Unclear Contract Terms

Detailed information about Axia Payments’ standard contract is not readily available. Their website mentions “competitive rates” without further specifics. Axia Payments, prominently partnered with Merrick Bank, might resell Merrick Bank contracts, though this is not confirmed. Merrick Bank’s back-end processor, TSYS, lists swipe rates of 2.5% plus $0.20 and keyed-in rates of 3.5% plus $0.20. Merrick Bank’s contracts typically include a liquidated damages clause as an early termination fee, a $75.20 annual PCI compliance fee (charged quarterly), and a 48-month non-cancellable equipment lease.

A single Axia review referenced a fund-hold issue not disclosed in contract terms. Axia’s early termination fee calculation is based on remaining months and average monthly transactions, but details on PCI compliance fees and monthly minimums are unspecified.

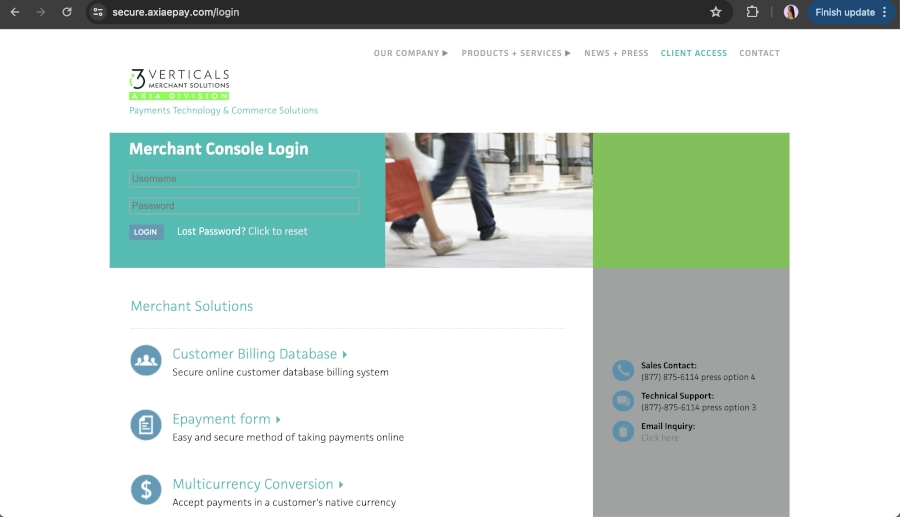

Virtual Terminal and Payment Gateway Pricing

Axia Payments also offers virtual terminal and payment gateway services, but specific pricing for these is not publicized. Typically, such services include gateway fees, technical support fees, batch fees, and additional transaction rates associated with e-commerce services.

Few Contract Complaints

The scarcity of complaints about Axia Payments’ contract terms suggests that most clients are content. However, without definitive details, it’s uncertain if Axia’s pricing competes with more affordable merchant accounts. Those with firsthand information about Axia’s standard contract are encouraged to share their experiences in the comments below.

For more insights, readers can consult our list of the best merchant accounts.