Overview

In this article of MerchantPlus, we will provide an in-depth look at this notable merchant account provider, focusing on key areas like rates and fees, contract terms, and customer experiences. We'll assess their payment processing services, including mobile and e-commerce solutions, and examine their security measures and fraud protection. We'll also evaluate the effectiveness of their recurring billing system and the quality of their customer support. Insights into the company's location, ownership, and legal standing, including the Visa & MasterCard lawsuit settlement, are provided. We conclude with a balanced perspective, highlighting the pros and cons based on customer and employee feedback, giving readers a comprehensive understanding of what to expect from MerchantPlus.

About MerchantPlus

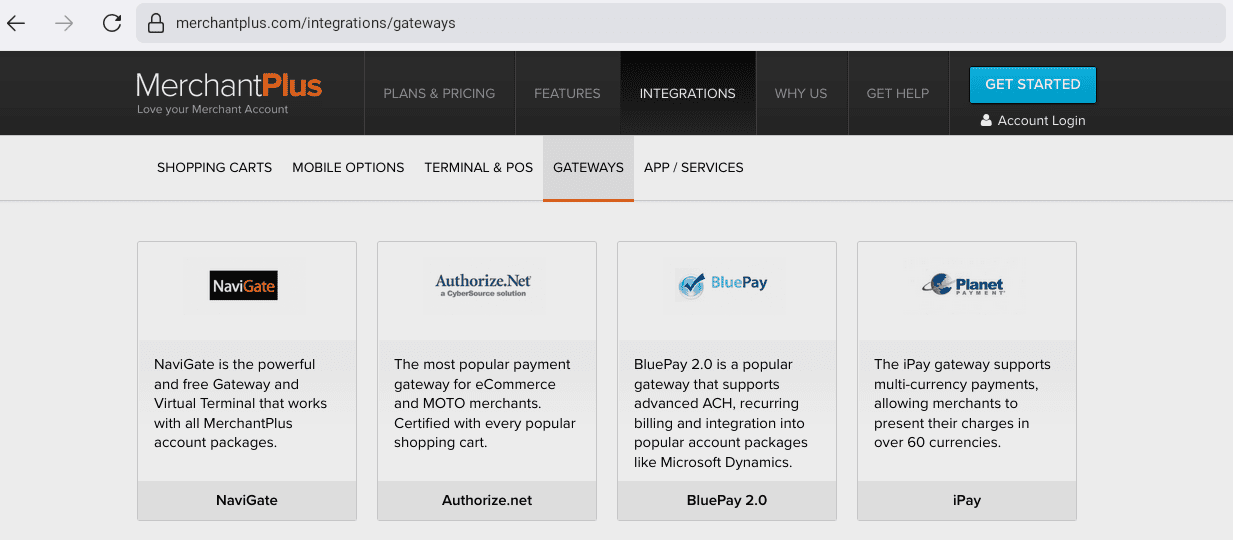

MerchantPlus, founded in 2003, is a U.S.-based merchant account provider focusing primarily on multi-platform, enterprise solutions, small-businesses, mobile payments, and global currency. The company offers its own payment gateway which is compatible with Authorize.Net.

MerchantPlus Products and Services

Payment Processing Services

MerchantPlus handles payment processing for all major debit and credit cards across various business types. Their services include EMV card readers and swipers, POS systems, mobile solutions, e-commerce solutions, ACH processing, and access to multiple payment gateways, including their proprietary NaviGate gateway. They also offer business management apps, the RateAssure variable rate program (based on volume), and international payment processing.

Mobile Payments

As mobile payments become increasingly popular, MerchantPlus equips businesses with the necessary tools to accept payments via smartphones and tablets.

E-commerce Integration

MerchantPlus supports seamless integration with widely used e-commerce platforms, facilitating easy setup and management of online stores.

Security and Fraud Protection

MerchantPlus emphasizes security by employing advanced fraud protection measures and sophisticated encryption technology.

Recurring Billing

For businesses offering subscription services or requiring recurring payments, MerchantPlus offers a recurring billing feature. This service streamlines the billing process and ensures timely payment collection.

Customer Support

MerchantPlus provides consistent customer support, with a dedicated team available to assist businesses. This support ensures that businesses can receive timely help and guidance to address any issues or concerns with their payment processing solutions.

Garry Marino

Taking $196 from me 2 months in a row, over and above all of my authnet fees ($30), Merchant Plus ($30 monthly) and fee and about $70 in percentage charges. Then out of no where $196. Have called and left 3 messages with this office in NY

Merchant Plus, LLC

30 Vesey Street, 9th Floor

New york, NY 10007

(800) 546-1997

No response. Charged my $196 2 months in a row, no explanation, no call back. Stay away from these people. Contesting the charges now.

From The Editor

This Post Might Help: Let Us Eliminate Fees From Your Contract For You

Lucas

Never do business with company, lots hidden charges and you can never cancel their services. This is the second month I am trying to contact them and they are still charging me for Discovery even after closing the account with them. I mean big bucks. Zachary is a scam! I had to change my entire bank account because of these guys