Keep Your Eyes Peeled

Here's a strange truth about credit card processing: most “hidden fees” that merchants complain about are technically disclosed in their merchant agreements. This doesn't mean that they are “fully” or “fairly” disclosed; rather, it just means that they satisfy the legal requirements for disclosure. Some of the very worst sales agents in the industry will flat-out lie to merchants about rates, monthly fees, cancellation penalties, or equipment leases, but even these agents can usually fall back on the claim that the fees were listed somewhere in the huge quantity of paperwork they rushed their merchants through.

So how do otherwise cautious business owners manage to overlook the fees explicitly outlined in their contracts? For one thing, they're usually being pressured to finish the signup process by an anxious sales agent who's hoping to make a commission off of high rates or fees. For another, the fees are often scattered in various places throughout the paperwork rather than combined in one simple list, and some of these places are very easy to miss.

To help you hunt down the sneaky provisions lurking in your merchant account contract, we've identified the following five places where processors like to hide fees. This list doesn't cover every possible hiding spot, but it will point you to the most common tricks and teach you how to dig for other undisclosed expenses on your own. If you have any additional tips for your fellow merchants, please share them in the comment section below this article.

1. Downgrade Fees Section

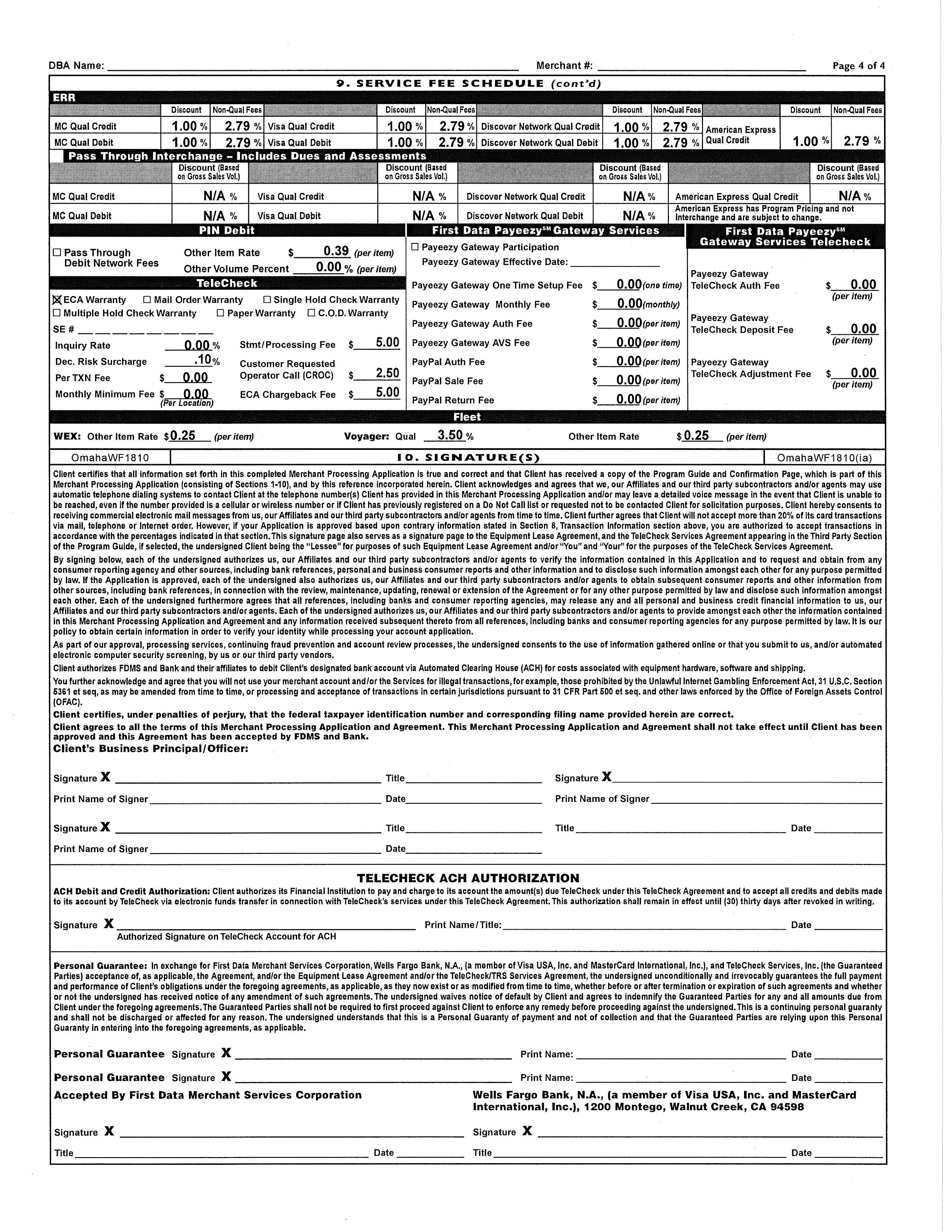

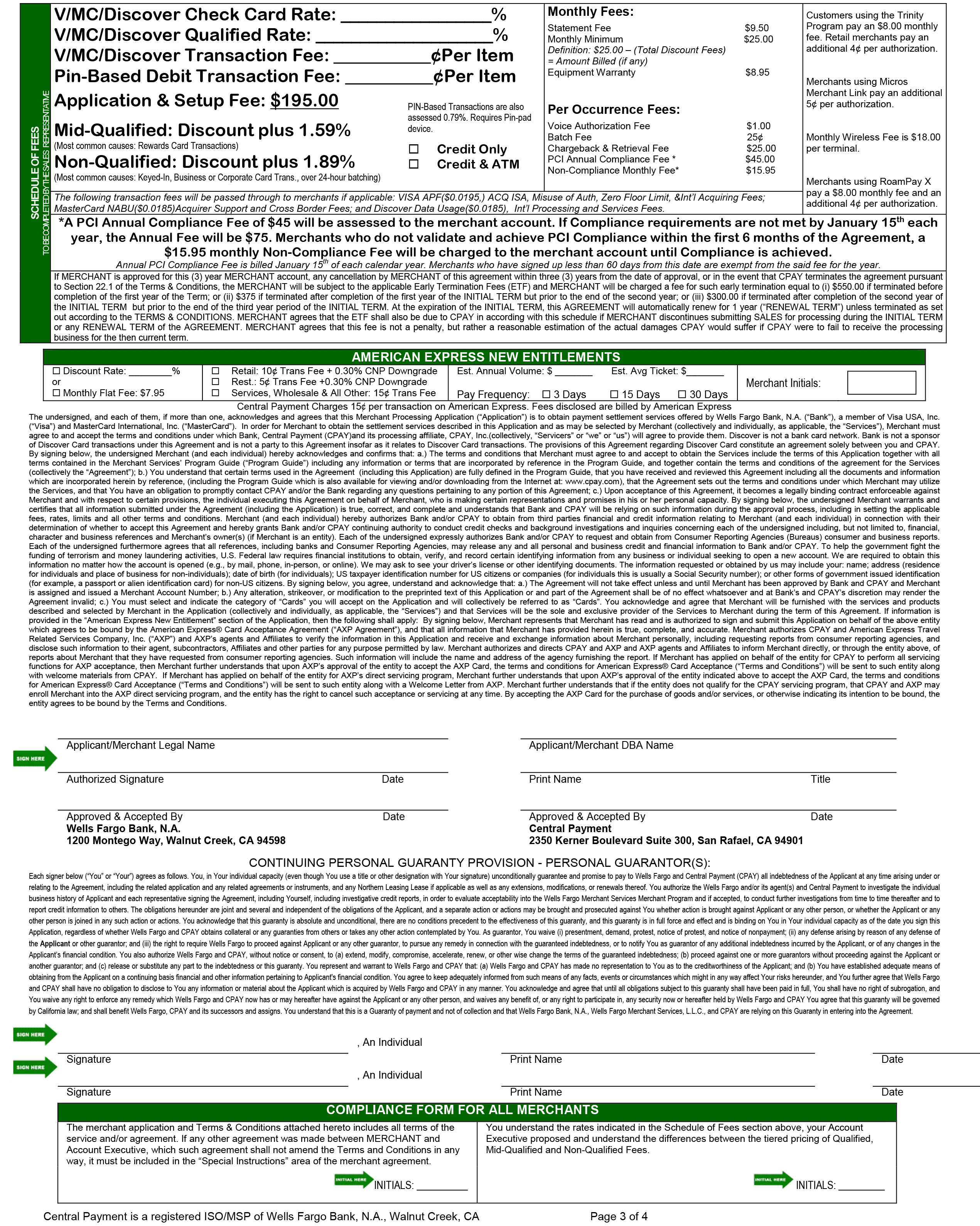

In a tiered pricing plan, downgrade fees are the higher mid-qualified and non-qualified rates charged on top of a merchant's qualified rate. The key thing to remember about downgrade fees is that they are added to a merchant's qualified rate rather than substituted for a merchant's qualified rate. Unfortunately, they are not always disclosed in this way. Here's an example from the Freedom Card Solutions contract:

You can see a number of rate quotes at the very top of this page, including qualified and non-qualified debit and credit card rates for MasterCard, Visa, Discover, and American Express. At first glance, these seem pretty clear. The qualified (“Discount”) rate for each card is always 1%, while the non-qualified fees are always 2.79%. The problem lies in the way that agents might quote these rates.

On a large number of our reviews, we receive complaints about agents who quote rates like “1% for qualified cards and 2.79% for non-qualified cards.” This type of rate quote is designed to obscure the fact that the non-qualified rate is added to the qualified rate. So, in the case of Freedom Card Solutions, the actual rate that merchants pay for non-qualified transactions is 3.79%, not 2.79%. And as you can see, that isn't really explained anywhere on the page.

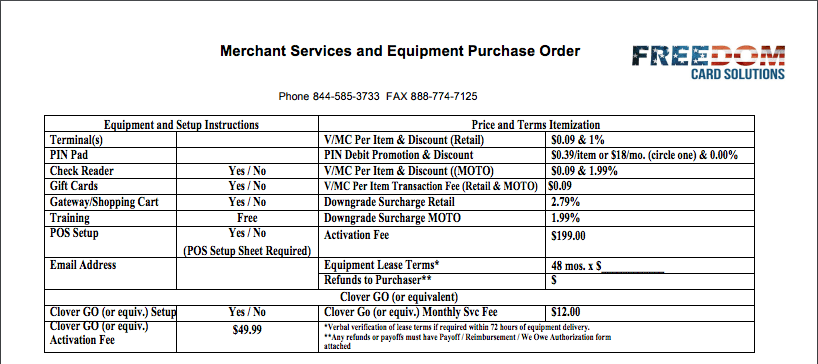

It is, however, confirmed in this section on page 2 of the company's agreement:

Here, the 2.79% rate is referred to as a “Downgrade Surcharge Retail,” which is a clearer acknowledgement that this is a downgrade fee. However, it still leaves it up to the sales agent to explain that this fee will be added to the merchant's qualified fee of 1%, since there is still no mention of the effective 3.79% that merchants will pay for non-qualified transactions. This is a very basic point of confusion for many merchants who are new to the industry, and it stems from the counterintuitive way that providers list their downgrade fees.

2. Above Your Signature

If a fee should be listed anywhere, it's above your signature, right? Processors and agents alike will often defend their sales tactics by pointing out that the terms of the agreement are spelled out in plain language directly above the line where merchants sign their contracts. After all, how could the agent have deceived the merchant when the merchant wrote their name right next to a fee disclosure?

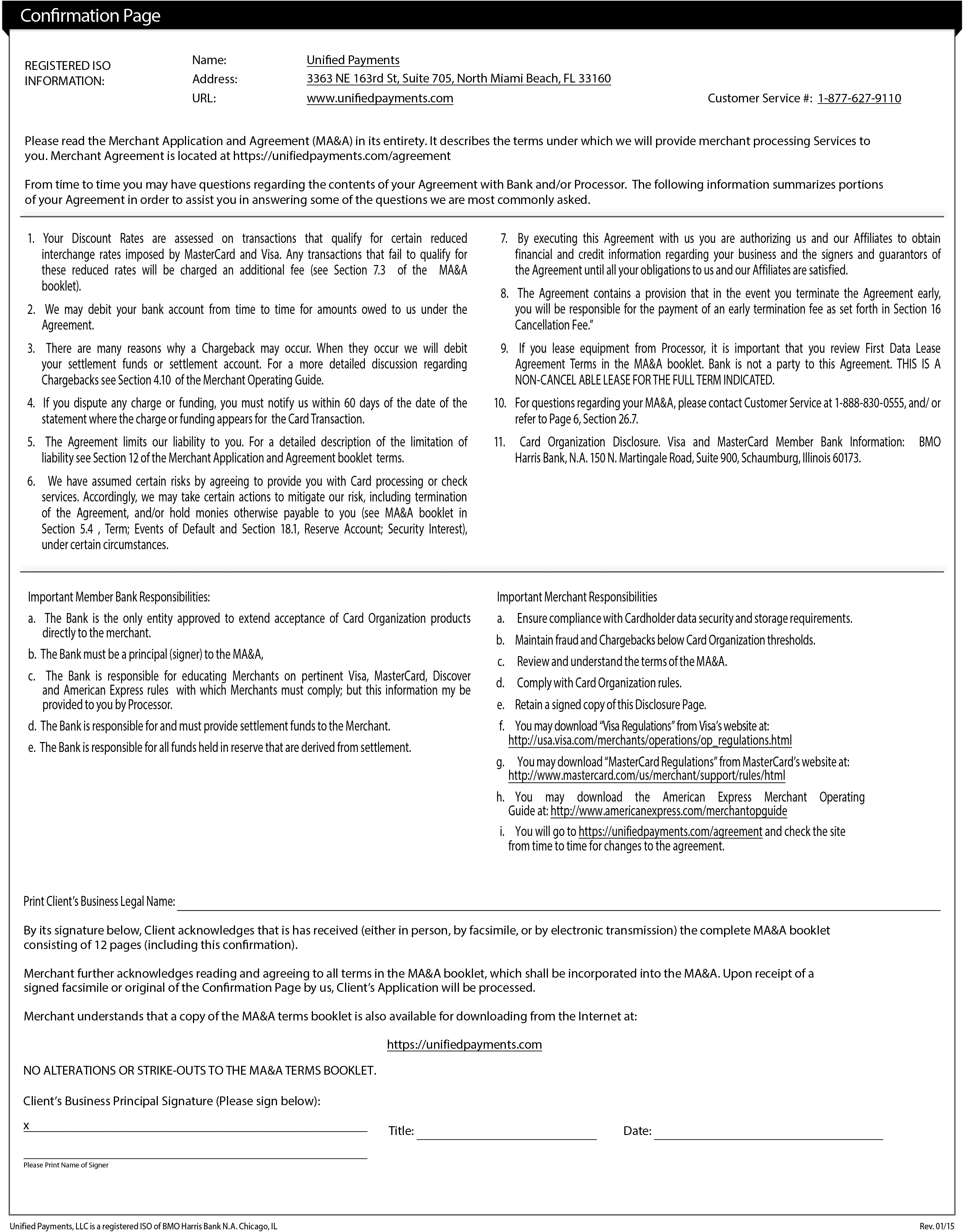

Here's how (example from the Unified Payments contract):

First of all, do you see any dollar signs, percentages, or term lengths on this page? No! In fact, it mostly seems like a bunch of legalese with phrases like “The Agreement limits our liability to you” and “By executing this Agreement with us you are authorizing us and our Affiliates to obtain financial and credit information regarding your business and the signers and guarantors of the Agreement until all your obligations to us and our Affiliates are satisfied.” Imagine that a sales agent handed you this page and assured you that “this is just a bunch of acknowledgements of what you've already read.” Since there are no new fees listed clearly on the page, you just might take their word for it!

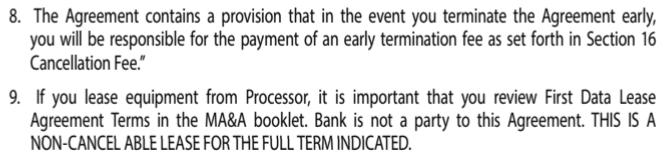

However, if you do take a moment to scrutinize numbered items 8 and 9, you'll see the following:

By signing beneath these numbered items, you are consenting to an undefined early termination fee and years of equipment lease payments that are not listed on the page. Even more troubling, the early termination fee you're agreeing to pay is apparently “set forth in Section 16 Cancellation Fee.” Go ahead and open the full contract and look for a section 16, or a section labeled “Cancellation Fee.” You won't find it! That's because it's listed in an entirely separate document referred to as the “MA&A Terms and Conditions.” So, by signing this page, you're agreeing to pay a fee that isn't listed anywhere in this document and may or may not have been provided to you separately. Technically, that's legally disclosed. But is it the sort of thing you would feel comfortable signing?

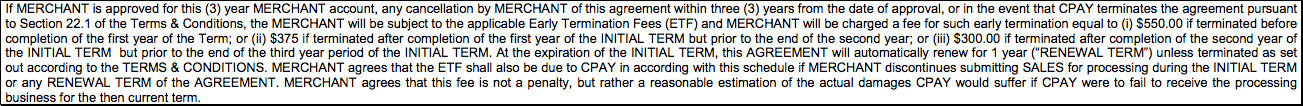

Maybe you don't feel like this is too deceptive. After all, they did provide a clearly numbered list of terms for you to look over. Here's a different example to consider (taken from an old copy of the Central Payment Corporation merchant agreement):

You can probably spot one red flag off the bat: this page is absolutely smothered in long sections of minuscule font above and below the signature line. Believe it or not, you could read every word of those two paragraphs and you wouldn't see a single mention of your early termination fee. But that's okay—maybe it's listed in the table at the top of the page that lists your qualified fee, mid-qualified fee, non-qualified fee, statement fee, monthly minimum fee, PCI compliance fee, and setup fee. Do you see it in there? No? Great! If you were going to be charged an early termination fee, it would definitely be listed there, right?

Nope. Let's magnify the chunk of tiny font squeezed between the prominent table full of fees and the blocks of legal language surrounding your signature:

This section not only outlines the length of the contract you're about to sign, but also includes the largest fee in the entire agreement. Despite this, it's much smaller on the page and harder to find than your qualified, mid-qualified, and non-qualified rates. Why isn't it more prominently disclosed, perhaps right next to the line where you sign the contract? You can probably guess. (NOTE: CPAY no longer charges early termination fees; this contract is outdated, but it is still a useful example of what you might see in other providers' contracts)

3. Summary Of Fees

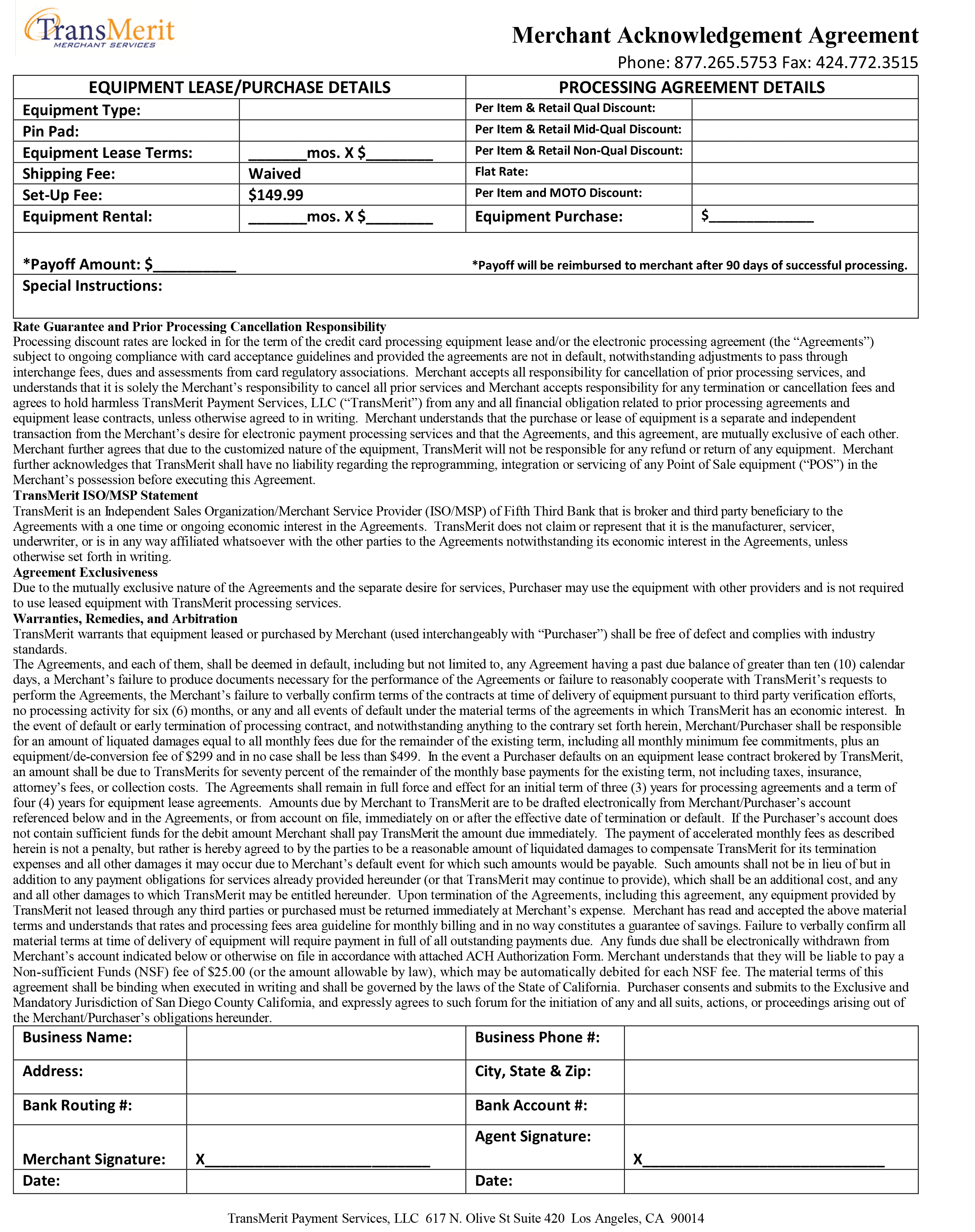

In order to refute merchant complaints about deceptive sales tactics, some providers have started issuing “Summary of Fees” documents to each merchant. In theory, these summaries give a line-by-line account of every fee that the merchant will be charged, and merchants are often asked to sign them as an acknowledgement that they were appropriately notified of their contract terms before opening the merchant account. Here's an example from TransMerit Merchant Services:

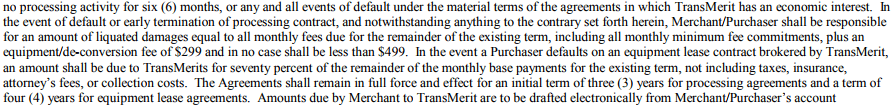

This might seem like a helpful, easy-to-understand breakdown of rates and fees. As usual, though, the devil is in the details:

Yet again, the largest fees in the document have been squeezed into microscopic print buried beneath paragraphs of legal language that merchants are likely to overlook. In this particular case, the fee is a liquidated damages-style early termination fee that “in no case shall be less than $499,” with accompanying non-cancellable lease payments to boot. Ask yourself why these fees weren't simply included in the table at the top of the page. Now ask yourself why you would ever take an agent's word about what's in a merchant account contract.

4. Deep Inside The Program Guide

Most merchant account contracts consist of two primary documents: the merchant agreement and the program guide. The examples in this list so far have been pulled from merchant agreements, which are usually four- to five-page documents containing basic information about the merchant, the account's pricing details, and multiple lines requesting signatures. These documents are also commonly referred to as “merchant applications,” although they function as binding agreements in the (highly likely) event that the application is approved.

The second document that merchants receive is the program guide, also referred to as the “terms and conditions.” In contrast to the merchant agreement, the program guide is usually a dense document packed with hundreds of contractual agreements and policies that merchants must adhere to. The average program guide is at least 10 pages long, although it's not uncommon for them to exceed 40 pages. They're extremely boring, they may or may not require a signature, and merchants routinely assume that there's nothing important to be found in them.

Sometimes, this assumption can be very costly. Here's an example from First American Payment Systems:

Again, we're looking at an avalanche of nearly unreadable legal language that the average merchant will have no time to read through. This is often a good sign that something important has been buried in the fine print. In this case, there are no fewer than seven fees embedded in this wall of text:

Remember, this document doesn't require a signature from the merchant. It's therefore possible that an unscrupulous agent could hand it to you without disclosing the terms contained therein or asking you to review it. Even if you took the initiative to start reading through it on your own, you wouldn't stumble upon these fees until page four. It doesn't seem like a stretch to consider these types of fees “hidden.”

There is one very simple method to help you quickly peruse your program guide. Ask your sales agent for a PDF copy of the full program guide, and then open it on your computer using a PDF reader. Press control + F (command + F for Apple users) to open a “text finder” search bar, and enter “$” in the search bar. Your computer should instantly highlight any dollar signs included in the contract, saving you the trouble of digging for specific fees. Other recommended searches include the words “termination” (to locate termination fees) “month” (to locate contract length), and “lease” (to uncover any lease agreements embedded in the contract). This method is much faster and more reliable than reading large portions of the entire program guide or trusting its table of contents to point you in the right direction.

5. At The End Of The Program Guide

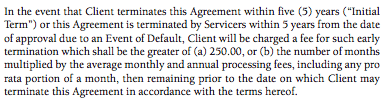

Occasionally, the early termination fee will not be outlined anywhere in the body of the program guide, but will instead be expressly stated on the very last page of the document. Here's an example from the Alpha Card Services program guide:

Here we are, 44 pages into a document packed with tedious policy after tedious policy, and only at this point is the $250+ early termination fee expressly described. And even here, it's nestled at the very end of the “Additional Fees and Early Termination” section:

This is the only mention of $250 anywhere in this entire document. If you open the full contract and go to section 24, “Term; Events of Default,” you won't find any reference to $250. If you scroll up to the third page, which includes a line for the merchant's signature, you'll find the following list item: “8. This Agreement contains a provision that in the event you terminate the Agreement prior to the expiration of your initial five (5) year term, you will be responsible for the payment of an early termination fee as set forth in Part III, A.3 under ‘Additional Fee Information'.”

Again, why wouldn't they simply disclose the exact early termination fee on page three, which requests the merchant's signature, rather than on page 44? You should know the answer by now.

As an aside, this program guide happens to be a standard First Data program guide, which is probably the most common type of program guide in the industry. One useful tip about First Data program guides is that their termination policies are almost always outlined in either section 24 of the agreement or the final page of the agreement. Other companies' program guides will differ, and not all First Data program guides are the same, but these are two very common spots where early termination fees will be buried.

There's More Where That Came From

As noted above, this is far from an exhaustive list of the hiding spots where processors will cram their fees. Companies change their contracts from time to time, and each processor has a different approach to how it discloses its fees. These are the most common trouble spots we have seen from merchants, but there will always be some new trick waiting to trap you into a bad deal.

With that in mind, here are a few simple guidelines to help you track down the sneaky fees lurking in any contract:

- Don't let agents rush you through the process of reading your contract

- Don't assume anything about the fine print

- If an abbreviation or term is unclear to you, ask for an explanation

- If a contract refers to a separate document, request that document immediately

- Ask for all documents before signing any documents

Sales tricks work like magic tricks. If you don't look where they tell you to look, you can usually see right through the whole thing.

Do you have any other examples of sneaky hidden fees? Share them in the comment section below!

Clarissa

This industry is so ridiculous with the fees! Is there anyone that doesn’t hide fees???