Overview

In this article, we will provide a detailed review of Elite Payment Processing, a credit card processing company. We will discuss the range of services offered, including merchant accounts, payment gateways, and point-of-sale systems. The review will cover the company's pricing structures, contract terms, and overall reliability. Additionally, we will analyze customer feedback and the quality of support provided by Elite Payment Processing. Comparisons with other payment processors in the industry will be included to help you determine if Elite Payment Processing aligns with your business needs. This article aims to equip you with the necessary information to make an informed decision.

About Elite Payment Processing

Founded in 2007, Elite Payment Processing is a merchant account provider based in Ft. Lauderdale, Florida. There is some evidence that Elite Payment Processing is partnered as a reseller of multiple processing companies. The company specializes in retail and multi-currency merchant accounts.

Elite Payment Processing Products and Services

Payment Processing

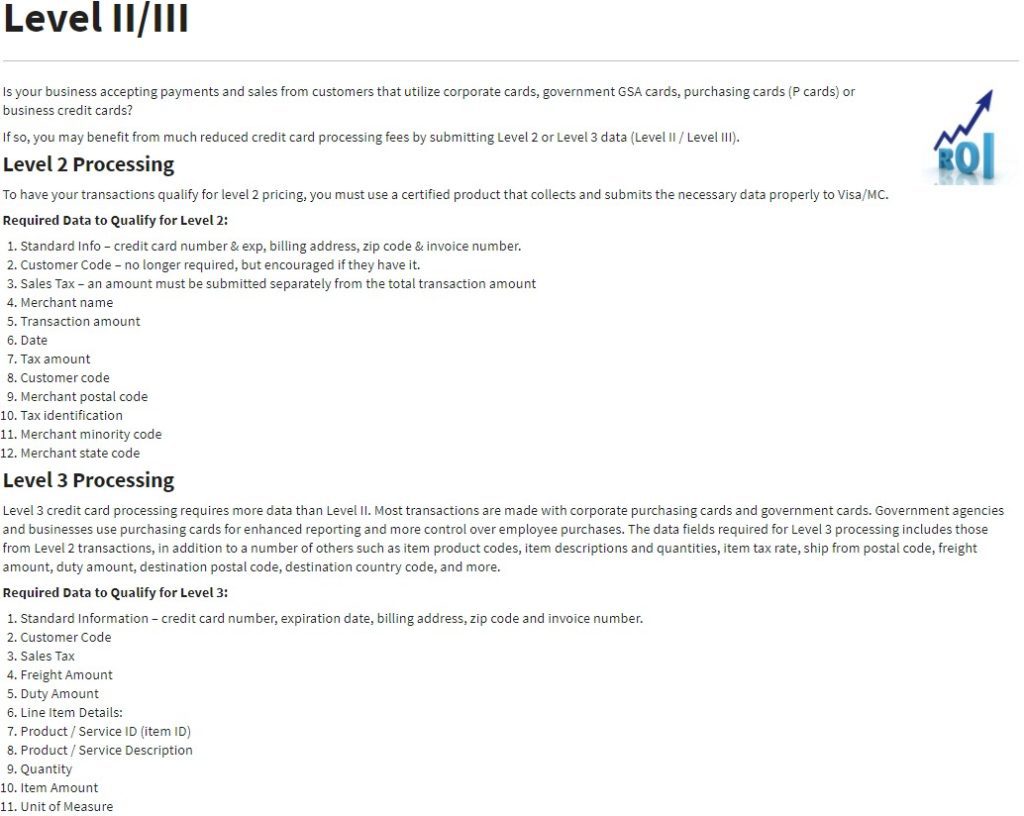

Elite Payment Processing handles transactions for all major debit and credit cards, catering to a wide range of business types. Their services include EMV swipers, POS systems, mobile solutions, processing in over 60 currencies, and various e-commerce solutions. Their e-commerce offerings include dynamic descriptors, transaction recycling, account updating, online reporting, recurring billing, virtual terminals, Level 2 and 3 B2B processing, and batch processing.

Card Not Present Solutions

Elite Payment Processing provides solutions for card-not-present transactions, aiming to offer payment flexibility that helps businesses retain customers. Their services are designed to reduce customer attrition by ensuring seamless purchase completions despite payment complexities.

Retail Solutions

Elite offers retail payment solutions focused on quick and secure credit and debit transactions through a robust merchant account system. These solutions are tailored to capture sales efficiently and securely.

Dual Pricing

Elite implements dual pricing strategies, which incentivize cash payments by offering cost savings to customers. This approach also helps businesses reduce credit card transaction costs. Dual pricing can be integrated into payment terminals or POS systems, showing both cash and credit prices.

Jayna Peters

I started with Elite services in July of 2016 and was told I had to buy 50 “Reliable” vendor names to be really successful on top of supplying my own 10 names per week. Those 50 ‘Reliable” were priced at $5,000! I was told not to worry, they would cover half the cost and I could finance the rest. I had a “coach who was nice enough but she kept giving me excuses why everyone was just on the verge of signing for a machine but never did.

As of the end of December I still didn’t have a sale and I quite paying for “my half” of the names fee. No one ever questioned why I wasn’t paying and I never heard from my coach again. Sounds like an admission of a rip-off to me.