Overview

Is this article we'll discuss a company that operates under the business name of “The Card Association” or “The Card Association Merchant Services” based in Scottsdale, Arizona. We'll provide insight on the services that The Card Association offers and how it is choosing to market those servicess. Additionally, we will delve into its ownership, related business ventures, legal issues, and other feedback we have received. If you have any further information that you believe should be added to this review, please leave it in the comment section at the end of this article.

About The Card Association Merchant Services

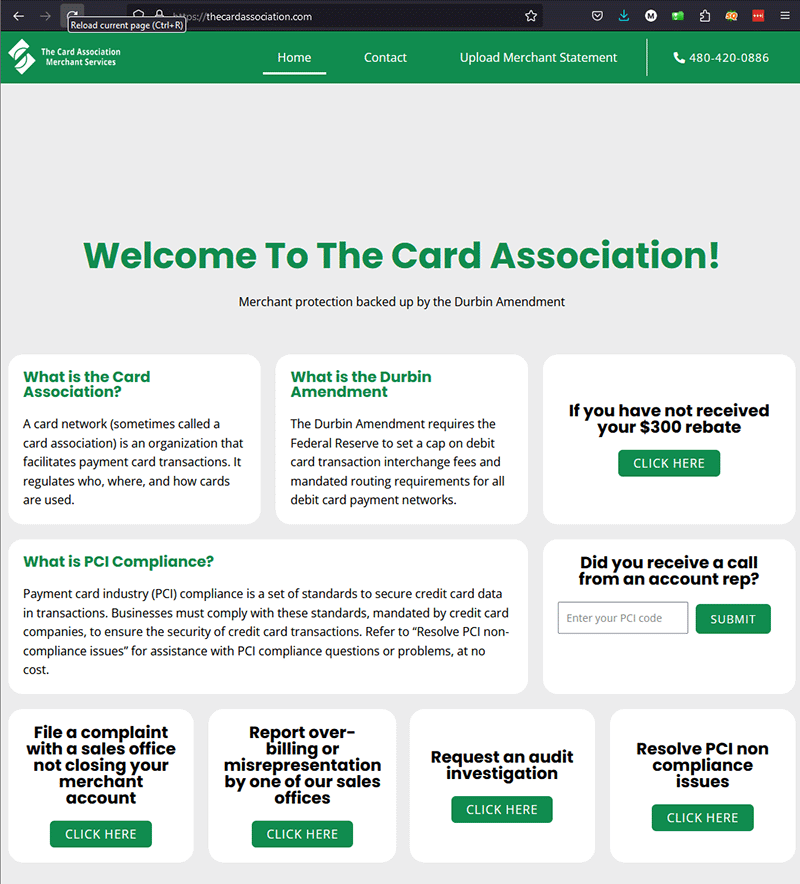

Most publicly available information about this company appears to me intentionally limited and hidden. However, through various methods, we have gathered a few facts that the owners were unable to hide. The Card Association is formally owned by TCA Commerce LLC, which is actually owned by Redfynn Technologies. Redfynn is one of many brands that market the credit card processing services of Paysafe Group. The Card Association, on the behalf of Redfynn, is engaging in questionable marketing tactics which we will cover below. It is not clear as of this update if Paysafe condones the actions of The Card Association.

Management & Ownership

The companies and individual behind The Card Association have been intentionally hidden in regard to the company's web presence. Not only is the information omitted from the company's own website, but the owners have also elected to hide their domain registration information behind a company called “Domains by Proxy,” which is a service that provides private domain registration services. Despite these efforts, we have uncovered two individuals with direct connection to the company, and a possible third who may also have involvement. These individuals are Richard Miller, Micheal Crawford, and Craig Wolman. The role each has in The Card Association is undisclosed but a few things seem to be implied by the evidence we collected.

Possible Leadership Team:

- Michael Crawford: Appears to be a co-founder and the General Manager of the organization.

- Richard Miller: Likely in a CFO or accounting roll, but evidence suggests that Miller could be involved as a co-founder.

- Craig Wolman: Involvement is unknown; however, Wolman and Miller are partnered in a related business discussed below.

Misleading Address Information

The Card Association website lists the address of the company at 1201 South Alma School Rd.,

Mesa, AZ but there is no other evidence to support that a company by such a name operates at this address. We also located another address associated with the company at 5010 E Shea Blvd, Suite 140 Scottsdale, AZ. This address is also used by Miller and Wolman for their accounting and tax service business, Miller Wolman CPAs.

Normally, we would assume that a CPA has only provided services to a business for the filing and establishment of an LLC; however, in this case, it appears that Miller could have a deeper involvement due to his filings listing the address for The Card Association and TCA Commerce as the same as as that for Miller Wolman CPAs, as well listing himself as a primary contact.

Sism

Friendly and knowledgeable support from beginning to finish.

Nate

My experience mirrors many of those above.

Before I found this page, the points that triggered my “spidy sense” were:

* Pressure to sign a Docusign form while the person waited with me on the phone

* They promised me 0.5% CC processing fees. I’d never heard of fees that low.

* Promise to integrate with our current POS system (Cake POS), but they would need to send us new hardware that “Cake’s software would run on.”

* Pressure to commit to leasing new CC processing terminals at $25/month

* Voicemails are always empty, sometimes up to 1min in length

I still receive calls every few days.

Previously it just showed as 480-420-0886 (Arizona) but recently caller ID does display “The Card Association.”

I contacted Cake POS and they had never heard of this company.

Greg Ryan

I was helped all the way through sign up and with cancellation of the other merchant service company

CC

They have been calling our business for almost a year trying to give us a “rebate” for using a POS system. The person I talked to, who gave me their name as Rebecca, tried to take information from me to process this. They said they’re PCI compliant, but when I started googling them, they started to panic. They eventually couldn’t keep up with answers and actually hung up on me trying to pretend that they’re a legitimate business. I’d avoid them at all costs if I were you.

Tracey

I received a call yesterday from Gabe who works for this company. He stated that he was calling on behalf of my current credit card processing provider and wanted to inform me that my account was flagged by their auditing department due to overcharging of monthly fees. He then asked me if we had received a $300 rebate credit for being PCI compliant and asked me to pull up my November 2023 statement to see if it reflected that rebate, which we hadn’t. He told me that it was his job to gather certain information from me so he could get it forwarded to the corrections team who would be able to refund my account for what we’ve been “overcharged” on monthly processing fees, and also get that $300 rebate applied to our next month’s statement. He then gave me an email address of [email protected], along with a confirmation number – and asked me to email him over a copy of my February statement. He said an auditor would look it over and set an appointment for this morning at 10am. I did send the first page only. I just got off the phone with the auditor his name is Alex Cruz. He stated we were paying way to much in fees and that our processing company was charging us 3.98% and that because of the Durbin Amendment they can’t charge more than 2.2%. He said he contacted our processing company and they hung up on him. I thought that was suspicious. He has emailed over his contract and shows they can save us $400 a month in fees and charges…. I looked it over and they are connected to Redflynn. I told him I would have to talk it over with my business partner and he is suppose to call back this afternoon. I won’t be answering that call now that I have seen this page.

Phillip CPO

Thank you for the detailed information, Tracy. It’s also worth noting that the Durbin Amendment does not regulate credit card Interchange fees. It only capped the fees of certain debit card transactions.

Kenneth Jacobs

I spoke with Angel Garcia, and she said she is an Auditor. Alvin asked me to send the statement and kept telling me about the overbill from my current provider. I didn’t realize it was a scam sales call for me to switch to Merchant Services. It was too late for me to realize it was a marketing strategy. They all sound the same accent

Fatima

Fatima Healings

808-818-3385

Fatima

I was weary at first after reading these reviews but with some consideration I decided to give it a try and I couldn’t be happier. They were able to help me save money and assisted in getting my previous merchant closed no problem.

Phillip CPO

Please reply to with your business website or contact information to authenticate your testimonial.

Marc

They called alleging that they are confirming information to send me a settlement check related to the VISA / MC litigation. “Aloha” started asking basic information and I smelled it out.

The phone number was from 561-594-0685 and her “number” was 480-530-3402

paul

I was contacted by a woman named, Vianna Dizon, claiming I was overcharged by First Data and that they were doing an audit to see how far back these overcharges had been going on. Also was told about the $300 credit and other credits. I was out of town at a trade show and unfortunately ( because I had prior issues with overcharges from First Data goin back 15 yrs ago) I believed that I could have been overcharged. I did the application for a new account and they have all my info, SS#, banking routing etc. and I had docusigned the agreement. Once I returned they have been asking for last 2 months statements and a voided check, which I did not send . Once I returned home, I checked all my statements and there were no overcharges from First Data. I have not cancelled my contract with First Data, I am still using my original Clover system which is programmed only to be processed by First Data.

My concern is, what can Card Association do with that info they now have? What steps should I take to protect my personal info and banking info? Should I file a criminal complaint? Any input about my next steps would greatly be appreciated.

Phillip CPO

Hi Paul, sorry to hear that you are dealing with this unfortunate situation with The Card Association. My advice would be to start contacting First Data to let them know what happened. After that, you may want to consider filing a report with the Arizona Attorney General as well as with your own state’s Attorney General. Monitor your credit report and bank accounts for anything that isn’t authorized and report it as fraud.

Kyle

My company was getting daily calls from TCA, this was back in July, and I found all the same info in this article by digging records. I asked them multiple times to remove me from their call lists. After they kept calling, I filed a complaint with the FCC and included all the info I found in the complaint. Once they called again I told them I had filed a complaint with the FCC and further calls will be reported. They have since stopped calling.

Sheri

I also received a call from this company and was suspicious that they didn’t have my information. I even told them I was questioning if this was another tactic to get me to change processors, they laughed and said, oh no, we are the wholesale company, and your processor is the middleman. Visa and MC hire us to check the accounts. They promised that because I was overcharged, I was now eligible for wholesale rates. And of course, they called my processor and were hung up on. My spidey senses are getting better and better.

Robin

Wow, carbon copy of my interaction as well! I specifically asked for them just to be honest if they were a way to get in and earn my business, of course the answer was. “No!” Anyway, looks like your senses are spot on!

Tiffany

I actually just got off the phone with a Mr. Alvin Cortez (or so he called himself) who works for this company. He stated that he was calling on behalf of my current credit card processing provider and wanted to inform me that my account was flagged by their auditing department due to overcharging of monthly fees. He then asked me if we had received a $300 rebate credit for being PCI compliant and asked me to pull up my November 2023 statement to see if it reflected that rebate, which we hadn’t. He told me that it was his job to gather certain information from me so he could get it forwarded to the corrections team who would be able to refund my account for what we’ve been “overcharged” on monthly processing fees, and also get that $300 rebate applied to our next month’s statement. He then gave me an email address of [email protected], along with a confirmation number – and asked me to email him over a copy of my November 2023 statement and that through up a big red flag for me. I told him if he was calling ON BEHALF of my current credit card processing provider, then he should already have access to all of that information. He gave me some bogus excuse as to why he couldn’t access that information from his side of things, and while he was doing so, I took it upon myself to look up The Card Association website, and I am glad that I did. That’s where I came across this page and it was VERY helpful. I told him that I looked up the company and saw that it was a scam and to please not call us back again.

Linda

We received a call from this company this morning claiming that we were owed a $300 rebate for PCI Compliance and that our processing company was overcharging us on our fees. She made it seem like they were doing this as a courtesy and that they would be able to refund us. She was insistent that she waits on the phone while we send them our November statement and I had a gut feeling that something wasn’t right and ended the call. Thanks to this article and these comments, I was able to determine that this company was a scam before sending them my company’s information. I then confirmed with my processing company that this was a scam, and they made a note on our account of what happened. Thank you for this info!

Eric

I got a call from these folks and I smelled a fish. They asked for a November Credit Card Statement to see if I had a “one time PCI fee credit of $100. I did not have it but I had one from October so they said to use that. They wanted a fax copy and repeatedly told me I did not want to miss out on the $300 rebate check. Finally I told the woman I would fax it over to them and give them my name as soon as I finished checking them out. She got really snippy with me and hung up. I win this round I guess.

GiGi Bee

They called us saying that they are trying to send us a missed credit card rebate and wanted to verify our information. I told them they should already have all that IF we were using their services, which I’m pretty sure we are NOT. I asked them for all their information, which was very basic, and in return, I gave them back basic BS :-)

Kari

I received a call from this company saying that they were auditing my POS processing fees, and CC machines, and wanted to know if I had received my $300 rebate for my PCI compliance too. They then asked me to send a copy of my Nov statement. Which I sadly did. I took a picture of it and emailed it to them from my phone. The one bit of information on it was my account number with my POS company and my sales numbers for the month. They called me back again the next day (after I gave them my cell #). I began to suspect something almost right away this time. Something didn’t feel right about it when she said they tried to call my POS company and she said they hung up on her when they questioned about the fees. I’m thinking, why would my POS company hang up on her just asking a question if it was legitimate. So many more things she said to try and confuse me. She caught me at a time when I was busy working in my store, so I was multi tasking when she called and began to fall for it. I’ve blocked her number to call me again, but I’m worried that with my account number for my POS that she can do more harm. Any advice would be so appreciated.

Phillip CPO

Hi Kari, its unlikely that they can do anything with your account without your consent. However, it might be a good idea to call you current provider to let them know what happened. They may be able to notate that nothing should happen with your account without your explicit authorization.

Scott

I received a call from this company. They said they were calling because they had been notified that CardConnect was overcharging us and acted like they were just making a courtesy call. After a few minutes, I realized it was a sneaky sales call and that they were trying to get me send them my statement. Very suspicious! Watch out!

Julie

Too late 😖