Overview

In this review of Menusifu, we will provide a detailed overview of the company's point-of-sale (POS) system designed specifically for the restaurant industry. We will cover the range of services they offer, including order management, payment processing, and inventory control. The review will identify the types of restaurants and food service businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific features provided. By the end of this review, you will understand whether Menusifu meets your restaurant's POS needs.

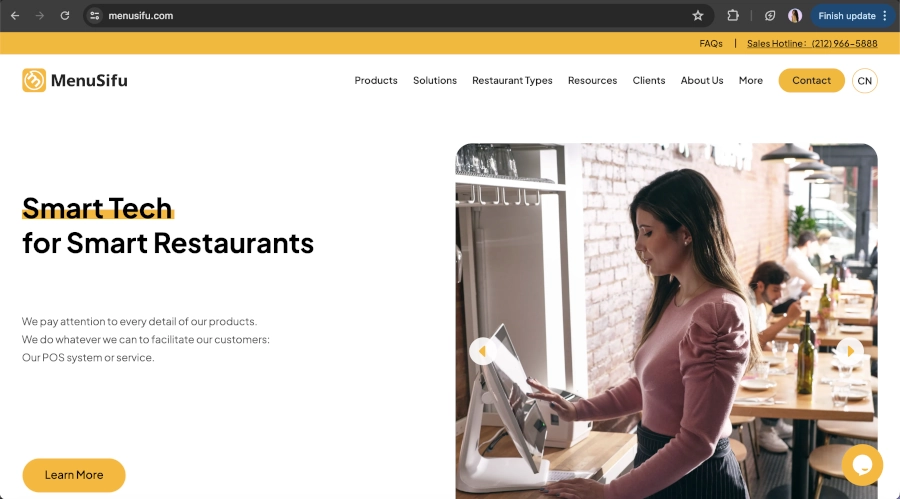

About Menusifu

Founded in 2013, Menusifu is a cloud-based point-of-sale product intended for restaurants and bars. Menusifu offers traditional POS systems as well as tablet-based systems that are compatible with Windows, Android, and iOS operating systems. The company is partnered with TSYS, First Data (now Fiserv), and WorldPay for its payment processing services, and it claims to be “the market leader in the Asian-American restaurant community optimizing restaurants in all 50 states.”

Menusifu Products and Services

Point of Sale

Menusifu primarily offers a POS system designed for restaurants, along with online ordering software.

Integrated Payment Processing

Menusifu's system features integrated payment processing, accepting all major credit and debit cards as well as mobile payments like Apple Pay and Google Pay. This integration provides a seamless payment experience for customers.

Order Management

The POS system from Menusifu supports comprehensive order management. It allows businesses to handle dine-in, takeout, and delivery orders from a single platform, including tableside ordering via mobile devices used by servers.

Inventory and Ingredient Tracking

Menusifu includes an inventory and ingredient tracking feature that helps businesses monitor stock levels and maintain necessary supplies. This functionality aims to reduce waste and enhance operational efficiency.

Real-Time Reporting and Analytics

Menusifu offers real-time reporting and analytics tools, enabling businesses to make data-driven decisions. Users can generate reports on sales, employee performance, and customer demographics, providing valuable insights into business operations.

Customer Relationship Management

The Menusifu POS system incorporates customer relationship management (CRM) features. It allows businesses to track customer preferences, spending habits, and visit frequency, which can be used to develop personalized marketing campaigns and improve customer retention.

Hao Li

The overall team is like a low-level alliance of scammers. After paying and signing the contract, there is no basic communication. The website is built in a mess, and repeated communication has not changed. The sales team is full of scammers. Because they have not received basic services, they apply for return. , The sales staff did not reply at all, and after repeated questioning, they did not reply, so just shut down the website. . . . . . This is simply scum