PaymentPop Rating for Western Union

Negative Feedback

This is the worst company you can ever used to receive money. I spent about six hours on the phone speaking to different Western Union representatives to try to help me retrieve my funds to transfer to my bank account and they were not able to help me m, not ONE even the supervisor couldn’t. I’m so disappointed because I’ve been using WesternUnion for about 15 years now and I am so sick of getting disappointed. The worst part about this company is that 99% of their location aren’t active but they’re still showing that they’re available on Google. I will never use this company again.

Positive Feedback

There are no positive reviews published about Western Union on the PaymentPop website.

Western Union BBB Rating

Western Union has an average customer review rating of 1 star and a rating of “B” on the BBB site based on 87 customer reviews. Almost all reviews have to do with Western Union’s cash transfer services for individuals. While these don’t necessarily reflect the experience a merchant will have with Western Union, they do give a good idea of the company in general.

Negative Feedback

Overwrought with scams, apparently not a new thing for them. My email was used by someone opening accounts annd I kept getting verification emails. It took 35 minutes of being on hold and over 20 minutes of no, Im not a customer, nor do I want to be. Remove my information from the system. to get them to just deactivate my email.

I would give zero stars if that were an option. I spent 30 minutes trying to get assistance with an international wire transfer, only to be transferred back to the start of the customer service queue after finally reaching a representative. After waiting another 15 minutes to speak with someone else, they were unable to answer even the most basic questions about transfer limits. The experience was a complete waste of time.

Positive Feedback

There are no positive reviews about Western Union on the BBB website.

Trustpilot Rating for Western Union

Western Union has an average customer review rating of 4.2 stars on the Trustpilot site based on 107,703 customer reviews. Again, most of these reference individual transfers.

Negative Feedback

Sent emergency money and the money has been taken out of my account, yet transactions are still in progress for 3 days. Very slow, and I wouldn’t recommend using this company to send emergency funds. I messaged them through chat today, and she stated they would escalate the matter, they should pay the money to the receiver straight away. Extremely disappointed!

I wanted to send money to my father for New Year’s. I sent it two weeks ago, but he still hasn’t received it. The customer service is terrible and they don’t seem to know what to do. I recommend using a different remittance company

Positive Feedback

I used western every often to send money to family and friends if very useful because the money can be picked up in minutes without no hassle

Easy to use

No problems

Clear concise information

Genuine review

Consumer Affairs Rating Analysis

Western Union has a 1.5 rating on the Complaints Board site based on 1,291 customer reviews. Like the other profiles, these are heavily focused on the company’s individual transfers.

Negative Feedback

I was sending money to my daughter in college they red flag every single person‘s account on Western Union as told me by the supervisor and the person talking to until they can prove it is not a scam artist sending the money even though the person sending it is in their computer with the name address and the people that they’re sending it to is in their computer. They will red flag it and stop all money transactions until they can figure it out, now my daughter is overdue for her books, her food, her expenses and we can’t do anything about it except send more money from some place else. I would never recommend this place. Do not go there.

It used to be a wonderful experience and for two more dollars you can go to Walmart to Walmart and you’ll get your money sent. Meanwhile, they have all your money and they’re probably earning interest on it somehow, so this is five days that they’re behind because they didn’t. I couldn’t prove even though they asked me personal questions at the store when I bought the money order whatever it is that invaded my privacy but I did answer them and then they asked me the same questions today on the phone to prove that it’s really truly my daughter that I’m sending money to. Do not attempt to use Western I.

– Complaint from November 21, 2023

WU is famous between scammers and thieves. So many scams taking place on Western Union that they fail to investigate. I have been a client for many years. Uploaded my documents. They verified me.. THEN all of sudden when I was sending funds to FAMILY (not scammer or third party) they investigated me like if I was a criminal. WHERE DID YOU GET THIS MONEY? WHY ARE YOU SENDING THE MONEY? WHO ARE YOU SENDING THE MONEY TO? WHY DOES HE NEED IT?

After responding to all those invasive questions.. they deducted the funds from my bank account and sat on it for 10 days and did not transfer to the bank account of beneficiary. When I call them .. all set next day .. next day.. THEN they asked for ID and personal info of the Beneficiary.. and here I am. We want to put a down payment for home and we are delayed due to WU KYC investigation.. probably my ** last name has to do a lot with it .. but what can I do.. profiling is hard to prove here.. I WILL NEVER USE WU again.

– Review from November 7, 2023

Positive Feedback

I made a transfer from Canada to my bank account in Jamaica. This was my first such transfer. I kept checking on the progress of the transfer and the status remained at “Direct Deposit to be made to Receiver’s Bank Account”. So after 3 days I contacted the Western Union in Jamaica to find out what was happening. Needless to say, I was peeved as I could not get any information because after speaking to the first agent, I was placed on either a hold with no sound to let me know I was holding or transferred to a number that rang endlessly while my phone minutes kept on going – running up my bill.

I contacted the Canadian agent today and to my dismay he told me I have to speak with a Jamaican agent (I almost cried). But God would have it going my way when I got a hold of Nyoka ** a Customer Service Specialist in Jamaica. She took control and in no time I understood what was happening and she got the matter resolved. She emailed me relevant documents and her response time to my queries via email was exemplary. I am keeping her contact in my email because I know I will be doing further business with Western Union and my experience with her will drive me to reach out to her once again. THANKS NYOKA. YOU HAVE REDEEMED WESTERN UNION.

– Review from June 22, 2019

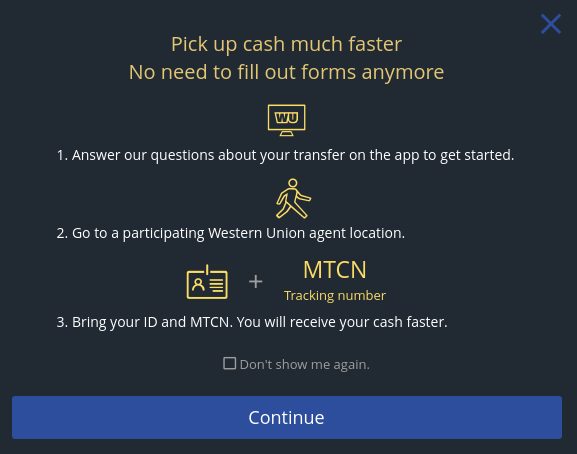

I was in one the Western Union store in Toronto (7053 Yonge St.) to send the money to out of country. one the staff explained to me everything about the app and also helped me to download the app on my phone to send a money with lower fee when you use the app. She was very friendly and helpful and I strongly recommend to everybody to go to same store to use their services.

– Review from December 30, 2021