Overview

In this review of Cash App, we will provide a clear overview of a popular cash transfer service by Square and Block. We cover important details like rates and fees, contract terms, and user experiences through common complaints and industry ratings. We also examine the Cash App Data Breach of 2022 to highlight security concerns.

We will discuss how Cash App works for both personal and business payment processing, including its features for stock and Bitcoin transactions, weighing the pros and cons. The article addresses the challenges users face, especially with fund holds and customer service issues.

We'll also look at the legal challenges the company faces, including lawsuits and fines, to give a full picture of Cash App's position in the payment processing industry. Our final summary offers insights into the app’s suitability for casual users versus more serious business applications, helping readers make informed choices about using Cash App for their financial needs.

About Cash App

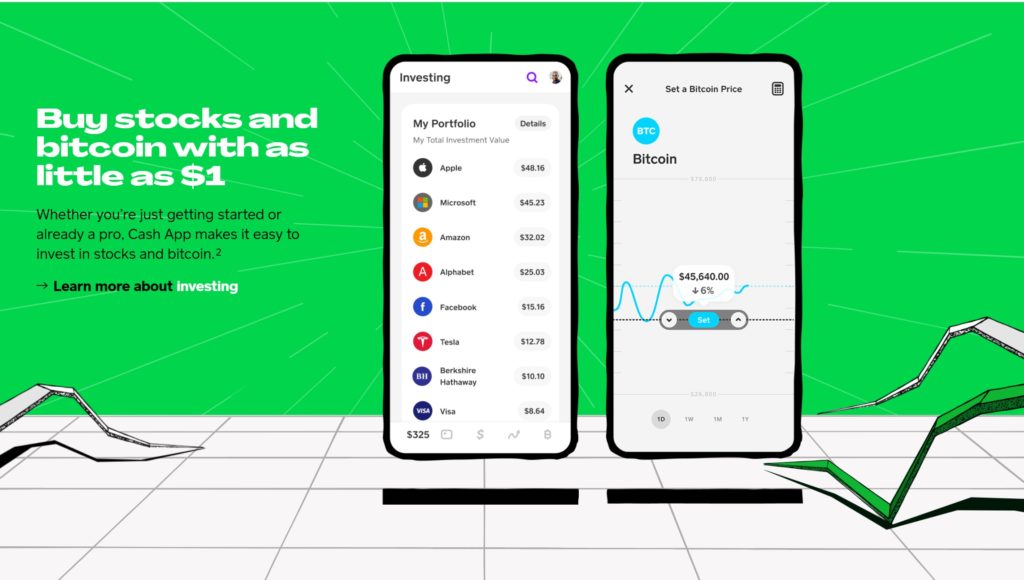

Cash App (formerly known as Square Cash) is a cash transfer service launched by Square (and parent company Block) in October 2013. Like Venmo, Cash App allows individuals to send cash amounts or Bitcoin to each other using a dedicated mobile phone application or via email from a linked debit card. It also enables businesses to get paid through the app for Square's usual price of 2.75% per transaction paid by the recipient of the transaction. In 2021, Square acquired buy-now-pay-later service Afterpay.

Cash App Data Breach 2022

In April 2022 it was announced that Cash App had experienced a major data breach, allegedly exposing over 8 million users' names and brokerage account numbers, in addition to other information. Breaches like this frequently lead to legal actions, but as of the writing of this review nothing has surfaced yet.

Is Cash App Holding Your Funds Right Now?

Thousands of users have had their payments frozen by Cash App. If you're one of them, then you might find these resources helpful:

- How to Contact Square

- Watch Out For These Square Cash App Customer Support Scams

- How to Make Your Payment Processor Release Your Money

Cash App Products and Services

Cash App Payment Processing – Send Money to Your Friends

The process for making payments is simple: download the company's Cash App from the iTunes or Android app store, create an account, enter the amount you want to send or request, select a recipient or payer, and hit send. Square will send a message to the recipient's email address immediately, notifying them of the payment, and the transaction will process within two days. All personal transfers through Cash App are processed for free.

Related: Sick of Cash App? Use one of our Best Mobile Apps for Sending Money instead.

Cash App Payment Processing- Businesses Can Use It, Too

Square Cash's solution for businesses requires merchants to set up a dedicated “cashtag,” which is a landing page where customers can enter their card details and pay the business directly. Cashtags are intended to be easily shared payment methods that would work best for the personal services industry, non-profits, and short-term fundraisers. Each payment accepted via a Square cashtag costs 2.75% of the payment amount to process, which is roughly on par with most mobile payment processing services. In 2022, it was announced that the IRS would require reporting of transfers of over $600 on Cash App and other peer-to-peer payment apps, which will heavily affect the taxes of those using the app for large transactions.

Charlene Williams

Money Disappeared

I’ve never had money disappear from my PayPal or Venmo. This is completely unacceptable. It’s been about a month since filling a complaint. With all evidence provided. The customer service rep basically said he was sorry. There was nothing he could do except hand the complaint over to higher authority. Cash app has employees stealing money and no one is being reimbursed…. Also, they have hidden all Truth reviews on the Google Play App

Gennyfer Coss

CashApp closed my account without warning stating that I violated their terms of use. However, they have been completely unwilling to explain which of my absolutely typical transactions was a supposed violation. They offer me no explanation and no way to resolve the issue. They keep telling me that someone in their review department will contact me by email, but I have been waiting for almost 6 months for that email and it has never come. I have reached out through the app chat and by phone multiple times and I keep getting the same total BS response. This has been such a major inconvenience, as I have children away at college and other family members with whom I send and receive money. Now I have to use Zelle for everything. I personally got all of my family and friends to use this ridiculous app (regrets) and now I cannot even use it! I am telling everyone I can that they should absolutely steer clear of CashApp! Apologies to all those to whom I ever recommended it.

Tammy Little

My account was closed and I still have no idea why. I have been trying to get ANY KIND of support on the app for 5 days now and not one response. I’ve called the support phone line 4 times and they just tell me to go back on the chat support on the app. I have money that is on my account and bills that I need to pay. yet no one at cash app seems to care at all. you would think that anything important to their customers would be important to them as well, but obviously they could care less. If I don’t get a response soon I’m going to be contacting my lawyer and see what she has to say about it. This is completely ridiculous that you don’t even care about your customers, and could care less if they loose their house or can’t pay bills, just because you are to busy to help them. Maybe if you would have a support phone number that can actually help instead of just telling you the problem with the account and then pushing it off to the chat bot on the app. Or maybe you should hire more people to respond to the emails that are sent! You are messing with peoples lives and don’t even care, it’s pathetic!!!

John

Garbage serivice

Sarah Hart

Hi everyone i am Sarah from California, i’m a single mother having financial issues but right now i got a solution to that issues. i found a legit and reliable group called Premiumtoolsaid.com on website i checked them up and saw great reviews about them so i tried them out and it was shocking and amazing how they made me $10,000 from their service without delays it’s feels like a miracle i get to pay all my debt and i can afford all my bills still looking forward in doing more business with them

JENNA CUSSIMONIO

it’s wrong I’m in tears I feel so violated too they call and activist if they were supports carrying my f&^%&#@ account and I fell for it it’s like money that I worked for that I need for rent I cannot stand this freaking out it’s awful they’re so impersonal holy s#@! they need to warn people as soon as you open the app about these things taking place or they don’t have respect for their costumers ls they don’t care they’re s%$#@! on people why is it not first thing to prevent further fraud . they are claiming to be cash app support helping you. I have phone number to guy” Eric Dane ” scammer who stole my money and Bitcoin right in front of my face

Randy Ruebush

I recently was told that this gentleman if you want to call him that I’d like to call him other things. One is from Facebook his name is Albert, and he was going to help me get my Facebook back because it was stolen from somebody posing as someone from Cash App. He said we had to buy codes to get rid of the hackers on my account. Well he hacked my account through Cash App for $10,834. I have tried to reach out to Cash App you can never ever get a representative on cash app on any of their phone numbers. I have got the FBI local authorities and we’re investigating this, Cash App is nothing but a crooked outfit. And this Albert guy if you are reading this I really wish you’d come and find me. Me myself do not recommend using Cash App at all

tonyio afagbegee

My Maryland Unemployment Direct Deposit was rejected by Cashapp on 08/19/2020. I called Customer service and was told the money will be reflected back on the senders bank account in 1 to 3 business days. It’s been 4 business days, i called the Maryland Department of Labor and they are telling me the payment cleared and was not sent back. The amount involved in almost $13,000 and this is money me and my family really depend on. This is very stressful, Cashapp is not trying to do anything to answer my questions. I just need the money back because my family depends on it.

Jacelyn

All I needed was a prove to show the judges I married a Cheat! So I could get a divorce . I tried hard but my ex wife is good at keeping things. I finally found this hacker (Support @ hacker4wise. com) he hacked into his phone in less than 2 hours. And I got all the prove I needed . Contact him today. he keeps his prices low and works in a unique way. you will thank me later he is the best out here

Zeiad

Money was stolen out of my account they claim I sent I was hacked. About 300 was stolen from me. They won’t return it. Don’t ever use this app. I closed my account I’ll never use this crappy website again. The worst app to send money on

Robin

I’m tired of corrupt, dishonest people who say they have your back but drag you through the mud instead! I’m out 1200.00, and I want my money. How do you trust another application to send money across the world? I’ve contacted CashApp Support and have received responses but I don’t know if I can trust them. Thank goodness I saved all my conversations with them. I support anyone that can get a class action lawsuit against CashApp/Square!!

Will

CashAPP is horrible. Why are they even allowed to process payments since there is 0 protections for people and if you do make a complaint, there is no one to hear you…..

horrible No-Good Rip Off Company! They provide 0 protection for their customers.

DO NOT TRUST THEM

Noah

Aside from there being hundreds of complaints against square, I should point out that there are over 1000 complaints against cash app. I’ve been trying to start a class-action against them for the longest time now.

Amy

Trying to find out if someone sending me money I don’t know is a scam?

Teri

I misspelled the name of someone I was sending money to. It went to the wrong person. I received a call from the correct recipient stating they had not received the payment. When I looked back at the funds sent, I realized I had misspelled the correct recipient’s name. I immediately emailed support and called the Cash App number only to be told there were no live representatives and that I would have a response within 24 hours. I received a response today from Cash app stating they could not help me retrieve the funds and they threw out there their “terms of service.” Where is the help for situations like this. I explained that I could not just lose $590.00. I am so frustrated and very disappointed with their lack of assistance and no true protection for their customers.

Sameer Shrestha

Guys guys guys!!!! Please do not trust cash app. They are simply scammers and fraud.

There are couple of reasons for it:

a)The first thing is they do not have the proper help support system. They have one automated number, [REDACTED FOR CONSUMER SAFETY] which is not helpful. We cannot talk to the customer service for agents for help.

b)The communication is only through their email address which is [REDACTED – FALSE SUPPORT EMAIL] which is not that effective.

C)My friends had send me 3500 dollars through cash app it was 10 days back. They told me to pay thr clearance fee of 155 and will all the money back. I paid the clearance fee and they again told me to pay this. This went on until I paid the amount of 1060 till yesterday. They are asking me to pay 350 dollar more to get the money released.

Can you believe it, it has been 10 days and I have paid 1060 dollars but I still have not received the money yet.

So, they comes with different excuses to lure you to pay more and more making you broke at the end.

Mel

Zero ☆ is appropriate

I would do ZERO stars if I could, dont use cash app for any significant amount of money. You won’t get any type of assistance from them, their customer service is non-existent. I can guarantee that you will be blown off & get the “run around” If by chance, you are able to have an actual person respond to your messages. A complete waste of time. I’ve been trying to get someone to explain to me why I’m unable to get a cash card since March 2019. Nobody knows why & nobody can do a damn thing about it. Total BS, obviously it doesn’t take much to get hired here, just a bunch of morons re-typing the same script the previous moron sent you. You won’t be able to get one on the phone, I doubt they even speak English, which is probably why there isn’t even an 800 # listed anywhere.

Taneshia Wright

Cashapp f***** sucks a**! They took 1640.00 from my mother that I sent her to pay her rent she then called the fake 1800 number not knowing you can’t speak to anyone because she was having issues cashing out and the scammer rerouted the funds and took the money and when I reported it to my bank Chase reversed the transaction for fraud. After they so called looked into the case they then took 1640.00 out of my bank account saying they were able to contact someone from cashapp to verify that the funds went where they were supposed to. I’ve sent in bank statements, screenshots everything I could to get my money back showing where the scammers changed the account number to reroute the funds and NOTHING!!! Then they have this fake 1800 number listed for people who don’t know that cashapp doesn’t have people you can actually talk to so it’s like they are all in with the scammers because this company will not do anything to help you AT ALL!!! It’s ridiculous.

Robin

Cash App is S*** of an app. Everytime a request or I send funds it is refunded “for my protection” but takes days to go back to my bank account. This is even after I have verified my account. An account that I have had for over 3 years. This is the 4th time in 2 weeks. The amount is not even a reason. When you contact support no one responses back to emails. After 4 days money is in account again. As soon as my funds are refunded BACK TO MY BANK Im going to “for my protection” GET RID OF YOUR S****** A** APP…

Isaiah Z

Terrible, fraudulent company. Do not give them your banking info!

Sherri L Jordan

Looks like many are dealing with the same problem I have, withholding funds and no live communication. Still waiting since 9/16/19 for Cash App to return 200.00 to the person I paid on 8/2/19. I initially filed a claim to my bank because I thought the wrong person was paid but immediately canceled the claim when I realized it was correct. When requesting the 200.00, I receive a standard email stating that I am no longer allowed to use the app. That’s fine with me but the money still needs to be refunded. Not being able to talk with someone is very frustrating!

BELKYS HERRERA

Worst service ever, thieves!!!!

I had an account and after changing phones was not able to access my old account, they will not merge the accounts and kept $300 I had on my old account, be careful people do not trust this app.

Pamela M

I have been trying to get them to combine accounts they had me to open. They not only never contacted me back but they closed mt account wihtout warning and ive asked for my.money and still have not received it either. THIS IS A BAD COMPANY VERY BAD CUSTOMER SERVICE NOT CONSIDERATE ABLE TO EASILY BE USED IN FRAUDULANT ACTIVITIES AND THEY DONT HOLD THEMSELVES LIABLE FOR THEIR ACTIONS. INSTEAD THEY DISMISS THOSE CUSTOMERS WHO TRUSTED THEM AS IF THEY DID US A FAVOR WHEN WITHOUT US WHERE WOULD YOUR BUSINESS BE!! REVIEWS MATTER EVEYONES NOT BITTER THIS IS TRULY A HORRIBLE COMPANY

Michael Jones

Cash app sucks they denied me from receiving $7. Saying because of security. Even though the sender is my brother. They told me to try and send a lesser amount.

Tiara Brown-Prescod

My account was closed for no reason at all WITHOUT EXPLANATION in July! I’ve emailed several times without getting a response! I cannot open up a new one either! I relied on cash app like thousands of others for Peer 2 peer transactions. Their customer service is GRADE A TRASH!

This post will help: Beware These Square Cash App Support Scams

Tyeisha Jenkins

I am a customer with Cash App. I had no problems until they overdraft my account and forge the account activities to make it look like money wasn’t in my account when I made purchases. The app on my phone shows everything but negative activities. But They say on their end they see negative activities. HOW!?! DON’T GET THIS APP. They wait until your guard is down to take money. It’s good at first but it turn south in the middle!!!!

This post will help: Beware These Cash App Support Scams

-Phillip

Lisa Baker

Direct deposit ayroll was processed on August 1. My paycheck is still pendingvtoday on August 9. NOT impressed with Squa, and this is only the 3rd time it’s been used.

This post will help: How to Contact Square

Aishia McQuillan

I have 2 payments of $15 that is lost. No one is willing to provide the customer service necessary to get this resolved. I contacted my bank and they said there were no transactions from cash app on the day in question. I asked Cash App if they can 3- easy the call to my bank, the rep said they can’t because they communicate by email only. I emailed the CEO for a resolution after being passed on to 5 different reps and here I am almost a week later and he still hasn’t responded. No wonder ther reps act like that. No one cares when your money is lost. They ignore emails and they keep your money.

This post will help: How to Contact Square

Daniel

I got 1500 stolen from my bank account and I never had a cash app but my funds some how we t to them?

This post will help: How to Contact Square

Kathryn Samel

There is no security with this app or with the cash card. I recieved a notification that I had been charged for a purchase at a fast food chain restaurant in another state. I contacted square immediately but could do nothing more than email someone because there’s absolutely no support. I tried to flag it as an unauthorized payment and was told in the app I could report the card stolen. The app, and the computer-generated email I received said I had to deal with the merchant directly? So….I’m going to try calling a Sonic restaurant 12 states away? And hope they fix it? What a joke. I took all my money back that was left. As of now I’m going to seek a different platform with my business also. Square is a joke. It’s not good for consumers, one hiccup- you’re screwed without any resources to recoup your funds.

This post will help: How to Contact Square

Starla B

I posted an item for sale on letgo and a gentleman responded and asked me to set up cashapp and that is how I would get the money, he swore he has used the cashapp many times before and never had an issue. I received emails from cashapp when the guy supposedly sent the money and was told I should see it in a couple of days, well a couple of days went by and then I get another email from cashapp stating they were experiencing server issues and where having to upgrade the servers and it would be another 2 days. Then on Monday I get another email from them stating that the $ amount of the item that I sold was over the $ amount for personal use and and that I would have to change my account to a business account and then the money would be deposited. Then I get an message from the buyer stating that he had to add an additional $800 to my cashapp account and that once I refunded him back the $800 then I would see the money in my cashapp account, and cashapp even sent an email stating that and that until I sent confirmation that I sent the $800 back (through a Walmart card, to a completely different person in a different state) I would not see any of my money.I did not send the $800 back because this all seems fishy to me and they expected me to send the $800 out of my own pocket. I should not have to come out of my own pocket in order to get my money for an item I sold through letgo. Cashapp has been extremely difficult to deal with and I will never use them again! So basically what they told me is that until I send confirmation of refunding the $800 my money is just going to sit there. Which is extremely wrong of them to do!! So again this purchase was done last Monday and as of today there has been no resolution.

This post will help: Beware These Square Cash App Scams

CathyPruitt

Tried a 2nd time because I need something to use. Going to cancel again if I don’t get results in the next few minutes! No customer service!

This post will help: How to Contact Square

Gerald

Cash app blanket closes accounts even after verifying because they can and all they give you is a terms of service email which is generic at best. Contacting square or cash app Twitter account doesn’t do much better. We send them dob, ss, id, and bank account info for them just to be able to say oh well we don’t like you your account is close and it’s final. I feel there needs to be a higher level of accountability or decision making. I believe they use a computer to make these decisions cause the closed account email comes too quick. I wish the BBB or some federal agency would look into the practices. This is terrible the more I think on it. We give them our personal info and we don’t even know what happens to it after they close the accounts. Cash app and square have to do better. I followed all their verification steps to only have my account close and no reason given… Ridiculous

This post will help: Best Mobile Apps for Sending Money

WILL GREER

cross your fingers if you use the cash app. If anything goes wrong, Cash App will not help. They are happy to take your money but you can not get any out.

This post will help: Best Mobile Apps for Sending Money

-Phillip

Mar

I’ve been hit three times. July 17th, 18th and the 19th. I check my account just about every day, and the transfers didn’t show until today. Total of $50.

This post will help: How to Contact Square

Deb

They debited my account 7 times in one day for a total of $475. I am a senior citizen on a fixed income, I cannot afford this. They used my husbands debit card number, he does not carry his card or ever used it. Why are they still operating?

This post will help: Watch Out For These Square Cash Customer Support Scams

Myrlin Young

My ordeal started on July 5 when someone sent me 1000 dollars. I didn’t need the money, so I hit refund….WHY did I do that. Today is July 19 and the person still has had the money credited back. Not only did they not credit back the money, they have tried to withdraw a 1000 dollars 14 times… thank god my bank flagged it as fraud… No number to call… SIGH…. We have contact support so many times it is ridiculous. i WILL NEVER USE CASH APP AGAIN AND WILL TELL EVERYONE i KNOW TO NEVER US THEM… AND I AM REPORTING THEM TO FOLLOWING AGENCY

BBB, (FDIC), (NCUA), the Office of the Comptroller of the Currency (OCC), (OTS), and the Board of Governors of the Federal. IN ADDITION, I WILL INCLUDE SQUARE SINCE THEY ARE THE PARENT COMPANY AND OFFER NO ASSISTANCE

This post will help: Best Mobile Apps for Sending Money

Kimberly Hermanns

PLEASE PLEASE PLEASE PLEASE PLEASE..!!!!!!!!

You have my daughters money and you need to give it back now. You said you would put in a reversal and we would get the $2800 back in our account.Never got it and now you won’t even respond at all so that leads me to believe that you have now stolen the $2800. Why are you hiding just give us our money back it’s not yours it’s ours. That was the last payment for a medical internship and your ruining it for her. Just give it back now please. I beg of you to just send it back so she can pay it off.

This post will help: How to Contact Square

Thomas Mills

“We are sorry to hear this”, “we understand your concern”….blah, blah. The Run Around. This app used to be a legitimate way to transfer $. Don’t Do It!! Transferred $1k of child support the ex never received despite it coming out of my account. Called shady foreign “customer service” Jerry Parker who spoke broken English and delayed, delayed, pretended as if he was being helpful. Each customer service rep was more useless than the next. Corrupt! Advice: Do NOT wait call debit card immediately and dispute the charge!

This post will help: Best Mobile Apps for Sending Money

-Phillip

Rokeisha Boyer

Cash app has unethical business practices!There’s no structure or customer service. They have taken money and dont seem to care that its gone and will only respond through automated texts and emails. There’s no number for a live person and when you are dealing with other people’s money, you should have a better system in place to handle disputes. I’ve contacted my bank, states Attorney General and the BBB in California regarding my money. I work HARD for my money and for someone to auto text me a message with no real answers, doesn’t sit right with me and I’m not having it. If I would have read the reviews before using this app I WOULDN’T HAVE DOWNLOADED THIS RIP OFF PIECE OF CRAP!! So I’d advise everyone to not use or be careful. Im taking whatever actions necessary to get my money back and I dont care who doesn’t approve. I feel like someone stole money out my purse and just walked away like I didn’t see them do it!

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Cynthia Curtis

They closed my account for No apparent reason I was asking how to get verified for bitcoin for weeks sent them documents numerous times then they emailed yesterday saying they closed my account Don’t deal with them no reasons from them bad service

This post will help: 5 Reasons Why Your Application Was Denied

-Phillip

Cathy Pruitt

Thought this was pretty good until today. Had unauthorized charges and attempts on my account. Thank God I didn’t have much money in it. Apparently someone is making duplicate cards because someone actually had a card with my number. My card was not lost or stolen and I’ve never been to Milwaukee. Really bad that they don’t have a phone number that you can call to actually talk to a person to resolve an issue and there are not enough options to choose all problems. Only communication is through text or email.

This post will help: Best Mobile Apps for Sending Money

-Phillip

Kee Tompkins

Pay attention to Cash App & which account they are choosing to send your money. I opted to cash out & send it to my credit union. I have 1 account that I’m the owner & another account I’m labeled joint on. Cash App only asks you to “login” to your account & after that, you get a pop up message stating it was successful & they reveal the ending numbers on the checking account. Since I only owned 1 account, I didn’t pay attention & didn’t notice they had the last digits of the account I was “joint” on. I deleted the account off Cash App & tried again thinking I did something wrong. This time I noticed the digits to the account number & realized it’s the app not me. When cash app has a choice of multiple accounts, cash app doesn’t ask which one the customer wants, Cash App decides for you, where YOUR money will go. This app should be sued. It was none of the other persons business on the other account I’m joint on, how much money I received. I’m surprised this app hasn’t been shut down yet

This post will help: Best Mobile Apps for Sending Money

-Phillip

Penny Bishop

Cash app allows people to get by with stealing money from consumers and don’t have to be accountable for their business. This is a horrible business and hopefully wil not continue to exist. When you make a purchase and the person doesn’t provide the item you paid for and they block you and change their name that is a scam. Them your company doesn’t think you should be accountable to protecting the consumer but instead want to pass it off to the bank to handle. You don’t deserve to be in business.

This post will help: Beware These Square Cash App Customer Support Scams

Rhonda Lee

I’m completely disappointed with this company and it’s cash app. I was scammed out of 90$ for a purchase that I never received. So cash app just let people get on there app to steal your money. Your banks can’t dispute your payment because your sending payment to someone one personal account. So think this is unfair and the app needs to explain on the app to not send or use there app unless you know the person! How are the Coustmers on the app to know that . So anyone can contact you talk you into buying something you like and going through a legitimate app is what your thinking and it’s SO NOT!! Scammers!!!

This post will help: Best Mobile Apps for Sending Money

-Phillip

George

Was ok at first till my daughter needed money for school, Tried to use C.C. which they take. After giving ok to C.C. company they approved the transaction.But when cash app. wanted to verify me, it was crazy. They wanted info.

I don’t give to anyone. Bank sign in info, picture of C.C. this after my C.C. okayed everything. Stay away from this site, to much info. not worth it on safety level alone

This post will help: Beware These Square Cash Customer Support Scams

david fynn

i got this number 1877 960 7666 on google search is this right number ? i have problem in my cash app account then i google toll free number for cash app and i got this number 1877 960 7666 , and they solve my problem as well but i confused

You may have been scammed: Watch Out For These Square Cash Support Scams

Marlon Brantley

I opened a Cash App account and for some reason which was never explained to me, the company closed my account. I still had money in the account. I tried contacting the company via their 800 number for a week straight, no answers the phone a recording comes on and tells you to submit a claim through the app. I went on twitter and sent a message, I went on FB and left a message with Jack Dorsey the CEO. I received 5 auto replies telling me the steps to receive my money, it still doesn’t work. I have money sitting in an account that I can not access, no one will return my call or email. Trying to actually speak with someone is impossible. Cash App will close your account and will not let you access your funds.

This post will help: Watch Out for These Square Cash Customer Support Scams

Dave halver

Worst company ever

Complete scam

The will take your money & close your app

No customer support

100% scam

This post will help: How to Contact Square

Renita

My account was frozen and I didn’t know why so I called the number the number they have listed. I talked to a Mike who claimed he was a cash app support but he claims I will get my money back but he deactivated my account and had me to download the quick support app that gives him access into my cash app. I have not received my payment back k can. See him going into other people account and now I have no money nor cash app anymore.

This post will help: Watch Out For These Square Cash App Support Scams

Mai Smith

I do not have a Cash App account but paid a trusted friend through a link that he provided for a service. After I paid him using only my debit card, my daughter and I started getting hit with random, small charges on both of our bank accounts (which are linked because she is a minor). I had both of our cards canceled, and now it is happening again. The only other thing that I am told I can do is to close both bank accounts and open new ones which is going to be a huge pain! I cannot get in touch with anyone, because I don’t actually have the app – and certainly am not setting up an account with them now. The names on the transactions that hit the bank are Reid Lineberger, Zack Radke, Tim, and Corey Wills.

This post will help: How to Contact Square

Marlon

The same thing is happening to me keep getting these random withdrawal from someone who has a cash app that somehow has access to my bank account, what can I do.

This post will help: How to Contact Square

Larry Selzler

Square Cash. Someone created an account using my name and credit card number.

This post will help: How to Contact Square

Elisa Lopez

They are thieves! Stay away from this app. They stole $500+ from my best friend and $130 from me. I have emailed their “support team” and they do not reply. The only information on the app says to contact your bank and we did it and they don’t have any transaction. Please stop using their services, they will still from you at some point.

This post will help: How to Contact Square

Tee

I have 1802.44 in my cash app account. My checks from my job we’re getting deposited into my account and cash app closed my account without warning. They canceled my card so I can’t use it. I’ve been trying to get access to my money for over a month now. There is no customer support. I keep getting the same generic response every time I reach out to them. I linked a bank account and it will not let me cash out. I tried to link my debit card from the same bank account and it will not even let me add it. I have seen so many bad reviews about cash app. I think they are scammers and are taking people money. I have reached out to the bbb to try to get this issue resolved. That’s too much money to just let them have.

This post will help: Beware These Square Cash Customer Support Scams

Landi Rojas

I don’t recommend it! In case if you need help, nobody does it! It’s hard to contact them, I’ve been waiting 5 days for a transfer that did not reach my account and nobody can help me !!please take care !!!

This post will help: How to Contact Square

Donna Kaibel

Do not use this app lots of fraud I had both my bank accounts emptied out from this app when I sent in 4 requests for response never received one. I will be contacting my local police department. To file a report. My bank says they see alot of fraud from this app. Never again I lost $2000

Do not use this app ever

This post will help: Watch Out For This Square Cash App Customer Support Scam

Russ

I was scammed for 2400$ and my bank just washed there hands and asking me to pay back them money,I hope cash app team can help me with this nightmare

This post will help: Watch Out For These Square Cash Customer Support Scams

Lake Murphy

BEWARE as they will not fight if you have been the victim of a fraudulent user/merchant. They’re just the middle man is the card they play, but you are their custom as well. Joke of customer service, that’s why they hide behind email.

This post will help: Beware These Square Cash Customer Support Scams

Brinda

I repeat do not use this app they stole $550 from me today I was a dummy and went and bought google cards because they said that was the only way that they could re- plumish my account

Nothing but thieves

This post will help: Beware This Square Cash Google Play Card Scam

Dave Fuehring

Stay Away – their security and customer service is terrible. We just started using this app as a way to receive a security deposit and when we tried to move the cash to our bank account we found that someone else’s account had been fraudulently added to our profile and our money was sent to someone else’s account. We have no idea where our money went and Cash App support will not tell us anything. So frustrating.. We’ve used PayPal for years with no problems and will stay with them in the future.

This post will help: Beware This Square Cash Customer Support Scam

Mitchell Hagood

Support is the worse I have seen, they will terminate your account saying TOS violation but will not tell you what the Violation is and tell you that they will not. I find that a very poor business model.

This post will help: Top-Rated Merchant Accounts

Betty Chase

Someone was able to create a fake SQC account using my debit card. Now they keep trying to withdraw money from my bank account. Luckily my bank, Bank of America, denied the many money transfers. My concern is the lack of security with this app and how easy this was for someone to do this.

This post will help: Beware These Square Cash Customer Support Scams

Dave

So far 60+ fraudulent scams. Seems every time I use my debit card there’s several square cash fraudulent charges

This post will help: Beware These Square Cash Customer Service Scams

Sarah

I do not recommend anyone to use this app. I really had to file a fraud claim because cash app had stolen a little over a 1,000 dollars in increments over $20 to $15 over the course of 2 1/2 months. I have only used that app three in case of family emergencies. I have never used that app since. I recently deleted my account and the app and still continued stealing an additional 60 bucks from me today. I had to cancel my debit card and I have file an additional claim as well. Not to mention I also decided to look back at my statements and noticed that they have been doing this since I’ve downloaded the app over six months ago. Best believe I’m going to try and see if my bank will reimburse me from transactions that were made farther back. I’ve tried getting in contact with cash app and no one is any help at all. I have told everyone I know what has happened to me and to delete the app and to get a new debit card. At this point I am strongly considering filing a lawsuit, but I don’t know if I would even make a difference

This post will help: Beware This Square Cash App Support Scam

Michael B DePue

Cannot leave less than 0.

Worst customer service ever.

Total run around on every help issue I inquired about.

They have 330.00 of funds I sent to a daughter

that she cannot withdraw!!!

they will not answer several emails to say where the funds are!!!

This post will help: How to Contact Square

keith

Square Cash allows people to download their APP so that money can be stolen out of other people’s bank accounts w/o any attempt to require a vaild authorization. Squarecash WILL NOT provide people a method to contact SquareCash without first SIGNING UP and giving them your BANK CARD NUMBER! why the hell would anybody give SQUARE CASH their bank card information when they’ve already had money stolen through Square Cash?!

This post will help: Beware These Square Cash Customer Support Scams

Flor

Esa aplicacion es un robo se robaron mi cell y se yevaron 110 dll y les mande correo electronico y nada y ni un telefono para yamarles ..no la bajen es puro robo y ni caso le hacen a uno pero voy air con la policia para reportarlos

Translation via Google Translate: That application is a robbery my cell was stolen and they went 110 dll and send them an email and nothing and not a phone to yamarles .. do not download it is pure robbery and no case they do to one but I go air with the police to report them

Marshall

Let me just say that I already received an email detailing that I would be paid via the app and still haven’t received it. Now they are saying that I don’t have the money after I was informed that I do.

This guy hasn’t paid me for 3 weeks for 9 hours of work moving his storage unit and this is the best they can come up with. I have a screenshot stating:

“Your pay will be available in your cash app on Wednesday.”

It is now Thursday and the only response I have gotten from the Cash App support team is that I need to contact the person who is paying me. I am not on speaking terms with him as he has paid me 3 weeks late for 9 hours of work. This is useless to me and doesn’t explain why they would tell me the funds are available if they are not.

The sender refuses to pay me now and the app refuses to do anything about it. Apparently it is my responsibility to reach out to him even though we are not on speaking terms due to his late payment.

This is disturbing and unhelpful. This app is a disgrace and nobody should ever use it as they basically will do nothing to ensure you get paid for services rendered.

I have freelanced for many years and never have I encountered a payment service with this level of unprofessional behavior.

This post will help: Best Merchant Accounts for Freelancers

Bonnie

Thankfully my bank caught them,but attempts to transfer money from my bank account were made in the middle of the night using this app. I have no idea how my debit card was compromised, but hate knowing someone tried to use it. Seems like this app doesn’t have my security in mind-too easy to get ripped off.

From The Editor

This Post Might Help: Watch Out For This Square Cash Customer Support Scam

Loyal Customer

Cash app is bad!!! It’s a hard to trust a company that you can’t call or live chat with if there’s a issue

From The Editor

This Post Might Help: How to Contact Square

Linda Hill

Cash app has the worse customer service!!! it takes an act of congress to get someone to email you back. The really suck!!!!

This post will help: Best Mobile Apps for Sending Money

– Phillip

Tiara Anderson

I wish i could give this app a 00.00. Ive been using cash app for about a year until recently i recieved an email on Christmas December 25 stating they took 150 dollars out of my account to refund back to the sender. The transaction in question took place on November 7 which was over a month ago. I sent them screen shots explained that this wasnt fraud and she even had tried 2 times later in the day to sebd other amounts of money knowingly and yet they still said they couldn’t do anything. I am truely pi**ed that this app didnt do anything about it. They dont even have a customer service number so dont try to call if you have a problem. You will just have to wait a few days even when you send multiple emails to them to get a response. I just pray my bank will refund my my money so i can delete that stupid app. I wouldnt recommend any one using it if the own company cant even help. 👎👎

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Roseann Gaito

its takes my bank information good but says the debit card to that account is invalid. That is my main account where my checks go into..its valid. I can get money but not send. :(

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Mitch

I do not use Square Cash and I have never applied to them to do so. I always monitor my account online and discovered several SPC* withdrawals (9) from my business account! ($131) 11/23/18 I reported it immediately to my bank (CHASE) and they cancelled my debit card and said the money would be refunded to my account within 12 hours! I was lucky! The money was refunded and I went to the bank to withdraw cash to use until I received a new ATM card for several days. I also gave the teller my ATM card and she cut it up in front of me. It had never left my possession.

It inconvenienced me for a week or so until I received a new card. But I still have no idea how this was done to me because I never signed up for a Square Cash account?

The withdrawals were taken in small multiple increments of $14 and $15 in order not to raise suspicion I presume…

The person(s) the cash was withdrawn by is:

GABRIELLE PEARS (CA)

TRAVIS FRANCIS (CA)

BEWARE of one of these names appearing on your accounts!

From The Editor

This Post Might Help: Beware This Square Cash Customer Support Scam

Sensendo Adam

People don’t use cash app, the steal my money and it’s very hard to contact them

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Bonta

Beware of square cash they took $399.47 when my account had only $.53. It took more time and than a month to straighten up hat out their customer service is horrible you have to send 5 or 6 email just to initiate a claim. The took $121.00 this time. I’m so done with them. PayPal might cost more bu the service is worth it

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Latavia Raiford

I definitely wouldn’t run to PayPal they’re are holding 800$ of mine right now for no reason on a good standing never had a problem account and then saying it’s going to take 180 to release my money. Bs

From The Editor

This Post Might Help: How to Make Your Payment Processor Release Your Money

Nicholas Papadakis

Worst app I’ve ever seen. I’m surprised they are still in business. Customer service is non-existent. The app asks you for your email or your phone number. If you enter your phone number one time and your email the next time, it creates 2 separate accounts. Then if you try to consolidate them it give you an error. Try to contact support to fix the issue and the app crashes. Try to do it online and it gives you an error to log into the app. There are a ton of better options out there, don’t waste your time or effort with this.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Bobby Mihoc

Square Cash is fraud. I changed my phone number recently, and received some money via the old phone number (which I no longer have access to). The money was sent to my name, and through my email address. They would not recognize my name and email address. They only give you the money if they verify you through an old, non-existing phone number, which is impossible to do, obviously. So I lost that money. They kept it. This is theft.

From The Editor

This Post Might Help: Beware These Square Cash Customer Support Scams

Nibody

Don t trust that cash appt they will keep r money if u have no proof it’s been 30 days they have my money the account I send to return the money to them had they are giving a hard time

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Susan

Beware of this company!! They have allowed someone to fraudulently empty my account and it is impossible to contact an agent because I do not have an access code or sign up with their company. I never heard of their company. They are obviously not doing adequate safety checks because it’s all over the internet that they are depleting entire accounts fraudulently, basically stealing for a thief. I have had to cancel my card and we’ll have to redo all of my valid bill pay accounts. I am just lucky that my bank caught it, others were not so fortunate

From The Editor

This Post Might Help: How to Contact Square

Ana-Maria Mardini

CASH APP IS TERRIBLE!!!! I got signed out of my account and when i called the support line, they kept asking me to buy Google Play cards to “activate a new account” and then supposedly refund me the money i spent in google play cards. They robbed me! Every time i would call they would keep asking for another google play card. Needless to say i spent $100 and didn’t get it back. Not only did i lose the money i had in my cash app account but i also lost those $100.

From The Editor

This Post Might Help: Beware This Square Cash App Customer Support Scam

Leslie

Terrible money app! They say it is protected but it is not! My phone was stolen and they were able to hack in and transfer money out of my account into theirs! What does cash app do??? They told me to contact the recipient and get it back from them! I made a police report regarding the fraud and they were unwilling to corporate with the police! Would never recommend this app to anyone!

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Joshua Woodall

I had $4000 dollars stolen out of my cash app. There is no customer support for cash app. Beware!

From The Editor

This Post Might Help: How to Contact Square

Kandee

DO NOT USE THIS APP!!! I have been having transaction coming thru that I didnt make.. and they will not refund my money even tho I have proof. Im standing with my landlord in her yard and some made a purchase thru my account..mind u my card is on me… I have another where I’m driving to the movies and someone in NY is making purchases. I cant get ahold of a human to help me nothing. They can care less it’s not there money. And I have no way of getting a refund.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Ja'Keria Simpson

They need a better support team I still haven’t had my issue resolved yet

susan

The lack of prompt customer support has made this service unacceptable for me. Someone took money fraudulently and I contacted the app immediately, within minutes of the time that the transaction transpired. This is the moment that I discovered that there is no phone number to contact them. It was several days before I received a response and then it was too late to reverse the funds, which could have been stopped if they had responded promptly. I will be looking for another method for transferring cash in the future. Customer service is an important feature of any business and there just isn’t any with this company.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Nik

Cash App took $78.99 for a transaction that cost $21.01. I called the fake # and kept speaking to the same person using a new name. He kept hanging up on me when I refused to resolve the issue by putting an ADDITIONAL $400 onto my cash app account. Why would I do that when THEY owe ME? Found out thru research that there are THOUSANDS of people they have scammed for VERY large amounts (mine doesn’t even compare to those poor people)

Rena

Do not use this app. They are s scam. Their is no customer service. I am out 800 and have no recourse .

Rhonda

cash app stole 21 dollar from me over 3 Months using a Xbox logo. they said it would be refunded to me if i bought a google card for $100.00. i refused then transferred the remaining amount of the 200 which was now 190 to my bank account. when i checked my account the money was not there. cash app put another card on my account and stole the money

From The Editor

This Post Might Help: Beware These Square Cash Customer Support Scams

Vickey carter

Bought 10 in gas got charged 88.99 store couldn’t do anything…i called what i thought was customer service…immediately all funds were gone they drained while i was on the phone… then started draining our bank account. .. how is it fair they steal our money with no consequences or retributions

From The Editor

This Post Might Help: Beware These Square Cash Customer Support Scams

Daniel Hicks

A friend told me about this to send money to them in a hurry, so I downloaded this Cash App, to try it out. The first red flag was the Cash App telling me that I have entered the incorrect zip code. I was able to skip that step and I came back to it later. Still says Invalid zip and I’m looking at my address in my bank account while getting the same response. I instantly deleted it and I don’t trust that it’s legitimate. Also, the Cash App states that if you refer a friend, they will get $5.00, however since I had already downloaded the app and put in a code, the (Refer a Friend) is no longer valid because I am/was using it already, even within the first 5 minutes. Thank you, Have a nice Day!

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Ed

I lost $50 trying to send money to my daughter. Do not use this.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Sade honey

Terrible. Don’t even sign up. This is a total scam

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

kristan cole

Be Ware of the $Cash App

I tried to send money to my sons account. He didn’t receive it. $500. After being on hold for 32 minutes I called again and they said Andrew the guy I had been talking to was in the bathroom and was sick. I so ik, but you can help me right? Peter Nelson said he could. Then he told me that they were having technical issue and wouldn’t be able to reverse the charges until Monday. Then they said well the issue is I sent to much money and for my own security they were rejecting the money but it wouldn’t be sent back to me until Monday. I asked to speak to a supervisor and he hung up on me. I called back and this same Peter Nelson hung up on me 6 times. I called Chase bank Fraud Department and they are now going to handle this. Be ware of this app is a scam. Also this app customer service is foreign,which make it hard to get anything done. I am now going to blow them up on social media so this doesn’t happen to anyone else.

From The Editor

This Post Might Help: Watch Out For These Square Cash App Customer Support Scams

Wacheera

If you want to keep your money, do not use this app. It double sends money. Somehow money gets sent without you sending it even if you have a pin in place to send. You do not get your refunds and A there is not a person you can speak to for a resolution.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Teresa Walker

I don’t understand how a company would allow people to use there services and then don’t or will refuse to help their customer receive the best experience in resolving there issue.

Well lets talk about Cash App!!

I would never recommend this App to anyone and if I could I would have the App banned from all use.

I had an experience with tow customer service people today which by the way took me two days to find a 1 800 number to contact them in the first place. Well the issue I was having was that my son opened an account with them( 1. he is a minor 2. he does not have a banking account.) which I am not in support of because I don’t trust things I can not see. But he is young so moving on… He had an relative to send him money to this account which my relative does use this app as well but again that is no concern of mine. So now my son wants to use the funds that was sent to him and he cant. Well for one he is a minor!!! which you don’t find that out until you have signed up for the account, plus he didn’t read all that he needed to. He is a kid!! ok fine let me see if I can help my son as a parent should.

1.Where can you locate THE 1 800 ?

SO I FOUND IT 1-877-529-5137 GREAT

FIRST REP

LAUNGUAGE BARRIER but I’m ok that is not really a big issue. Until he said that you only have access to the funds for 5 days and once the 5 days is up you loose access to said funds, NO IT WILL NOT BE SENT BACK TO THE SENDER. IT IS TURNED TO A FEE AND CASH APP KEEPS IT. WOW REALLY!!!

Please transfer me to a manager or supervisor please because I don’t understand.( question?? is this illegal ?? I have never heard of this. )

SECOND REP/ MANAGER

FERIFY THE ACCOUNT AGAIN OK SURE

Please go buy a google card worth the same amount call us back with the information and then we can send the funds back to you. thank you lol

WAIT!! can you send the funds back to the sender? Its only day two, that is what this company does right? no we cant do that! why? because your son is a minor! wait !!! but you put the funds in the minors account correct? yes. ok is there another option? can I provide you with my banking information to transfer the funds to ? No

ok so I don’t have access to $170.00 right now to buy a google card.

well ma’am I cant help the your family sent your son this money we are a company have you never held an office position.

(OK NOW YOU HAVE POKED THE BEAR!! SAYING THIS TO MY SELF)

THIS IS NOT PERSONAL SO WHY ARE YOU ATTACKING ME? IM ASKING FOR OTHER OPTIONS.

ma’am your account is blocked and you now have no access to it

and that lead me to here.

Mr. Phillip Parker you should retrain all persons how work for you. You should as well review your own polices.

From The Editor

We are not Square Cash. We are an independent review website that has no affiliation with Square. The person you contacted may have been a scammer.

This Post Might Help: Watch Out For These Square Cash App Customer Support Scams

Terry Smith

I sent a friend $250 on August 10,2018 over the CASH APP. A hr later my friend send me back a refunded of the $250. I then received a text message on my cell phone which informed me that the money $250 would be available Tuesday August 14th. On August 14th i found myself speaking with a Cash app agent after not receiving my money when i was told i would. i was informed by the agent that i would have my money back in my account by 6pm that night. On August 15th 2018 I once again called the Cash app agent who this time informed me that i would have to spend $100 of my money to purchase a Google Play car valued at $100. The agent stated that by me buy the goggle play card he would be able to refund me the $250 i’m owed and a extra $200 for the google play card and inconvenience fee for my troubles. I did just that brought a goggle play card gave the agent the code on the back and was told that i would be called back in a hr to ensure money was transferred. After not receiving a call back form the agent i decided to call back when i finally got an answer i was told the agent Romeo was gone for the day and would return tomorrow. Today is August 17 2018 i called this morning only to hear that Mr. Romeo is busy and would call me back a 1pm. After not receiving a call from CASH app agent Romeo i decided to call back to see if i had been forgotten. When i got a agent on the line and began to inform them of my issue they cut me off in mid convo and stated that Romeo has my file and there’s nothing they can do and hung up the phone on me . I have experienced a great deal of disrespect over the last few days as a customer of CASH app. The professionalism and lack of communication and support shown to myself as a costumer has put me in a state of shock totally. At this point i have no other option but to continue to call to get my money back I hope no one else is treated this way by this company it’s a disgrace.

From The Editor

This Post Might Help: Watch Out For These Square Cash App Customer Support Scams

Blair

Cash Ap is the worst. They are not FDIC insured. When you have a problem and you want to talk to someone on the phone good luck. This company is a joke and they literally just steal your money. Your money is not safe in these accounts. The literally do absolutely nothing not even send you a new card of yours has been compromised.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Tip

I recently tried using my cas app are for a transaction and it denied it in which I had the funds on the card. I called cash app support & they responded saying Amy account has been hacked & informed the to go to a local Walgreens and purchase a $50 Google card and give them the14 digits off back to unlock my card. I responded no I will not purchase a card to get my own funds I will go to the nearest police station. After that conversation my card started to work. I felt as if it was an employee that was trying to hack my account.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Marie

My sister sent me 100.00 about a week ago and it has not been deposited yet. I called and spoke with a representative and was told it would be into my account within two to three hours. It’s been 24hrs and still not received. I called again and spoke with the same representative and he had no answer as to why I haven’t received the money. After I asked him what was the problem, his response was I cannot talk to you anymore and hung up on me. That was very rude and unprofessional. Friends watch out.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Rachel Sippel

This app will take day to process the money, and will even cancel a payment because of security “concerns” which is basically code for we are going to hold on to your money for a couple of days. What they are doing should be outlawed.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Adys Naranjo

I downloaded the “Cash App” through the Google play store and at first glance the reviews on there were positive. I sent my son 3 money transactions, however he only received 1. I tried to get some help to find out where my money was. I searched for customer service, a help line, something, someone, anyone that could give me answers, but all I found was an anonymous email. I sent them an email several days ago but apparently my email has gone

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Shinice Kelly

I use to love this app until I tried to refund my cash and the cash was never refunded back! The amount of 400 was not given back to me yet I have emailed,called and still no response . It has been two weeks and I still haven’t got my funds!! I am not happy and NOW THIS APP IS NOT GOOD!!!!!

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Matt

My account has been hacked twice. First time they didn’t get anything cause the amount tried to take I didn’t have. But next day after a friend payed me, someone took $90 out of my account. App says to contact the person for a refund, but it won’t even allow me to make a request to the persons name. When I physically type the name if for the request nothing comes up to be able to make the request. They’re not even in my list of contacts from past transactions. It’s like they non existant and don’t have an account but could take money from me.

Was a fan of the app, but obviously the Cash App(square cash) has very little consern for their customers security, or being able to help. There is no way to contact them. As in its not even possible. How this is possible for a large business like this is beyond me. Pretty much them giving the middle finger to a account customers.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Erika Williams

This can’t be legal… cash app deposited my cash out in my acct. They mistakenly deposited my cash out twice. Then they reversed the deposit twice taking what the mistakenly gave me and what was to be deposited in my acct. They asked for a screen shot of my bank statement showing the transaction. I emailed them the screen shot. Then they came back with” we didn’t initiate the reversal so you need to dispute it with your bank”. I am so furious. This has stop! They are stealing money!

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Kelli Harrod

I sent someone some $ and following that transaction they took how an additonal $300!!! How does that even happen?

I will never use this app again. Not secure!!

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Ty

Had my Cash App account hacked yesterday. Someone sent $60, $60, and $75 to a user I don’t recognize. Will not use again unless app becomes ALOT more secure.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Norma Vasquez

Please do not use Cash appt for usage of bitcoin.

I have sent my pictures and all the requirements 4 times and it never got approved. My money is held in bitcoin and I cannot get my money back. Please do not use this app.

From The Editor

This Post Might Help: Why Credit Card Processors Hold Funds

rosa

i have a question to anyone that may have had an issue that i am having with square cash. 175 was to be deposited into my checking by the end of the day on Friday july 6. after waiting all day i called square cash spoke with eric he said that there was a problem with the sever however he could process a refund that would take about 120 days because the amount had to be over 300.00 before they would be able to do a refund the same day. Per eric i needed to go and buy a google play card for a 125.00 to make up the total of 300.00 and he would guarantee i would have the total of 300.00 within a couple of hours. This was around 6 yesterday. Stupid me i did as requested in fact eric call me twice while i was in walmart. i came home and called him gave him the needed information from the per paid card

after about 3 hrs i call back he was gone for the day but i was guaranteed that my money was on it way.

as of 8 am this morning i still do not have my money. now when i talk to eric he said that my cashme out account had been compromised and he could not place any

money in to that account. please read what i am about to say very closely they now want me to give them an additional 200.00 and i would be refunded a total of 500.00 i yelled at him and told him there is no way i

am going to give them one dime more i

would be filing a complaint on monday with the US Trade commissions and the New York attorney general he said good luck and hung up but call me back to see if i

changed my mind. i know this sounds made up but all is true as far as i can tell square cash is a legitimate company. I think there maybe people who are scamming customers. possible without the company knowledge

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

beri

sent to Cash App: I have tried to get ahold of you guys multiple times. What you are doing is wrong.

I am business owner my client used her cash app card at my business. I refunded her, her money. That was July 20th. It has not been sent back to her back. What is going? How can her money just be floating around in cyberspace?

Why is there no number to call you. You need to hire people and be professional this is a money transaction site.

–Now This is what happened to me since your company is not doing what it should in terms of having a customer service line. Your “emails” are not cutting it.

So ultimately what happened to me was I found a “Cash App” contact number and spent 4 hours on the phone trying to figure out where my clients money is. “You” asked me for my credit card information, was told I need to put $350 on a google play card and that once it was received my client would receive the $650 owed and in addition the $350.00. Well they never put any money back. So “Cash App” stole from me. Also I then started to notice that money was taken out of my personal cash app account without my consent and my banking accounts were completely depleted. So now my personal banking accounts are at 0. There were over $3,000 that was wrongly taken out!!!!!

I need you to refund my clients money of $650.00. I also would like to be compensated for you not having a phone number and me having been forced to call a fake number because you don’t have one. This is crazy. I will be reporting you to bbb and the FTC, and posting negative reviews across the internet. I will also take legal action if this is not dealt with.

From The Editor

This Post Might Help: How to Contact Square

Ashley Lynn Robinson

The Same thing happened to me they got 357 dollars out of me had me purchase a Google play card and cash app still haven’t investigated it’s been 2 weeks cash app said that they are a we’re of this but the haven’t warned customers are paid me back

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Theresa Frierson

on june 7th. I sent 100 to my friend and the app cancelled the payment an told me it was refunded to me i never git the 109 dollars..i called an talked to the wirse customer service rep.ever they were rude keot telling me to send then 100 dollars first then they will refund my 100 dollars.im fed up an disappointed. I was referred to the app by a family member…my next call is to my lawyer…my email is [email protected].

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Ernie

Got a new debit card, now dont work, bank says is fine on their end. Cant get help. Just irrelevant emails. I need this bad. very frustrating

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Yvette

DO NOT USE CASH APP!!! if your money doesn’t go through you will never see it again!!! and there is absolutely no one to call!!!

DO NOT CALL THE CASH APP SUPPORT NUMBERS ON GOOGLE SEARCH ENGINES!! They are scammers, looking to remote onto your computer to steal even more from you!

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Theresa

I noticed this morning small withdrawals from my account overnight that had SQC*SQUARECASH as the withdrawer (one withdrawal for $4, three withdrawals for $5). I do not use Square Cash– didn’t even know what it was until I looked it up online. I called the bank immediately, as these were not my transactions. The bank confirmed someone was fraudulently withdrawing form my bank account using Square Cash. They say it is common– the thief starts with small amounts to test if you’re paying attention or not, then cleans out your account. Thankfully I caught it and the bank closed my account and credited the fraudulent withdrawals. But if it’s “common” for thieves to use Square Cash to steal from other people’s ban accounts, there is something seriously wrong with this company’s security. On that point, I would neither use it nor recommend it.

Ashon pARKER

This happen to me also

I noticed this morning small withdrawals from my account overnight that had SQC*SQUARECASH as the withdrawer (one withdrawal for $4, three withdrawals for $5). I do not use Square Cash– didn’t even know what it was until I looked it up online. I called the bank immediately, as these were not my transactions. The bank confirmed someone was fraudulently withdrawing form my bank account using Square Cash. They say it is common– the thief starts with small amounts to test if you’re paying attention or not, then cleans out your account. Thankfully I caught it and the bank closed my account and credited the fraudulent withdrawals. But if it’s “common” for thieves to use Square Cash to steal from other people’s ban accounts, there is something seriously wrong with this company’s security. On that point, I would neither use it nor recommend it.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Sunie

I found out today that cash app upgraded me to a business account last year without my permission or knowledge. While my profile still said personal at that so how this was done is beyond my understanding. now they are telling me I can’t get more than 30days of fees THEY ILLEGALLY CHARGED ME back. ON a business account I NEVER UPGRADED to. Please be sure to check the fees being deducted from you as cash app will rob you without your permission. I’m looking into the BBB to see what can be done. And will never refer anymore business to cash app they are a scam company that will rob you blind if you aren’t aware.

Ashley Mccranny

Cash app is a scam I had someone send me money on cash app so my banking info isn’t on there so I have a cash card from cash app, I went to the gas station where the card was declined so I checked the app and seen the money was still there so I drive home and call customer service and I talked to a very rude lady she asked for my card number PIN number and zip code as soon as I gave her that information she hung up on me so I called back and they kept hanging up on me so I checked the app and what do you know the money was gone and now I can’t get in touch with anybody there. I advise anyone DONT USE THE APP!!! Thank god my banking information is not on their site

Sarah Turberville

This is the first time I’ve ever heard of the so-called “Square Cash.” I found this website out due to a lovely phone call I received yesterday. Turns out I’m a victim of fraud. Money was taken from my account without my permission. Y’all just lost a future member. Someone needs to shut this business down. Honesty that person with balls enough to do it will most likely be me. So be prepared and have a good day.

Glenn

Just had over $300 ripped off from my account with Square Cash. Someone in California some how can use it and steal money from Louisiana. Come on, we have it bad enough with our Dem governor trying to steal all our money, he doesn’t need any help

Stephen Barker

Cash App does not work. I tried to receive funds 10 different times and not one transaction went through. It is a dismal failure. Don’t waste your time.

Margie

I was hacked, scammed, and robbed! These guys stole $175 straight out of my bank account. Sender was Jeff Wiggins (240-425-7423),and the Recipient was Genesis (973-816-5457). These 2 stole and when contacted, Jeff states its the wrong number, Genesis states he can pay me back but he needs time, and when following up with him, he ignores me completely. Delete the app people! Putting ur bank info and personal info is risking you to get hacked, scammed, and stolen from. I was a victim of a serious fraudulent crime and the Cash App customer service will take their sweet time and not respond to you at all. They will steal and keep your hard working money. Do not risk it at all. You are risking what you have if u end up downloading and using this app. I definitely do not recommend using this app. Once again, this is a scam. These guys also hacked into my mother’s bank account and stole $800 from her. Seriously, your info is not protected, and you will be just another victim like me and my mother.

Erik R.

Margie, Were you able to dispute this through your actual bank?

I bank with Chase and they are refusing to even process my dispute.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Regina F.

I don’t use this app a lot, but my boyfriend and I use it sometimes to send money back and fourth to each other. Until recently I haven’t had a problem with it but like I said I don’t use it a lot. On May 18, 19, & 21 my bank account was hit from the cash app from someone named Marcus for a total of $143. I don’t even know anyone named Marcus and definitely hasn’t sent him any money.

I contacted my bank and reported fraud on this person and also deleted my cash app off my phone. I will never use this app or another app that’s like it ever again. I still can’t figure out how he was able to transfer the money from my account to his without going on my phone and getting on the app.? I also had a 4 digit pin lock on the cash app so no one could get access to the app from my phone. I’m very disappointed and mad at this app!

Khaalis ONeill

I only wished I had done my due diligence before downloading and using this app to send money to my son in college. I sent him money on several occasions without issues but this last payment I sent say’s it expired. Well, I’m assuming he did not accept it or something but’s that’s very unlikely since I notify him prior to sending the funds. Two weeks later after the payment has expired I have not received a refund. I see the money deducted from my account on 4/30/18 and it’s now 5/17/18 and nothing. I have a failed receipt in Cash App but where are the funds? I have sent numerous emails and nothing. No response other than the canned message that someone will contact me. It’s very frustrating and scary considering I trusted this company with my account information. Stay away at all cost. If you can not contact a live person consider it a big red flag. Now I can do nothing but wait. Be warned!

Shirrell Wheatley

Don’t use it help fake businesses rip people off

Yvonne Eason

My daughter asked me to send her some money thought this app. So I downloaded and sent her money. I was shocked to find that they had charged me 2 times for the same amount. Will NEVER USE – PLEASE DONT USE

Liza

This happened to me also. Never got a refund.

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Janice Simms

Do Not Use Cash App – easy to sign up but no way are you going to talk with a live person should you have an issue with the service. I sent money to receiver and receiver unintentionally sent it back. I received a message from Cash app that the money had been refunded. Seven (7) days later the money has not shown up in my bank acct and after 24 hours of trying to get a real live person on the phone, I receive the email below. The FRB Federal Credit Union confirmed that no payment/refund has been received and that my account has been debited the payment cash app claims to have refunded.

Good morning Sender,

I apologize for the confusion and trouble this payment has caused.

I was able to locate the transaction you mentioned, and can confirm it’s been voided. That means the payment was not successfully captured and you were not charged.

It’s important to point out that a voided payment may show as a pending transaction on your bank statement, but will typically drop off within a few business days. We’ve already sent a void notification, and it’s your bank’s responsibility to release any hold on the pending funds.

Also note that a voided payment will appear on your bank statement as having cancelled itself out within the same statement line as the original payment. It will not appear as a refund in another statement line.

I want to make sure these funds are returned to you, so please let me know if you have any additional questions. I’m happy to help! :)

Best wishes,

Sterling,

Cash Support

Peter Michael DeFrancisco

Janice I need your help!! Someone accessed my account and withdrew lots of money. How do I contact the Cash App vendor to get the charges reversed

From The Editor

This Post Might Help: Best Mobile Apps for Sending Money

Linda