Overview

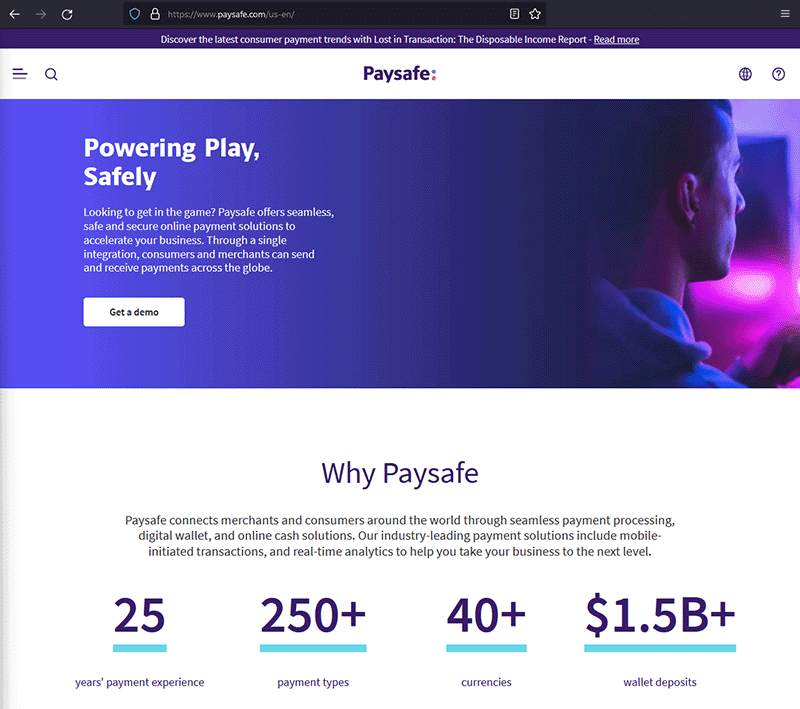

In this review of Paysafe, we'll provide a detailed look at the company's operations and customer experiences. We'll cover the range of payment processing services offered by Paysafe, highlighting its role as a large multinational organization with a vast network of subsidiaries and partners worldwide. We'll address the company's track record of customer complaints, mainly about held funds, and the complexities arising from its numerous subsidiaries, each with different contract terms.

We'll examine Paysafe's payment processing capabilities from a small business perspective, detailing its offerings in credit and debit card processing, digital wallet services, and specific industry focuses like gaming and investing. We'll also discuss the company's regulatory compliance and global reach, facilitated through partnerships with several banks.

A key part of our review will be an analysis of customer reviews and legal challenges, looking at the nature of customer complaints and the legal actions faced by the company to provide a nuanced view of the customer experience.

Finally, we'll cover Paysafe's fee structure, contract terms, and sales tactics, offering insights into the company's pricing and marketing strategies. This comprehensive review aims to give a well-rounded perspective on Paysafe's services for small businesses looking to accept credit card payments from their customers.

About Paysafe

Also known as Paysafe Group, Paysafe is a UK-based merchant account provider that has acquired multiple large payment processing subsidiaries during the past five years. The company was formed in 2015 as a rebranding of Optimal Payments, and it was subsequently acquired in August 2017 by two private equity firms called The Blackstone Group and CVC Capital Partners. Its major acquisitions under both the Optimal Payments and Paysafe brands include Skrill, Meritus Payment Solutions, MeritCard Solutions, Merchants' Choice Payment Solutions, and, most recently, iPayment. In 2020, Paysafe announced a partnership with US-based sports-betting platform FOX Bet as well as one with the Microsoft Store. In 2021 Paysafe expanded into cryptocurrency with a partnership with transcoin.me, and in 2022 they acquired SafetyPay. Further partnerships in 2023 included Greyhound and HotelKey.

Related Companies

- Optimal Payments

- Skrill

- Meritus Payment Solutions

- MeritCard Solutions

- Merchants' Choice Payment Solutions

- iPayment

Paysafe Products and Services

Payment Processing

Paysafe offers a range of payment processing services catering to various industries, designed to facilitate electronic transactions. Their services include:

Merchant Accounts

Paysafe provides businesses with merchant accounts, which are essential for accepting and processing credit and debit card payments. These accounts serve as intermediaries between the customer's card issuer and the business’s bank, enabling the transfer of funds.

Credit and Debit Card Processing

Paysafe handles the technical aspects of processing credit and debit card transactions, ensuring smooth and secure payments.

Point of Sale (POS) Systems

The company offers POS systems and integration options for businesses to manage in-store transactions effectively.

Online Payment Gateways

For e-commerce businesses, Paysafe provides payment gateway services that securely transmit card data from the website to the payment network for processing and authorization.

Mobile Payment Solutions

Paysafe offers mobile payment solutions, enabling businesses to accept payments via mobile devices through mobile-optimized gateways or dedicated apps.

Multi-Currency and Cross-Border Payments

Paysafe supports more than 40 currencies and offers over 250 types of payments, facilitating international transactions. They report handling over $15 billion in wallet deposits.

Regulatory Compliance

Paysafe is regulated by the Financial Conduct Authority under the Electronic Money Regulations 2011, ensuring compliance for issuing electronic money and payment instruments.

Larrecia Shealey

They say I owe them money but I don’t do not go with this company they are liars

jeremy paceley

tried closing acount since oct 2023 and the rep told us he was not going to close anymore account found out that they had been charging us for a store that had closed 1.5 years ago. now they sent us to collection and can not get a staight answer out of them

Jeffrey Winters

Mickel is pretty much am idiot with a bad attitude. DO NOT USE THIS COMPANY. As soon as I get my funds released I will be heading somewhere else. I don’t have time to deal with a bunch of degenerates who have no interest in helping the customer. Yes I am the customer and treated like crap. So sad at the way this company works. I am going to blast and you should too on Google Reviews and I am recommending all my followers to do the same, and let me tell you I have plenty. Mickle is going to regret he ever dealt with me in the manner he did. This whole c=situation could have been avoided with a little compassion and understanding and trying to make this incident work smoothly and fast, but all I get is it will take 3 to 5 business days as he is looking at the information I have sent. Not brain surgery.

Jeffrey Winters

Paysafe has a risk review company called Houston Risk Review which has the most unprofessional staff I have ever dealt with. Rude is not even the word I would use, and they are unwilling to help in any way. Houston Risk Review will hold your fund so they can collect interest on your money while they make up some excuses to not send your funds through.

TIM

THEY ARE HOLDING OVER $20,000 OF OUR FUNDS, REFUSING TO RELEASE THE FUNDS.A BOGUS CLAIM THEY NEED OUR COMPANY’S FINANCIAL INFORMATION AND STATEMENTS TO GET OUR MONEY FROM OUR CUSTOMER’S CREDIT CARD THAT CLEARED. YEAR IN BUSINESS, WE HAVE MADE 2 X FORMAL DEMANDS, AND THEY WILL NOT ANSWER. WE HAVE ENGAGED A LAWER. ADVISE: RUN !!!

Joseph

Wow, what a ripoff. They approved my account, I had processed three transactions then they suddenly without warning closed my account back in July. They still haven’t deposited the thousands of dollars into my account after repeated attempts. They keep saying tomorrow and the tomorrow’s are going on 3 months already. Do not under any circumstances get involved with this boiler room operation.

Joseph

Wow, what a ripoff. They approved my account, I had processed three transactions then they suddenly without warning closed my account back in July. They still haven’t deposited the thousands of dollars into my account after repeated attempts. The real devil in this situation is a guy named Mickel [email protected] who lies through his teeth promising tomorrow, tomorrow, tomorrow and the tomorrow’s are going on 3 months already. Do not under any circumstances get involved with this boiler room operation.

Alli

This Company is a fraud. Do not, I repeat, do not engage their services.

gail harding

yes agreed 100 percent …. you can not get a hold of anyone they drag the whole thing out for days. and do fraud charge backs.

Alli Ojeifoh

I can’t agree less with you. They fraud

Suzanne

We did not complete the sign-up pricess and have received no equipment to process payments. While signing the contract, we questioned the $15/month statement fee. We stopped the process because we realized we wanted to stay with Square.

We noticed a $62.95 charge to our business account. It was unclear who the charge was coming from & took a while to track them down. They are refusing to refund these charges that started almost ONE YEAR ago! Meanwhile, they have no completed contract. We have no equiptment and have not processed one single payment through them.

Misti

This company has done the same thing to me that others below have stated.. I am not going to wait on these scammers… I have refunded my customers through my merchant portal and they better refund them back their money… I am closing my account… This is not gonna work. Sounds like they take peoples money and draw interest on it and then never give it back..

Tony

My company was approved for a merchant credit card processing account less than two months ago, after a review of my company’s BANK STATEMENTS that were sent by me on 26 Jan 2023, with the following stipulations: $5,000 average sale, $25,000 maximum sale, $50,000 monthly average.

We began using the account on 14 Feb 2023. Our 4th transaction was in the amount of $5,087.12. The customer’s credit card issuing company, Wells Fargo, “declined” the three attempts by the customer to make this payment.

The customer called Wells Fargo, and after a short phone called, the fourth attempt for the $5,087.12 amount was approved, and processed by PaySafe. This transaction was physically conducted on 8 March 2023, but dated 10 March 2023 by PaySafe.

PaySafe flagged this exchange as fraud, and seized the $5,087.12 funds, as well as the funds of two subsequent transactions, for a total of $18,278.11, “for up to 180 days”.

PaySafe subsequently closed our merchant account on 15 March 2023.

Wells Fargo VISA, 3/10/2023, $5,087.12 –

Chase VISA, 3/10/2023, $3,940.00, –

Discover, 3/14/2023, $9430.63.

While PaySafe had sent emails on Friday, 10 March 2023, as well as Monday, 13 March 2023, those emails came from “Houston Risk Review”, and were subsequently sent to my spam folder. Those emails contained a questionnaire concerning the $5,087.12 transaction, and once again, wanted “3 months of bank statements” that we had already provided when opening the account less than two months previous.

A PaySafe employee from the Houston office, “M”, called me on Tuesday, 14 March 2023, and literally started the conversation with, “Your account is scheduled for closure”. I didn’t immediately associate “Houston” or “PaySafe” with any company that my company was doing business with, so my immediate impression was this was some kind of phishing scam.

After over ten years of business, transacting several million dollars in credit cards transactions through other platforms, including PayPal, Shopify and Square, we wanted to replace Square with a more “premium” credit card processing platform. We applied for this PaySafe account through a company called “Leaders”, which was highly rated.

Unfortunately, part of the PaySafe experience is a bit of shell game of a myriad of different name companies, all seemingly working together, but without any logical connection with each other.

For example, when I applied through Leaders, I expected to get a a credit card processing platform that would be called some name with “Leaders” in it. Nope. That company was PaySafe.

So, you’d think that we would have a processing platform called “Leaders”, or “PaySafe”? Nope. That site is called “SwipeSimple”. Guess where you see where the transactions go? Another site, called “iAccess”.

There’s even some other site called “PCI” that does something that I never really learned what that’s for. When they start taking money DIRECTLY OUT OF YOUR BANK ACCOUNT, through a collection agency, for various fees, that company will show up as “MOT” (or similar), and you won’t have a clue who is taking the money.

If you do business with this company, have a separate account from your main business that you can close after you are done doing business with them.

On Wednesday, 15 March 2023, the Houston office of PaySafe noted that the reason for the closure of our credit card processing account was “actual processing observed is inconsistent with expected”.

We promptly notified each of the three affected customers that they would need to initiate a “dispute” (chargeback) with their respective credit card company, and find an alternative way to pay us for our services and products.

We will recommend that they each do as we will do, and make reports to their respective Better Business Bureau (BBB), State Attorney General Office, Federal Trade Commission (FTC), and other government agencies as may be appropriate.

In addition, should PaySafe NOT release the funds back to our customers in a timely manner, we will take, and we will recommend that our customers take whatever additional legal steps as may be required to properly adjudicate these issues.

I suspect that there will be a whole series of future “fees” associated with closing out of this account that will need to be addressed, but we do not presently have any knowledge of any such fees as of this date.

PaySafe needs to QUICKLY and PROMPTLY release the $18,278.11 in customer funds, and either send those funds rightfully to the merchant (our company), or return the money to the customers through the “dispute” resolution process.

In addition, PaySafe needs to waive any and all fees that they may dream up in the future, and promptly close out this account.

Amber Rousseau

I am a small business making hardly anything and they have been taking out close to 30% of my profits. I was sent to paysafe with no authorization through another merchant. They will rob you blind!

JL

I am experiencing the same exact issue as Jenny and many others alike. I had sent in all the information requested by Paysafe, and they are still holding my funds. They want my bank statement with my bank account numbers- WTF! I don’t think so! They have lost their minds. No one should EVER give them this type of information. I will be fighting this for sure!

Richard/Cynthia Keenan

My name is Richard Keenan of K & B Water Works. You (PaySafe) have been taking out of my Business checking account for 4 month and I never authorized anyone to take out of my account. These funds need to be refunded right away or I will be turning this over. I have reached out to this company for help, and I keep getting the run around. I was told that I would be sent a form to fill out and never received one. This is the last time I will be contacting PaySafe to have this resolved. You can talk with my wife Cynthia Keenan about this matter. Funds that need to be refunded are Nov. 1, 2022/ 33.24, Dec. 1, 2022/ 8.24, Jan. 1, 2023/8.24 and Feb. 1, 2023/ 93.19 My contact number is [redacted] or email listed below.

George Kaiho

I got charged 10% credit card processing fee 2 months in a row. I called they couldn’t answer why? just keep saying might be many bad credit cards!! Whattttt??? I told them I want to cancel my account so they offer how about 5% This is a scam company. Never ever think to use them!!!

Jenny

Did you get your money back? I have only used them for few days, and I have not even received any funds to my bank account I thought it probably take longer cause it was Thursday to Sunday. Today is Monday I received an email said exact same thing as the email you received. They closed my account effective immediately, funds will remain held for 180 days. I’m like wtf??? I’m losing sleep over this, cause I have never had an issue with any merchant service like this in the past.

Lamont

I would NEVER EVER recommend this company to anyone. I have a customer that made a purchase 9 days ago….money is to me in my bank acct within 2 days…after 3rd day I called customer service and they thought it was “strange” then get an email from a PAYSAFE letting me know that they are holding the customer’s money until i send in the document they are requesting…My Bank statements, customers invoice, what my company do, and the website (which bank and company is on file) so now we are going into the 5th after sending documents…and the representative is not in today (SO BUSINESS JUST STOP) then the person who tries to help look for my email and can’t find it, and say no she didn’t get my email and I insist that I sent it and it went thro on my side…..she said, get this, oh let me check spam and sure enough that where it was….so she says “its a good thing you call cause she would have never seen the email” so now 9 days later I call to see if Michael Wolf is the current CEO and the girl that picked up the phone didn’t know, so she put me to customer service and I ask who is the CEO or someone in the executive office cause I would like to write a letter to them about my experience and why I am closing my account and once again he said he has to put me in touch with PAYSAFE GROUP who is the one handling the risk management.

STAY AWAY FROM THIS COMPANY…….not sure how long they are in business but they give me the impression of a fly-by-night company.

Tina glass

Do not use this company! Horrible service, price keeps increasing and they don’t respond to your request.

Problems after problems

Diane Baxter

I signed up in Aug. with Paysafe to run my credit cards though. I didn’t have a problem until Dec. 18th when I ran my Gas station company for 16,962.00. The transaction went through on my end and on my customers end. I then received an email stating that I needed to provide my bank statements and all the details of the transaction with contact information for my customer.

Paysafe then called the customer and confirmed that this in fact was exactly what they wanted. Then called me and said that they can’t continue with the transaction. I asked why? They said it was outside the amount I was approved for.

I explained that when I signed up the agent on the phone told me that I would be fine running these transactions. I sent all of my bank statements over to him at that time as well proving I make these types of transactions about every 4 months. They said I still need to do a refund to the customer.

I then ask if they could wave the Fee for the refund as well as the transaction fee because I was mislead by the salesmen when I was signed up. They said that I would need to talk to a manager for that was on 1/14/22. no call

I called back on the jan 26th to see where we stood and I was told I need to make the return and I would need to talk to a manager. I asked again for the manager to please call me. no call

I called again on the 27th and I was told to make the refund and I would need to talk to a manager. I made the refund on the 1/27/22.

I still haven’t received a call from a manager nor has my customer received the refund. As well as Paysafe is still holding the $16,962.00.

its now 2/15/22

Patrick Gelin

This is a scam company they approved merchant soon as I ran about $4300 getting paid through my clients they closed my account and telling me they are gonna hold my funds for 180 days and no charge backs. I called risk management and talked to Ginny (prejudice as hell) didn’t want to hear me out and hang up the phone called back spoke to supervisor David of the department and hang up on me. They are disgusting and founds out they are a scam company they have a class action law suit against them do not do business with them and I contacted the fbi and atty general about them. I want my money you thieves !!!

Artur Sattarov

The worst company ever, stay away from them, charge you fees and won’t refund them, froze account for a while and wouldn’t unfreeze it for a while leaving us without credit card processing for two weeks .

none of the guys working there was able to resolve stuff for a while, Jay was especially useless , thanks a lot Jay !!!

Got new merchant account already, never again with them!!

robert clark

Had service since 2016! Have been charged $147.40 for last 3 years with $0.00 sales. Paysafe said we called and canceled business but was told they did not receive a signed letter. I hope Ken Paxton attorney general for state of Texas looks into Paysafe business practices! I am sure I’m not the only small business being robbed monthly! Also after I was sent contact to email signed cancellation, the email has been Denied!

Philippe Martins-Baltar

As an end user…I never met such incompetents people…through their Branches, Skrill and Neteller, managed from uk with headquarter in isle of man…tried to open accounts, made me 10 days (may3rd to may 14th) filled usd and euro balance on skrill with difficulties (rejected my MasterCard three times with no reason)…I tried to use my balances to pay merchants (numbers time via Skrill twenty five ones from may 14th to june 4th) never worked…saying on the merchant applet that balance is unavailable….contacter Skrill through their stupid VA…”it’s the merchant fault”…I tried to call, I had someone who just repeat or read the report on his screen, no solution…I made it short of course, and cherry on the cake, one minute later, I received an email from Skrill that they have decide to close my account for non compliance…30 seconds later I received same mail from Neteller…the cousin of the first one ;)…teeling the same.

Well, I do not know which rules I broke…I just know that I will be refunded of my euro balance…I don’t know when…and I don’t know what about the refund of my dollars balance either.

They are just what I call go-between, poor in knowledge and in consumer relation management but…greedy for profits and dishonest … in short … useless companies dubbed by a banking system which is inexorably moving away from its core business.

Sandra Seino

I am dealing with this company and their fraudulent activities, which including pilfering my business account without authorization.

I did file with the FTC ask for Nick at 877-382-4357 as they need all complaints. My bank has initiated fraud charges as well and I’m filing with the State Attorney General, SO, and the US Dept of Justice Civil Rights Division.

There is a case from 2002 that mirrors mine and many of the reports made here are stated by the same thing, as if these culprits are moving from one location to another, changing names and continuing their practices.

I am going to the media next because if they’re willing to rip off a disabled small woman owned business owner that is a widow, they’re willing to do it to anyone!

This group goes by many names; Merchant Services, MobilePay, PaySafe, Flagship and even BBVA which as of yesterday 5/14/2021, they informed me that they are NOT affiliated with them, and when I pressed if they had in the past, I was told, “We no longer have anything to do with them.” Outside of that, no one will talk to you.

I signed up for a simple swipe, they charge you for a merchant account for a website and an online gateways that you never use! Also other fees are taken for another company that is either a willing association or unaware but if nothing has ever been used in any way, they know it and so do I as a Coding Engineer and Web Developer. I have no use for those as I get all business from the phone and I service properties!

I have suffered greatly from this, emotionally, financially and my business as well because of the countless hours I’ve spent trying to get them to stop, trying to find anyone be to assist me to read due to visual impairment, and then almost daily trips to travel to the bank to file documents, close my account, get new cards, checks, and contacting all businesses that are set up with auto payments.

They were taking triple payments even though I was clear about the upcoming multiple eye operations and temporary closure of my business.

This company and all individuals affiliated with them will tell you to contact one of their other numbers and then they tell you someone different. Bottom line, no one will help stop the pilfering of your funds. It took 6 months to finally get a cancellation form which has no mention of previous funds taken or prior dates. You are only allowed to fax, yet their method is email. I sent by USPS and they claim they never got it. They finally sent another in April, and I’m still calling demanding they cease and desist but they don’t!

I’m out hundreds of dollars, and on top of that, more fees because while I’m having eye surgeries and believe they stopped and funds were there for my living expenses, they were continuing to pilfer the account!

Derek Schleer the salesman told me this would be less than Square. Lie! So many hidden fees I’m learning now and I stated I couldn’t read due to my inability to see and asked him to read it all back, and he took full advantage, just as the other employees that I have full record of. He conveniently omitted his contact information.

File your case with the FTC! They do take down these individuals but only if enough people file. My case mirrors FTC File No: 012-3193. Just look up:

FTC FILES COMPLAINT CONCERNING CREDIT CARD MERCHANT ACCOUNT SALES AND BILLING PRACTICES

“Unauthorized Fees Allegedly Withdrawn from Small Businesses’ Bank Accounts The Commission’s Allegations Relief Sought”

We need to fight together, not alone!

Sarah Zhang

In April 2020, our total revenue dropped to $419.67 but Paysafe/Bankcard charged us $3,072.68!!! And when I mentioned those charges, no one reply to my email! A total scam.

David Schieffer

Paysafe Payment Processing is connected to National Bankcard and will be referred to as from this point on. National Bankcard/Paysafe’s processing entity risk department closed our account without warning. Two days worth of processed payment transactions (Batch receipts for 9.01.2020 = $578 & 9.02.2020 = $170) totaling $748 were never received into our bank account. I called National Bankcard and their processing entity (Paysafe) numerous times and was told our credit card processing account was closed by their risk department. They said that since the account was closed, the $748 was just returned to our customers. That means that therapeutic services we provided were not paid for because National Bankcard/Paysafe gave the money that was paid to us through credit cards ($748) was given back to these customers. There is no way for us to recover that money. We view this as theft on the part of National Bankcard/Paysafe.

David Schieffer

Theft of income from our business – any help with we can do

Marc Choyt

DO NOT under any circumstances work with this company.

I’ve been with them for nearly 2 years. The sales rep quoted a fixed rate and set up my terminal. He did not abide by a fixed rate. They have been charging me 4%!

The terminal was set up to batch at a “non-qualified rate” that has cost me thousands of dollars. They set it up this way.

Plus, the sales guy told me I could get out of the contract month by month and then signed me up for 3 years.

THEY TOTALLY LIED TO ME.

L. Lackland

Would never recommend or use this company again!! They wasn’t depositing my funds and when I asked the representative (Ginny) from The Woodlands location about it, she became very disrespectful. I asked for a supervisor and was not only denied, but she had my funds held for over 180 days because of it. Not only that, somehow a lot of my batches mysteriously “vanished “ from their system, but their still in my terminal. I had to report them to the FTC and file an IC3 against them. I hope that they all get prosecuted to the fullest extent of the law!! Getting over on their customers especially at a time like this?? Straight heartless!!

Joan Stanford

Very dissatisfied with Paysafe customer service or lack of. We have had funds held for months with no helpful responses after many attempts to resolve or minimally, talk to someone.

CPO

Joan,

We have a guide put together to help PayPal users get their funds released.

Nathan behmetuik

I just paysafe zero star review I’d like to start by introducing myself on Nathan with above and beyond renovations Inc and I’ve had nothing but a horrible experience with this company I quite possibly think that they might be scamming small businesses they have a contract that doesn’t even have my signature on it but I have a copy of my contract with them and it does have my signature in our contracts do not look the same now for the last two months I’ve been trying to pay the $495 fee that I wasn’t aware of when I signed up with paysafe to cancel their services and they’re refusing to take the payment in a timely fashion and in turn I’m inquiring extra monthly fees while I’m waiting for them to cancel my contract with them I would absolutely not recommend this company to anyone on this planet or therefore in the milky way galaxy thank you very much and have a nice day pay safe will be lucky if they don’t hear from my attorney

CPO

Nathan,

This article may help: How to cancel a merchant account without paying a fee.

-Phillip

Taisiya P

This review is for Paysafe Merchant Service provider. The company is an absolute SCAM.

1. They charge you much more that you agreed, you will be buried in hidden and unexpected fees.

2. They constant lie, starting with the sales rep, ending with every call center representative. I caught them so many times on lies.

3. They unlawfully withheld some of my transactions, not paying them out to me, telling lies about the reason why (I have proof).

4. They signed me up for a bunch of services that they call free, and guess what, I started to get billed monthly by all of them shortly after.

5. You will spend hours and hours on hold with their support, who would NEVER SOLVE ANYTHING over the phone. They always say they need to contact some other department and they will get back to you within the next 24-4 hours. And they never do, as the issues are never solved either.

The easiest way to get out of all this mess is to close your bank account.

Dave Patch

The are holding over $130k in funds due to 4% chargebacks. Do the math, its incredible they can destroy a business over something like this. WORST F****** COMPANY I HAVE EVER WORKED WITH IN 20 YEARS.

Helmut Dobler

stay away from this processing company I cancelled and keep charging fees my only option will be to close my bank account

CYNTHIA WHITELOW

This is not a good choice when it comes to merchant services. I would not recommend them to anyone. I faxed and emailed closure form in the beginning of October yet they say they did not close the account until Oct 31. So this is their reasoning for charging my account due to me not wanting to continue services with them. I told the man when he called to set it up “I have read reviews on the service you plan to put me with and I do not want to continue this account”. All of a sudden a charge on my account. This was in September. Do not use Paysafe. They are not safe.

Taisiya

To my opinion, trust score for this company should be ZERO. The company’s unethical practices brought me financial losses.

The relationship started with a few unauthorized charges that nobody from Paysafe could ever explain or refund.

They continued by me finding out that NOT ALL settled transaction are paid out. So Paysafe receives my customer’s money but not paying it out to me. Tried to resolve this issues in the course of a few weeks, spent over 6 hours on the phone with support who straight up lied. Every representative would come up with a different excuse and try to brush me off saying that they will resolve the issue within 48 hours and will contact me back. As you may have guess, nobody ever resolved the issues or contacted me.

Support would admit the issue over the phone but refuse to email me a written affirmation admitting the issue has happened. The whole situation looks extremely shady and practices employed resemble scammers. My month-long collaboration with this company resulted in a financial loss.

Taisiya

Trust score should be ZERO. The company’s unethical practices brought me financial losses.

The relationship started with a few unauthorized charges that nobody from Paysafe could ever explain or refund.

They continued by me finding out that NOT ALL settled transaction are paid out. So Paysafe receives my customer’s money but not paying it out to me. Tried to resolve this issues in the course of a few weeks, spent over 6 hours on the phone with support who straight up lied. Every representative would come up with a different excuse and try to brush me off saying that they will resolve the issue within 48 hours and will contact me back. As you may have guess, nobody ever resolved the issues or contacted me.

Support would admit the issue over the phone but refuse to email me a written affirmation admitting the issue has happened. The whole situation looks extremely shady and practices employed resemble scammers. My month-long collaboration with this company resulted in a financial loss.

Joseph Sayed

Allowed me to deposit funds when i did not have enough to cover the amount..in the past they would deny my deposit..this caused me to incur a overdraaft charge.

Alla Jackelli

The worst experience! Never trust this company! They will charge tons of money after telling you about FREE service. Even after cancelling their service they still charging money! Horrible!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Dawn Drucker

Stay Far Away From Them, Worst Customer Service!!!!!!! I have been calling for 4 months to get this company to stop charging me there fees. I signed up in May 2019 and immediately changed my mind called my rep to cancel and to this day I am still being charged. I don’t and have never even had they terminal to process cards. The first couple of months of calling I was told only your rep can close your account and they will call you back within 24 to 48 hours. which never happens. Then when you call and ask for a supervisor they just run through a script and put you on hold for ever. Finally earlier this month I talk to someone named Eric and he said he could close my account I just had to fill out a form and send it back and within 7 – 10 business days my account would be closed and I would have my refund.Just got off the phone with them again 12 business days since sending in my paperwork and this time I am being told they have numerous accounts being closed and mine was in the stack but they now have noted my account closure as urgent and I am stuck with another reference number yet again and now being told it could take another month to close my account. If I ran my business this way I would be bankrupt, but wait they will not go bankrupt because apparently from what I have seen now they are ripping each and everyone of us off!!!!!!!!!!!!!!!!!!!!!!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Emmanuel Smallwood

Horrible company!!!! 1st class crooks!!!

They took money out my account for a chargeback on more than one occasion and after calling over 50 times well over a month I keep being told a supervisor has to approve the refund and that they can never get a supervisor on the phone. Each call takes over 2 hours and the collections department closes at 5 so they will either deliberately hang up on you or keep you on hold and wast your time just to say they are going to send an email so the supervisor can call you back and they never call back. Never use this company because they are a scam and they charge a lot more than they claim to charge on processing fees.

This post will help: Best Payment Processors for Great Customer Service

-Phillip

Lori Wolfe

First of all, they lure you in telling you no early termination penalty, no monthly fees, yadayadayada. It’s all false. After looking into the small amount of information they give you, in order to sign up you have to give your account information then they send you a document online to sign. Well, make sure you read all terms and conditions for every little thing. There is an early termination fee and there are all kinds of extra monthly fees you agree to if you sign up. I called them and said I did not want to go through with the service. When they asked why I mention early termination and extra fees. They then sent me an “Adendum” that stated no early termination fees- Hum, I wonder how many people they got away with not sending that adendum to. I still cancelled of course. Never even received any processing equipment or set up my online account. But the monthly charges to my account began the following month. They did allow me to cancel the service the same day after I requested to speak to management. Its been 2 months and I have had 3 fraudulent charges to my account. The first 2 charges it took a few phone calls and emails to get them reimbursed. I’m typing this as I have just now discovered the third fraudulent charge and I’m currently waiting on refund.

Stay away, stay far away from these thieves.

This post will help: 5 Places Where Processors Hide Fees In Your Contract

-Phillip

David

After 2 months of not using their services, I attempted to cancel by sending in a cancellation document. They claim it wasn’t sent properly and proceeded to charge me over $700 over the course of a year instead of contacting me. I will be doing whatever it takes to get my my money back.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Barbara Timmons

Paysafe has been taking money out of my business account for 2 months. I don’t have an account, processor or recieve any services from them. For the past 3 days. They keep telling me they can’t get a hold of anyone in the department to close the account. The representative said there is no supervisor to talk to. This all happened because I was inquiring about there services

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Montez Smith

Some how this company has gotten my information & starting charging my account for services never received. Never signed up for this company as I use Square! Called this company June 4,2019 to cancel services I never used because they charged my bank account. They said it was canceled then a couple weeks later June 24, 2019 this company charged my account AGAIN! This time charging $139. I have canceled this again! I’ve never heard of this company & would just like for them to cancel whatever it is & stop charging my account.

This post will help: Cancelling a Merchant Account Without Paying a Fee

Stone Oak Pediatric Dentistry

Just finished my third call to Paysafe. They are holding over $4,500.00 of our money and half of it is from May 2019. They promise the issue is resolved, however, we still don’t receive our money. Would never recommend this company to anyone!

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Judy

Never signed up with this company and they have been taking money out of business account for a year. Contacted them and they cannot produce contract because I never signed one. They have taken over 1000.00 out of my account. They need to be shut down and going to do everything I can do make them pay me back my money they stole from me.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Titan

Rotten customer service. They’re a credit card processing company alright, and that’s about all they seem capable of doing.

Whenever we have a chargeback, we are presented with roughly 2 to three entire business days to respond, and for them to address our response before we are out of time and have to eat the fraudulent chargeback. They have no care for us as customers and will happily let anyone place a chargeback without giving us suitable time to respond with the information of the sale.

Their phone customer service is terrible as well. We recently got a new machine as our old one was printing poorly. When asking for the new machine, the woman on the phone asked me the time we want our batch closed. I told her, but when the machine arrived, it was set to a totally different time, not even close to what I told her.

As we are unable to change the batch closeout time on the machine itself, we need to call their customer service number to get someone to do it for us. So far, I have had to call and wait on hold twice today, as the first time I was asked for our merchant ID (which I had) and Tax ID (which I did not have and needed to get from the business owner) – I was NOT asked for further information.

The second time, I was asked for Merchant ID, Tax ID, and the last four of our bank account (which is a piece of information they have never asked for and which I did not have, and had to again ask the owner for). So, now I get to wait in line again to see if they decide to add any NEW stipulations on what information is needed. All to change the batch time which they set improperly in the first place.

I just want the darn machine working properly, there’s no good reason for this to be such a hassle and it’s cut into my morning work. It’s a shame every card processing company is awful, it’s not like we have other good choices. What a shame. Terrible customer service every time we contact them throughout the years, they are just consistently unhelpful.

This post will help: Best Payment Processors for Great Customer Service

-Phillip

MONICA CASANA

The are the worst!. Have been trying to resolve Merchant Account and scanner never working for over a month now.

Quick to withdraw their fees from your bank account regardless that your merchant account never worked. A plethora of Ticket #’s and false promises that you will be contacted or refunded. Wait time is 1½ hr with no resolution. STAY CLEAR OF THIS COMPANY!

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

Bethina Redd

I just found out that my account was over drown and with out me knowing. I called them and I was on hold for along time after talking to a sails rep she switch me to the people that suppose to stop the account, but know one answer the phone.

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

Linda Kajma

We went to this credit card processing company based on what we thought was a cutting edge company with a staff to support it. I have never in my life dealt with such incompetent people. The contact number on the invoice just keeps ringing, so we tried another number from their website and found out we were talking to someone in the Carbbean! They could not find our account. Really? They found it to keep taking funds out. Something needs to be done to stop them. Any ideas?

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

Rydawg

Thanks for all the positive feedback I’ll definitely give them a shot.

Lawrence A traw

This company is a total rip off a scam. I never used them to process any payment and they charged a bunch of fees that I was not aware of. After we finally found out who was debiting my account, I ask the service rep about these fees and I wanted my money back. He told me that i signed a contract which I do not remember and basically told me tuff luck. The total fees for not using this service were $3200, automatically deducted from my checking account over the past year. Hidden in my transactions. I am a very small business and this kind of fraud is very devastating to my bottom line. These guys are a bunch of crooks. Be very aware.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

wayne

Skrill moneybookers is owned by paysafe , I deposited funds last year November 2018 into my skrill account 9 days later the funds had not reflected so I contacted skrill ([email protected]) I received a case number and the soon thereafter the funds reflected. In March 2019 I made another deposit this time the amount was much more than the previous 16 days later no funds reflected I once again contacted skrill and explained I followed exact same procedure as last time and no funds reflect, I received an inquiry number and then nothing after that. No funds have reflected and zero communication from them. I have even provided them with the Bank transaction statement.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Alfred Natrasevschi Robocut Inc.

Company has been holding all processed credits and refunds. This has been ongoing from November 2018 to February 2019. Then they closed our account. November 26, 2018 through February 4 2019 Pay save has not deposited credits or refunds for our credit cards charged. They have closed our account and our holding our funds. I have been trying since February to get the funds released. I have talked to Mohammed 800-549-4631, Patrice Stampp 800-327-0093 and Brenda 800-549-4631. Patrice gave me a reference number 42178586. Mohammed said funds would be deposited almost a month ago. Brenda said today she is waiting for Gina from collections to release our money. I have asked many times for a manager to call us or to speak to a manager. They will not let me talk to a manager. A manager has never called. I believe this credit card processing company business practices are illegal. Do not use them.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Johnson Johnson

Paysafe staff is stupid, and the service is the worst. Their message recording system is cheating. There is an early termination fee for 500 bucks. Don’t use paysafe!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

rick

they keep taking money out even though im not using their service,i put a stop on them and they changed their name twice and put it througjh,i finally had to close my account and open under new number.called paysafe after 25 minutes i hung up

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

GENE

Hi there

I would like to make a formal complain about this agent named: ALEXANDER SERFES who actually signed me up for the contract with PAYSAFE.

We had all the conversation and discussion before I signed up for the contract, he sent me an online form and told me everything was as per what we discussed and there was a time limit for the online contract and so I have to sign it quick. I trusted him and signed it and I was supposed to get the device FREE with ONE YEAR ADDENDUM.

However, I was charged USD180.26 since NOVEMBER 2018. I called the customer service and they informed me that I must speak to the agent. So, I called Alexander multiple times, and he assured me that all paper work was submitted for the refund, and I should be receiving them soon. However, it didn’t happen. I called him many times, I hardly could reach him and he hardly return calls or answering my emails. And by early JANUARY, he told me I would receive the refund before 15th of January after his confirmation with the manager, and again, this never happened.

And on Jan 24, he sent me a document for me to sign, I was kind of shock as he mentioned all paper work for the refund was submitted before, however, i signed and hoping I will get the refund soon.

And again, numerous calls were made to Alex, no answer at all. I sent emails to him as well, and again, no reply.

Today, I spoke to the Customer service, and Nicoleen mentioned to me that there wasn’t any request submitted for the refund.

I am not sure if there was a misunderstanding, but however, I am truly disappointed of the service from ALEXANDER SERFES which was so irresponsible as in not returning calls, giving empty promises, ignoring emails.

I hope someone will answer to this issue. I actually read all the good reviews about PAYSAFE before, and decided to go with PAYSAFE instead of other MERCHANT services, but I am so disappointed because of this agent. It is such a small issue at first, but it took 5 MONTHS, and yet I am not receiving any update or answer.

I hope someone will answer to this.

Regards

Gene Phillips

This post will help: Best Payment Processors for Great Customer Service

-Phillip

Carlos Garza

PAYSAFE? More like waste your time on hold for more than 30 min. at a time. Beware local rep released all my bank information without my authorization and I am having hell trying to get a refund for which I did NOT give my consent I am writing this review and have been on hold for the last 48 min…What A JOKE!!!!!

This post will help: Best Payment Processors for Great Customer Service

– Phillip