints and other consumer protection websites posit some kind of link between NBMS and Internal Resource Network, so the exact relationship between the two companies remains unclear at this time. It is also unclear whether “Internal Resource Network” and “IRN Payment Systems” are the same company.

As of this update, Jennifer Portillo is the managing member of Internal Processing Center (internalprocessingcenter.com), a company that maintains offices in Arizona and names Internal Resource Network as one of its divisions. The Internal Processing Center website also displays the Merchant Services Bureau logo on all of its pages.

In February 2013, Michael Salman pleaded guilty to felony theft and felony forgery and was convicted of defrauding the state of Arizona's Medicaid program of more than $118,000. The following is taken from an announcement by the Arizona Attorney General's office:

Michael and Suzanne Salman lied about their household income to the Arizona Department of Economic Security (DES) and received health insurance benefits through the Arizona Health Care Cost Containment System (AHCCCS) for themselves and their children.

Between 2008 and 2012 the Salmans submitted false information regarding their household income on applications for AHCCCS benefits and also submitted false statements about their employment with Bureau of Merchant Services – an entity whose initial board of directors consisted only of Michael and Suzanne Salman.

Between May 2007 and March 2012, Frank Salman misrepresented his income to DES in order to receive AHCCCS health insurance benefits for himself, his spouse and his children. He also reported to AHCCCS that he was employed by NBMS.

According to this bulletin from the Arizona Department of Real Estate, Michael Salman also has a previous felony conviction for aggravated assault in 1992 and a 2002 misdemeanor conviction for impersonating a police officer.

Monika

How do we get your company to stop calling daily? We do not accept credit cards and have no intention of ever doing so. This is a constant annoyance and disrupting to our business. I have requested numerous times to be removed from your call list but to no avail.

WENSCO [REDACTED – contact information]

Michael

First of all our company is not shady. We have been in business since 2004. That is over 10 years. Since then we have had a total of 30 complaints. 90 % of them resolved. We have had over 4000 clients. Do the math?? That is over a 99% customer satisfaction. Even the complaints even though important to us are complaints based and made by people who signed a contract with our company and 2 years later cancelled without notice and were charged a cancel fee according to their contract and are angry there is a cancel fee. We make sure we follow all guidlines rules and regulations. Sometimes we.can not come to a.resolution. Yet many times we do and have.

Second of all, what happens in our personal life is our business. What happened to us personally has nothing to do with the way we conducted business. How many business owners or employees that work for various companies have been arrested for DUI or domestic violence or such. Why would what happened to us personally be against how we do business. Plus what happened to us was resolved with everyone satisfied. So we resolved the misunderstanding and took care of our debits.

Last of all. I still believe that there is no better company out there or people that will treat you better. I have been married 14 years and have 7 children. I am a family man and work very hard to make sure I have a clear and clean conscience. I have been in the industry over 12 years. I stand behind our services and our written guarantees. I believe our 99% track record speaks for itself.

David Grater

My name is David Grater my company is Grater Foods LLC. I am the owner of 3 Pizza Shops and 2 Banquet Halls in New Jersey and Pennsylvania. I use and continue to use this company for my processing. I get calls all the time about my business from people who want me to switch. They come into my shops and I can tell you one thing, nobody has beaten these guys and on top of that they have never screwed me. I am sorry but these reviews against this company suck and are in accurate. I welcome anyone to contact me at [email redacted] or come into my shops. I would recommend and continue to recommend this company. Any business person is stupid if they don’t give these guys a try.

Phillip CPO

Hi David, we attempted to locate both “Grater Pizza” and “Grater Foods” in New Jersey and Pennsylvania but were unable to find any listings for these business names. In order to authenticate your testimonial, please reply with the names of the businesses as well as the addresses of each location.

*UPDATE 3/14/2014: Mr. Grater refused to supply any evidence to support his testimonial.

Terry

I got a call from Brendan Farmer at IRN. He described IRN as a direct processor of Visa/MC and said a review of my companies track record with credit cards had elevated us to where we can get direct processing and bypass the merchant services provider. This rather surprised me, as we are a very small company and our credit card receipts are annually in the 10’s of thousands.

Along with the bad review on this site, I also found additional information o the owner. The web page www dot irnsystem dot com shows the owner as Micheal Salman. A link is provided to his Facebook page as “Pastor Micheal Salman”. His About box shows: “Bishop at Harvest Christian Fellowship – An Alethian Christian Church and Pastor at Harvest Christian Fellowship Ministries”.

Here are some relevant articles about him:

Jailed for using his residential property as a church:

Pled guilty of Fraud:

https://www.phoenixnewtimes.com/news/pastor-michael-salman-guilty-of-felonies-in-health-care-fraud-case-6654550

Reports to Jail:

This last article also says that the Pastor is the owner of Mighty Mike’s Burgers and that he and his wife own a credit card processing company.

Alan

DO NOT DO BUSINESS WITH NATIONAL BUREAU OF MERCHANT SERVICES / IRN PAYMENT SYSTEMS OR MICHAEL SUZANNE AND FRANK SALMAN

We started using National Bureau of Merchant Services 3003 W Northern Ave Phoenix, AZ 85051 / IRN 800 Shames Drive Westbury, NY 11590 1-800-366-1388–Internal Resource Network to process our carpet cleaning customer’s credit card charges on August 29, 2008 signing a 48 month rate guarantee which would expire 8/29/2012. When signing Steve Marcus told us if we did not fulfill the 48 month agreement the max exit fee was $300. Our sales rep Michael Salman was not able to provide us with a cost effective way to swipe credit cards at a customers home. We only had a terminal at our office. Another company called that was able to offer a better rate and a cost effective way to swipe customer credit cards at customer’s home using Roam Pay.

On 10/25/11 We spoke to Robert Thomas @ National Bureau of Merchant Services 1-877-441-4599 and asked if I changed vendors if it was a problem and was told that my 48 month rate guarantee expired on 8/29/12 but I could just pay the minimum account billing fee of $15 until the end of the 48 month rate guarantee (as stated in my contract). Upon request I faxed a letter to Robert Thomas & Garrett Fulton requesting the cancellation of our merchant account upon the expiration of our contract.

As far as I knew I was ok with the agreements made. In February we stopped processing with National Bureau of Merchant Services / IRN and used our new vendor. On March 12, 2012 an unauthorized withdraw of $1,000 was made from our bank account by IRN. We had received no phone call or letter from National Bureau of Merchant Services/IRN informing us of this. We called Ray who is the manager of the cancellation department at IRN and was told our sales office – National Bureau of Merchant Services had instructed him to close our account. This was done even though as mentioned above we requested it to be closed at the end of our 48 month agreement.

We called and spoke with Frank Falman (CEO), Michael Salman (Director), Joseph Torres (Director) and Garrett Fulton from National Bureau of Merchant Services. I had to call several times and leave messages rarely receiving a return call. I asked them to show me where the $1000 cancellation fee is in the contract. It does not exist! In addition upon examining section 13 Term and Termination of the contract It begins by saying “This agreement shall remain in full force and effect for an initial term of one year.” So the 48 month agreement was only for the processing rate guarantee.

After having a very unprofessional conversation with Joesph Torres he said he would credit the $1000 back to us if we started processing with them again for at least another year. Why would I want to do business with a company like this that thinks they can withdraw any amount of money they wish from your account at any time without notice and does not follow through on agreements made by their staff. (Agreed to let us pay minimum account billing of $15 a month)

The unauthorized $1000 withdrawn from our bank account needs returned. It was deserved because 1-we requested our account to be closed at the end of the contract, National Bureau of Merchant Services closed our account. 2-I called and confirmed with National Bureau of Merchant Services that it would be ok to change processors and pay the minimum account billing amount through the end of our contract to which they agreed. 3-Even if a cancellation fee was valid we were told it would be $300 when we signed up, but instead $1000 was withdrawn which is not in the signed contract.

All documents and signed contracts can be provided.

You can see other cases of unethical and illegal activity of National Bureau of Merchant Services and Michael, Suzanne and Frank Salman by following the link below. Where possible this information has been reported/filed including the websites below. If the $1000 fee is returned and this issue is resolved I will post a follow up comment stating what was done to resolve the situation.

IRN Payment Systems Review

National Bureau of Merchant Services Review

Linda Battisto

I started doing business with NBMS when a sales rep with IRN promised me the “BEST” customer service and best rates. He said he would be available 24 hours a day 7 days a week if I ever needed anything.

Well before I even changed my machine over to IRN I was charged a $25 fee. I called the number he gave me and the gentlemen said he would definitely take care of it….along with the $9.95 fee that I was charged for the statement fee. When I signed up I went online and registered to get all my statements off their website so that I would NOT get that $9.95 fee each month. I have continued to receive the $9.95 fee each month, the $25 fee that he promised would be reimbursed has still not been resolved.

My rep who promised me the moon will not even answer my calls or return my calls when I leave a message. The other man I spoke with in charge of tech support will not return my calls or answer his phone. I have been calling them for weeks to take care of this issue.

I would like to do business with another company now. Last Thursday I called a number I found in the contract and told her my problems. She was very nice and said she would take care of the matter. I called her first thing

Friday to see what she had done…..no answer. So today, Monday, I called, she answered and again listened to my issue. She then said she would take it to her boss and she would call me back immediately. No call.

I am very tired of doing business with a company that has the poorest customer service and will not resolve issues or even face the issues by not answering their phones!!! Also, when I asked her the termination policy

with IRN she said it would be a total of $556.50. Well I live in Arkansas and a law was passed in 2007 that a credit card processing company could not charge more than $50 when a merchant terminates the contrace. I told her this and she said she would talk to her boss about that, also. Still no word. HELP

Lauren Tanis

This company is shady. They called our business stating that Visa/Mastercard mandated a review of our account. When I asked for the documentation on that, “Cindy” hung up on me. When I called back numerous times, no one answered the phone.

I then called from another phone and someone answered, I then asked for whoever was in charge and got “Carrie”, who tried to tell me they are a direct processor for Visa/Mastercard. A quick review of their website reveals they are simply another resale group. No one accesses Visa/Mastercard directly. Visa and Mastecard is a group of bankers/financial institution directors that simply govern the industry and set the interchange fees that are not only mandatory, but also non- negotiable. It is a level playing field.

This company is ignorant at best, dishonest at worst —

Mike

So the owner and her husband are pretty trustworthy. I just saved one of my merchants from dealing with these guys.