Note: As of 2023, it appears that MatchRate Plus is out of business. We are unable to find any evidence of activity from the company since 2019. We will no longer be updating this profile. If you have any evidence that MatchRate Plus is still in business, please let us know in the comments below.

A Referral Service for North American Bancard

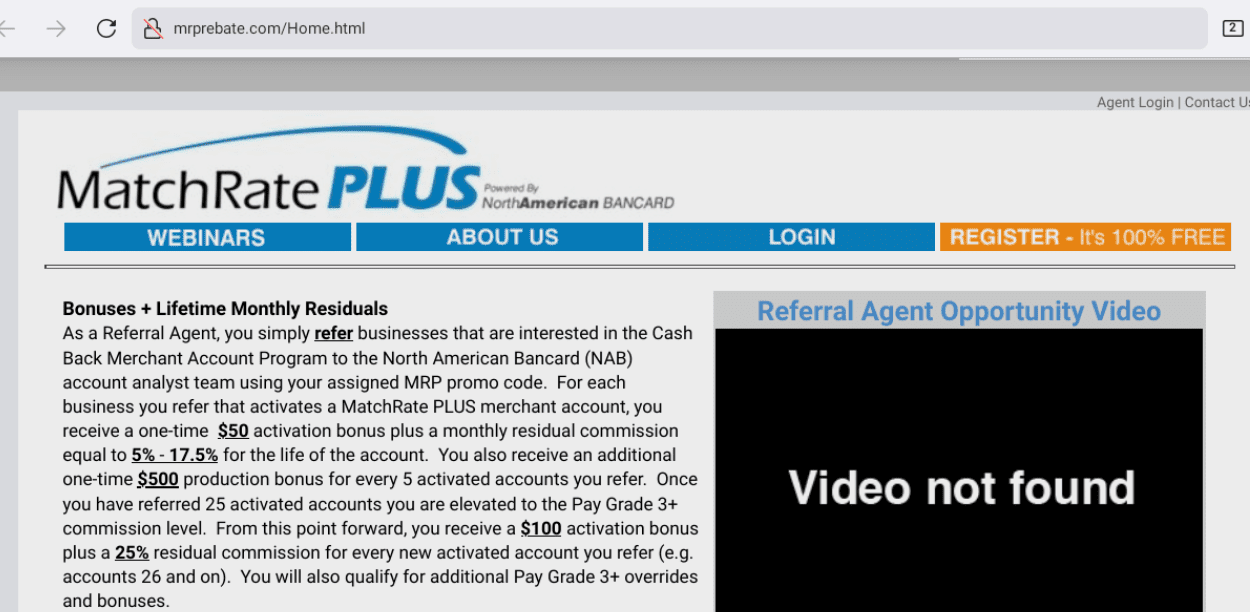

MatchRate Plus does not appear to be an actual merchant account provider itself but, instead, a referral engine for North American Bancard. The company’s business model seems to rely heavily on enlisting independent “Referral Agents” to generate leads. These agents are then paid a commission and residual for the leads that turn into accounts. MatchRate Plus also promotes that it gives 25% of the commission and residual that it receives from North American Bancard back to each merchant it signs in the form of a monthly rebate.

MatchRate Plus Payment Processing

Aside from directly paying agents to sell its service, the company appears to operate several websites designed to market to potential referral agents and merchant leads. There also appears to be a Multi-Level Marketing (MLM) component in which Referral Agents that refer other agents can earn income from their referred accounts. This may also be the reason that numerous websites exist to promote MatchRate Plus.

MatchRate Plus Ownership & Location

Reports state that MatchRate Plus was founded in 2010 and is headquartered at 4888 Davis Blvd, Naples, FL 34104. However, the BBB lists the company at 9045 Strada Stell Ct STE 106 Naples, FL. Gary “Clay” Fishman is listed as the CEO of MatchRate Plus.

MatchRate Plus Review Table of Contents

- Costs & Contract: MatchRate Plus appears to offer a month-to-month contract through North American Bancard with a variable early termination fee.

- Complaints & Service: MatchRate Plus complaints number fewer than 10 on public complaints forums.

- BBB Rating: MatchRate Plus has an “A+” rating with the Better Business Bureau and has received 0 complaints in the past 3 years.

- Sales & Marketing: MatchRate Plus hires independent sales representatives but has not received any complaints about its sales practices.

Jim Licitri

I am a small business owner and have 2 merchant accounts through MatchRate Plus. As the logo states, “powered by North American Bancard“, which means they are the credit card processing company. MatchRate Plus sent me to North American Bancard and they did the rate comparisons and sent me my free terminals all programmed and ready to go. All I had to do is literally plug them into my telephone line. I checked both companies out. North American Bancard has an A+ BBB rating and MatchRate Plus has an A-. I have spoken with both companies on a couple occasions and had a positive experience. My MatchRate Plus agent that contacted me in person asked me a simple question. “If I can lower your rates and get you cash back every month, can I earn your business?” They did exactly that and that is why I am a customer. I have been through several merchant service companies in the past 10 years and everything I disliked about them is why I love MatchRate Plus. Kudos to both North American Bancard and MatchRate Plus.

David J.S.

Does anyone know why Dowe Kaufman is no longer President of MatchRate Plus?

Dennis Graves

I would have to agree with most of the reviews here.

It does take a long time to generate a sizable monthly income so don’t think you are going to get rich quick. One of the ways to build your monthly income is to grow your own Referral Agent Organization and get paid monthly from their efforts as well. I am currently making more money from my Agent Organization’s Referrals than from the merchants I personally referred. I also provide a lot of extra tools to Agents that join my Team so I might be having better luck than most Agents.

Don’t rely on this program for enough income right away to quit your day job. You need to build your MRP business “on the side” until you have a decent monthly residual coming in. This will take some time, and you need to build your Referral Agent Organization at the same time.

The program is free and will continue to grow even after you stop working it if you build your Agent team also. Some of the commissions can be pretty small depending on the amount processed by the business, some of them can also be a decent size. When I am talking with potential Referral Agents I compare it to having gumball vending machines all across the country.

David

I have been a referral agent with MatchRate PLUS for about a year now. I have had a great experience with them. Their referral agent program is 100% free to join, so I don’t see how anyone could legitimately claim there’s any ripoff, or even risk, with joining this company. I’ve wasted a lot of money, precious time, and pieces of my soul in other business ventures; I’ve hardly sunk a penny and very little time into this one.

They do encourage buying business cards, flyers, and post cards through Vistaprint, as they’ve established a relationship to have Vistaprint print these items for an extremely low cost–e.g., the post cards are $18.74 for 100. These are sales tools that are helpful for promoting the merchant account offer to local businesses. However, I’ve yet to buy one of these sales tools, though I have been intending to for a long time now, but no one’s ever tried to coerce me into buying them. Whether Dowe Kaufman gets a commission from Vistaprint, I don’t know; but I couldn’t imagine it would amount to very much nor would I even care.

So, in my year I’ve hardly put any effort into my MatchRate PLUS referral business and have referred just a couple of merchants so far. However, I earn a residual income of around $17 per month (plus the $50 one-time signup bonus for each referred merchant). I’m not getting rich–yet–but neither do I have to service these accounts. It’s like I’m getting a free $17 every month for doing absolutely nothing. I can’t complain one bit, and that money would even pay for my sales tools. As well, in the two live trainings I’ve attended, Dowe and others stressed that no one’s going to get rich quick. Although, I’ve seen that those who put the time into working this business have yielded commensurate results.

I intend to get serious with my MatchRate PLUS referral business this year. If I’m already making $17 every month by putting in virtually zero effort, I’m excited to find out what the results will be when I actually put some real effort into it.

John Hardin

MatchRate Plus is a ripoff. Dowe Kaufman misleads everyone about your income potential. He tries to get you to order supplies at the beginning because he makes a cut out of that also. The sales reps at North American Bancard cherry pick the leads and put very little effort into selling the customers that you refer to them. They actually close less than 10% of all referrals. This is a total waste of time.

Tom

Hey John,

Do you have any knowledge of the cherry picking,or can back it up.

I only ask out of curiosity, because I don’t know if they have anything to do with the sale

of the account, and I’ve heard that the “close rate” was fairly good.

Tom

daniel funk

This company does conduct business on the up and up with their referral agents. Had a friend go with them and was an installation disaster. the compensation is a rip. Merchant does several thousand dollars monthly with our commission based on a 45 days batching period. This merchant can do anywhere from 8- 15k in a 45 day period! My compensation was $2.05 are you kidding me ! They claim that there profit is low but we never are privy to that amount . That’s pennies on the dollar! do not waste your time!

Matched Rate

Phillip,

Great review. One minor change I would suggest is that MRP is not an MLM company. They are a multi-tier Affiliate program. With MLM programs, there is a fee to join, and part of that fee is then paid to the upline. Here, MRP operates just like any other affiliate program that you see on Amazon.com, WalMart.com, and hundreds of thousands of others. The only difference is that they do pay down several levels, which helps you build up a residual income. This model has been used by many hosting companies over the years as well.

Additionally, merchant services is an extremely regulated industry – everything needs to be up and up and run by more legal departments and lawyers than most can imagine. It is a legitimate business for those looking to build a part-time income. It takes time, just like any other business and many of us do this on the side in addition to other businesses or our jobs to supplement our income. It’s as easy as dropping off a flyer when you are out and about to your dry cleaners, gas stations, restaurants, etc. Just word of mouth marketing – but being compensated for it, which is always nice.

Dowe

If you have any questions about MatchRate PLUS, please feel free to contact me.

Kind Regards,

Dowe Kaufman

President, MatchRate PLUS

Aaron McClendon Sr

I’m an agent ID#19189 and I want to know why every time I try to log in it tells me as soon as I open the page, whether agent or potential client that the website is under construction!!! Why is the site still saying this after 4 months???

Aaron McClendon Sr

That’s 4 weeks not months!!!