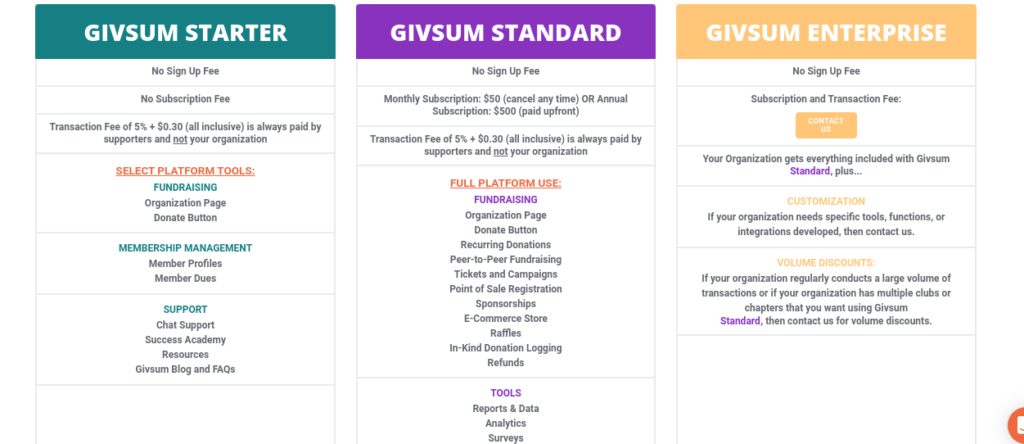

Payment Processing

Givsum provides a social feed and volunteer tracking system for donors, along with merchant accounts for charities through Braintree Payments, a PayPal subsidiary. The platform supports various donor campaigns, including tournaments, raffles, races, walks, runs, shows, concerts, ticketed events, peer-to-peer and team giving, and item sales. Additionally, Givsum offers tools to promote and track donations.

Point of Sale App

Givsum has introduced a Point of Sale (POS) app and mobile card reader to facilitate checkouts and transactions at in-person fundraising events.

Community and Case Studies

The company offers case studies that demonstrate how their services have benefitted various organizations. These case studies provide insights into the impact of Givsum’s services on advancing organizational missions.

Types of Events Supported

Givsum supports a wide range of fundraising events, including golf and poker tournaments, raffles, runs, walks, races, shows, concerts, fundraising auctions, and other ticketed events.

Additional Tools

Givsum provides tools such as donation embeds, widgets, emails, surveys, and text messages to enhance the fundraising and volunteer management experience.

Reports and Data

The platform includes features for generating reports and data to help organizations track their fundraising and volunteer activities, offering analytical insights to aid in decision-making.