Braintree Payments Card Processing Reviews & Complaints

Company Overview

Braintree is a merchant account provider based in Chicago, Illinois. Founded in 2007, Braintree markets its services primarily to e-commerce merchants, subscription-based businesses, and merchants that key in all of their credit card transactions.

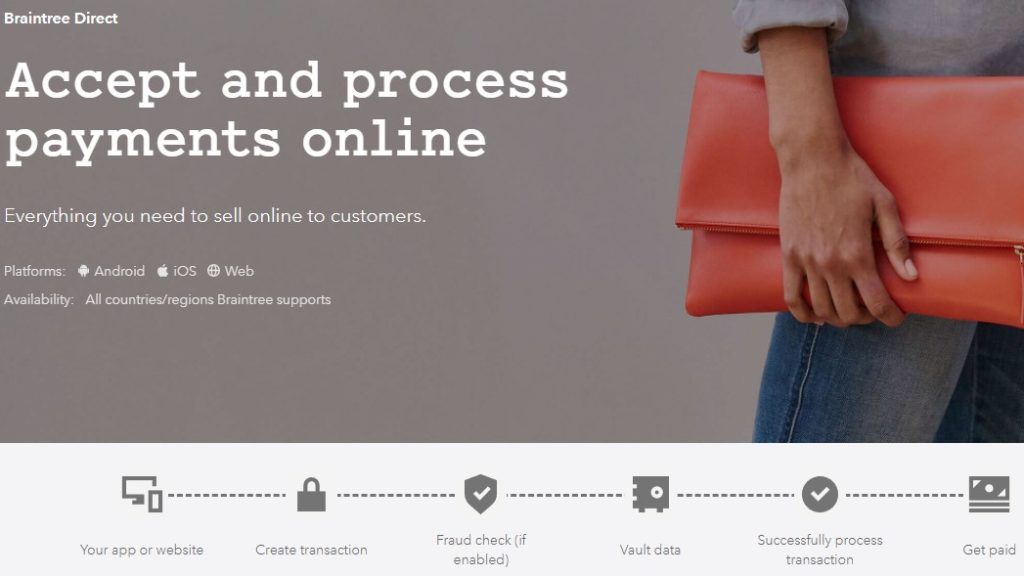

Braintree Payment Processing

Braintree processes all major debit and credit cards for all business types. Their services include online payments, recurring billing, data reporting and analytics, rewards programs, e-commerce solutions, and POS solutions. Braintree’s payment gateway offers virtually automatic PCI Compliance by storing the credit card data off of the merchants' systems and on its own secured servers. The system allows cards to be recharged or refunded without re-entering the card information and enables merchants to set up recurring charges for periodic billing purposes, such as subscriptions and memberships. Braintree is also considered to be one of the best multi-currency merchant accounts, allowing U.S.-based merchants to accept international payments in 134 local currencies with settlement in 44 different currencies.

A PayPal Subsidiary

Braintree was purchased by PayPal in September 2013 for $800 million. The acquisition also included Venmo, Braintree's mobile cash transfer service. Braintree uses First Data (now Fiserv) for its card processing network, but merchants appear to deal with Braintree exclusively for the service of their accounts.

Braintree's Credit Card Processing

Central to Braintree's service offerings is credit card processing. This feature allows businesses to accept a wide array of credit and debit card payments, thereby creating a smooth and efficient transaction process that enhances customer experience.

Mobile Payment Solutions by Braintree

Recognizing the growth of mobile commerce, Braintree offers mobile payment solutions. This service enables businesses to process transactions securely via mobile devices, offering customers a seamless and convenient mobile shopping experience.

Braintree's Global Payment Services

For businesses operating internationally, Braintree provides global payment services. This allows companies to accept payments in over 130 currencies, thereby accommodating a broader customer base and facilitating global expansion.

E-Commerce Solutions from Braintree

Understanding the growing relevance of e-commerce, Braintree offers a comprehensive suite of e-commerce solutions. These include secure online payment processing, facilitating a smooth and safe online shopping experience for customers.

Subscription Billing Services by Braintree

For businesses with a subscription-based model, Braintree offers subscription billing services. This enables automatic recurring billing, reducing administrative workload and ensuring a steady, reliable revenue stream.

Braintree's Marketplace Payments

Braintree provides marketplace payments solutions, particularly suitable for e-commerce platforms that connect multiple sellers with buyers. This service streamlines the payment process, ensuring secure and swift transactions between all parties involved.

Security Measures from Braintree

Security is a priority for Braintree. They offer advanced security measures, such as data encryption and fraud protection tools, to ensure that businesses and their customers are protected from potential security threats during transactions.

Location & Ownership

Braintree is located at 222 W Merchandise Mart Plaza, Suite 800, Chicago, Illinois 60654, and the company’s acquiring bank is Wells Fargo Bank, N.A., Concord, California. Bill Ready is the CEO of Braintree.

Video Summary

| Pros: | Cons: |

|---|---|

| Global payment support | Complex pricing structure |

| Seamless integration options | Account stability issues |

| Advanced fraud protection | Limited merchant support |

| No monthly fees | Chargeback fees |

| PayPal Integration | Higher transaction fees |

| Strong mobile support | Requires technical expertise |

Braintree Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 50+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Fund-holds |

| Recent Lawsuits | No |

Low-Moderate Complaint Total

Our search has uncovered over 50 Braintree reviews. A minority of these reviews label the company as a scam or a ripoff, primarily due to issues related to fund holds. Additionally, there are mentions of challenges with customer service. While fund holds can be frustrating for businesses, Braintree seems to adhere to typical industry practices for fraud prevention. For those encountering fund hold issues with Braintree, it may be beneficial to explore strategies for getting your processor to release your funds. We encourage sharing your Braintree experiences in the comments below.

Braintree Lawsuits

No significant class-action lawsuits or FTC complaints have been identified against Braintree. Clients seeking amicable solutions to their grievances are advised to report them to appropriate supervisory bodies.

Braintree Customer Support Options

Considering the commonality of fund-hold complaints in the industry, Braintree’s modest number of such complaints suggests effective handling of these issues. Additionally, a substantial volume of positive reviews highlights a responsive and competent customer support team. Braintree provides various support channels, including phone and email, along with a comprehensive online knowledge base.

Braintree Customer Service Number

- (877) 511-5036 – General Support

Other Support Options

- Braintree’s support form is available for additional assistance.

Braintree Online Ratings

Here's How They Rate Online

| BBB Reports | 24 |

|---|

Under 10 Complaints

The Better Business Bureau has combined Braintree’s account with that of PayPal, meaning most of the reviews on the account will reference the larger company. Previously, the BBB had assigned a “B-” rating based upon 16 complaints filed in the last 36 months. 11 of these 16 complaints were resolved by the company to the satisfaction of the merchant. The remaining 5 were resolved to the dissatisfaction of the merchant or received no final response.

What Merchants Say

In addition to those 16 complaints, the company also had 8 informal reviews posted to its BBB profile. Only 1 review was positive in nature, while the remaining 7 were all negative. The most review offers a disparaging take on the company’s services:

We’ve been using Braintree for 5 years but they have betrayed us for the last time. Their system is not secure, they charge ridiculous fees, customer service is terrible and they have made almost zero improvements to their system over the last five years.

It is difficult to pinpoint the basis of this business’ issue with Braintree. It should be noted that informal reviews are not authenticated by the BBB like complaints are. In any event, choosing a merchant service provider takes diligence on the part of any company. Researching the best available options for merchant accounts is important to finding the best fit for your business.

A “B” Performance Overall

Considering the company’s poor efforts at resolution, we agree with the BBB’s former rating.

Braintree Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 2.90% + $0.30 |

| Equipment Leasing | No |

Braintree’s Competitive Pricing Structure

Braintree maintains a straightforward pricing model, aligning with industry standards set by comparable providers like PayPal and Stripe. The company applies a universal charge of 2.9% + $0.30 per transaction across all card types, notably without imposing any monthly, minimum, PCI compliance, or cancellation fees. Unique costs include a $15 chargeback fee for disputed transactions, a 1% fee for transactions in multiple currencies, and a specific $0.15 transaction fee for submissions to American Express.

Special Rates and Additional Fees

Braintree extends a discounted rate of 2.2% plus $0.30 per transaction to non-profits. Charges for American Express transactions are set at 3.25% plus $0.30, and ACH payments incur a fee of 0.75%. Furthermore, Braintree offers tailored pricing solutions for enterprise-scale businesses, providing advanced services and interchange-plus pricing opportunities. For businesses seeking to integrate Braintree’s payment gateway with alternate processing services, fees are structured at $49 monthly, with an additional 10 cents per transaction and $10 for each extra merchant account.

Pricing Transparency

Braintree is recognized for its transparent pricing and terms, minimizing the risk of unforeseen expenses. Businesses are advised to assess Braintree’s offerings in relation to other market-leading merchant account services to ensure they secure the most advantageous terms.

For comprehensive comparisons and insights into merchant services, business owners are invited to explore our curated list of the top merchant account providers.

Braintree Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

No Deceptive Sales Tactics

Braintree does not appear to use any deceptive advertising, price quoting, or sales tactics. The company markets its services primarily online, with an in-house sales team, and through strategic partnerships, so there is very little risk of an independent reseller misrepresenting the company’s pricing.

Full Disclosure

We are currently unable to locate any negative Braintree reviews that mention the company’s sales team, and the company actively displays its full pricing and contract terms on its website. This transparency likens Braintree to some of the top-rated merchant account providers, so we therefore award the company an “A” in this category.

Our Braintree Review Summary

Our Final Thoughts

Braintree Payment Solutions scores well as a credit card processing provider in this review due to its flat transaction fee and its elimination of monthly fees, PCI Compliance fees, setup fees, and cancellation fees. It also maintains a very low complaint rate for its size and time in business. Overall, the service appears to be best suited for e-commerce and subscription/membership businesses, but it also stands out as a reliable merchant account provider for eBook sales and for web developers.

If you found this article helpful, please share it!

Liz Willis

How can you give them a good review? Horrible awful company to deal with. Absolutely ZERO customer service. I lost $1,000s and nobody willing to help. Cannot phone them and no email support. Bunch of thieves!!

Keith lau

No reply from contact form and phone calls for 3 months.

PayPal replied me yesterday and she said it will take 3-4 months to setup an account.

A bunch of jxxks.

Chris

Braintree has horrible service. We tried switching to them from Authorizenet because the price was right. There was ZERO assistance with the setup. Any questions or issues we had with processing orders they would just refer us to the online “help” files. It was all online and through email. Nothing on the phone. Our sales rep tried for a bit, but she ultimately was no help.

There was very little fraud detection options and filters despite what they claim and in the short time we used them, we saw our fraudulent orders skyrocket. All they have is this general “slider” which is basically “do you want more fraud or less fraud”? Pretty stupid.

Vyacheslav

After more than 2 years of successful cooperation, they just locked our account forever. With a very weird explanation like our business model is too risky for them. Selling advertising is risky, really? No problems with customers, just 1 dispute for more than 2 years. Yeah, really risky.

They also have frozen our money for 90 days.

Now we need to switch all our customers to another payment gateway.

The right way of doing business in such cases is to notify a partner sometime before you decide to terminate cooperation. But they just stopped it immediately!

Extremely unreliable partner, you cannot plan your company or cash flow with such a provider, avoid them at all cost!

From The Editor

This Post Might Help: Best Merchant Accounts for Marketing Firms

Juan

I used Braintree for almost 2 years on my eshop. We faced 5 cases with fraud cards for which they held my funds without informing me at all, and finally they blocked my account without any notice. For 3 days my clients could not pay for their orders online and we couldn’t identity the reason because the awful customer care of Braintree forgot or ignored to send and email.

When we requested an explanation and an official reply from them concerning the outcome of th chargebacks they just forwarded us our statements. The guys there are ridiculous

Scott

I have to agree with the recent reviews here. These guys really suck at knowing how to treat customers.

After spending about 2 months setting up our billing with an intermediary and choosing Braintree (after their initial account setup and verification), Braintree wanted to do a risk assessment.

So we provided all the information and then got a reply to say they were closing our account IMMEDIATELY because we were deemed too risky.

No opportunity to respond to their concerns and no chargebacks, that we have been informed of.

In this day and age of internet payments and services, what company decides to unilaterally close down a legitimate business in startup mode without a right to reply.

Braintree is seriously making some fundamental mistakes in this area and when my company has ‘000’s of customers they will regret it.

Totally unbelievable treatment by these guys. It would have been better if they had never opened our account as we now have live customers and can’t take payment.

If you are looking for a gateway, choose someone else and beware of Braintree.

William

What do you expect with PayPal in Charge?

user

After months of using Braintree fine they closed my account without warning and held my funds. I think this website is a scam. I spent a lot of money developing payment integrations with Braintree but now all that money is wasted and I will lose all my customers which are stored on the Braintree system. I am unable to access information, I no longer have access to my account, money, or anything. They demanded I send them a copy of my driver’s license a copy of my tax certificatie, social security number, tax id number, and much other personal information. After prividing ALL of this VALID information, very reluctantly they immediately came back and said “we couldn’t verify so we closed your account”. Even though it is ALL VALID INFORMATION.

Braintree is a SCAM and it is just there to steal your clients, steal all your personal information, and ruin your credit with a worthless hard inquiry which will lower your credit 10 points immediately.

BEWARE!! AVOID BRAINTREE AT ALL COSTS!!

William

As Braintree is Owned by PayPal,what do you expect,read the Reviews about with holding clients Funds for Months.

John

I integrated Braintree in Q3 of 2016 on my ecommerce website and was beyond disappointed. Braintree processed 3 successful orders over the course of about 48 hours – ALL THREE WERE STOLEN CREDIT CARDS that resulted in chargebacks. Their fraud detection and deterrence suite is absolute garbage. Stay away from this company if you are in ecommerce.

K Braxton

This is the worst company ever. I own an online store and have been selling for 8+ years online. I decided to start going through Braintree with receiving payments recently. Well, I drive 2 hrs to pick up supplies for my business, get there and PayPal card declined. I had $7K in my PayPal account. Come to find out, after calling and being transferred to 7 different departments, there was a fraud on my account with 3 orders within the same day. Braintree asked me to refund these orders and don’t ship, then they will lift the limitations off my account. I went through this whole deal for 3 days without access to money then Braintree tell me to update some Braintree fraud tools to prevent this again, then my account will be back. Well I called Braintree again and got someone to walk me through the process of the fraud tools. After he said he will get them to review it within 24 hours. Day 4. I call Braintree again to see why my account is still limited. They told me give it 24 hours since I submitted all the documents they need. Day 5 (Saturday) I call to see what’s going on. I’m on hold for 35 mins. And she says, “I’m sorry but we usually have a specialist here at Braintree lift the limitations on the weekends, but unfortunately no one is here this weekend to do it.” So now here i am, a business owner that trusted Braintree and PayPal to handle my payments, now I had to turn away all walk in customers this week with debit cards and I couldn’t ship none of my online orders this week because I ship through PayPal and my account is locked. No access to my money but they let my customers continue to pay for items from me. Note: I have a family to take care of and I use this account for many things. I had to be ashamed asking people to borrow money for food for my kid because braintree decided to lock my account because they allowed a fraud transaction to come through. So I’m just here and I have to wait until Monday to even get more information about MY MONEY that I work hard for. Braintree is the worst company ever. Don’t ever trust them.!!!!

Brady Hussain

These guys seem to be collecting data i sent my passport image they wanted the full image so they could see the mtr etc, sent letters with proof of address and then linked paypal to it and my UK bank account as well. They wanted business bank statements and sooo much more, i really was so frustrated with these guys and i know 10 other people who applied and got refused or just gave up like me. I would strongly recommend you stay away from these guys! Feels like some kind of scam to get my personal data now they have my passport images and proof of address and more :( either t is a scam or only for the 1% super big business only… COMPLETE WASTE OF MY TIME!

Brandon

I like others on these reviews have had a terrible time just trying to open an account with them. I am running a marketplace app, basically what Braintree was intially designed for. They called me high risk and said they wouldn’t split payments and I would have to do it manually (defeating the whole purpose of using them). Their advertisements are also misleading saying their are no fees until you hit a certain dollar amount. This is untrue; for the marketplace clients, you will pay all fees immediately, but they hide that truth in the faq section. Do yourself a favor and just use Stripe, if your company grows you can negotiate lower rates with them, with paypal/braintree you are stuck at the same rate no matter how big you grow. Braintree will interrogate you and request very personal information like copies of your passport and and drivers license via insecure email, where they could easily/accidentally forward this info to people that shouldn’t have it. The whole process takes way too long with Braintree, it’s madness! Take my advice, if they are this bad upfront, think about how bad they must be when you are already a customer. Just avoid the madness and use Stripe

—

Are you with Braintree? Learn how to resolve this complaint.

Luis

Hello,

I totally agree with SIlvia.

Our case is similar but in a higher amounts.

Please Realy be careful to reling on Braintree for your online payments.

If you are in Europe their assistance is poor, but the main critical issues are related with fraud.

If you are running an international business they do not advise you or set up with a basic configuration to avoid fraud.

As an expert gateway payment tehy should provide a basic fraud prevention configuration.

But the worst part is that i you are having some fraud and chargebacks they could retain your funds !!! and like Silvia your business been affected.

Braintree is only a reseller and the processor is Adyen.

Again be carefull!

John

I just called Adyen and I can confirm that Braintree is in fact a 3rd party reseller for Adyen.

And here I thought Braintree was a first party. No, Braintree is not a payment processor. Braintree is a 3rd party reseller for another payment processor, Adyen.

John

Now that I looked, look at Braintree’s logo. It says, “Payment solutions”. As in, they will resell another payment processor’s services and get middleman fees for being a reseller. Braintree is not the actual payment processor, they are a 3rd party.

Silvia

I wish i could give Braintree a half of a star considering they ran my business to the ground. I signed up for Braintree after being with Stripe Payments that is (phenomenal).

I decided to open up a third website and i thought of being outside of the box after all they had better pricing. Needless to say i made a giant mistake by giving my business to braintree for payments. Braintree took payments and i was approved for a account in no time, after providing all the proper documentaion i was good to go. I even received a email from Marty Chanes, saying i was good to go and i could go about fulfilling orders and operate my business as normal. Day’s pass and braintree hasnt made any funding to be but my merchant account was acquiring currency daily. I reached $9,000 and made a call to the offices located in Chicago I was tethered with on the phone when i asked who can direct me to help with pulling a record of ACH funding that were or should have been transferred to me. I was never allowed to speak to Marty Chanes but others. I was told my account was under review and my fund would be held until i reached a certain amount. I was outraged! i have been fulling orders and fronting clients because i thought i had a reliable merchant that would be paying me soon. I told them i had cleared any review and was given the ok from “Marty Chanes” and i took his word i shipped merchandise. They said they couldnt pay me unless i showed them i had shipped i said ok thats easy and provided tracking numbers and invoices. I was tethered with once again and was told they needed to hold my funds for 90 days!!!!!!!!!!!!

A small business cant survive without a flow of income and now these customers that paid haven’t really paid because now i wouldn’t be seeing the money. I felt robbed and felt like my money was being taken and held hostage. Braintree decided they were taking back my account because i had another business and used another merchant and they frown upon that. Also Bobby with Braintree stated because 3-4 customers cards declined i needed to be held in review, I was furious and told them my business would fail because i used my personal savings to ship to clients and invested in merchandise as they had assured me i was good to go 7 days prior. All over a couple declines ! I hate braintree my niche idea and small start up was ruined because of them. I was left with no choice but to close up shop and was left with bills and merchandise because braintree lies to there clients and gives accounts and allows you to build and build revenue and turns around and tells you there holding it for 90 days!!!! Meanwhile you starve your business fails and your left with nothing. What you choose is your prerogative, my idea made 9k in a week and i honestly think they couldn’t handle such vast money being made. They are a nightmare run the other way they pick and choose who and what they want. There owned by Paypal which is awesome but braintree sure is there own problem and entity and now my dream crusher. I wish you the best of luck and recommend Stripe they handle business well, i read somewhere that Stripe was founded by Paypal but that’s there own monopoly.

Tina

Hi Phillip,

I am looking for a new solution to online processing since Google dumped its Google Checkout. I am looking at Braintree ( Google is partnering with them) and you stated that there was no monthly fees. But, on their site they state there is a $35.00 monthly fee.

I have a physical terminal hooked into my phone line for people who come into our shop. I am considering using that account for online purchases as well. I really like Ecwid for my shopping cart and can use the emulate Authorize.net but it will take some setup.

CPO

Hi Tina,

I believe the monthly fee to which you are referring is charged if you choose to only use Braintree’s payment gateway in conjunction with your current merchant account provider. Otherwise, you just pay Braintree’s transaction fee when you make a sale using the integrated credit card processing service.

Here is an list of other Google Checkout Alternatives: Google Checkout Alternatives

Sammy

Braintree will not provide payment gateway solutions, unless the majority of the users/ customers reside in the US. This is the information I got when I tried to get a payment gateway for my website. My users live all over the globe, and a large percentage of them reside in Asia,

If a company has a condition that the majority of users should live in the US, and the “target audience should be those living in the US”, how does this company qualify as a provider of international payment gateway solutions?

This company’s service is NOT international if this is a condition to get a service,

Anonymous

Switched from Intuit Merchant Services + Authorize.net and couldn’t be happier. Braintree has been a great company to work with. Very professional, courteous and helpful through the entire process. Plus, for smaller businesses, you only get charged what you use (similar to PayPal – which has subsequently purchased Braintree).

Cutting out the higher merchant fees with Intuit, plus the recurring Gateway fees of Authorize.net allowed me to save thousands of dollars within the first 6 months of switching. And your fees are removed at the time of deposit, rather than end of month.

Strongly suggest Braintree!

CPO

Hello,

When you leave a testimonial as “Anonymous,” it really brings into question its authenticity. I would recommend replying to this comment with your business name and location if you want other merchants to take your review seriously. Thanks!