Overview

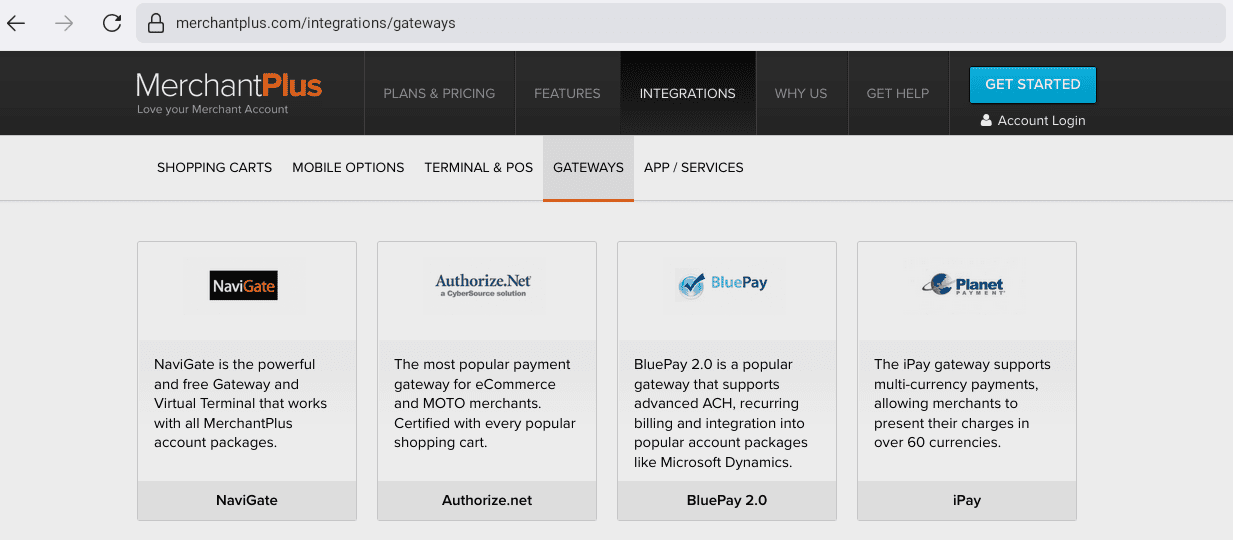

In this review of MerchantPlus, a well-known merchant account provider, we take a detailed look at their rates, fees, contract terms, and overall customer experiences. Our analysis covers their payment processing solutions, including mobile and e-commerce options, as well as their security measures and fraud protection to evaluate how effectively they safeguard transactions. We also assess the functionality of their recurring billing system and the quality of customer support. In addition, the review examines company details such as location, ownership, and legal standing, including the outcome of a Visa and MasterCard lawsuit settlement. By weighing both pros and cons drawn from customer and employee feedback, this article provides a balanced overview to help businesses understand what to expect when working with MerchantPlus.